Letter Template to Remove Inquiries from Credit Report

Your financial history plays a crucial role in determining your ability to secure loans and favorable interest rates. Occasionally, there may be details on your record that negatively affect your score, even if they shouldn’t be there. Taking the necessary steps to challenge these details can significantly improve your standing in the eyes of potential lenders.

Addressing these entries involves communicating directly with the agencies responsible for maintaining your financial profile. By following a structured approach, you can request the correction or removal of any inaccuracies that may hinder your financial goals. This process is vital for anyone looking to maintain or rebuild their financial reputation.

In this guide, we will walk you through the process of formally disputing these unfavorable marks and offer advice on how to structure your request. Understanding the right approach will help you tackle any issues effectively and ensure a smoother path to improving your financial future.

How Credit Inquiries Affect Your Score

Your financial standing is largely influenced by the way lenders perceive your ability to manage debt. When they assess your application, they not only review your financial habits but also your history with borrowing. One key factor that can influence their decision is the frequency of certain checks into your financial background.

Understanding Hard and Soft Checks

There are two types of checks that can impact your financial profile: hard and soft. Hard checks occur when a financial institution or lender evaluates your history as part of a formal application process, such as when applying for a loan or mortgage. These checks can cause a temporary dip in your score. On the other hand, soft checks, which happen when companies look at your background for non-lending purposes, do not affect your score.

The Long-Term Impact on Your Financial Profile

While a single check may not drastically harm your standing, multiple hard checks within a short period can create a red flag. Lenders may interpret frequent assessments as a sign of financial instability or an increased risk of debt. This perception can lower your score and make it more difficult to secure favorable terms on future applications.

Understanding the Impact of Hard Inquiries

When lenders assess your financial history, they often conduct a thorough evaluation to determine your creditworthiness. This process can involve looking at various aspects of your background, and one key element that influences their decision is a specific type of check. These assessments are considered more intense and can leave a lasting effect on your financial profile.

How They Affect Your Score

A hard check typically leads to a temporary decrease in your overall score. While the impact may not be significant initially, it can accumulate over time, especially if multiple checks are made in a short period. This can create a negative impression for lenders, suggesting that you might be seeking to take on more debt than you can handle.

When Do They Matter Most?

Although these assessments may seem minor, their effects are more pronounced when you’re applying for larger loans, such as mortgages or auto loans. In these cases, a drop in your score due to frequent checks can hinder your ability to secure the best possible terms. Being mindful of when and how often these evaluations are made can help you manage your score more effectively.

Why You Should Remove Unwanted Inquiries

Unnecessary checks on your financial history can have a lasting effect on your ability to secure favorable terms when applying for loans or other financial products. These assessments, especially when numerous, can send the wrong message to potential lenders, suggesting that you are a higher risk borrower. Addressing and disputing these entries is essential for maintaining a healthy financial standing.

Improving Your Chances for Better Terms

Every time a lender reviews your financial background, it can slightly lower your score. While a single review might not make a significant impact, multiple instances can add up. By eliminating unnecessary checks, you can improve your score, which can directly influence your ability to qualify for loans with better interest rates and conditions.

Protecting Your Financial Reputation

Excessive evaluations may create a negative perception of your financial habits. Clearing up these records can help portray you as a responsible and stable borrower, which can be critical when seeking large loans or other important financial services. Disputing these issues can strengthen your overall financial reputation and make future borrowing more accessible.

Benefits of Clearing Your Credit Report

Maintaining an accurate and up-to-date financial profile is essential for achieving long-term financial success. By addressing and correcting any outdated or inaccurate entries, you can significantly improve your standing with lenders. Clearing your record can open up a range of opportunities, from better loan terms to more favorable interest rates.

- Improved Borrowing Opportunities: A clean financial history increases your chances of being approved for loans, mortgages, or credit cards with better terms.

- Higher Credit Score: Eliminating errors or outdated information can boost your score, making it easier to access financial products in the future.

- Better Loan Terms: Lenders are more likely to offer favorable interest rates and repayment terms to individuals with a clear and accurate financial background.

- Peace of Mind: A well-maintained financial profile provides confidence when applying for new credit or making important financial decisions.

Taking the time to clear your financial history is a proactive step toward ensuring your financial goals are met. It can pave the way for improved financial health and better opportunities down the line.

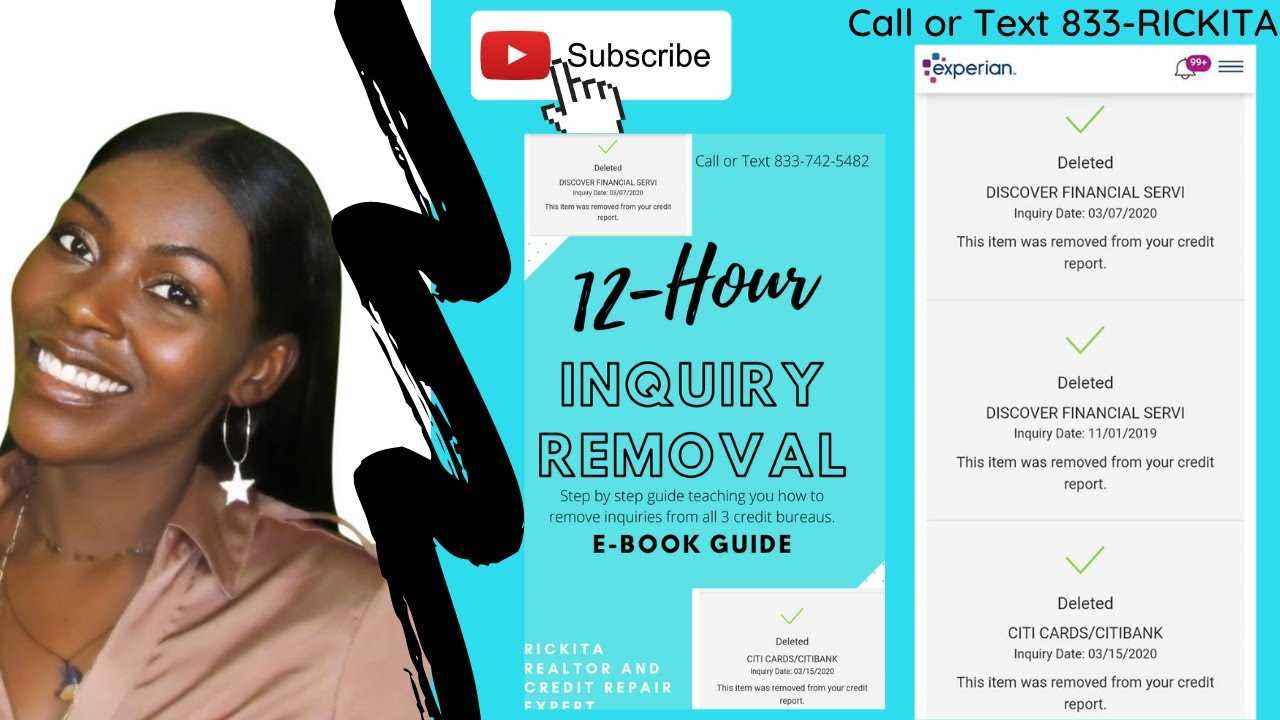

Step-by-Step Guide to Request Removal

When you identify incorrect or outdated entries on your financial profile, it’s important to take the right steps to address them. By following a clear and structured process, you can formally challenge these entries and work toward getting them corrected or removed. The following guide outlines the essential steps for submitting a request and increasing your chances of a successful outcome.

Start by gathering all necessary documentation that supports your claim. This may include proof of any inaccuracies or evidence that the entry should no longer be on your record. Once you have your information ready, contact the relevant agency or institution responsible for maintaining your financial history. Make sure to clearly explain the issue and provide all supporting details to back up your request.

After submitting your request, it’s crucial to track its progress. Most agencies will provide a timeline for review and resolution, so staying informed throughout the process is key. If your request is successful, the unwanted entries will be corrected or removed, helping to improve your overall standing and financial health.

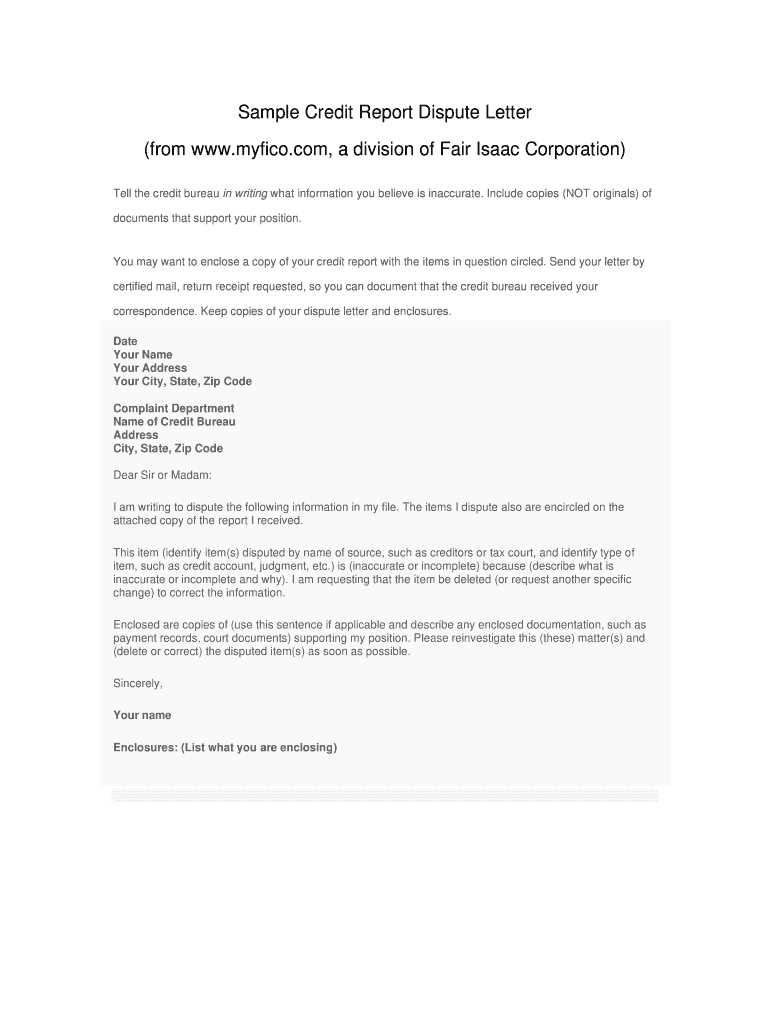

Crafting an Effective Inquiry Removal Letter

When disputing inaccuracies on your financial history, clear communication is key. An effective written request can significantly increase your chances of having unwanted entries removed. It’s important to structure your message in a professional and concise manner, providing all necessary information to support your case.

Start by addressing the relevant agency or institution that maintains your financial profile. Include your full name, address, and any reference numbers that may help them locate your record quickly. Clearly state the reason for your request and provide evidence that the entry in question should not be present. Be polite yet firm, ensuring that your request is taken seriously.

In your message, it’s also helpful to mention any applicable laws or regulations that support your claim, as this can add weight to your request. Finally, make sure to follow up if you don’t receive a response within the expected timeframe to ensure your issue is resolved efficiently.