Letter to Credit Bureau Template for Disputing Errors

When discrepancies appear in your financial records, it’s essential to take action. Correcting mistakes in your financial history can help you maintain a better standing and improve your overall score. In this section, we’ll guide you through the process of drafting an official communication to challenge any errors.

Why It’s Important to Act Quickly

Errors in your financial history can negatively impact your ability to secure loans or favorable interest rates. By addressing inaccuracies as soon as possible, you protect your financial future and ensure that your report accurately reflects your current situation.

Common Mistakes to Avoid

- Inadequate Documentation: Always include supporting documents to back up your claim.

- Vague Language: Be clear and precise about the error you’re disputing.

- Failure to Follow Up: Don’t forget to check on the progress of your request.

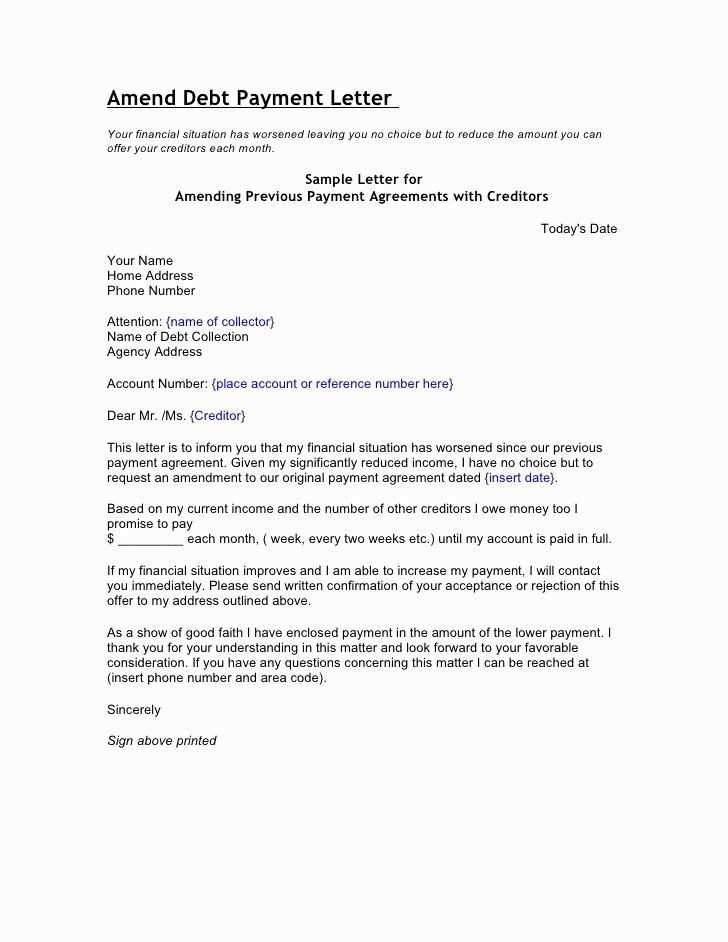

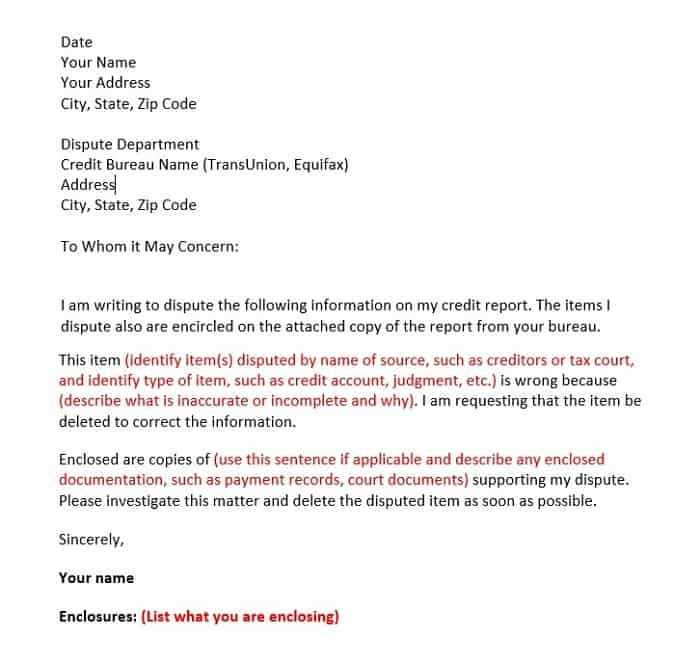

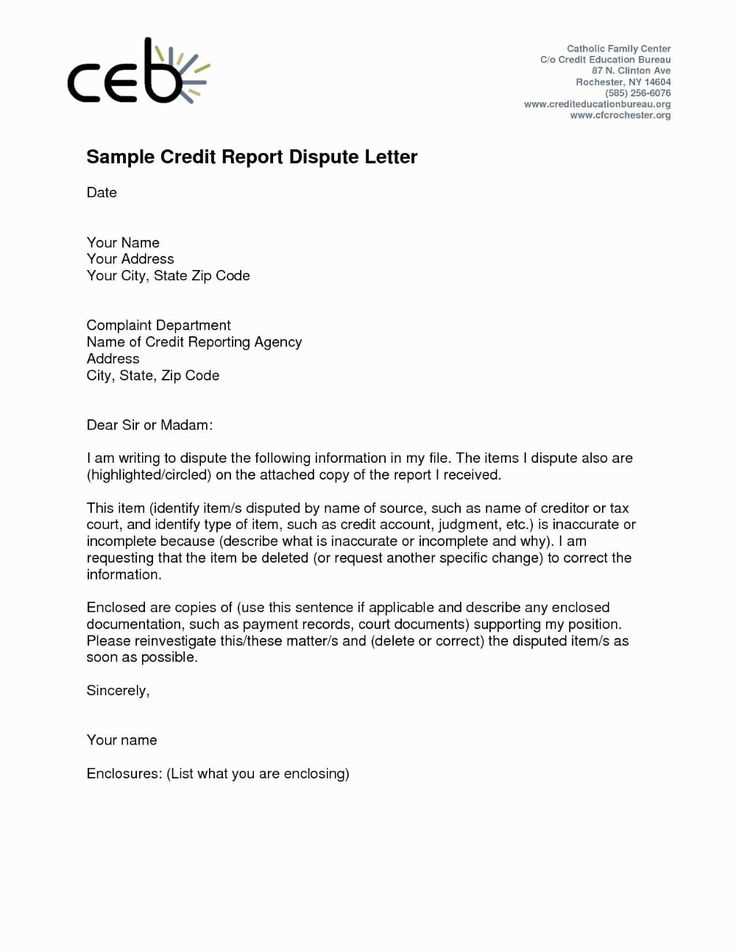

How to Craft a Strong Request

Writing an effective request involves clearly explaining the issue, providing all necessary details, and being polite yet firm. Here’s a step-by-step approach:

- Identify the Error: Begin by noting the exact issue you want to dispute.

- Provide Supporting Documents: Attach any evidence that substantiates your claim.

- State Your Desired Outcome: Be specific about what correction or adjustment you expect.

- Use Professional Language: Keep the tone formal and respectful.

When to Send Your Communication

Ideally, send your request as soon as you notice an issue. The earlier you act, the faster the process can begin, and the sooner you can expect a resolution. Ensure you’re within the required time limits to avoid delays.

Why You Need a Financial Report Correction Request

Addressing errors in your financial history is crucial for maintaining an accurate record. Mistakes can impact various aspects of your financial life, such as loan eligibility or the interest rates you are offered. Taking the initiative to resolve these discrepancies will help you ensure that your financial profile is correct and fair.

How to Draft an Effective Dispute Document

To dispute any inaccuracies, your request must be clear, concise, and well-documented. Focus on providing specific details about the issue, include relevant proof, and specify the exact adjustment you are requesting. A well-written request helps prevent confusion and speeds up the correction process.

Common Mistakes When Contacting a Financial Agency

Many individuals make errors that can delay their dispute. Some of the most common mistakes include:

- Failure to provide supporting evidence: Always attach copies of relevant documents to support your claim.

- Vague explanations: Be specific about the nature of the error and the correction you’re seeking.

- Ignoring deadlines: Ensure that you act within the required timeframes to avoid unnecessary delays.

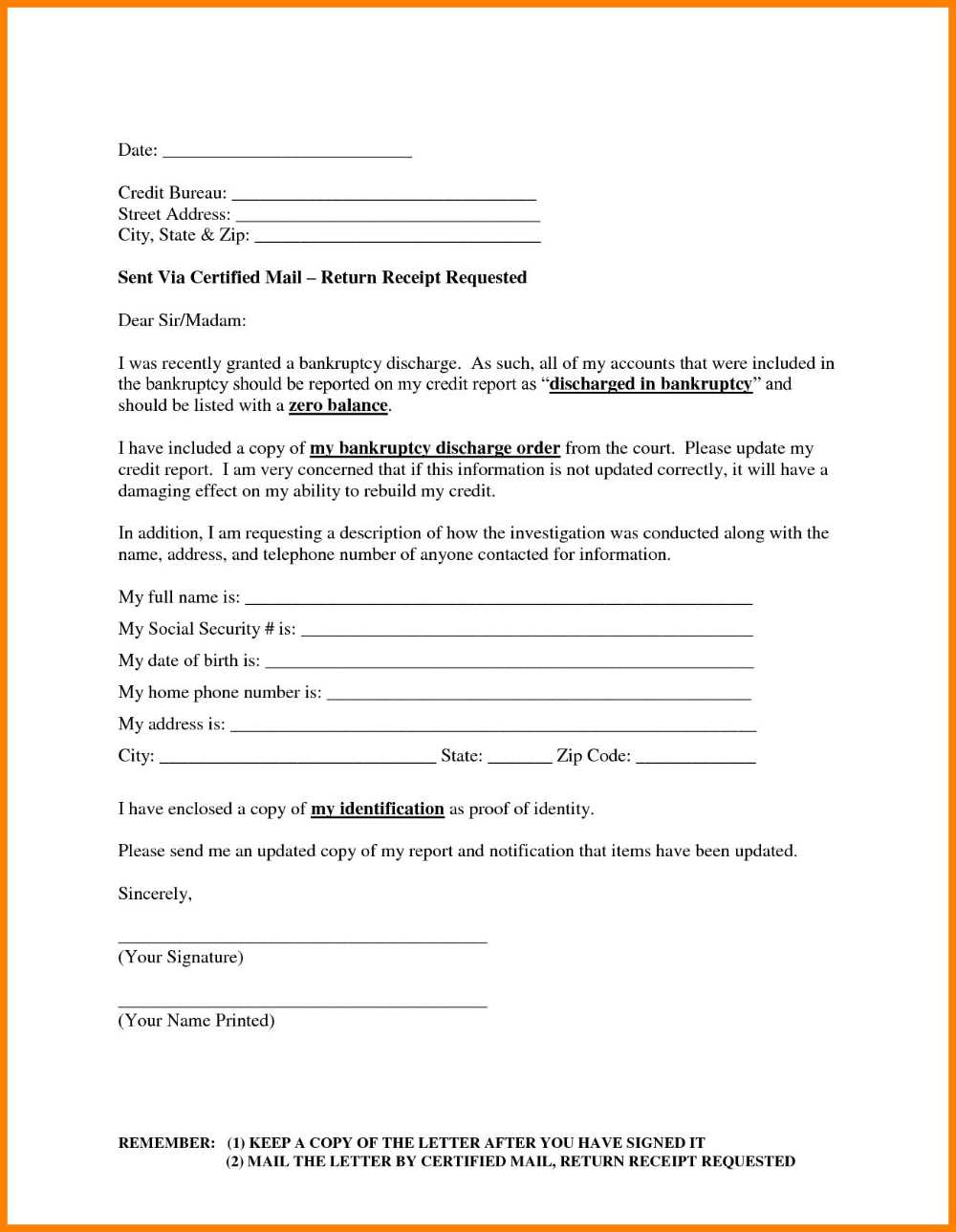

Understanding the Agency’s Response Process

Once your request is submitted, the agency will typically review it and verify the details. The process can take some time, and it’s important to be patient. If the correction is accepted, the error will be updated in your records. If further information is needed, you will be contacted for clarification.

Tips for Enhancing Your Financial Record

To improve your standing, it’s essential to regularly monitor your report, avoid missed payments, and maintain a healthy balance between credit utilization and available credit. Consistently addressing any inaccuracies can lead to a more favorable financial profile over time.

When to Submit Your Dispute Request

It’s best to submit your request as soon as you notice an error. Early submission gives you the best chance of quick resolution, ensuring your financial records remain accurate and up-to-date.