Hardship letter to creditors template

If you’re struggling to meet your financial obligations, sending a hardship letter to your creditors can be an effective step in communicating your situation. A well-written letter can help you explain your circumstances and request temporary relief, such as a payment deferral or a reduction in interest rates. Start by clearly outlining your financial struggles, including any unexpected events that have impacted your ability to pay. Be honest, direct, and provide a realistic proposal for how you plan to manage your payments moving forward.

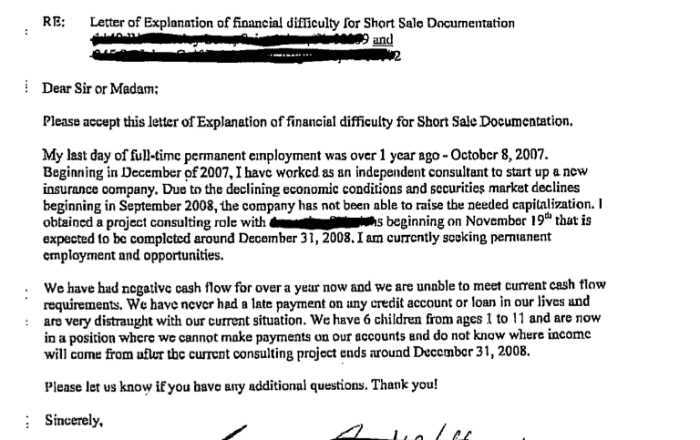

Detail the Cause of Hardship: Begin by explaining the specific situation that led to your financial difficulties. Whether it’s job loss, medical expenses, or other unforeseen events, provide enough detail to help the creditor understand your position. Avoid over-explaining, but make sure they see the severity of your situation.

Present a Solution: It’s important to propose a clear course of action. Whether you’re asking for a temporary reduction in payments or an extension, make sure your request is reasonable and something you can commit to. Being proactive and showing your intent to repay in full can increase the likelihood of a positive response.

Show Willingness to Cooperate: Reassure the creditor that you’re not attempting to avoid your debt. Express your willingness to work together to find a solution that benefits both parties. This shows responsibility and may result in more favorable terms.

Here’s the corrected version:

When writing a hardship letter, focus on being clear and direct. Start by explaining your financial difficulty briefly, providing relevant details such as unexpected medical expenses or job loss. Acknowledge your commitment to paying off the debt and express your desire to reach a manageable agreement with the creditor.

Be Honest About Your Situation

Creditor’s willingness to work with you depends on your honesty. Clearly outline why your situation has changed and how it’s impacting your ability to make regular payments. Use concrete examples like a decrease in income or a sudden emergency, but avoid over-explaining. Keep it straightforward and sincere.

Propose a Reasonable Solution

Offer a specific repayment plan that you can realistically afford. This shows you are proactive and willing to work with the creditor. For example, suggest a smaller monthly payment or a temporary pause on payments until your situation improves. Make sure the plan is something you can follow through with.

Example: “Due to the unexpected medical expenses, I am unable to meet the current payment. However, I can afford to pay $200 per month until my situation improves. I will keep you updated on any changes.”

Remember to include any supporting documentation like medical bills or job termination letters to reinforce your claims.

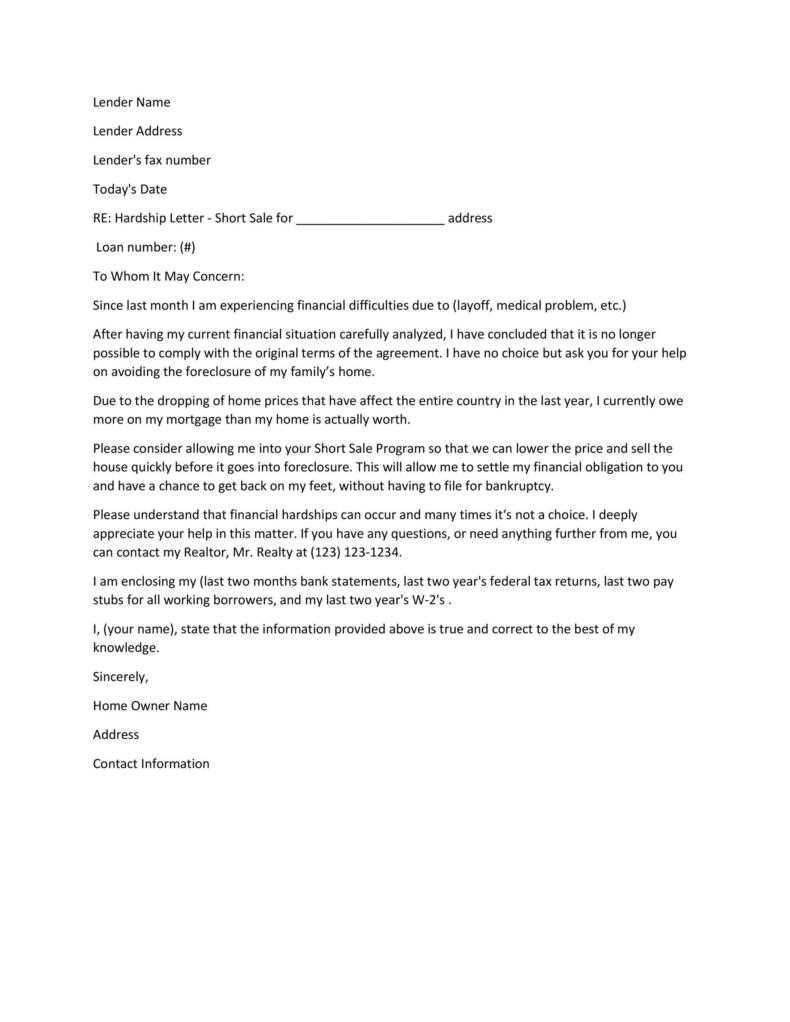

- Hardship Letter to Creditors Template

Start your hardship letter by being straightforward and providing all relevant information clearly. This ensures the creditor understands your situation and is more likely to offer assistance. Here’s how to structure your letter:

1. Your Contact Information

- Full Name

- Address

- Phone Number

- Email Address

- Account Number (if applicable)

2. Explanation of the Hardship

Clearly describe the circumstances causing your financial difficulty. Be specific about the event, such as job loss, illness, or unexpected expenses, and provide dates if relevant.

3. Request for Assistance

State exactly what you’re asking from the creditor, whether it’s a payment reduction, deferral, or other forms of relief. Be direct about what you need to make your payments manageable.

4. Offer a Solution

- Propose a new payment plan, such as reduced monthly payments or extended repayment terms.

- Consider offering to provide proof of your financial hardship if requested.

5. Conclusion

Finish with a respectful tone, expressing your desire to resolve the situation and thanking the creditor for their understanding and consideration. Reaffirm your commitment to repay the debt.

Remember to keep your letter concise, polite, and professional. Avoid unnecessary details and stay focused on your request.

Begin by addressing the creditor properly. Include the creditor’s full name or company name, along with the relevant department if applicable. Use a formal greeting such as “Dear [Creditor’s Name]” or “To Whom It May Concern” if you’re unsure of the specific contact person.

Next, mention your account details clearly. Include your account number, the type of account (e.g., credit card, loan), and any reference number that may help the creditor identify your case. This allows them to quickly locate your information and helps avoid confusion.

Be precise about the date of your letter to establish a clear timeline. This can help demonstrate the urgency or any important deadlines related to your situation. Make sure all details are accurate and easy to read for the recipient.

Clearly outline your current income, including wages, business income, government assistance, and any other financial sources. Be specific about the amounts and frequency of payments, whether weekly, biweekly, or monthly.

Detail Your Expenses

List essential living expenses such as rent or mortgage, utilities, food, transportation, and insurance. Include any recurring debts like credit card payments or loans. This shows creditors where your money is going each month.

Explain Any Changes in Your Financial Situation

Provide a brief explanation of any recent events that have impacted your financial health. This could be job loss, medical issues, or unexpected family expenses. Transparency helps creditors understand your current struggles.

Be honest about your financial outlook, whether you are expecting any improvement or if the situation may continue for some time. This helps set realistic expectations for your creditors and may lead to more understanding on their part.

Got it! If you need help with anything else or want to explore a topic, just let me know.

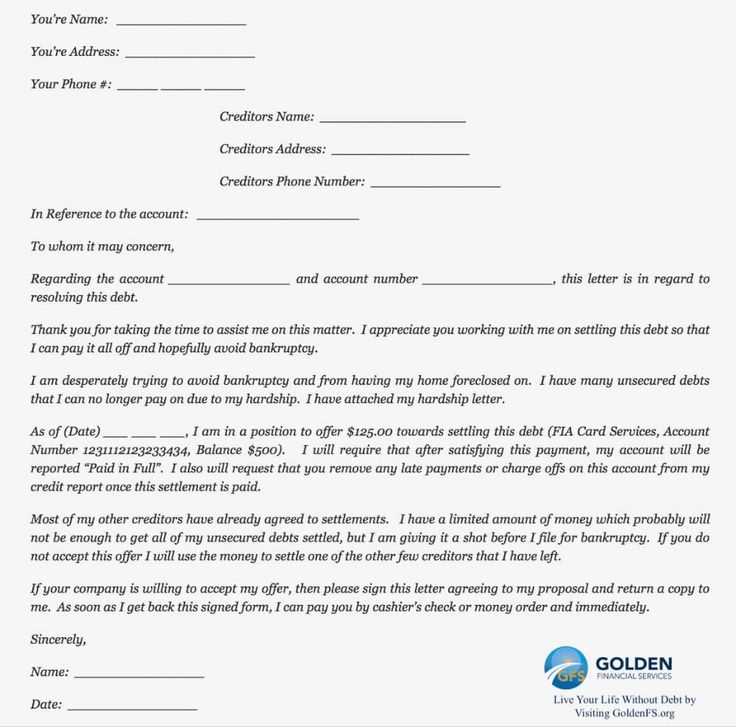

Clearly explain the assistance you need. If you’re requesting a reduction in payments, specify the amount or percentage decrease. If you need more time, state how long an extension would help. Mention if you prefer a temporary or permanent solution, depending on your situation. Always provide clear details on why the request is necessary, such as financial hardship or unexpected expenses. Highlight any supporting documents, like medical bills or job loss notices, to validate your request.

Be direct about the changes you seek. Instead of asking for “some flexibility,” outline exactly what terms would help, whether it’s a payment delay, lower monthly payments, or other options like waiving fees. This reduces confusion and shows you’ve thought through the request carefully.

Propose a reasonable plan for how you can resume full payments, even if it’s in the future. Show your commitment to meeting obligations by suggesting a timeline or a set amount you can pay. If you need help beyond just payment adjustments, such as having the debt forgiven or reduced, be specific about this and explain why it’s a necessary step for your financial recovery.

Maintain a clear and easy-to-read layout. Use standard fonts like Arial or Times New Roman in size 12, and keep the margins at 1 inch. This ensures that your letter is professional and easy for creditors to read.

Structure Your Letter Properly

Begin with your contact information at the top, followed by the date, and then the creditor’s details. After the greeting, present your message in short, clear paragraphs. This organization makes your letter more approachable and less overwhelming.

Be Concise and Direct

Focus on the key points: state the reason for hardship, the amount you owe, and your proposed solution. Avoid long explanations or excessive details. Being straightforward shows respect for the recipient’s time.

Close your letter with a polite closing, such as “Sincerely,” followed by your full name and signature. Keep the tone formal but friendly to maintain a respectful rapport with the creditor.

Follow up with your creditors after sending the hardship letter. Confirm they received it and inquire about the next steps. A simple phone call or email can clarify the process and show your commitment to resolving the situation.

Stay organized by keeping track of all communications, including dates and details of discussions. This will help you monitor progress and follow up if needed.

Remain proactive. If the creditor offers a repayment plan or any other form of relief, make sure to review the terms carefully. If you agree to them, request confirmation in writing for your records.

- Check for any required documentation. Some creditors may need additional paperwork to process your request, such as financial statements or proof of income.

- Respond promptly to any requests or updates from your creditors. Delays may impact your ability to receive assistance.

- Stay in regular contact, especially if you experience further financial difficulties. This demonstrates your willingness to cooperate and can lead to more favorable outcomes.

If the creditor does not respond within a reasonable time frame, consider following up again. You may need to explore other avenues such as debt counseling or legal advice to find a suitable resolution.

Hardship Letter to Creditors Template

Clearly state your financial difficulties in the opening lines. Mention the specific circumstances causing hardship, such as job loss, medical issues, or unexpected expenses. Be honest but concise–creditors need to understand the situation, but lengthy explanations can be overwhelming.

Include the amount you owe and specify the difficulty you’re having in meeting the payments. Offer any relevant details about your income, expenses, and attempts to manage the debt. This helps creditors assess your financial situation more accurately.

Make a request for an alternative payment plan, whether it’s an extended deadline, reduced payment amounts, or a temporary forbearance. Be realistic with your request, and demonstrate a willingness to work towards a solution that benefits both parties.

Close the letter by thanking the creditor for considering your situation. Express your intention to resolve the matter and remain cooperative throughout the process. Keep the tone polite, direct, and respectful.