Dispute Letter Template for Credit Bureaus

If you’ve found inaccuracies in your financial records, it’s essential to take the right steps to correct them. Mistakes on your records can affect your ability to get loans, mortgages, and even jobs. However, you have the right to challenge any incorrect information, and taking action can lead to the resolution of these issues.

The process of addressing discrepancies involves clear communication and providing necessary details to the right institutions. It’s crucial to ensure that the information you provide is accurate and detailed, so the institution can verify and make necessary changes to your file.

In this guide, we will walk you through the proper steps to follow when seeking corrections to your reports. With the right approach, you can resolve the issues and protect your financial health moving forward.

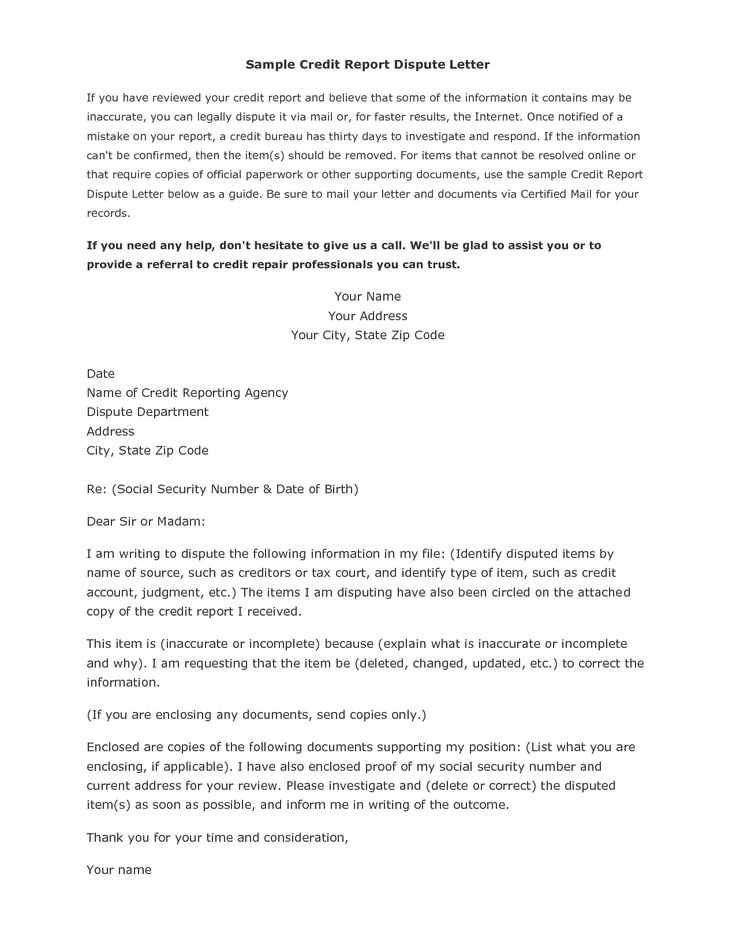

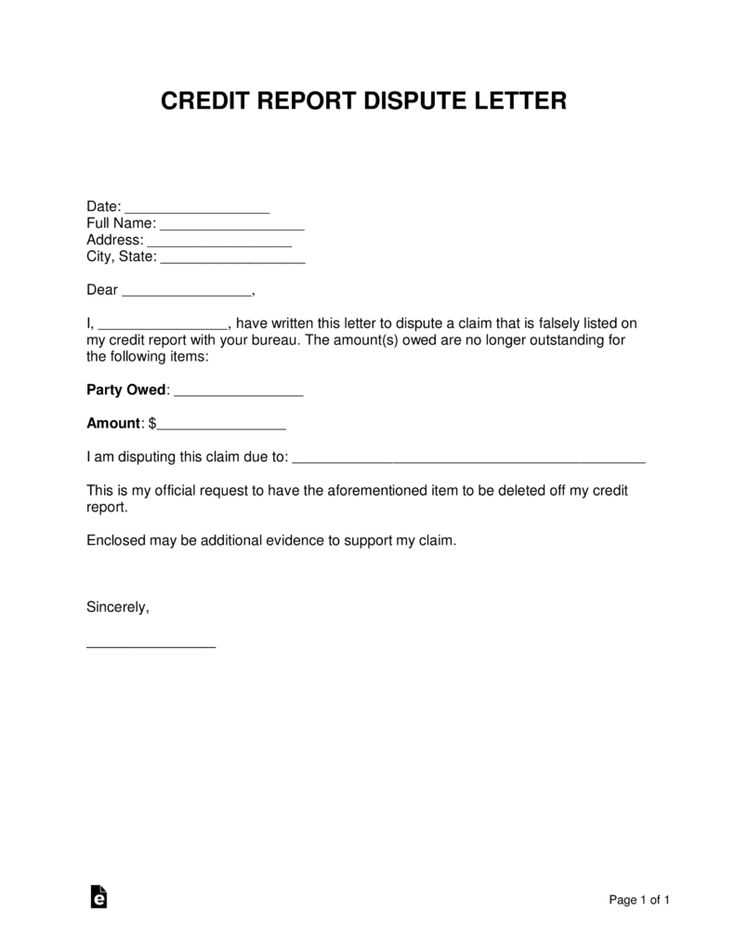

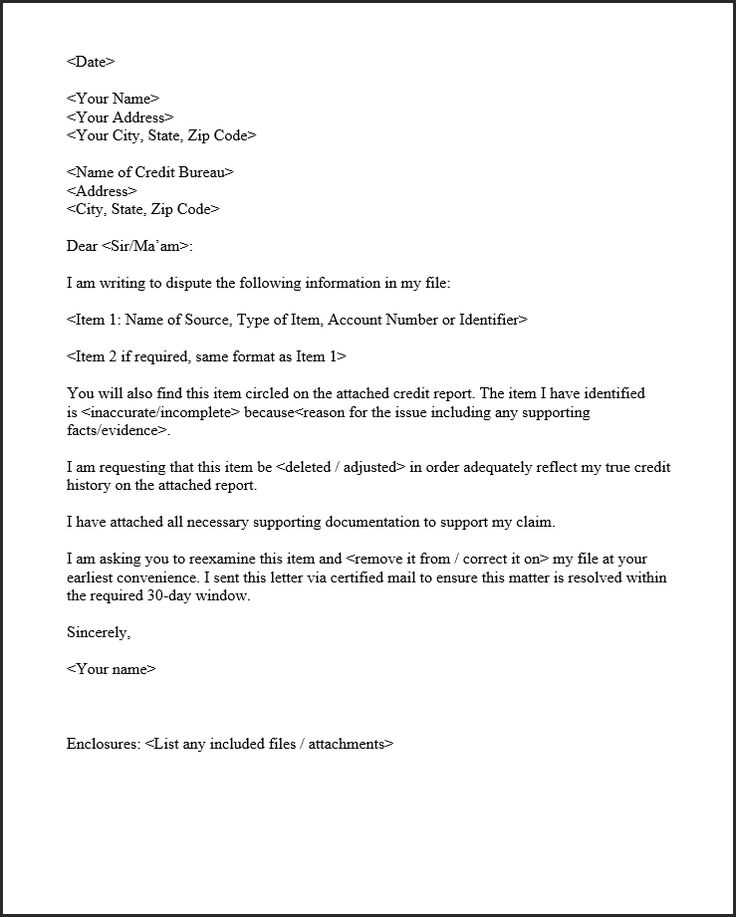

How to Write a Credit Dispute Letter

When errors appear in your financial records, it’s essential to respond in a structured and clear way. To begin, you need to clearly state the issue you have identified, outlining the exact problem with the details that need correction. A well-written request will help ensure the institution understands the nature of the mistake and can address it promptly.

Start by including personal information such as your full name, address, and account number. Then, describe the discrepancy, providing specific information about the item you are challenging. Attach any relevant documents that support your claim, such as statements or receipts that prove the error.

Finally, make a formal request for the institution to investigate the issue and correct the inaccuracies. Be polite but firm in your approach, and remember to keep a copy of the request for your records in case you need it for follow-up or further action.

Understanding Your Credit Report Errors

Financial records can sometimes contain mistakes that could impact your ability to secure loans or other financial services. These mistakes may arise from incorrect information, data entry errors, or outdated details. Understanding what causes these errors and how to identify them is the first step towards resolving them effectively.

Common Types of Errors in Financial Records

- Incorrect account details or balances

- Wrong payment history or missed payments

- Duplicate entries of the same debt

- Outdated personal information

- Incorrect account statuses or closures

How to Spot Mistakes in Your Report

- Review each account entry carefully, checking balances and dates.

- Verify that payments made on time are reflected accurately.

- Check for accounts that should no longer be listed as open or active.

- Ensure personal information such as your address, name, and phone number are correct.

By thoroughly reviewing your financial record, you can spot errors that may affect your financial health. Once identified, the next step is to correct them promptly to ensure your financial standing is accurate and up to date.

Steps to Address Credit Bureau Mistakes

When inaccuracies are found in your financial records, taking quick and effective action is crucial to prevent any further issues. The process of resolving errors typically involves a few essential steps, ensuring that the institution has all the necessary information to correct the mistake and improve your standing.

First, gather all relevant documentation that supports your claim. This may include bank statements, receipts, or correspondence that proves the error. Having these documents ready will strengthen your case and help expedite the review process.

Second, clearly identify the incorrect information in your report. Point out the specific details that need correction, whether it’s an incorrect balance, payment history, or personal data. The more precise you are, the easier it will be for the institution to locate and verify the error.

Next, submit your request to the relevant institution. You can typically do this through a formal process, either online or by mail. Be sure to include all supporting documentation and your contact information, ensuring that they can reach you if needed.

Finally, keep track of the progress and response. After submitting your claim, monitor the status and follow up if necessary. Make sure to keep copies of all correspondence for your records in case you need to escalate the issue or take further action.

Important Information to Include in Your Letter

When addressing errors in your financial records, providing the right information is crucial to ensure a timely and accurate resolution. Including the necessary details allows the institution to understand your concern clearly and verify the issue effectively. Here are key elements to include in your correspondence.

Your Personal Information: Always begin by providing your full name, address, and any identification numbers tied to your financial accounts. This helps the institution locate your records easily and ensures they are reviewing the correct information.

Specific Details of the Error: Clearly describe the mistake you’re addressing. Whether it’s an incorrect balance, payment history, or outdated data, be precise in identifying the issue. Reference specific dates, amounts, or transactions that are incorrect to avoid confusion.

Supporting Documents: Attach any relevant evidence that backs up your claim. This could include bank statements, receipts, or proof of payments that demonstrate the error. Including this documentation strengthens your request and speeds up the process.

Your Request for Action: Be clear about what you expect from the institution. Whether you’re requesting a correction, removal, or an update to your records, ensure your request is straightforward. Politely state that you would like the matter investigated and rectified promptly.

Common Mistakes to Avoid When Disputing

When addressing errors in your financial record, it’s important to avoid common missteps that could delay the process or reduce the chances of a successful resolution. Making these mistakes can result in unnecessary complications, so being aware of them can save you time and effort.

| Mistake | Explanation |

|---|---|

| Not Providing Enough Evidence | Failing to include supporting documents such as bank statements or receipts can weaken your case and lead to delays in resolving the issue. |

| Being Vague or Unclear | Not specifying the exact issue or referencing incorrect information can cause confusion and lead to further errors in processing your request. |

| Missing Deadlines | Many institutions have specific timelines for submitting requests or claims. Missing these deadlines can result in the rejection of your request or additional complications. |

| Using Aggressive Language | While it’s important to be firm, using rude or hostile language can cause unnecessary tension and may hinder a positive outcome. |

| Overlooking Follow-Up | After submitting your request, failing to follow up on the status or missing any response can delay the process and prevent a resolution. |

By being careful and avoiding these common errors, you increase the likelihood of resolving the issue efficiently and successfully. Always double-check your information before submitting and maintain clear communication throughout the process.

How Long Does the Dispute Process Take

The time required to resolve an issue with your financial records can vary depending on the nature of the mistake and the institution involved. While some corrections can be made relatively quickly, others may take more time due to the complexity of the error or the need for further investigation.

On average, the process typically takes between 30 to 45 days. This is the standard timeframe many institutions adhere to when reviewing claims and making necessary adjustments. However, certain factors may influence how long it takes.

Factors that can affect the duration:

- Complexity of the Issue: More complicated errors may require a deeper investigation, which can lengthen the process.

- Supporting Evidence: If additional documentation is needed, it could delay the timeline as the institution waits for the required information.

- Response Times: The speed at which the institution processes and responds to your request can vary, depending on their workload and efficiency.

While the process may take some time, staying in touch with the institution and following up if needed can help ensure that your request is handled as quickly as possible.

What to Do After Sending Your Dispute Letter

Once you’ve submitted your request to correct an error in your financial records, the next steps involve monitoring the situation and being proactive in ensuring a resolution. While the institution processes your claim, it’s essential to stay organized and follow up when necessary to ensure the matter is addressed promptly.

First, keep a copy of all documents sent, along with any confirmation or tracking numbers that prove your submission was received. This serves as important evidence should you need to reference your communication later.

Next, monitor the progress of your claim by staying in contact with the institution. Some may provide updates via email or through their online system, while others might require you to follow up manually. Be sure to allow enough time for them to complete their review, but don’t hesitate to reach out if the expected timeline has passed without a response.

Finally, if the issue is resolved in your favor, verify that the correction has been made and reflected accurately. If the matter is not resolved or is denied, review the response carefully to understand the reasons behind the decision, and consider escalating the issue or seeking further assistance.