Section 609 credit dispute letter template

If you believe there is inaccurate or outdated information on your credit report, sending a Section 609 credit dispute letter can help you challenge those entries. This section of the Fair Credit Reporting Act (FCRA) gives you the right to dispute any unverifiable or incorrect details. Using a well-crafted letter can be the first step in clearing up mistakes and potentially improving your credit score.

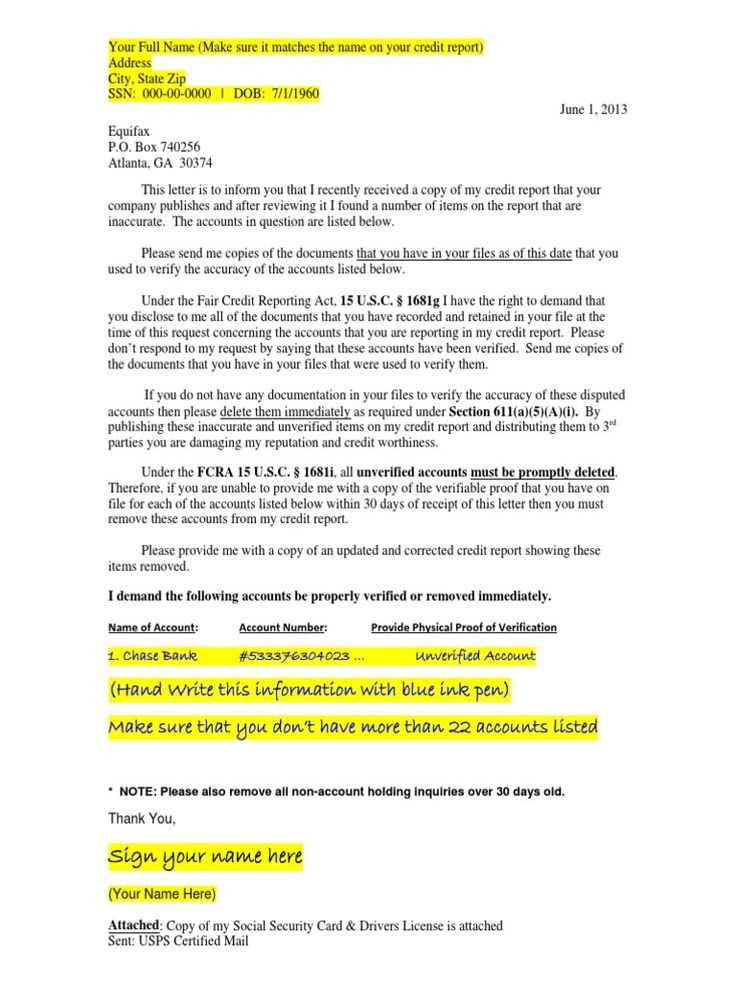

The key to an effective Section 609 dispute letter is clarity and precision. Start by identifying the exact information on your credit report that you believe to be incorrect or incomplete. Be specific and refer directly to the items you are disputing. Include any relevant documents that support your claim, such as bank statements or receipts, to strengthen your case.

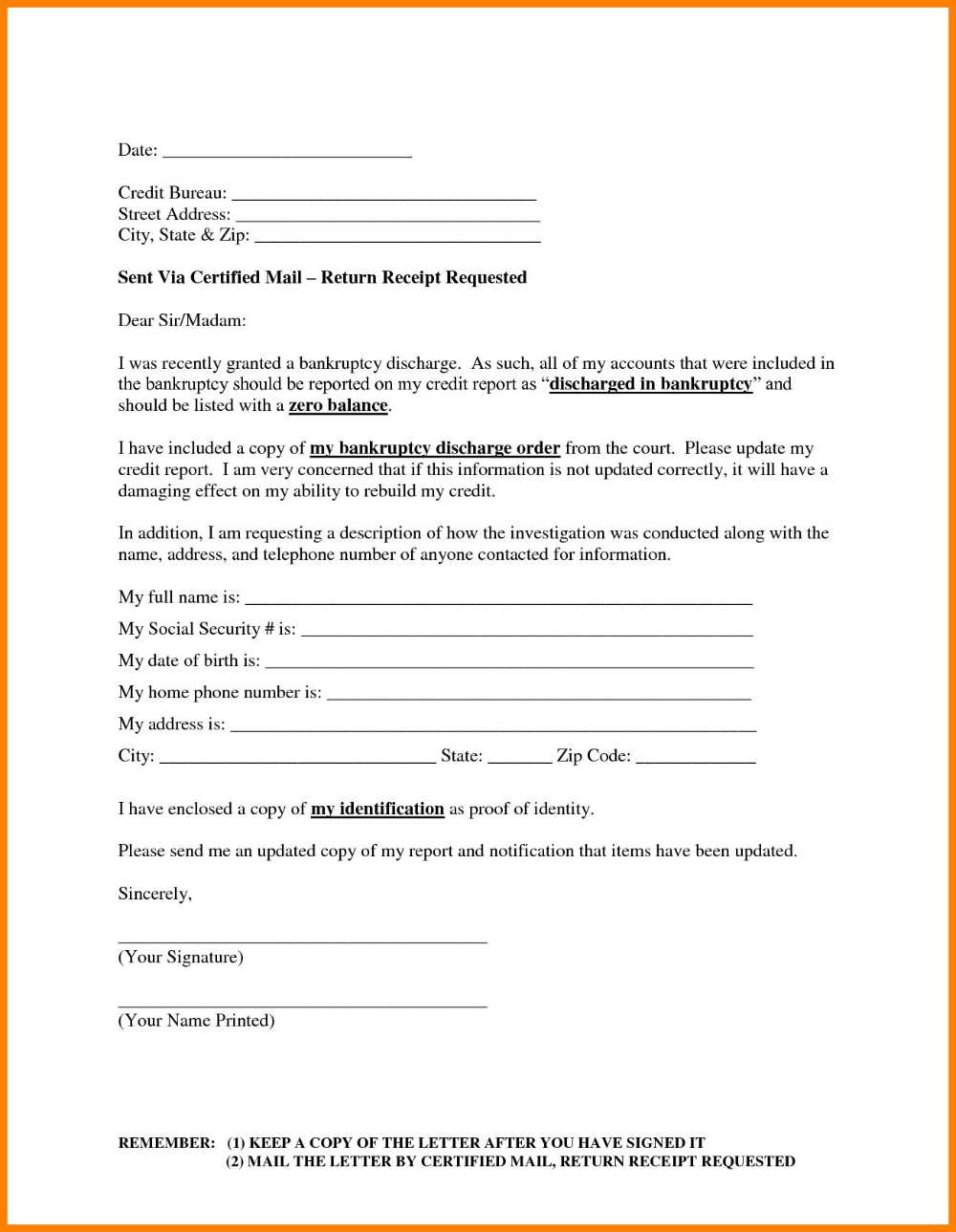

Your letter should be formal and direct. Clearly state that you are disputing the listed item under Section 609 of the FCRA. Request verification of the information or its removal if it cannot be verified. Make sure to include your personal details like name, address, and Social Security number to help the credit bureaus locate your file.

Once your dispute letter is sent, the credit reporting agency must investigate the issue and respond within 30 days. If the disputed information is not verified or corrected, it must be removed. Keep a copy of your dispute letter and any correspondence for your records, as this can be crucial if further action is needed.

Here is the revised version:

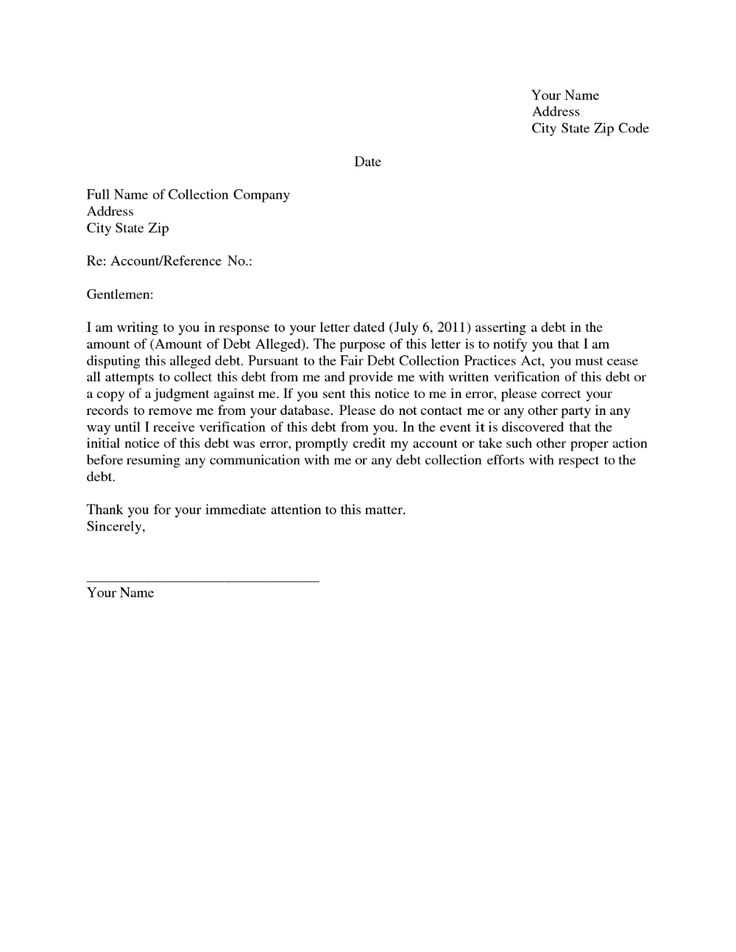

If you’re facing an issue with a Section 609 dispute, begin by addressing the incorrect information directly. Start your letter with a clear statement of your rights under the Fair Credit Reporting Act (FCRA) to dispute any inaccuracies on your credit report.

Point out the specific item(s) you are disputing, providing any necessary details or supporting documentation. Be sure to explain why the information is incorrect and how it does not reflect your actual credit history. Attach any relevant proof, such as bank statements or account documents, that support your claim.

Request that the credit reporting agency either verify or remove the disputed item. Keep the tone polite but firm, ensuring they understand your expectation for prompt resolution. It’s helpful to request a written response within the legal timeframe, which is typically 30 days.

At the end of the letter, provide your contact information clearly and ask for confirmation of the dispute being addressed. Retain copies of all correspondence for your records in case further action is needed.

Section 609 Credit Dispute Letter Template

Understanding the Purpose of a Section 609 Credit Dispute Letter

How to Identify Incorrect Information on Your Credit Report

Step-by-Step Guide to Writing a Section 609 Dispute Letter

Key Elements to Include in Your Dispute Letter

What to Do After Sending Your Dispute Letter

Common Mistakes to Avoid When Disputing Credit Report Errors

A Section 609 credit dispute letter helps you challenge incorrect or outdated information on your credit report. This is a powerful tool that allows you to ask credit bureaus to verify information they’ve listed. If they can’t confirm the accuracy of an item, it must be removed from your report.

How to Identify Incorrect Information on Your Credit Report

Review your credit report carefully to spot inaccuracies. Look for accounts that don’t belong to you, late payments or balances that have been paid off, incorrect personal details, or accounts that have already been closed. Compare your report to the records you have, such as bank statements, loan documents, and payment receipts.

Step-by-Step Guide to Writing a Section 609 Dispute Letter

Begin by addressing the credit bureau and stating your intent to dispute the information under Section 609 of the Fair Credit Reporting Act (FCRA). Clearly identify the item you’re disputing by referencing the account number or specific details. Explain why the information is inaccurate and request that it be verified or removed. Attach copies of supporting documents to back your claim.

Be sure to include your full name, address, Social Security number, and date of birth at the top of the letter for proper identification. Send the letter via certified mail to ensure confirmation of delivery.

Key Elements to Include in Your Dispute Letter

Your dispute letter should be concise and contain the following key elements:

- Your contact information (name, address, Social Security number, date of birth)

- A clear statement that you’re disputing the information under Section 609

- Details about the incorrect entry (account number, name of creditor, etc.)

- Explanation of why the information is inaccurate

- Supporting documents that prove your case (bank statements, payment receipts, etc.)

- A request for the bureau to remove or correct the information

What to Do After Sending Your Dispute Letter

Once you’ve sent your letter, keep a copy of everything for your records. The credit bureau has 30 days to respond. If they don’t provide verification, the disputed item should be removed. If they confirm the information is accurate, you can appeal or escalate the matter.

Common Mistakes to Avoid When Disputing Credit Report Errors

Don’t include personal opinions or unrelated information. Stick to the facts and provide only the necessary documentation. Avoid disputing too many items at once in one letter, as this can cause confusion. Lastly, ensure you send the letter to the correct credit bureau, as each bureau handles disputes separately.