Letter of Explanation for Credit Inquiry Template

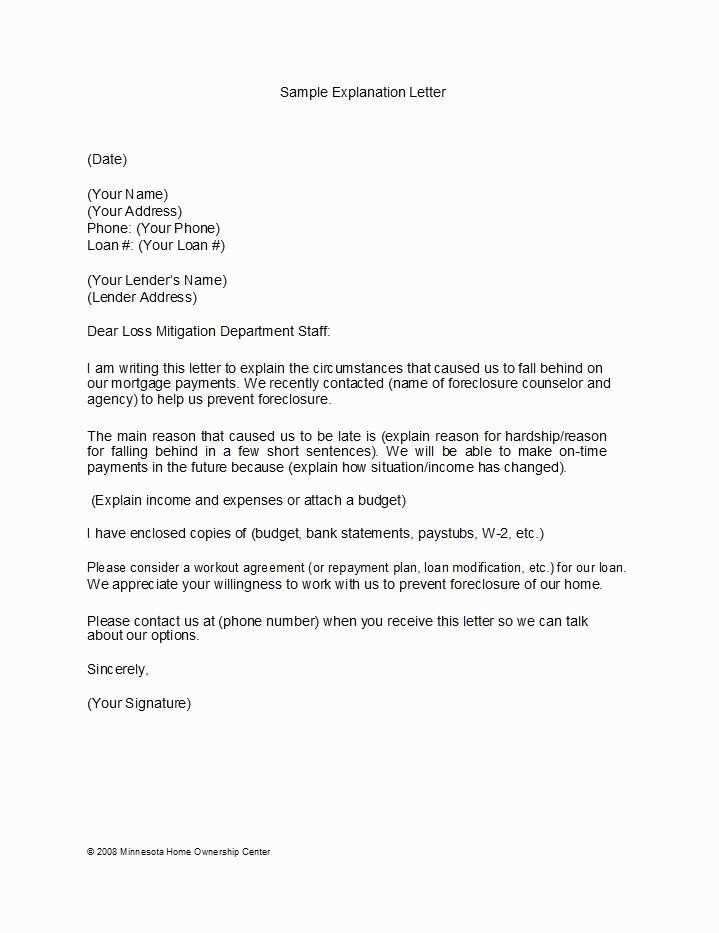

Sometimes, financial institutions may review a person’s history and notice details that require clarification. This may happen due to misunderstandings, errors, or unique situations that could affect a person’s financial standing. Providing a clear written explanation can help resolve any concerns and ensure that records are corrected appropriately.

Essential Components of a Response

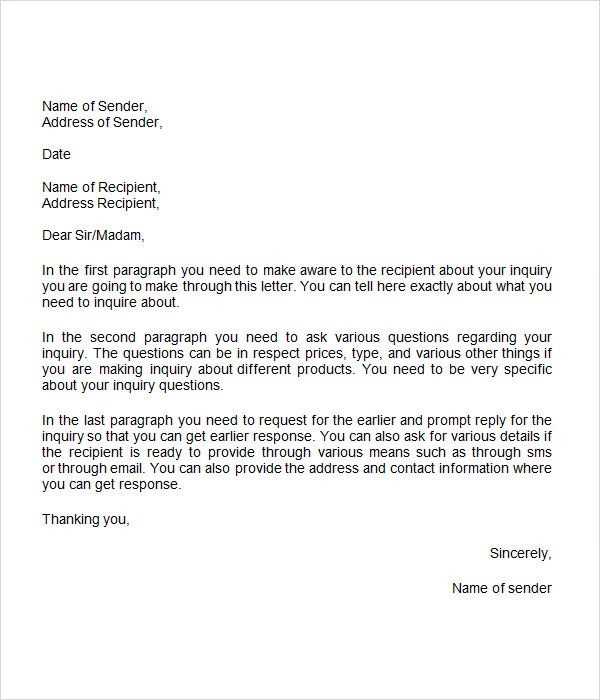

A well-crafted response should include several key elements to ensure clarity and professionalism. Here are the main components to focus on:

- Introduction: Start by briefly stating the purpose of your message and reference the issue being addressed.

- Details: Explain the situation clearly, providing relevant facts or circumstances that led to the concern.

- Evidence: If possible, support your explanation with supporting documentation or proof that clarifies the situation.

- Conclusion: Conclude by requesting a review of the issue and express your willingness to provide additional information if needed.

How to Present Your Case Clearly

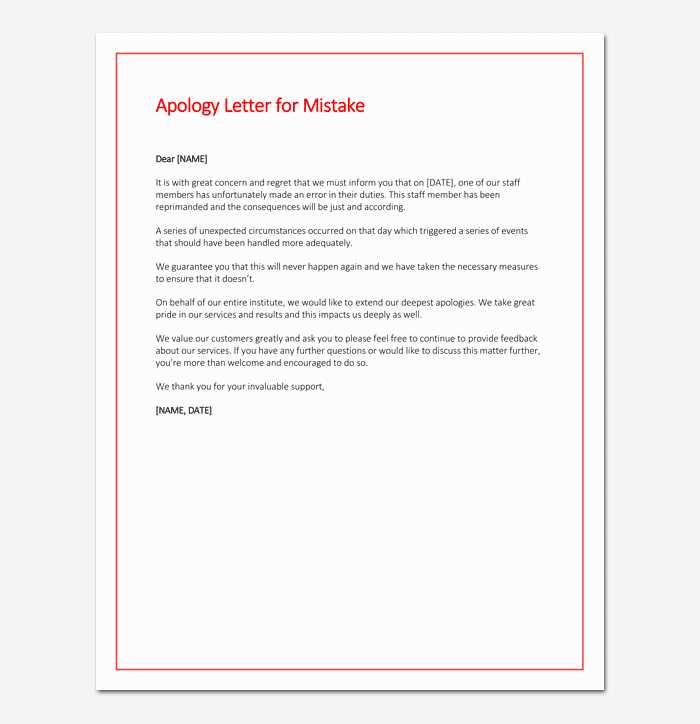

When writing your response, it’s important to be concise and straightforward. Avoid using overly complex language and focus on providing facts. Stay polite and professional throughout the process. A well-organized message is easier to understand and more likely to receive a positive outcome.

When to Send Your Message

It’s important to act promptly when addressing such matters. Sending your response as soon as possible after the issue arises can help prevent further complications. Additionally, timely communication demonstrates your willingness to resolve any discrepancies quickly and efficiently.

Common Mistakes to Avoid

- Being too vague: Avoid leaving out important details or making your explanation unclear.

- Being defensive: Stick to the facts and avoid overly emotional or defensive language.

- Failing to include documentation: Whenever possible, back up your claims with supporting documents or evidence.

By following these guidelines, you can ensure that your response is effective and well-received, helping to clear up any misunderstandings and improve your financial record.

Understanding Financial Record Clarifications

When financial organizations assess an individual’s history, inconsistencies or unclear entries might require further explanation. Addressing these issues promptly and with clarity can help ensure that all records are accurate and up-to-date, avoiding any negative impact on the individual’s financial reputation.

Crafting a well-organized and effective document is crucial when responding to such requests. A clear and concise response will provide the necessary context and information, helping to resolve any issues swiftly and efficiently. Avoiding unnecessary details and staying focused on the relevant points will ensure that the recipient understands the situation and can act accordingly.

It is important to avoid common mistakes when addressing these matters. Errors such as being vague or overly defensive can hinder the resolution process. It is essential to maintain a professional tone and provide supporting documentation whenever possible to back up your claims.

When resolving financial discrepancies, responding thoughtfully can also positively impact your financial standing. A well-written communication may encourage a more favorable review, which can, in turn, contribute to an improved financial score.

Including the necessary information in your document is key to ensuring that the recipient can easily understand the context and resolve the issue. Be sure to include all relevant facts, and provide any required evidence to support your case.

Timing is another important factor in the process. Sending your response promptly after receiving the request can prevent delays and demonstrate that you are taking proactive steps to address the matter. Timely submissions increase the likelihood of a faster and more positive outcome.