Letter Template to Dispute Errors on Your Credit Report

When you discover inaccuracies in your financial history, it’s essential to take action quickly. Mistakes can affect your ability to secure loans, get favorable interest rates, or even impact your overall financial stability. Understanding how to challenge such discrepancies is an important skill for protecting your financial well-being.

Taking the proper steps to communicate with the relevant authorities ensures that you can resolve issues efficiently. Crafting a formal request that clearly outlines the errors and provides necessary evidence is key to getting these issues corrected. With the right approach, you can safeguard your financial future and ensure your history reflects your actual standing.

Why Addressing Mistakes in Your Financial History Matters

Errors in your financial records can have significant consequences. They may distort your actual standing, affecting important decisions made by lenders, insurance companies, and other entities. Addressing these mistakes promptly helps maintain your financial credibility and ensures that you are not unfairly penalized for inaccuracies.

Timely corrections can also improve your chances of securing loans at favorable terms and increase your access to important financial services. Taking control of your financial history empowers you to make informed decisions and avoid potential setbacks caused by mistaken information.

| Consequence | Impact |

|---|---|

| Inaccurate Financial Standing | Higher interest rates on loans or credit cards |

| Uncorrected Errors | Rejection of loan or credit applications |

| Slow Response to Mistakes | Long-term negative effects on financial health |

Understanding Common Financial Record Errors

Financial records can contain various inaccuracies, ranging from simple clerical mistakes to more complex errors that affect your standing. These mistakes can often go unnoticed, but they can have significant consequences if not addressed. Identifying and understanding these common issues is crucial for ensuring your history reflects your true financial situation.

Common mistakes include incorrect personal details, outdated account statuses, or missing payments that were actually made. In some cases, a fraudulent activity might be recorded, leading to unjustified negative effects. Recognizing these issues and knowing how to handle them is essential for maintaining a fair and accurate financial history.

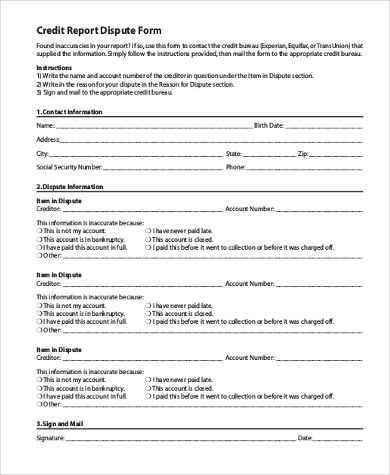

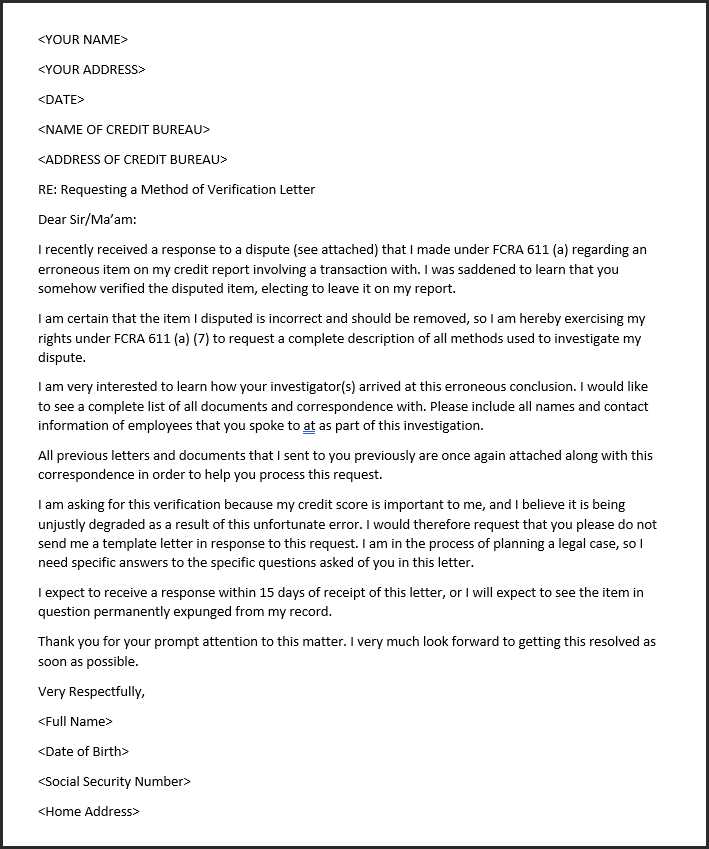

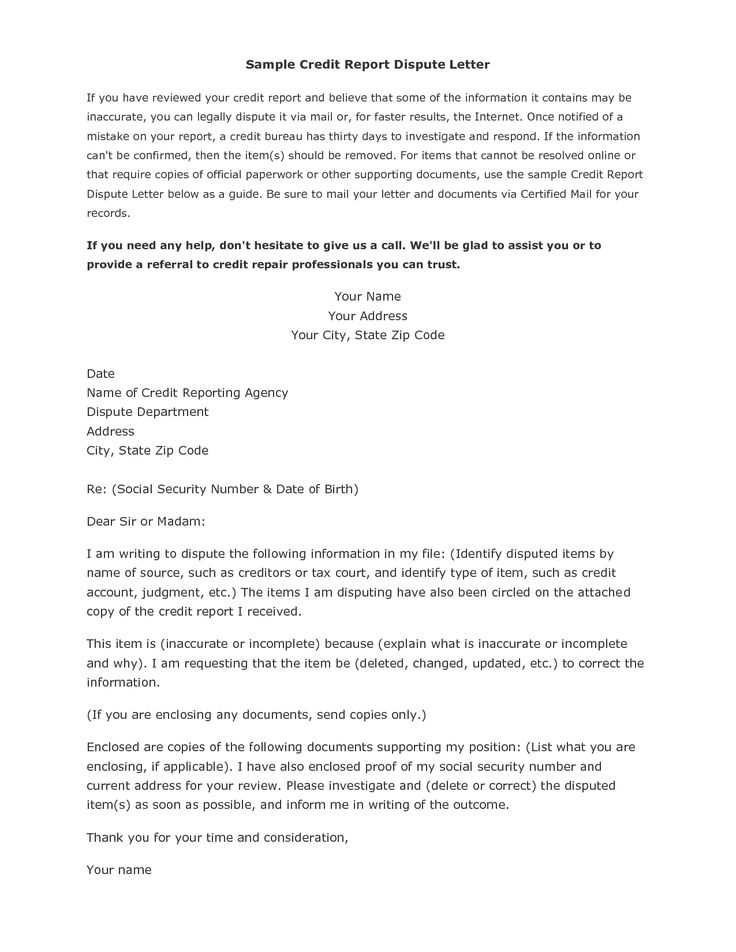

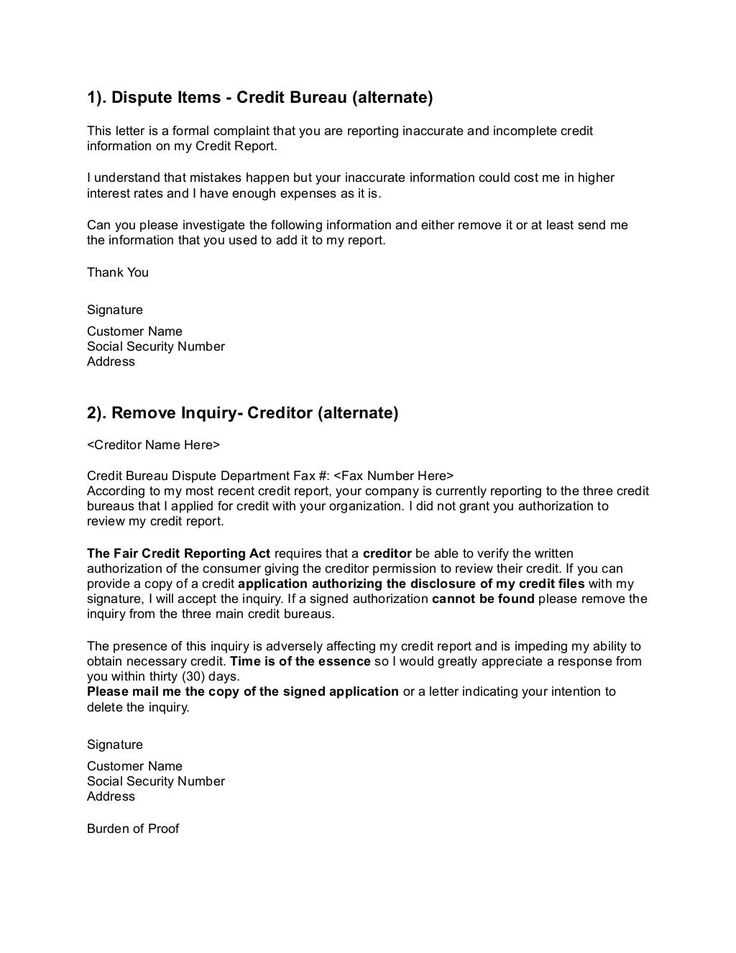

How to Write a Formal Request for Corrections

When you identify mistakes in your financial records, it’s essential to clearly communicate with the relevant authorities to have them corrected. Writing a formal request involves providing specific details, explaining the error, and supplying any supporting evidence that backs your claim. This structured approach ensures your request is taken seriously and addressed promptly.

Begin by clearly stating the mistake and referencing the particular item in question. Provide any necessary information, such as account numbers or dates, and be sure to attach any documentation that supports your correction. A polite and professional tone is important to encourage a quick and favorable response to your request.

Key Information to Include in Your Request

To ensure your correction request is processed quickly and accurately, it’s important to include all necessary details. Providing clear and precise information will help the recipient understand the nature of the error and support your claim effectively.

- Your Full Name: Ensure your name is clearly stated as it appears in the relevant records.

- Account Information: Include account numbers or references related to the mistake to help identify the issue.

- Description of the Error: Clearly explain what the mistake is and how it affects your history.

- Supporting Documents: Attach any relevant paperwork, such as receipts, bank statements, or proof of payment.

- Request for Correction: Clearly state what action you want to be taken and how the error should be rectified.

Providing this information in a concise and organized manner will help ensure your request is reviewed and resolved efficiently. The more precise and thorough you are, the quicker the issue is likely to be addressed.

Steps to Send Your Request for Corrections

Once you’ve prepared your formal request for correction, the next step is to send it to the relevant authority. Following a clear and organized process will ensure that your request is received and handled efficiently, speeding up the resolution of the issue.

Prepare Your Documents

Before sending your request, double-check that all necessary documents are included. This should include your written explanation of the error, any supporting evidence, and your contact information. Make sure that everything is clearly legible and well-organized.

Choose the Right Sending Method

Select the most reliable method of delivery. You may choose to send your request via mail, email, or an online submission form, depending on the guidelines provided by the recipient. If you are sending physical mail, consider using certified mail or another tracked service to ensure delivery confirmation.

By following these steps, you can be confident that your request will be sent properly and receive the attention it requires for timely resolution.

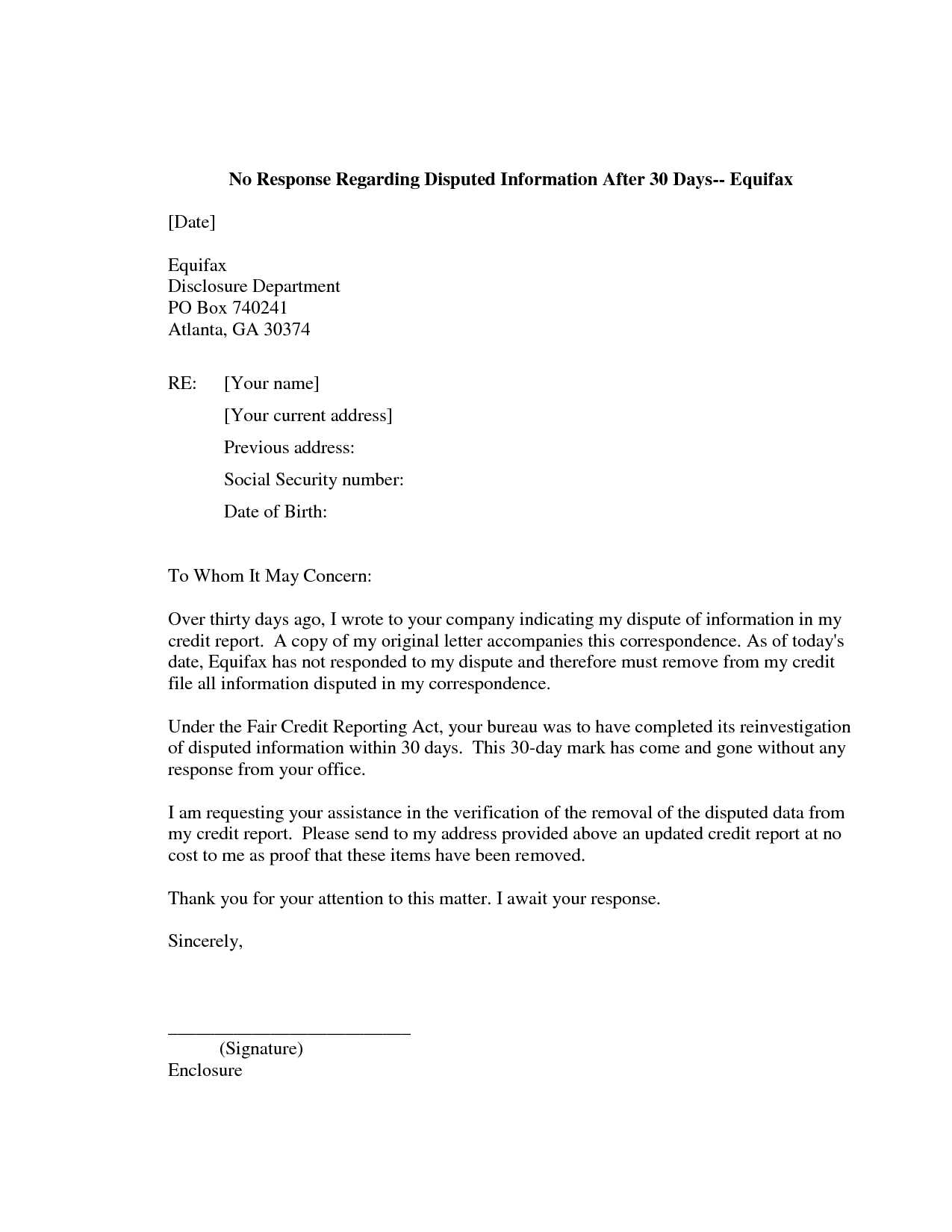

What to Do After Submitting Your Correction Request

After submitting your request for a correction, it’s important to follow up and monitor the progress of your case. The process may take some time, but staying informed and prepared ensures that your issue is addressed appropriately.

Monitor the Response

Keep an eye out for any communication from the relevant authority. They may request additional information or notify you of the resolution. If you don’t receive a response within the expected timeframe, follow up with a polite inquiry to check on the status of your request.

Check for Updates

Once you’ve received a response, review the changes carefully to ensure the error was corrected. If the issue persists or was not fully addressed, you may need to take further action. Document everything throughout the process and keep records of all correspondence. Staying proactive is key to achieving the desired outcome.