How to Create a Template Dispute Letter for Credit Bureau

When reviewing your financial history, it’s essential to ensure that all details are accurate and up to date. Mistakes can occur, affecting your overall standing and causing unnecessary complications. It’s important to take swift action if you notice discrepancies that need correction.

By addressing these inaccuracies directly with the responsible organizations, you can restore the integrity of your financial record. Knowing how to approach the issue can make a significant difference in ensuring a smooth and effective resolution.

Understanding the process of formally addressing these issues allows individuals to navigate the system more confidently and ensure that their financial information is properly maintained. Clear communication and the correct documentation are key to resolving misunderstandings quickly.

Understanding Financial Record Corrections

Errors in your financial history can have a significant impact on your ability to secure loans, obtain favorable terms, or even affect your overall reputation. It’s crucial to identify any inaccuracies that may be present and take steps to rectify them. In many cases, such mistakes may arise from clerical errors, outdated information, or even identity mix-ups.

The process of challenging these inaccuracies is designed to ensure that your records reflect accurate and up-to-date information. By addressing these issues promptly, you can minimize any potential negative consequences and ensure your financial standing remains in good shape.

When navigating this process, it’s important to approach it methodically, providing the necessary evidence and following the correct steps to ensure a swift resolution. Taking control of your financial documentation is key to maintaining trust and ensuring fair treatment by financial institutions.

Why Correcting Mistakes is Important

Inaccurate information in your financial records can lead to serious consequences, such as denied loan applications, higher interest rates, or even damaged trust with institutions. Addressing these errors promptly is essential to ensure that your information is correctly reflected and does not negatively affect your financial opportunities.

When mistakes go unchallenged, they can persist, impacting your reputation and limiting access to favorable financial options. By taking action to correct these inaccuracies, you help ensure that institutions make decisions based on accurate, reliable details, which can improve your chances of approval for future transactions.

Additionally, maintaining accurate records is not just about securing loans; it’s about protecting your overall financial well-being. Ensuring that your information is up to date allows you to monitor your financial health and avoid unnecessary complications that could arise from outdated or incorrect data.

Steps to Draft a Formal Request for Corrections

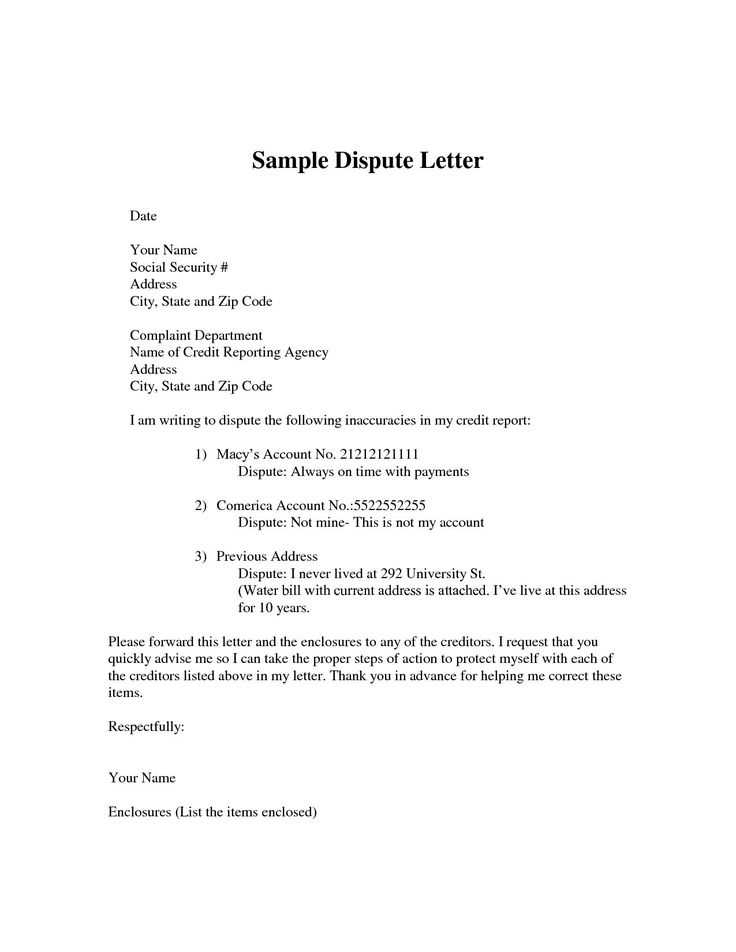

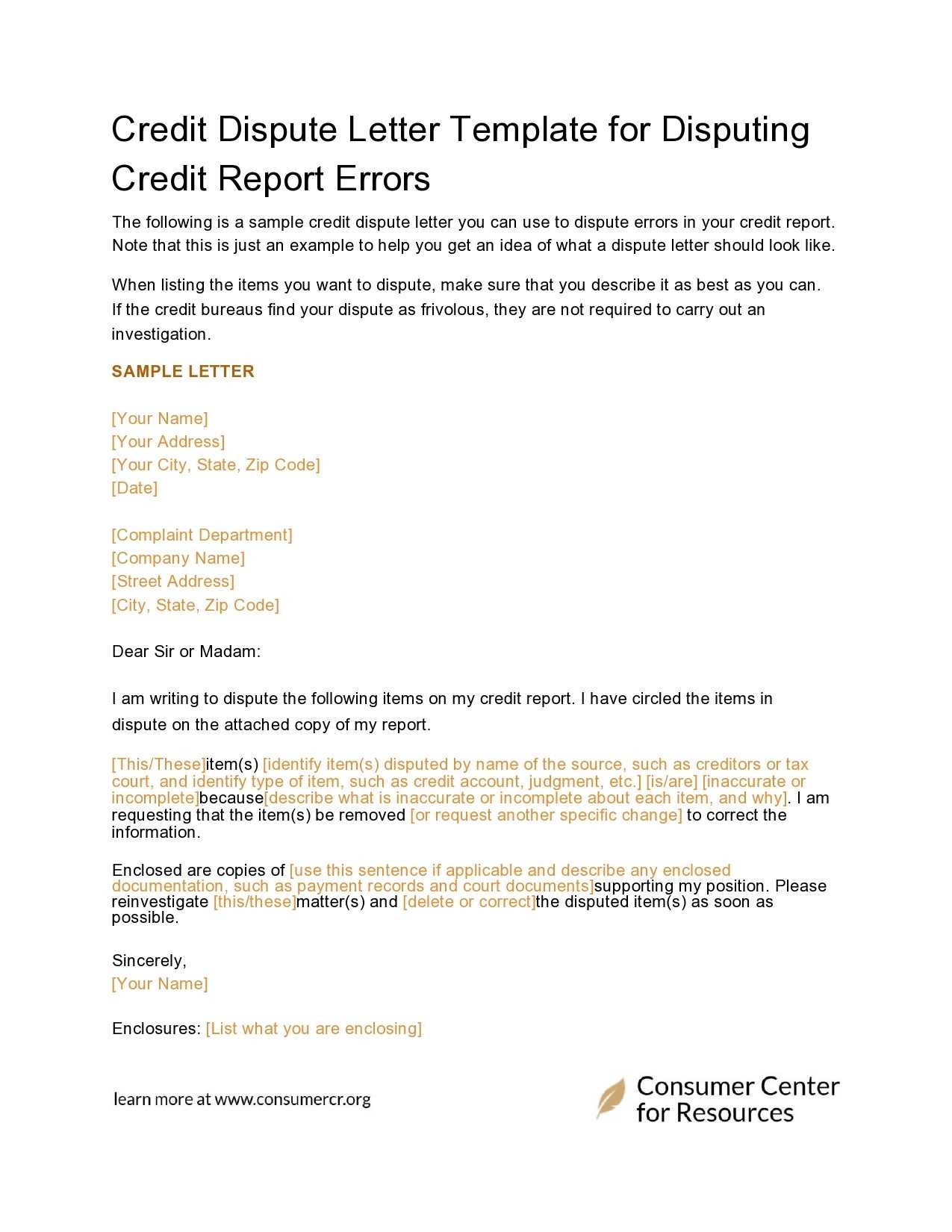

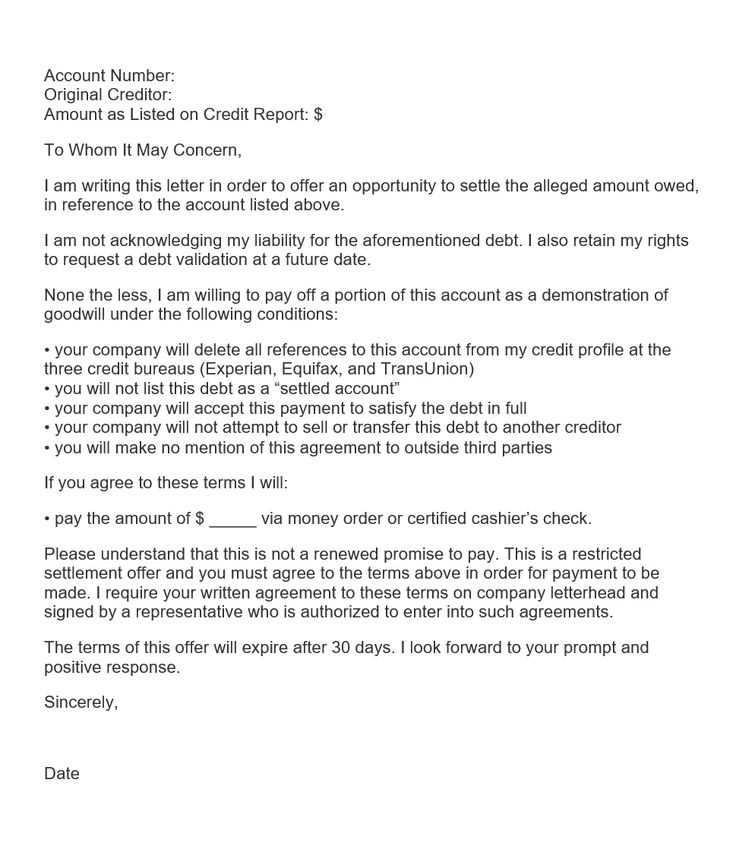

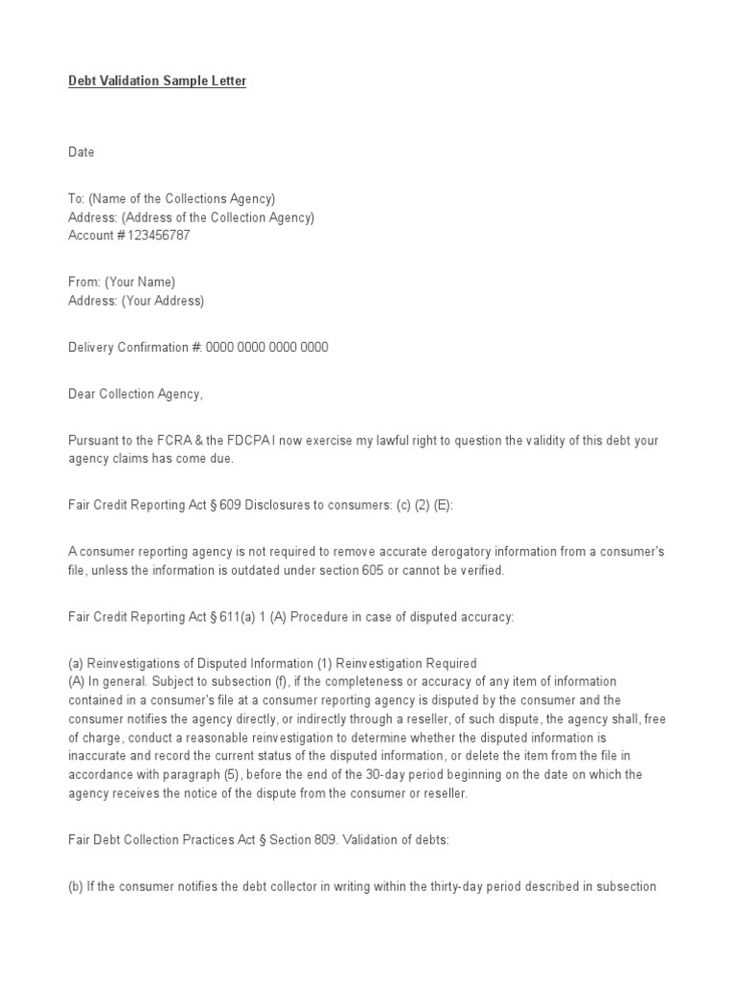

When you identify an error in your financial history, it’s essential to take the necessary steps to notify the relevant organization. A well-structured request is key to ensuring that your concerns are addressed promptly. The process involves providing clear details, offering supporting evidence, and maintaining a professional tone throughout.

First, clearly identify the error you want to address. Be specific about what is inaccurate and include any relevant account or transaction details. This will help the recipient easily locate the mistake and begin reviewing it without confusion.

Next, provide supporting documentation that validates your claim. This can include bank statements, receipts, or any other records that prove your position. Having this information at hand makes the review process more efficient and shows your commitment to resolving the matter.

Lastly, ensure that your communication is polite and professional. Maintaining a respectful tone not only facilitates a smoother process but also increases the likelihood of a favorable outcome. Being clear, concise, and cooperative will help to expedite the resolution of your concern.

Key Elements to Include in Your Formal Request

When submitting a formal request for corrections, it’s important to ensure that all necessary information is included. A well-organized document increases the chances of a quick and effective resolution. Including the right details helps to avoid confusion and supports your case by making the request easy to review.

Here are the essential components you should incorporate into your communication:

| Element | Description |

|---|---|

| Personal Information | Include your full name, address, and contact information so the recipient can verify your identity. |

| Error Details | Specify the exact mistake you are addressing, providing account numbers, dates, or any relevant transaction identifiers. |

| Supporting Documents | Attach any evidence that substantiates your claim, such as receipts, bank statements, or relevant contracts. |

| Request for Action | Clearly state the action you want taken, whether it’s correcting the error or removing inaccurate information. |

| Signature | Sign your communication to formalize the request and ensure it’s treated as an official document. |

Ensuring that each of these components is included will make your request clearer and more effective, which can lead to a faster resolution of any discrepancies.

Common Mistakes to Avoid in Resolving Errors

When addressing inaccuracies in your financial records, it’s essential to avoid common errors that could delay the resolution process or negatively impact your case. Being mindful of these missteps can help you approach the situation effectively and increase the likelihood of a favorable outcome.

One frequent mistake is failing to provide sufficient evidence to support your claim. Without clear documentation, it can be challenging for the receiving party to verify your version of events, which may lead to a prolonged investigation or dismissal of your request.

Another common issue is using vague or unclear language. It’s crucial to be specific about the error you’re addressing, providing all relevant details such as account numbers, dates, and other identifying information. Lack of clarity can result in confusion and delay the resolution process.

Additionally, neglecting to follow proper procedures can create obstacles. Not sending the communication to the correct entity or missing important deadlines could cause setbacks in your efforts. Ensuring that you adhere to the right steps from the start is crucial for efficient handling of your request.

How to Send a Request for Corrections

Once you’ve identified an error in your financial records, it’s essential to send your request to the correct entity. Properly submitting the necessary information will ensure that your concern is addressed and resolved efficiently. There are several methods available, each with its own benefits and steps to follow.

Sending Your Request by Mail

One of the most traditional ways to address inaccuracies is through physical mail. Ensure that you send your request to the appropriate address for the organization in charge of managing the records. Include all supporting documents and a clear explanation of the issue to help facilitate the review process. It’s also recommended to use certified mail to confirm that the recipient receives your communication and you have proof of delivery.

Submitting Your Request Online

Many organizations offer the option to submit your request electronically through their website. This method can be quicker, and you may receive updates on the status of your request more promptly. Be sure to follow the instructions provided on the website carefully, uploading any necessary documentation and accurately filling out the required forms to ensure a smooth process.

Timeline for Resolving Errors

The process of correcting inaccuracies in your financial history can vary in length depending on several factors, including the complexity of the issue and the method of submission. Understanding the general timeline helps you manage expectations and follow up as needed to ensure timely resolution.

Typical Resolution Timeframes

Generally, the time it takes to resolve discrepancies follows a standard process:

- Initial Review: Within the first 30 days after submission, the organization responsible for the records will typically review the submitted information.

- Investigation Period: Depending on the complexity of the issue, the investigation may take an additional 30 to 45 days, especially if the error involves third-party entities.

- Final Decision: After completing the investigation, a final decision will be communicated, which can take up to 60 days from the date the request was submitted.

What to Expect After Submission

After sending your request, it’s important to follow up and be proactive:

- Monitor your account for updates. Many entities provide a status check option through their online platform.

- If you don’t hear back within the expected timeframe, contact the responsible organization to inquire about the status of your request.

- Ensure you receive official documentation confirming the resolution of the matter.

By understanding the typical timeline and being proactive, you can ensure a smoother and more efficient process for correcting any errors in your financial records.

What to Do After Resolution of Errors

Once the review and correction of inaccuracies are completed, it’s important to take steps to ensure that your records reflect the changes and that the process has been fully resolved. Knowing what actions to take after the matter is settled can help you maintain an accurate financial history and prevent future issues.

Verify the Changes

After the correction has been made, make sure to check that the changes are reflected in your records:

- Obtain an updated version of your financial history and verify that the error has been corrected.

- Ensure that any relevant accounts or information now accurately represent your situation.

- Cross-check the details with your supporting documents to confirm that all discrepancies have been addressed.

Monitor Your Financial Records Regularly

Even after the resolution, it’s a good practice to keep an eye on your financial information:

- Set a reminder to check your records periodically to ensure no new issues arise.

- If any further inconsistencies appear, address them promptly to avoid potential problems down the road.

- Maintain a log of any communications or updates related to your records for future reference.

Taking these steps will help you stay on top of your financial health and prevent any new complications from arising in the future.