Dispute Credit Letter Template for Quick Resolution

When inaccuracies appear on your financial report, they can negatively impact your ability to secure loans, get favorable interest rates, or even affect your overall financial health. It’s crucial to take prompt action to correct any errors and ensure your records are accurate. One of the most effective ways to resolve these discrepancies is by formally reaching out to the relevant parties involved.

By following a structured process, you can create a professional communication that clearly states the issue, provides supporting evidence, and requests the necessary adjustments. This approach helps avoid delays and improves the chances of a swift resolution. Whether you’re dealing with a mistaken transaction, incorrect balance, or any other issue, understanding how to effectively address these concerns is essential for maintaining a clean and accurate financial profile.

What is a Dispute Credit Letter?

When errors or inaccuracies arise in your financial documentation, it is essential to formally notify the involved parties to initiate a correction. This process allows individuals to clarify discrepancies, request modifications, and ensure the accuracy of their records. Such a formal communication serves as an official request to amend any issues found in financial statements or reports.

Purpose of Formal Communication

The primary goal of this written communication is to bring attention to specific mistakes and provide evidence supporting the need for correction. By articulating the problem clearly and concisely, individuals can avoid unnecessary delays in the review process. Whether the issue involves incorrect transaction details or an inaccurate balance, this formal approach helps in resolving the matter efficiently.

Essential Elements of the Communication

A well-crafted document should include relevant details such as the individual’s personal information, the nature of the error, and any supporting documentation. Additionally, it’s important to specify the desired outcome, whether that’s a correction to a record or the removal of an incorrect entry. This structured communication is often required to initiate a review and make the necessary adjustments to your financial file.

Why Disputing Errors is Important

Correcting inaccuracies in your financial documents is crucial for maintaining a healthy financial standing. Mistakes, even minor ones, can have significant consequences, potentially leading to higher interest rates, loan denials, or a reduced ability to access credit. Ensuring that your records reflect the most accurate and up-to-date information helps protect your financial reputation.

Avoid Financial Setbacks

Errors in your financial history can result in unfavorable decisions by lenders and other financial institutions. Inaccurate information could suggest a higher level of risk, causing you to be rejected for loans or offered unfavorable terms. Taking action to correct these mistakes allows you to prevent potential setbacks and maintain a favorable standing in the eyes of creditors.

Improve Financial Opportunities

By resolving discrepancies promptly, you can improve your chances of securing better financial opportunities. A flawless record opens doors to more competitive rates, easier approvals, and better terms. Addressing issues early ensures that you won’t miss out on advantageous opportunities due to inaccuracies in your personal or financial information.

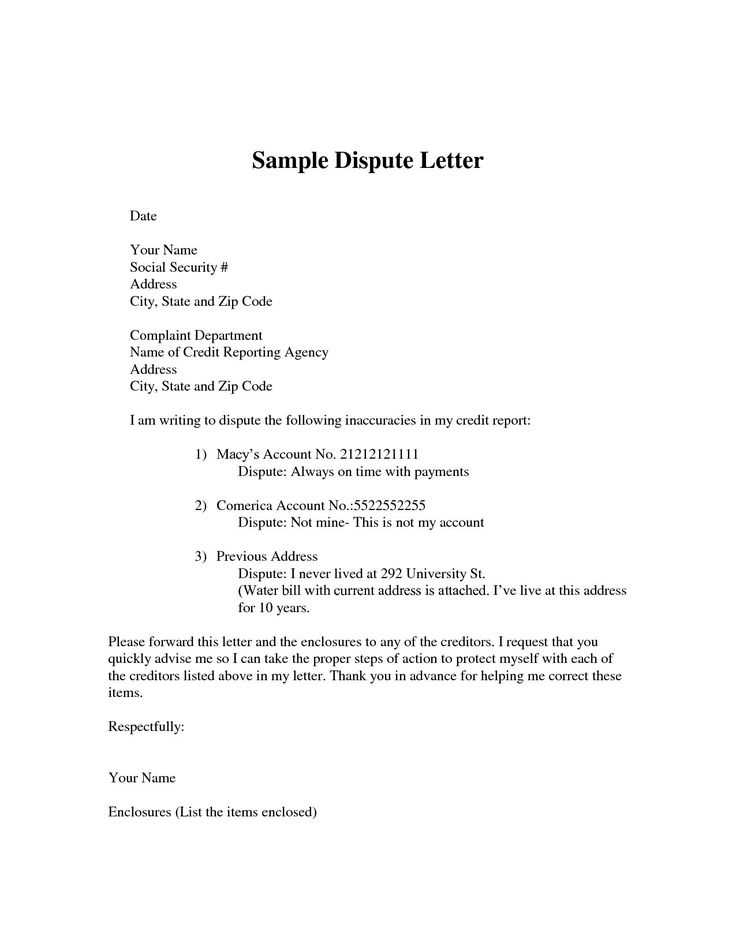

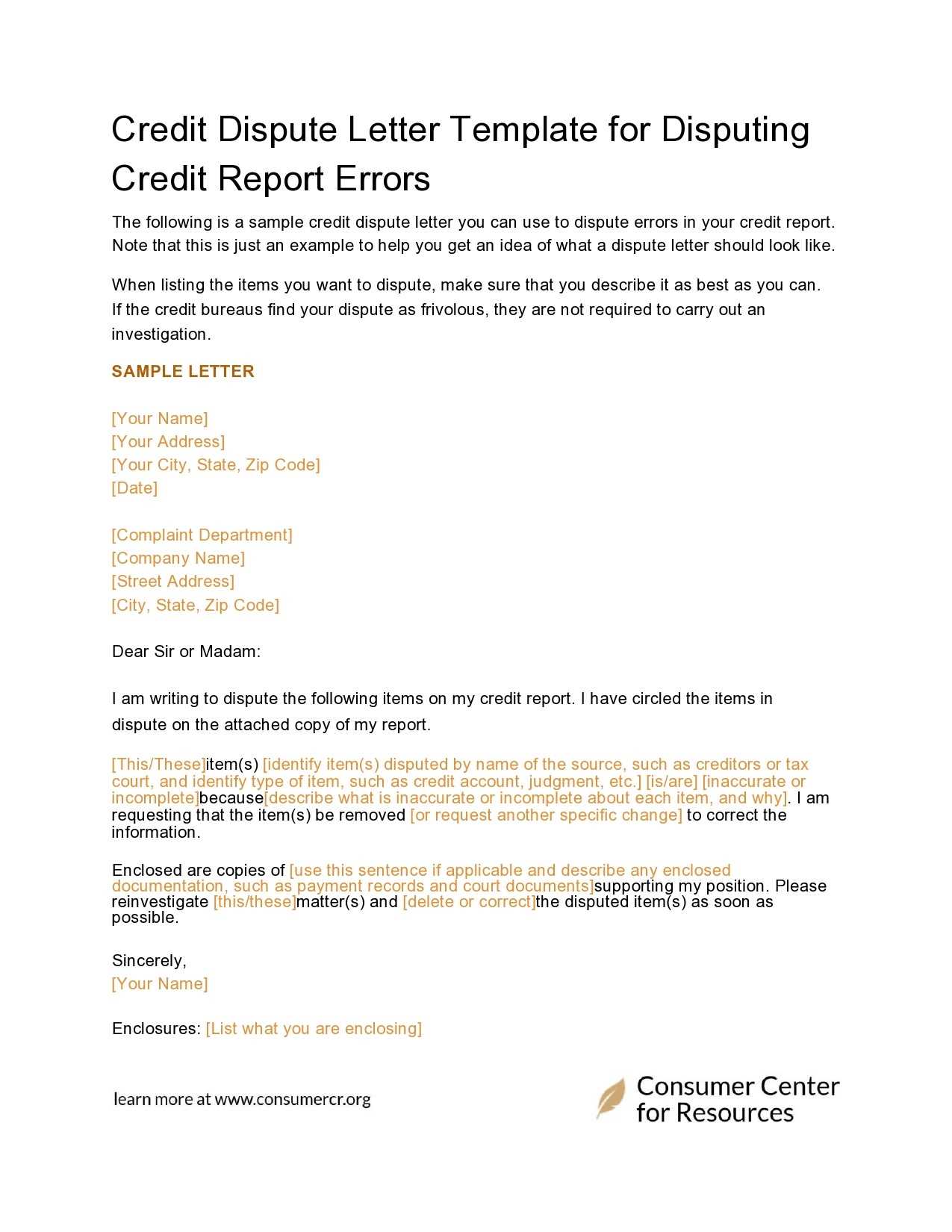

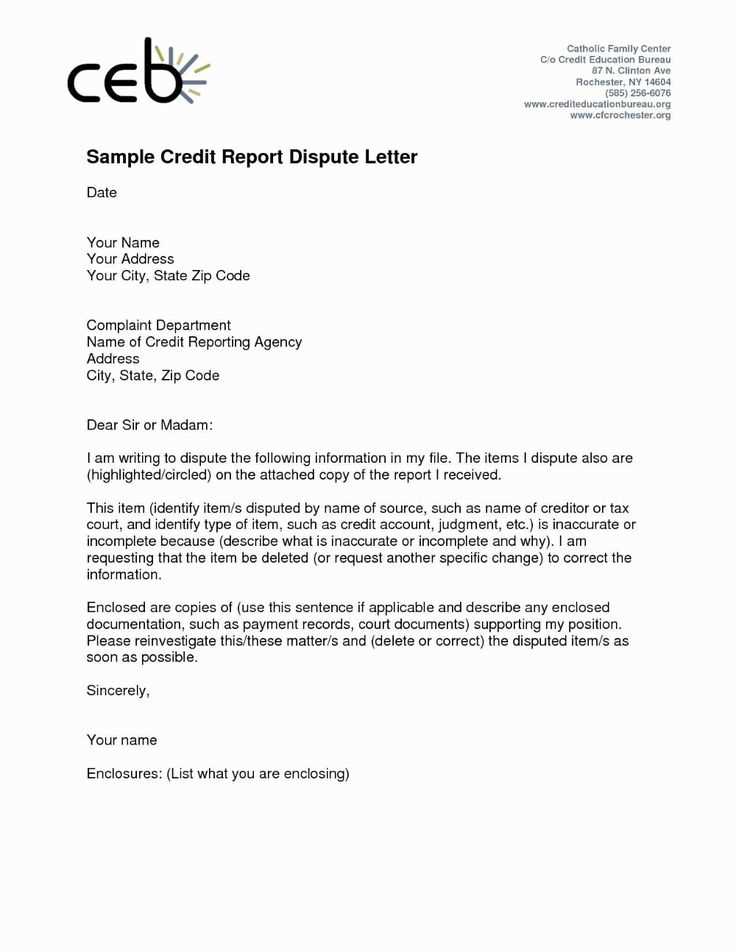

Step-by-Step Guide to Writing a Letter

When you need to formally address an error in your financial records, it’s important to follow a clear and organized approach. Writing a well-structured communication ensures that your request is taken seriously and processed quickly. A properly written document helps the recipient understand the issue and the corrective actions you are requesting.

1. Include Your Personal Information

Start by providing your full name, address, contact information, and any relevant account numbers. This helps the recipient quickly identify your records and ensures that your request is associated with the correct file. Be specific and accurate with the details to avoid any confusion or delays.

2. Clearly State the Issue

Describe the problem in a clear and concise manner. Include any specific errors, such as incorrect charges or transaction details, and refer to the relevant documents that support your claim. Avoid unnecessary details, but make sure you provide enough information for the reader to fully understand the situation.

3. Provide Supporting Documentation

Attach any documents that support your case, such as bank statements, receipts, or transaction records. These will strengthen your claim and help the recipient verify the error. Make sure all attached materials are easy to read and clearly labeled, ensuring they are linked to the issue you’re addressing.

4. Specify the Desired Outcome

Be clear about what you want to happen as a result of your communication. Whether it’s correcting an entry, removing an incorrect charge, or updating your financial information, make sure to outline your expectations. This will help guide the recipient toward resolving the issue in the way you need.

5. Use a Professional Tone

Maintain a polite and professional tone throughout your message. Avoid using accusatory or confrontational language. Instead, focus on stating the facts and requesting the necessary actions in a respectful manner. A professional approach increases the likelihood of a positive and timely response.

Common Mistakes to Avoid When Disputing

While addressing errors in your financial records is essential, making certain missteps can hinder the process and delay resolution. It’s important to approach this task carefully to avoid mistakes that could complicate matters. Being mindful of common pitfalls ensures that your request is clear and actionable, increasing the chances of a swift and positive outcome.

Key Mistakes to Avoid

| Mistake | Consequence | How to Avoid |

|---|---|---|

| Providing Incomplete Information | Delays in processing your request | Ensure all personal details and account numbers are correct and complete. |

| Using Aggressive Language | Possible rejection of your claim | Keep a professional and polite tone throughout your communication. |

| Failing to Include Supporting Documents | Unverified claims leading to rejection | Attach clear, well-labeled evidence that supports your case. |

| Not Being Specific About the Request | Unclear expectations for the recipient | Clearly state the correction or action you want to be taken. |

| Ignoring Deadlines | Possible loss of the opportunity to correct the issue | Adhere to any specified timeframes and follow up if necessary. |

By avoiding these common mistakes, you can streamline the process and improve the chances of your request being processed efficiently and accurately. Keeping your communication clear, professional, and complete will ensure a better outcome in resolving any discrepancies.

How to Address Different Credit Issues

When dealing with inaccuracies or discrepancies in your financial documentation, it’s important to tailor your approach depending on the nature of the problem. Each situation requires a specific response to effectively resolve the issue, whether it involves a fraudulent charge, an incorrect balance, or missing transactions. Understanding how to address each scenario helps ensure that the error is corrected promptly and without complications.

1. Incorrect Transactions or Charges

If you notice charges that don’t align with your records, it’s crucial to gather supporting evidence, such as receipts or transaction logs, that prove the error. Clearly outline the incorrect amounts, dates, and nature of the transactions in your communication. Request the necessary adjustments, and provide any documentation to back up your claim.

2. Missing or Uncredited Payments

When payments are not reflected in your account, ensure you have proof of the transaction, such as bank statements, payment confirmation emails, or transaction IDs. In your communication, specify the amount, date, and method of payment, and ask for a review of the records to update your account appropriately. Providing as much detail as possible will facilitate a faster resolution.

Tips for Effective Communication with Creditors

When addressing any issues with your financial provider, clear and respectful communication is key to achieving a positive outcome. To ensure that your message is well-received and processed quickly, it’s important to approach the conversation in a methodical way. Below are several tips that can help you communicate effectively and resolve matters with your creditor efficiently.

1. Be Clear and Specific

Make sure your message clearly outlines the issue you’re addressing. Providing exact details helps the recipient understand the problem immediately and ensures there’s no confusion about your request. Here are some things to include:

- Your personal and account information

- A clear explanation of the problem or discrepancy

- Supporting documents that verify your claim

2. Keep a Professional Tone

Even if you’re frustrated with the situation, it’s important to remain polite and professional. A courteous approach increases the likelihood of a favorable response and keeps the lines of communication open. Avoid using confrontational language or accusations, and focus on presenting the facts in a calm and respectful manner.

3. Stay Organized

Organize your communication in a logical and easy-to-read manner. Consider using bullet points, numbered lists, and headings to break down complex information. This structure helps the creditor quickly find and understand the most important details of your request.

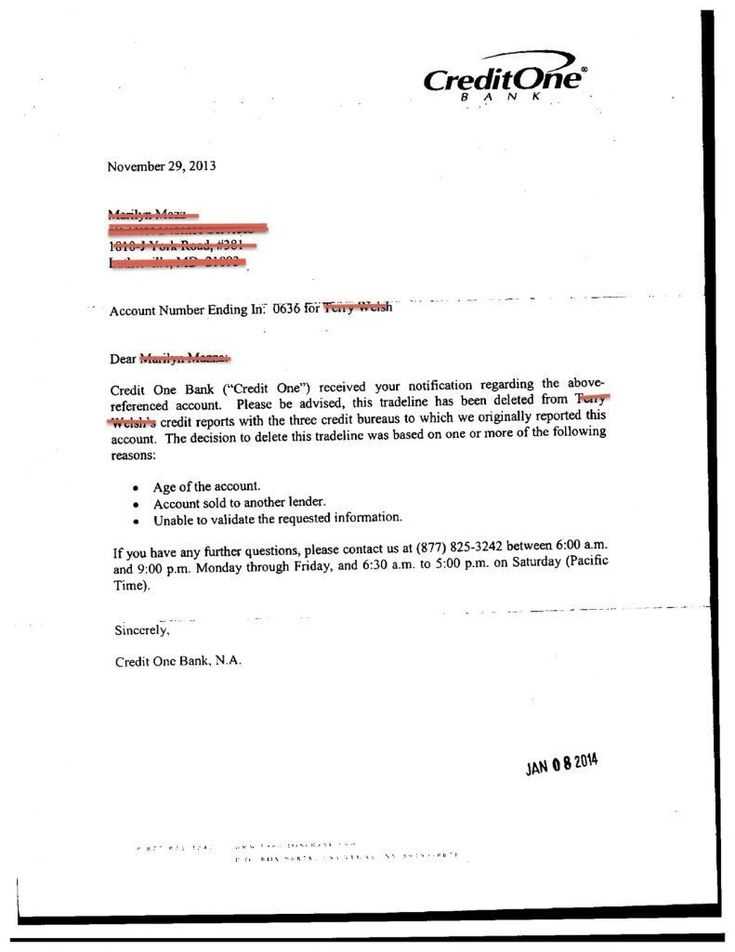

4. Follow Up

If you don’t receive a timely response, don’t hesitate to follow up. Keep a record of your communication and follow up with a polite reminder. Persistence shows your commitment to resolving the issue and encourages the creditor to address your request promptly.

5. Know Your Rights

Understanding your rights and the creditor’s obligations can strengthen your position. Familiarize yourself with the relevant regulations governing financial transactions and consumer protections in your country. Knowing your rights helps you approach the situation with confidence and ensures you can assert your position when necessary.