Hardship Letter Template for Creditors

In challenging financial times, individuals may find themselves struggling to meet their obligations. Communicating with those they owe money to is essential to reach an understanding and request support. Crafting a well-structured and sincere message is key to obtaining help during difficult circumstances.

Key Elements of a Request

A successful request for relief requires clear communication and the right tone. It’s important to outline the issue, provide relevant details, and express a genuine need for assistance. Below are some critical components to include:

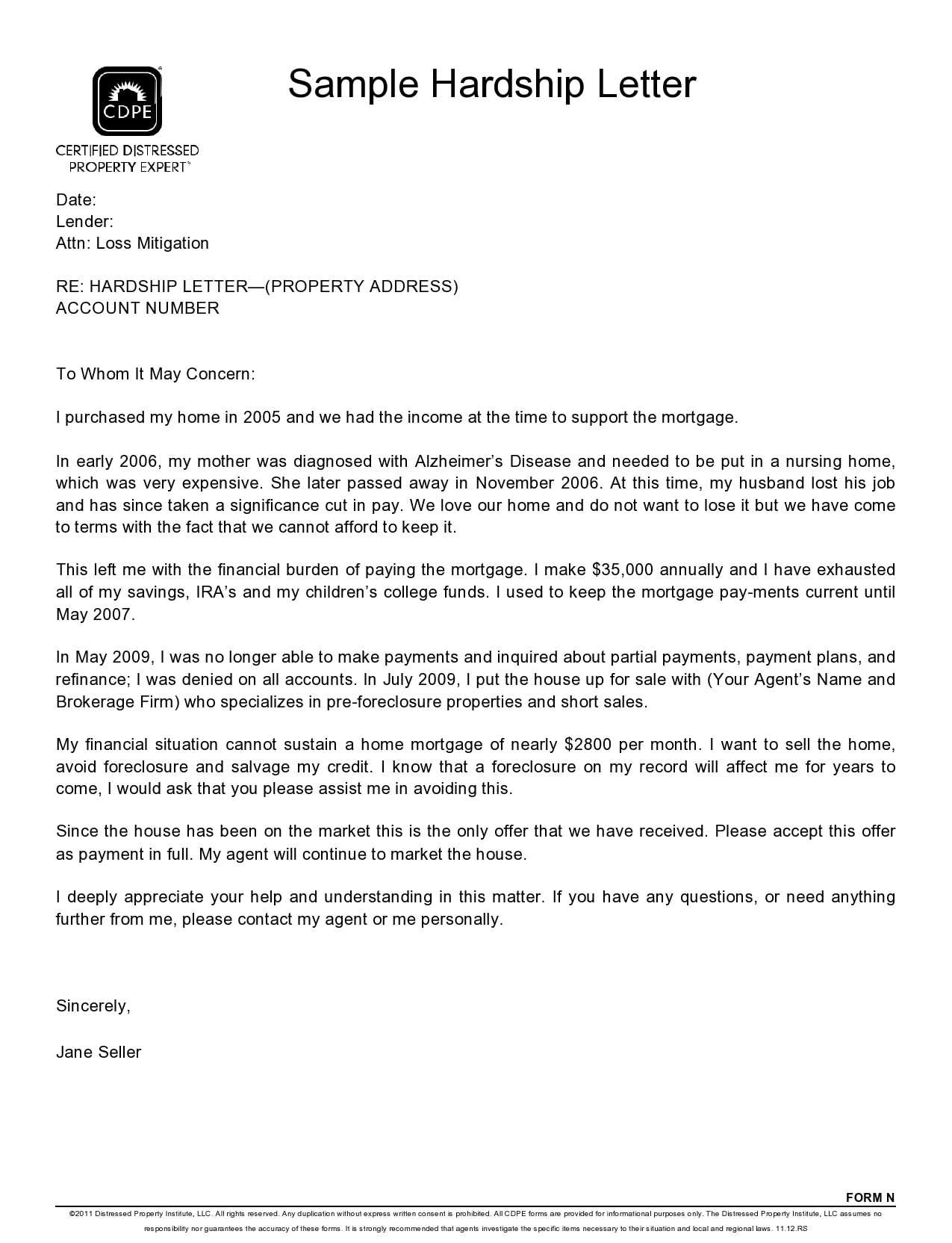

- Introduction: A brief introduction that clearly states the purpose of the communication.

- Explanation: An honest description of the situation causing financial difficulty.

- Request: A specific ask for assistance or a reduction in obligations.

- Conclusion: A polite and respectful close, offering to provide additional documentation if needed.

Steps to Craft a Persuasive Message

When writing your appeal, consider the following guidelines to increase its effectiveness:

- Be honest: Clearly explain your situation and avoid exaggerating or omitting facts.

- Stay professional: Keep your tone formal and respectful, even if the circumstances are emotional.

- Provide evidence: If possible, include any supporting documents that validate your claims, such as medical bills or loss of income details.

- Be concise: Keep your message brief and to the point, making it easy for the reader to understand the situation.

Avoiding Common Mistakes

When writing your appeal, certain errors can weaken your request. Avoid these common pitfalls:

- Being too vague: Without clear details, the reader may not fully understand your situation.

- Using an overly casual tone: A message that lacks professionalism may not be taken seriously.

- Failure to follow up: If you do not hear back within a reasonable time, be proactive in reaching out again.

Understanding the Response

Once the request is sent, it’s important to understand how the recipient may respond. Depending on the situation, they could offer a temporary solution, such as reduced payments or extended deadlines. If your request is denied, don’t be discouraged–there may be other options to explore.

Financial Assistance Request Process

When facing financial difficulties, reaching out for assistance through a written request is often the best way to communicate the need for support. An effective request can help establish an understanding between the person in need and the institution or individual to whom the request is directed. Crafting this communication requires a careful approach to ensure clarity and sincerity.

Key Elements of a Successful Appeal

An impactful request contains several key components to ensure its success. These elements should be structured in a way that is clear and professional, without overwhelming the recipient with excessive information.

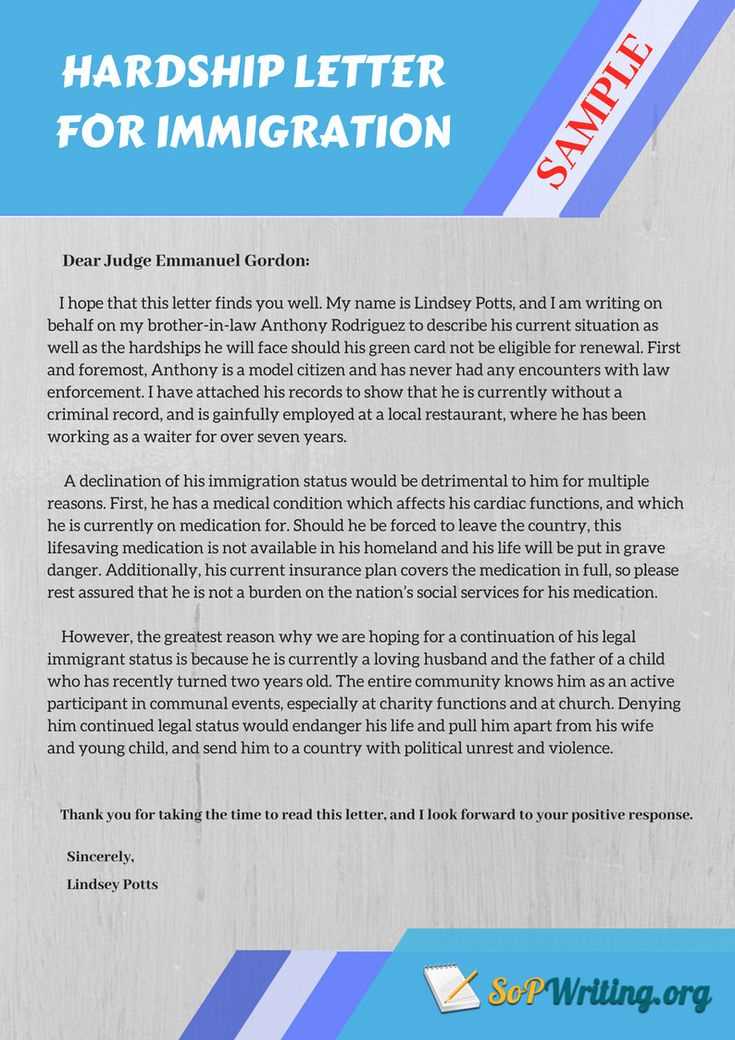

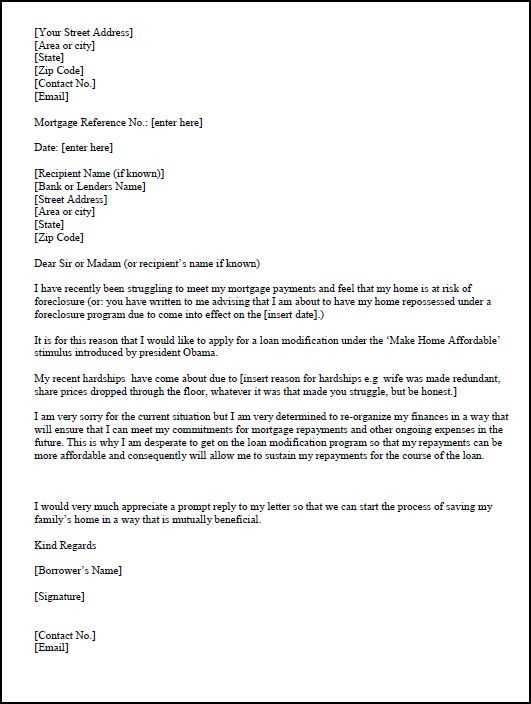

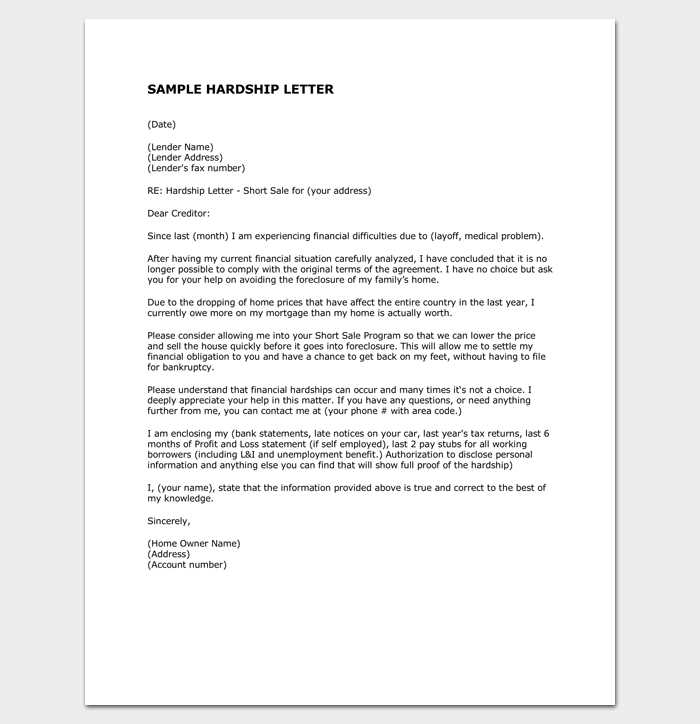

- Introduction: Start with a brief introduction that clearly states your request and the reason for writing.

- Explanation: Describe the circumstances that have led to the financial difficulty, including any relevant details that provide context.

- Specific Request: Clearly state what you are asking for–whether it’s a temporary reduction in payments, an extension, or another form of assistance.

- Conclusion: End on a polite note, expressing gratitude for the reader’s time and consideration, and offer to provide further documentation if needed.

How to Address Financial Challenges

When addressing financial challenges in your request, it’s important to be transparent about your situation. Provide relevant facts, such as job loss, medical expenses, or other unforeseen hardships. However, ensure that your tone remains respectful and professional throughout the message, as this will make the request more persuasive.

Additionally, avoid exaggerating or misrepresenting facts, as this could harm your credibility. Be concise and stick to the most important details, focusing on the aspects that directly relate to the assistance you are seeking.

Tips for Writing a Convincing Appeal: To make your request more persuasive, consider the following advice:

- Be clear and specific: Avoid vague language and focus on what exactly you need from the recipient.

- Use a respectful tone: Maintain professionalism, even if the circumstances are emotionally charged.

- Provide supporting evidence: If possible, include relevant documents that back up your claims.

Common Pitfalls to Avoid: Many appeals fail due to simple mistakes that could have been avoided. Be sure to watch out for the following:

- Being too vague or unclear about your needs.

- Failure to maintain a formal and respectful tone.

- Neglecting to follow up if you do not receive a timely response.

How Financial Institutions Respond

Once the request is sent, financial institutions or individuals may review the appeal and determine whether they can accommodate the request. Responses can vary, with some offering temporary relief in the form of adjusted payment terms, while others may not be able to grant the request immediately. Understanding the likely outcomes will help you manage expectations during this process.

Have you ever had to make a similar request, or are you looking for specific advice on how to structure your own?