Complete Guide to Letter of Credit Explanation Template

In business transactions, particularly those involving international trade, providing a clear and structured document outlining the terms of payment is essential. This document serves as a written agreement between parties, detailing the conditions and obligations that both sides must meet. Properly drafting such a document ensures transparency and security for both buyers and sellers, reducing the potential for disputes.

Key Components of a Payment Assurance Agreement

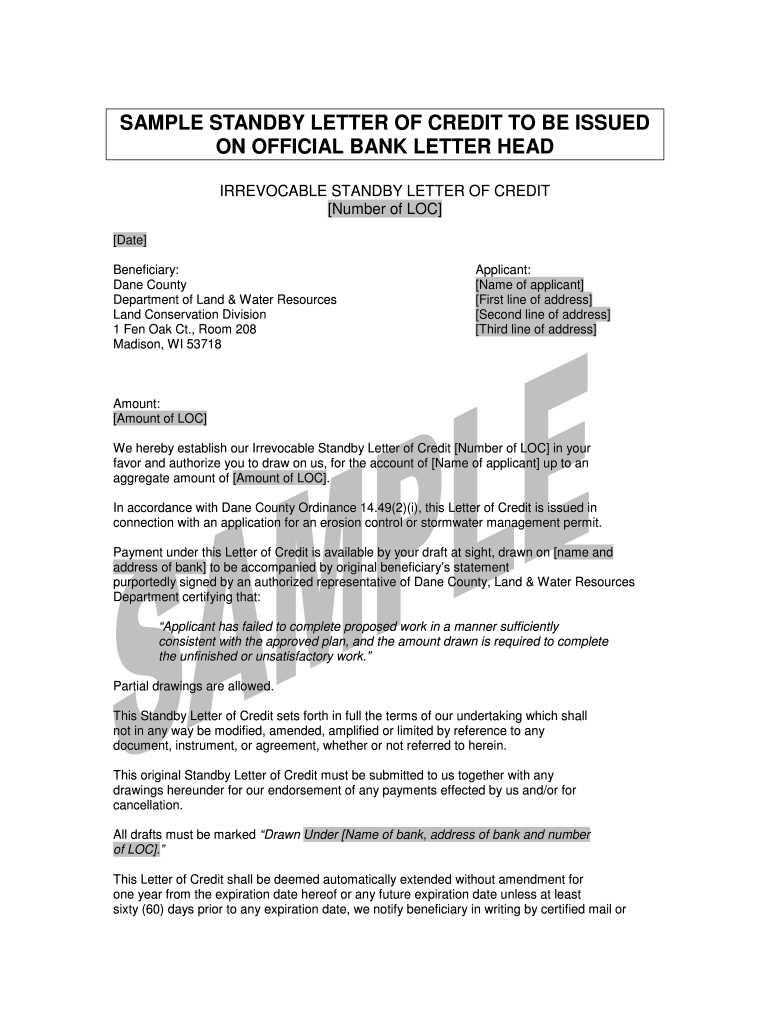

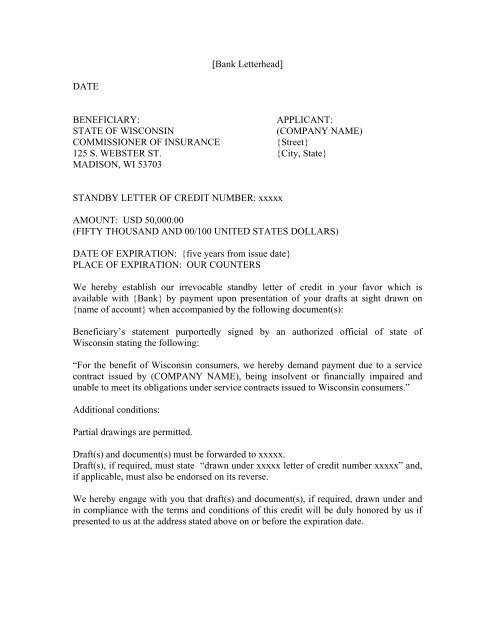

A well-structured payment assurance document includes several critical elements to ensure both parties are aligned on the terms of the transaction. These components generally cover the following:

- Parties Involved: Identifies the buyer and seller, along with their relevant contact information.

- Payment Conditions: Describes how and when payment is to be made, including payment methods and deadlines.

- Documentary Requirements: Specifies what documents must be submitted to confirm that obligations have been fulfilled.

- Dispute Resolution: Outlines procedures for resolving conflicts should they arise during or after the transaction.

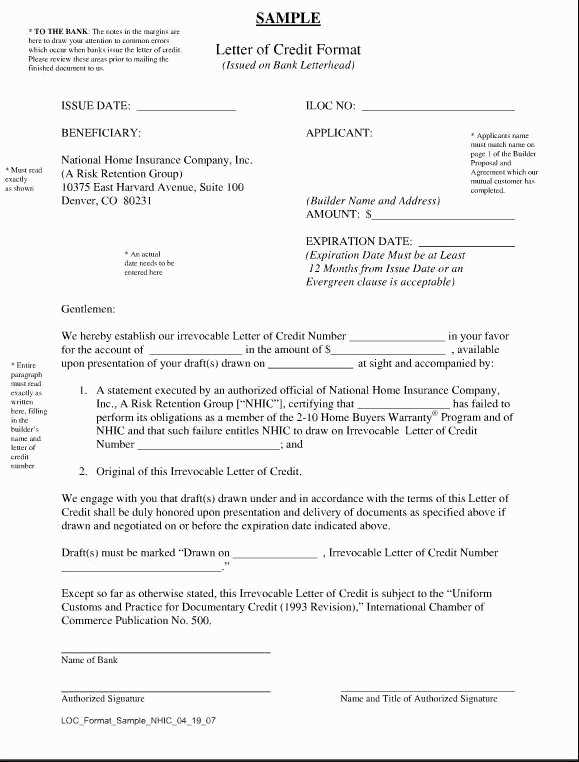

Steps to Create an Effective Agreement

To ensure your document is effective, follow these basic steps when drafting:

- Identify all parties: Clearly state the names and addresses of both the buyer and the seller.

- Define terms: Make sure all terms used in the agreement are clearly defined and easy to understand.

- Establish deadlines: Set clear deadlines for performance and payment to avoid confusion.

- Clarify procedures: Explain the processes for fulfilling conditions and resolving potential issues.

Customizing Your Document for Specific Needs

Different business contexts may require slight modifications to the standard document structure. For instance, in some cases, additional clauses may be necessary to account for more complex payment arrangements or to accommodate specific legal requirements in different regions.

Common Pitfalls and How to Avoid Them

When preparing a payment assurance document, it is crucial to avoid certain mistakes that could lead to misunderstandings or legal issues. Some common pitfalls include:

- Vague language: Avoid using ambiguous terms that may lead to different interpretations of the agreement.

- Missing signatures: Ensure that all parties sign the document to validate the terms.

- Unclear dispute resolution terms: Specify in detail how disputes will be handled to avoid lengthy legal processes.

By carefully considering these elements and taking steps to tailor the agreement to your specific transaction, you can ensure that both parties are protected, and the process runs smoothly.

Understanding Payment Assurance Basics

In any financial transaction, especially those involving large sums or international trade, establishing clear agreements is essential to ensure both parties meet their obligations. A well-structured document provides the foundation for transparency and security, minimizing the risk of disputes. Crafting a document with precision ensures that all involved understand the expectations and can avoid complications during or after the exchange.

Effective documents should outline the conditions under which payments are made, the necessary documentation required to confirm the transaction, and the resolution processes if conflicts arise. Clear language and specific terms protect both sides and build trust in the transaction process.

Several key elements must be included to guarantee clarity and enforceability. The agreement must clearly identify the parties involved, the payment conditions, and the required paperwork. Furthermore, the document should include a dispute resolution clause to address any issues that might arise.

When drafting such an agreement, it’s crucial to carefully define each term used within the document to avoid misinterpretation. The steps should include stating all essential details, establishing timelines, and specifying the conditions under which actions will be deemed fulfilled. A properly structured document sets the stage for smooth transactions.

One of the most common mistakes in creating financial documents is failing to clearly state the payment terms or leaving crucial details undefined. Ambiguity leads to confusion, and in some cases, may result in legal complications. To avoid such errors, ensure that every term is well-defined and every process outlined in detail.

Tailoring the agreement to fit specific needs may require adding clauses to reflect unique conditions or requirements of the involved parties. This ensures that the document is relevant to the situation, providing both flexibility and security for the transaction.

Finally, ensuring that the document complies with legal standards is crucial. The terms must align with relevant laws, especially in different jurisdictions, to ensure the agreement is enforceable and provides protection to both parties involved.