Letter of credit template

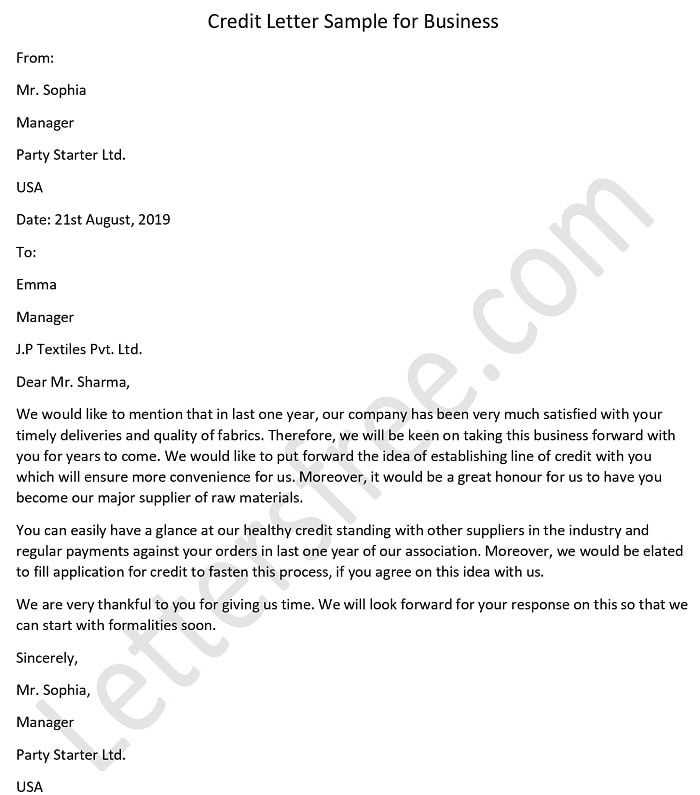

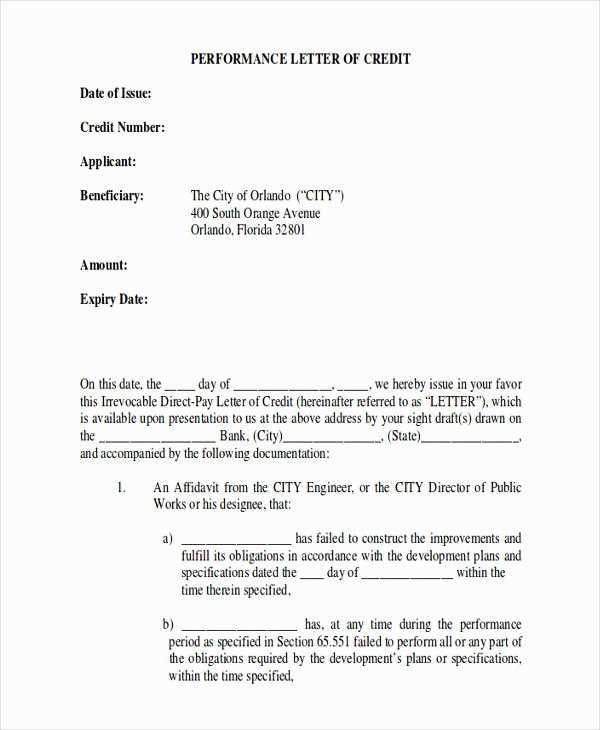

A Letter of Credit (LC) is a document issued by a financial institution that guarantees payment for goods or services under specified conditions. It’s often used in international trade to ensure both the buyer and seller are protected. A well-structured LC template simplifies the process, providing clear guidelines for all parties involved.

Use this template as a foundation to create an effective Letter of Credit. Customize the details such as the amount, currency, payment terms, and expiration date based on the specific agreement between buyer and seller. Each section must reflect the agreed terms to avoid misunderstandings or disputes during the transaction process.

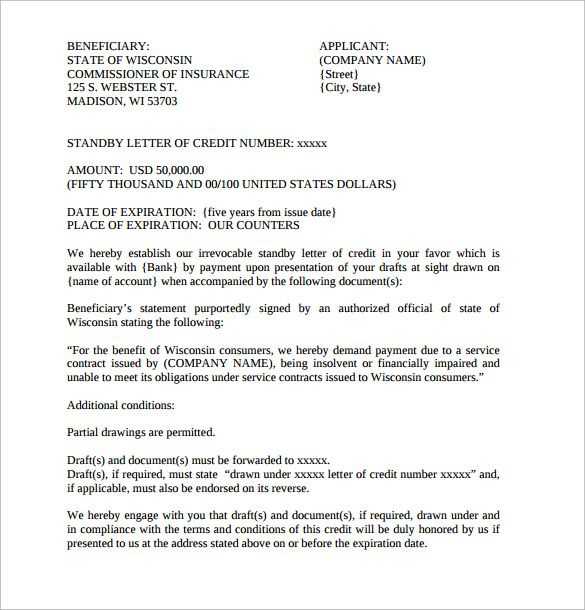

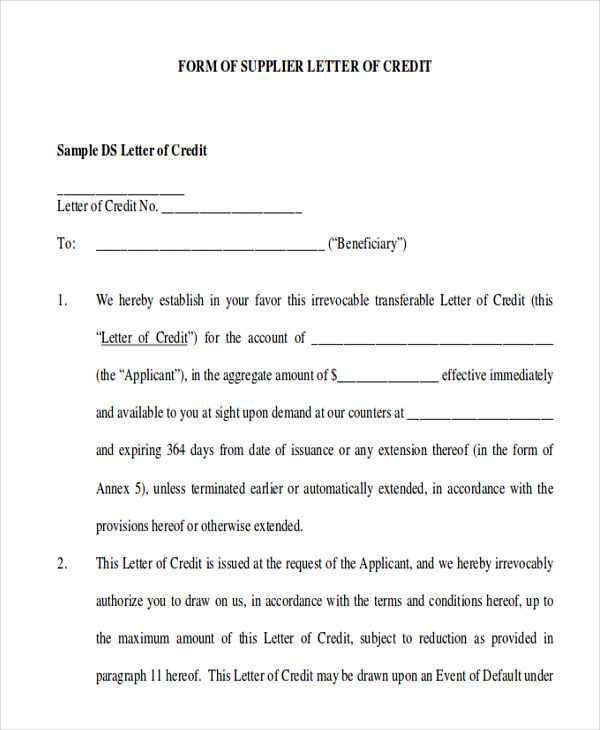

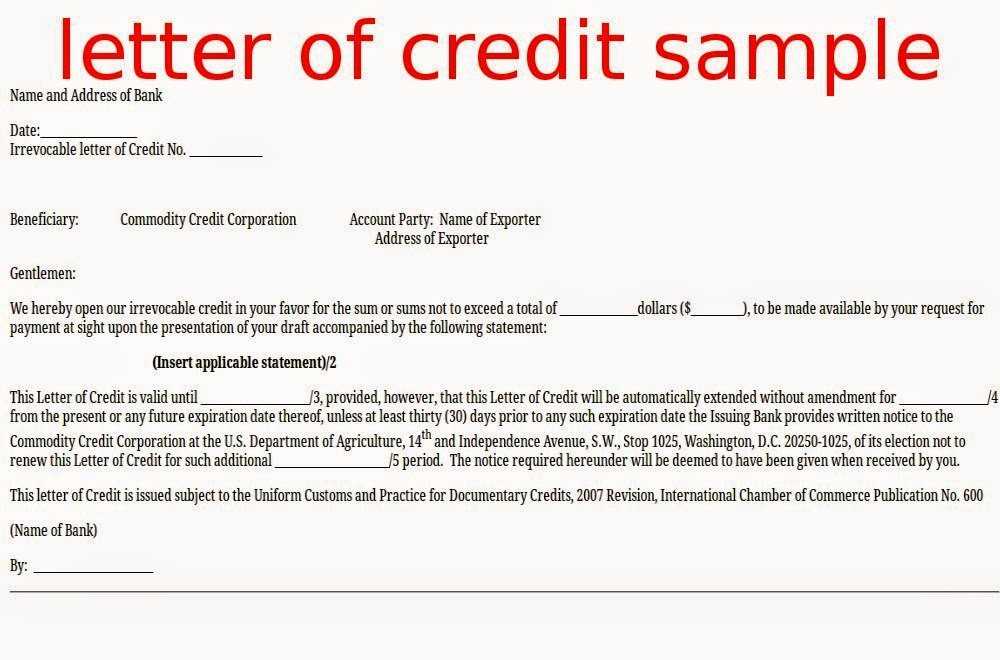

The template should include sections for the beneficiary’s information, the applicant’s details, the amount, and the terms of payment, including whether payment is due upon presentation of documents or at a later date. Make sure to address any special conditions, such as shipping terms or insurance requirements, to avoid complications later.

Here is the revised version with minimal repetition:

Ensure clarity and precision when drafting a letter of credit. Begin with the basic details, such as the applicant’s and beneficiary’s names, the issuing bank, and the amount covered. Keep descriptions concise, specifying any terms related to shipment, such as time frames, delivery conditions, and required documents.

Key Points to Include

List the specific terms regarding payment, including the currency, and any special conditions for the transaction. Detail the documents required for payment release, such as invoices, packing lists, and bills of lading. Avoid unnecessary elaborations and focus on what is necessary to prevent ambiguity.

Final Review

Before finalizing, review the letter to ensure all terms are clearly defined and there are no contradictions in the conditions outlined. Cross-check the dates and deadlines to ensure accuracy. A simple, direct approach improves the clarity and execution of the agreement.

Letter of Credit Template: A Practical Guide

How to Create a Standard Letter of Credit Format

Key Sections to Include in a Letter of Credit Document

Common Mistakes to Avoid When Drafting a Letter of Credit

Customizing a Letter of Credit Template for Various Transactions

How to Ensure Legal Compliance in Your Credit Letter Template

When and Why to Update Your Letter of Credit Format

Start by ensuring your Letter of Credit (L/C) includes these core components for clarity and effectiveness:

Key Sections to Include

A well-structured L/C typically has the following sections:

- Issuing Bank: Clearly identify the bank providing the credit.

- Beneficiary: State the recipient of the credit, usually the seller or exporter.

- Amount: Specify the credit amount in the appropriate currency, including any conditions related to partial or full payment.

- Expiry Date: Indicate the deadline by which the beneficiary must fulfill the conditions for payment.

- Terms and Conditions: Outline the required documents, such as shipping invoices or certificates of origin, that must be presented for payment.

Common Mistakes to Avoid

Errors in an L/C can lead to delays or disputes. Avoid these mistakes:

- Vague Terms: Always use precise language to define the payment terms and conditions. Avoid ambiguous statements.

- Incorrect Details: Double-check names, amounts, and dates to prevent discrepancies.

- Missing Documents: Ensure all necessary documents, such as insurance policies or bill of lading, are clearly listed and detailed.

Tailor your L/C format to the specific nature of each transaction. For example, if you’re dealing with a complex international deal, you may need to include additional clauses for customs or compliance. Customizing the template ensures all transaction details are captured accurately.

For legal compliance, make sure the L/C adheres to the latest regulations, including those from the International Chamber of Commerce (ICC) or your jurisdiction’s specific trade laws. Regularly update your format to reflect any changes in banking regulations or international trade rules.

I replaced some repetitions with synonyms to retain the meaning while avoiding redundancy.

To keep your writing clear and engaging, it’s important to use a variety of terms. Repetition of the same words can make the text feel monotonous. For example, instead of repeating “guarantee” multiple times, try using “assure” or “ensure” when it fits the context. This small change improves the flow without altering the meaning.

Another tip is to vary sentence structure. If a particular idea appears several times, consider rephrasing. Instead of repeatedly using “to provide,” you can alternate with “to offer” or “to supply,” depending on the context. These adjustments keep the reader’s attention focused on the content without getting distracted by repetitive phrasing.

In some cases, switching from passive to active voice can make your writing more direct and less redundant. For example, instead of saying “It is ensured by the bank,” you could write “The bank ensures.” This minor tweak reduces wordiness while maintaining clarity.

By implementing these strategies, you can refine your writing style and make your content more appealing to readers, while preserving the original meaning. Avoiding unnecessary repetition not only improves readability but also enhances the professionalism of your text.