Letter to credit card company template

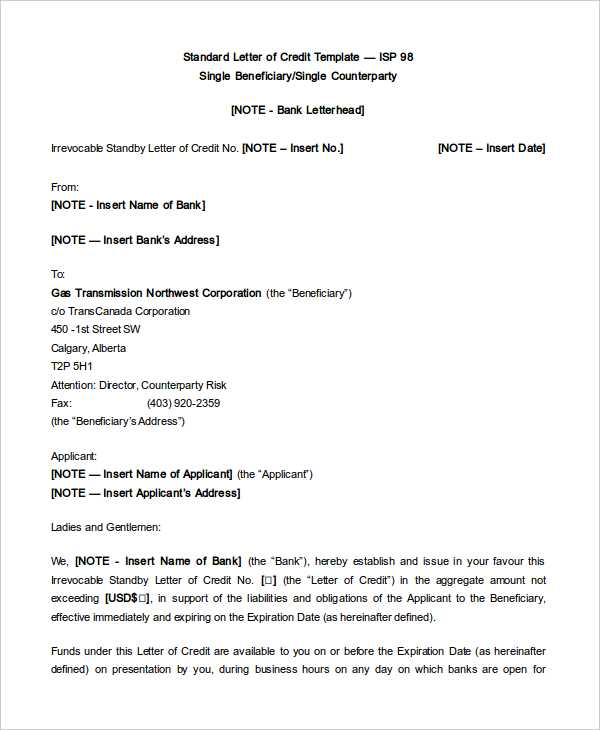

Begin by addressing your credit card issuer with a clear and professional tone. Ensure your name, account number, and the nature of the issue are immediately presented to avoid confusion. Use the opening paragraph to briefly explain the situation or request. For example, if you are disputing a charge, specify the transaction date and amount that requires attention.

Provide details about the matter you’re addressing. If it’s a billing error, list the specifics that support your claim. If you’re requesting a service, such as a credit limit increase, clearly state the reason for the request and any necessary supporting details, like your account history or income updates.

In the closing paragraph, kindly ask for prompt action and provide your contact information for follow-up. Make sure to thank the company for their attention to your request, while keeping the tone respectful and polite. Always end by signing your name and including any documentation that may be relevant to your request.

Here’s the corrected version:

To ensure clarity and accuracy, always begin your letter with a direct reference to your account details. This allows the recipient to quickly locate your information and process your request efficiently.

Include the date of your letter at the top, followed by your full name, address, and account number. It’s important to keep this information concise and organized for easy reference.

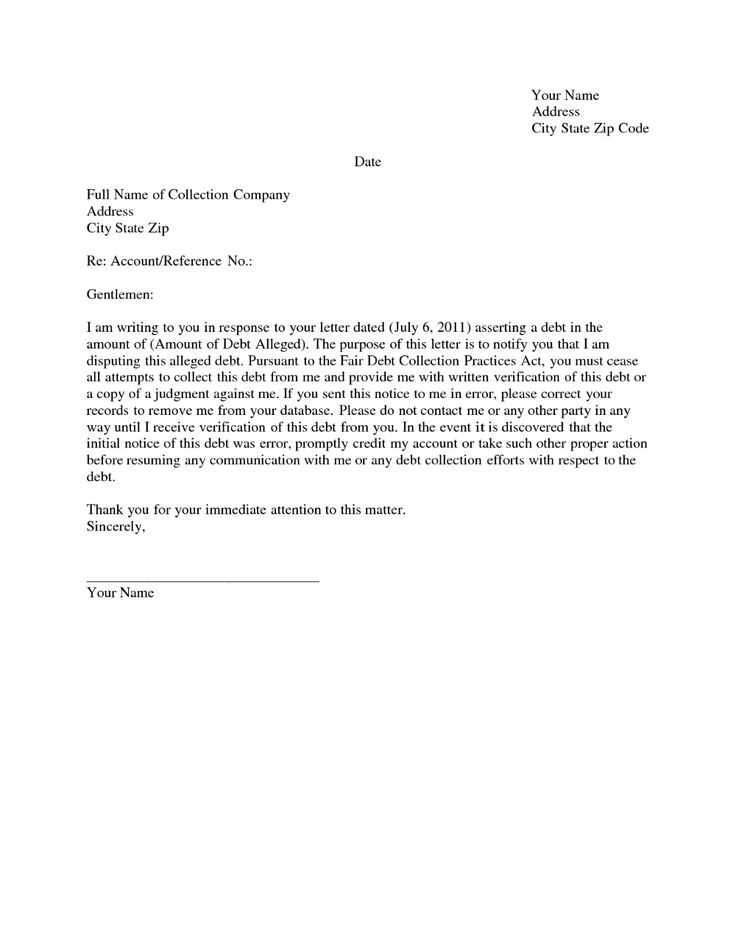

Next, outline the specific issue you are addressing. Whether it’s a billing error, an unauthorized transaction, or a request for a credit limit adjustment, make sure to be clear and precise about the problem. Include relevant dates and amounts if applicable.

- For billing errors, list the incorrect charges and provide copies of supporting documents, such as receipts or statements, if available.

- For unauthorized transactions, specify the date and amount, and mention any steps you’ve already taken (like contacting customer service).

In your request, remain polite but firm. Clearly state what you expect as a resolution, whether it’s a refund, correction of the error, or other action. It’s also helpful to mention any relevant policies or terms and conditions to support your request.

Finally, close with a polite but assertive request for a timely response. Include your contact information and thank the recipient for their attention to the matter. Make sure to sign the letter if submitting a physical copy.

- Letter to Credit Card Company Template

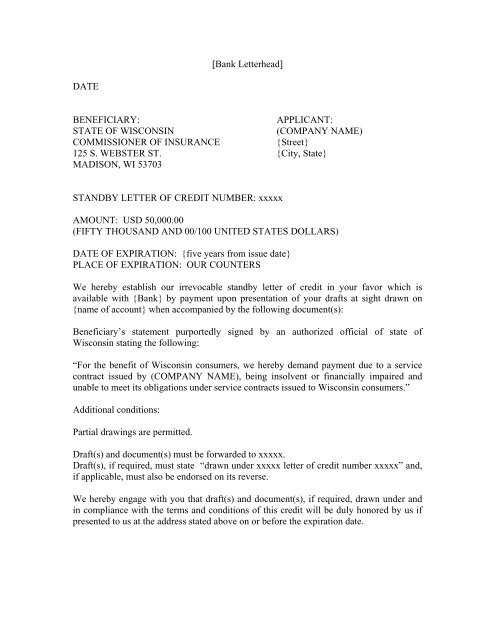

Begin with a clear and direct statement of your request. Address the issue or inquiry you have regarding your credit card account, such as a billing dispute, payment issue, or inquiry about terms. Keep the tone polite but firm to convey the seriousness of the matter.

Provide Account Information

Clearly include your credit card account number, name as it appears on the account, and any other relevant details. This ensures that the company can easily locate your records and process your request without delay.

Explain the Issue or Request

Describe the problem or question you are raising. If you’re disputing a charge, mention the date and amount of the transaction. If you’re requesting a change in your account terms or need assistance, explain your specific need. Keep the details concise but thorough.

Close your letter with a polite request for resolution. Request confirmation of the actions they will take or a timeline for resolution. Include a thank you for their attention to the matter.

Begin by addressing your credit card provider directly. Use a polite and professional tone, ensuring clarity in your communication. State your purpose for writing the letter upfront to avoid confusion later. For example, if you’re disputing a charge, mention that right away, like this: “I am writing to dispute a charge on my credit card statement.” This helps the reader immediately understand the nature of your request.

Use Clear and Direct Language

Avoid ambiguous or overly complex phrasing. Be straightforward and concise with your wording, focusing only on the necessary details. Providing all relevant information at the start can help your request move forward smoothly and prevent delays caused by follow-up questions.

Include Personal Information Carefully

Ensure you mention your full name, account number, and any other identifying details clearly. This helps your provider quickly locate your account and process your inquiry without unnecessary back-and-forth. Make sure your personal data is accurate and formatted properly for quick reference.

Make your request clear and concise. Include the following key elements for a strong and effective letter:

1. Your Account Details

Start by stating your account number and any relevant personal information. This ensures the recipient knows exactly which account you are referring to and helps avoid confusion.

2. The Specific Request

Clearly outline the action or decision you are requesting. Whether it’s a credit limit increase, fee waiver, or any other request, being specific helps the recipient understand your needs and respond appropriately.

3. Supporting Information

If applicable, provide supporting documentation or evidence that justifies your request. This can include proof of income, a recent statement, or any other documents that make your case stronger.

4. Your Contact Information

Provide the best way to reach you for follow-up. Include both email and phone number to facilitate an efficient response.

| What to Include | Why It’s Important |

|---|---|

| Account Details | Helps identify your account and prevent mix-ups. |

| Specific Request | Clarifies your needs and ensures you get the correct outcome. |

| Supporting Documents | Strengthens your request and increases the chance of approval. |

| Contact Information | Ensures easy communication for updates or additional information. |

Keep your letter professional and to the point, ensuring it includes all necessary information to help expedite your request.

If you’re experiencing an issue with your credit card, it’s crucial to clearly explain the problem when contacting customer support. Begin by providing all relevant details such as the date of the transaction, the amount, and any charges you believe are incorrect.

Common Issues to Address

Some common card problems include unauthorized charges, billing errors, or issues with rewards. Be specific about the problem, and provide any supporting evidence such as receipts, account statements, or screenshots.

| Issue Type | Information to Include |

|---|---|

| Unauthorized Charge | Transaction date, amount, and merchant details |

| Billing Error | Invoice number, disputed charge amount |

| Rewards Issue | Details of the reward program, transaction date, and reward points |

Resolving the Issue

Once you’ve gathered all necessary information, contact customer support and request a resolution. Be polite but firm in explaining the situation. If the issue is unresolved, you can escalate the matter to a higher department or file a dispute.

Begin your letter with a clear statement of your request or concern. Address the issue directly, while ensuring your tone remains respectful. For example, “I would appreciate it if you could review the charge on my statement for the month of December.” This conveys your request without ambiguity.

Maintain professionalism by using courteous language, such as “please” and “thank you,” but avoid excessive softness that could make your request seem unclear. For instance, instead of saying “I would be so grateful if you could,” try “I would appreciate your prompt attention to this matter.” This communicates urgency while keeping the tone polite.

Acknowledge the company’s policies or procedures where appropriate, but be firm in expressing your expectation for resolution. For example, “I understand that billing issues are typically reviewed within 30 days; however, I trust you can expedite this matter given the circumstances.” This shows you are aware of standard practices, while asserting your expectation.

End with a clear call to action, such as “Please let me know if you require further details” or “I look forward to your prompt resolution of this issue.” This leaves no room for misinterpretation and emphasizes your desire for a timely response.

To follow up on your credit card company correspondence, wait about 7-10 business days after sending your letter before reaching out. This gives the company adequate time to process your request. When you contact them, reference your previous communication by including any case or reference numbers provided in the earlier correspondence. Be polite but clear in your request for an update on the status of your issue.

If you haven’t received a response within the expected timeframe, consider using multiple contact channels such as email and phone for quicker resolution. In your follow-up, briefly reiterate your original issue and mention that you have not received any feedback so far. Be direct but maintain a professional tone.

Keep records of all follow-up actions, including dates, times, and the names of representatives you speak with. This documentation can be useful if you need to escalate the matter later on.

End your letter with a clear, polite request or statement. Ensure that the recipient understands what actions you expect next. For example, if you’re requesting assistance, express it directly, like: “I would appreciate your prompt attention to this matter.” This helps avoid confusion and reinforces your expectations.

Be sure to thank the recipient for their time and attention. A simple, courteous sentence like: “Thank you for considering my request” shows appreciation without overdoing it.

- Keep it brief but direct. Avoid unnecessary elaboration in the closing lines.

- Provide your contact details if appropriate, ensuring the company can reach you easily if needed.

- Use a friendly but professional tone. Your closing remark should leave a positive impression.

Finish with a respectful closing phrase, such as “Sincerely” or “Best regards.” This helps reinforce professionalism and shows respect for the recipient’s time.

Ensure the letter is concise and direct. Clearly state your purpose, such as disputing a charge or requesting an adjustment. Start with the date of the transaction and the amount in question, providing any relevant supporting details. Avoid excessive explanations. Address the recipient respectfully and maintain a professional tone throughout.

If you’re requesting a refund, specify the reason for your dissatisfaction and explain why the charge is incorrect. Include any documentation that supports your claim, such as receipts or screenshots. Make your request clear: whether you seek a refund, a charge reversal, or another solution.

End the letter by thanking the recipient for their attention to the matter and express your willingness to provide further information if needed. Be sure to include your contact information for follow-up. Close the letter with a polite sign-off.