Financial Hardship Letter Template for Creditors

In times of financial difficulty, reaching out to your financial institutions or service providers can feel overwhelming. It’s important to express your situation clearly to seek the help you need. Proper communication can lead to understanding and possibly even a temporary solution to ease the burden. Crafting a well-structured message can make a significant difference in how your request is received.

Understanding the right approach is crucial when asking for assistance. You need to convey the reasons for your current challenges while maintaining a respectful and professional tone. A thoughtful, concise explanation will help the recipient understand your situation and the actions you’re requesting.

While it’s tempting to explain your struggles in detail, it’s essential to remain focused on the key points. Clear and direct communication ensures your message is effective and can increase the chances of receiving a favorable response.

Understanding Financial Hardship Letters

When faced with unforeseen challenges that affect your ability to meet payment obligations, it becomes necessary to explain your situation to those you owe. This form of communication allows you to share the reasons behind your struggles and request assistance. The goal is to provide enough context for the recipient to understand your predicament and consider possible solutions to alleviate your burden.

Key Purpose of This Communication

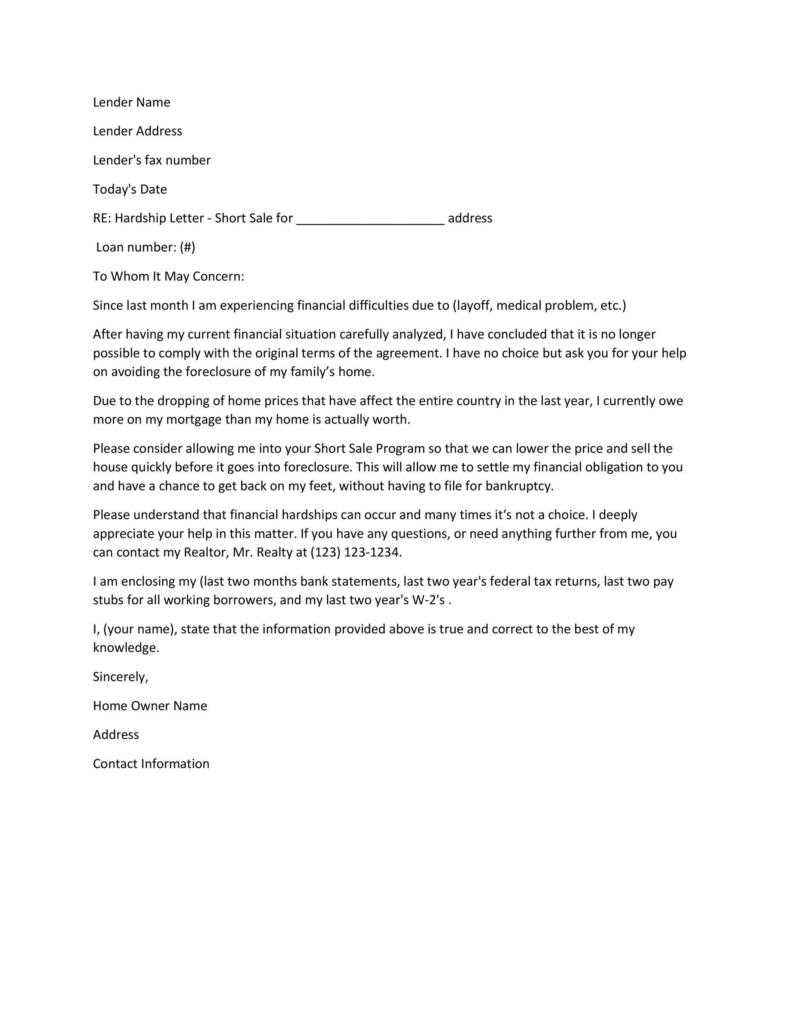

The main objective of this type of correspondence is to request temporary relief or restructuring of terms due to an unexpected life event. Whether it’s a medical emergency, job loss, or other circumstances, your message should focus on the cause of your difficulty and your intent to fulfill obligations once your situation improves.

What Makes the Approach Effective

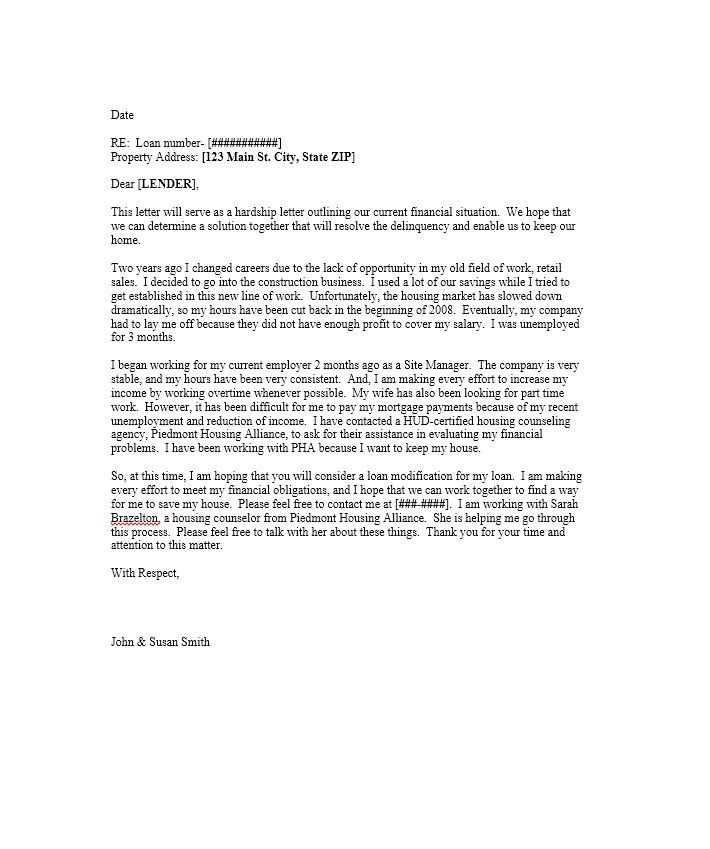

To be impactful, it’s essential to maintain a respectful and professional tone. A well-structured message should include all necessary details while staying concise. Offering a clear explanation of the issue at hand, while expressing your willingness to work toward a resolution, enhances the chances of a positive response. It’s also important to acknowledge the terms you’re requesting and provide a realistic timeline for when you’ll be able to resume regular payments.

Why You Need to Write a Letter

In situations where paying off obligations becomes difficult due to unexpected events, it’s essential to communicate your circumstances clearly. By writing a formal request, you create an opportunity to explain your situation and request assistance. This communication is a way to show the other party that you are proactive in managing your responsibilities, even if you’re currently facing difficulties.

Without this type of formal communication, it’s hard for others to understand the challenges you’re dealing with. A written request not only explains your current situation but also demonstrates your intention to work out a solution. Taking this step shows your commitment to resolving the matter, which can lead to more favorable outcomes, such as temporary relief or a more manageable payment plan.

Key Elements of a Financial Hardship Letter

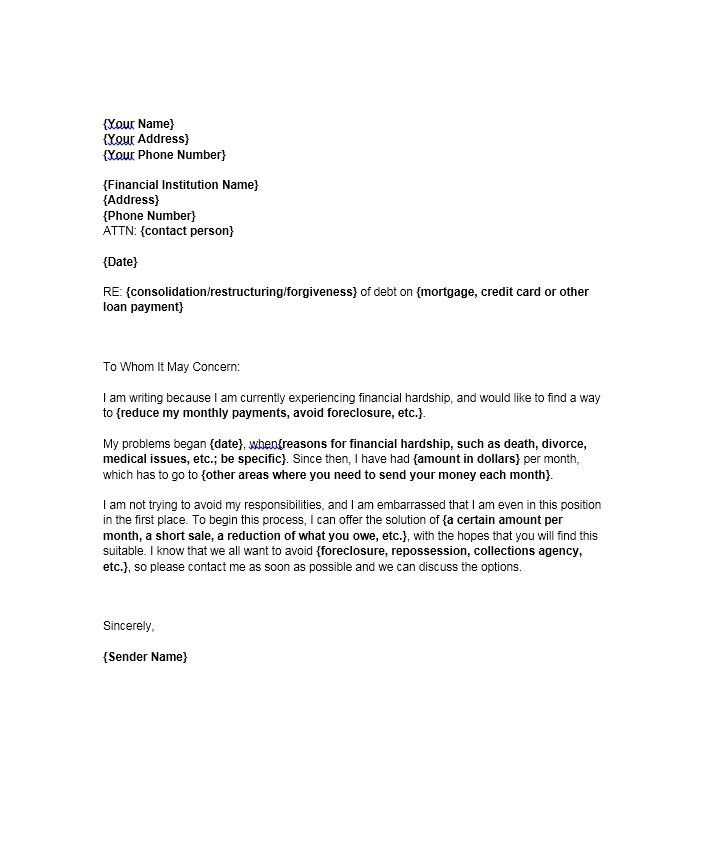

When crafting a request for assistance, it is important to include specific information that will help the recipient understand your situation. A well-structured message should provide clear details about the circumstances affecting your ability to meet obligations, while also showing your commitment to resolving the issue. Including the right elements ensures your communication is both professional and effective.

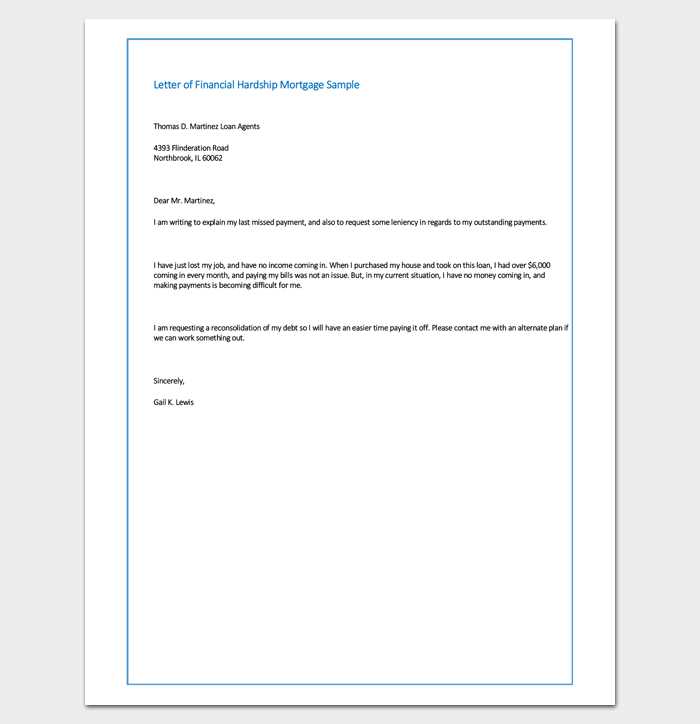

Start by briefly explaining the reason behind your current financial difficulty. This could include job loss, medical emergencies, or other significant life events. It’s crucial to be honest, as this helps the other party understand the situation. Following this, offer a proposed solution or request, such as an extension, reduced payments, or an adjusted payment plan. Lastly, provide a timeline for when you expect to be able to resume normal payments, demonstrating your intention to fulfill your responsibilities when possible.

Essential Information to Include

When requesting assistance, it is important to provide certain key details to ensure that your communication is complete and clear. This allows the recipient to understand your situation fully and evaluate your request more effectively. Including all relevant information helps build a case for your request, increasing the likelihood of a favorable response.

Personal and Account Information

Begin by providing your full name, contact information, and any relevant account numbers to help identify your file. This ensures that the recipient can quickly locate your details and process your request. Without this essential information, your communication may be delayed or overlooked.

Explanation of the Situation

Clearly explain the reason behind your current difficulty. Whether it’s due to health issues, job loss, or other circumstances, being transparent about your situation gives the recipient a clear understanding of why you are unable to meet obligations. The more specific and honest you are, the better the chances for a solution.

| Information Type | Description |

|---|---|

| Personal Details | Full name, contact information, and account numbers |

| Reason for Difficulty | Job loss, health issues, or other personal circumstances |

| Proposed Solution | Request for an extension, adjusted payment terms, or other alternatives |

| Timeline | Indicate when you expect to resume normal payments |

How to Approach Creditors with Compassion

When reaching out to request assistance or understanding, it’s important to approach the situation with empathy and professionalism. Demonstrating respect for the other party’s position while explaining your own challenges can create an environment of mutual understanding. Compassionate communication can make a significant difference in the response you receive and can lead to more favorable outcomes.

Be Honest and Transparent

Honesty is crucial when conveying your struggles. Clearly explain your situation and the circumstances that have led to your difficulty in meeting obligations. Being upfront about your challenges allows the other party to understand that your request is not made lightly, and it fosters trust. Providing details helps humanize the conversation and allows the recipient to see that you are not trying to avoid responsibility but are simply seeking support.

Maintain a Respectful Tone

It’s important to approach the conversation with a tone of respect and professionalism. While you may feel frustrated or overwhelmed by the situation, it’s essential to communicate in a manner that invites cooperation rather than conflict. A respectful tone increases the likelihood that your request will be taken seriously and that the recipient will be willing to work with you to find a solution.

Tone and Language for Effective Communication

The way you communicate can significantly impact the outcome of your request. Using the right tone and language ensures that your message is taken seriously and that your request is clear and respectful. By choosing your words carefully and maintaining a professional demeanor, you increase the chances of a positive response to your appeal.

A calm, respectful, and cooperative tone is key when discussing difficult situations. It’s essential to avoid sounding defensive or confrontational, as this could alienate the person receiving your message. Instead, focus on being polite, acknowledging the situation, and offering constructive solutions that show your willingness to work together.

Additionally, language should be clear and precise. Ambiguous statements can lead to misunderstandings and may delay resolution. Keep your message concise while providing enough detail to fully explain your circumstances. A straightforward, no-nonsense approach helps convey your sincerity and makes it easier for the recipient to understand your position and respond appropriately.

Common Mistakes to Avoid in Your Letter

When crafting a request for assistance, there are several common errors that can undermine the effectiveness of your communication. Avoiding these mistakes will help you present your case more clearly and improve the likelihood of a positive response. It’s important to remain professional, clear, and focused on your goals while addressing the situation.

- Being Too Vague – Failing to provide specific details about your situation can leave the recipient unsure of your needs. Always be as clear as possible about your circumstances and the solution you are seeking.

- Blaming Others – While it may be tempting to point fingers, blaming external factors may come across as unprofessional. Focus on explaining the situation without assigning blame.

- Making Unreasonable Requests – Ensure that your request is realistic and achievable. Asking for an extreme reduction or unrealistic terms may hinder your chances of a favorable response.

- Using Negative Language – Negative language, such as “I can’t” or “I won’t,” can create a barrier. Instead, use positive language to frame your request in a cooperative light.

- Not Being Honest – It’s important to be truthful about your situation. Misrepresenting facts can damage trust and make it harder to reach a fair solution.

Ensuring Your Request is Clear

For your appeal to be effective, it is essential to express your needs clearly and without ambiguity. A straightforward message helps the recipient understand your situation and the specific support you are seeking. Clarity eliminates confusion and facilitates faster decision-making, increasing the likelihood of a positive response.

- State Your Request Directly – Avoid beating around the bush. Clearly outline what you need, whether it’s an extension, a payment reduction, or a different arrangement. This ensures there is no misunderstanding about your expectations.

- Provide Relevant Details – Include any necessary background information that supports your request. For example, mention your current financial status, the reason for the difficulty, and any efforts you’ve made to resolve the issue.

- Offer a Solution – Propose a realistic plan or solution that can help you meet your obligations. This shows that you are proactive and willing to work towards a resolution.

- Avoid Overcomplicating the Message – Use simple and concise language. Over-explaining or using jargon can confuse the recipient, making it harder for them to understand your needs.

- Be Specific About Timeframes – Indicate when you would like to revisit the situation or when you can begin making the proposed changes. Providing a clear timeframe helps set expectations.