Template for credit dispute letter

If you notice discrepancies in your credit report, addressing them swiftly can help maintain your financial health. A credit dispute letter is an effective way to request corrections from credit bureaus or creditors. This letter should clearly state the issue, provide evidence, and follow a formal yet polite tone.

The key to a successful dispute lies in presenting accurate information. Start by identifying the item in question, explaining why it’s incorrect, and attaching any supporting documents that prove your case. Stay concise and avoid unnecessary details to ensure your request is processed without delays.

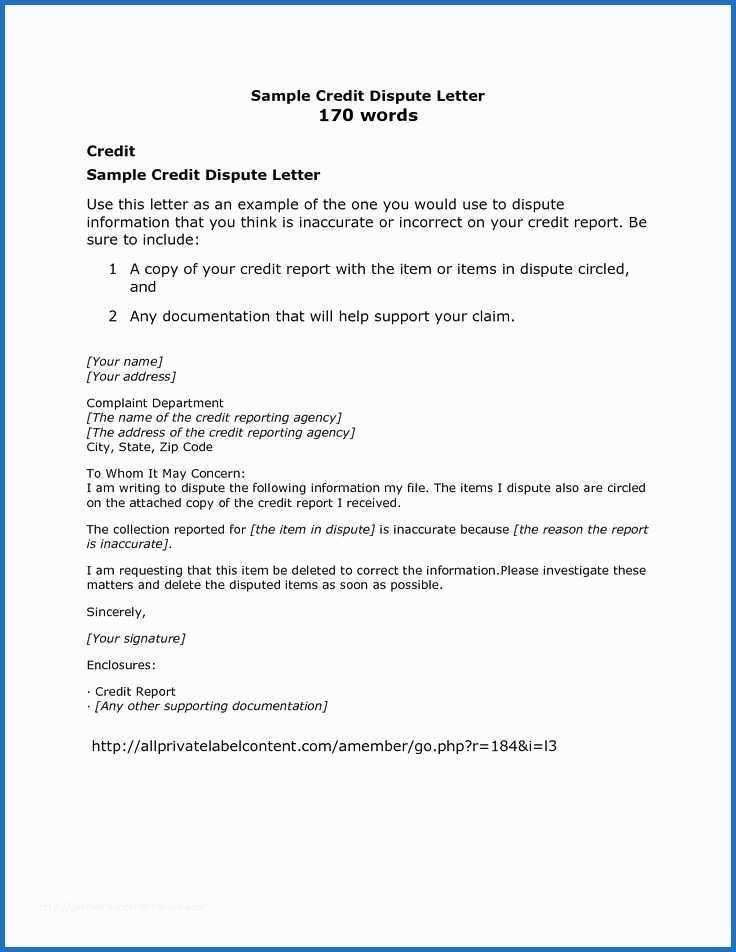

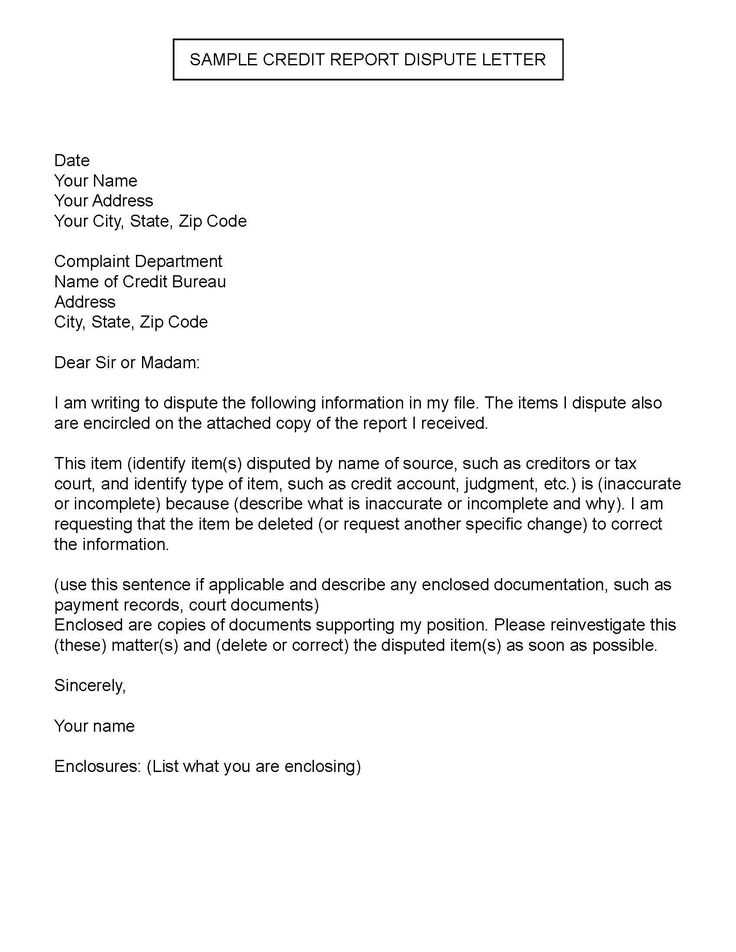

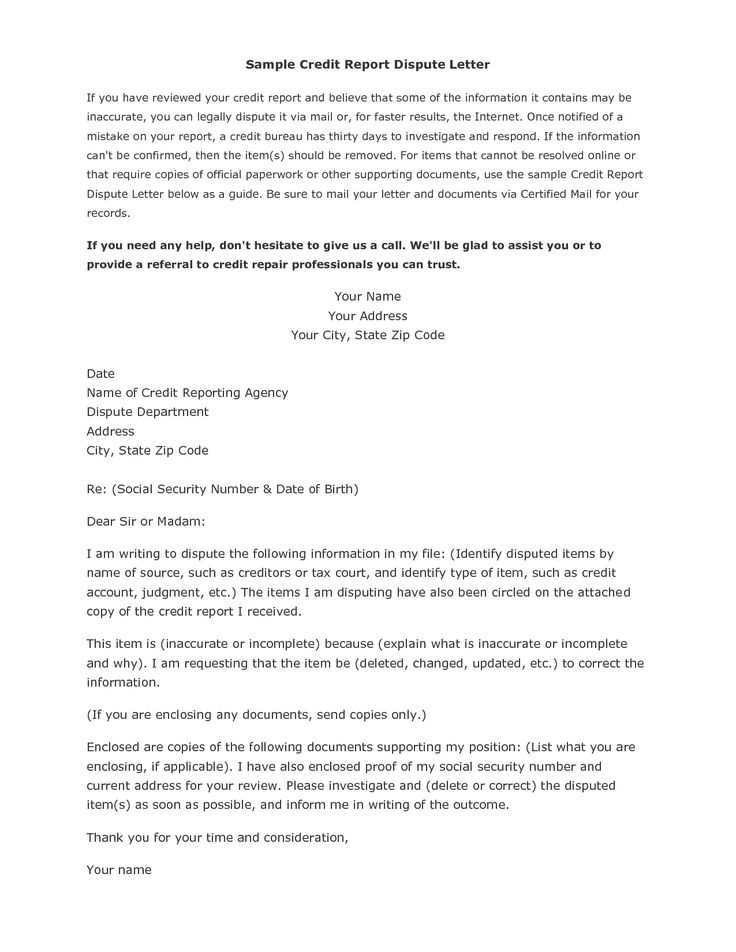

Use the template below to structure your letter and ensure that it meets the necessary requirements for credit bureaus or creditors to handle your dispute promptly.

Here’s an improved version of the text with minimized word repetition:

Start by addressing the credit bureau with a clear, polite statement of your issue. Include your full name, account number, and any relevant details that can help them identify the dispute quickly. Avoid unnecessary explanations, sticking to the key facts. Present your case clearly, indicating the specific error on your credit report.

If you have supporting documents, attach them. Reference these documents in your letter, ensuring you explain how they substantiate your claim. Focus on the facts and avoid emotional language. Your goal is to make the dispute resolution process as smooth as possible for the credit bureau.

Close your letter by requesting that they investigate the issue and update your credit report accordingly. Be sure to include your contact information and state that you expect a response within a reasonable timeframe. Stay polite and professional throughout, emphasizing your willingness to cooperate in resolving the matter efficiently.

Template for a Credit Dispute Letter

How to Address a Credit Dispute to the Right Agency

Key Details to Include in a Dispute Letter

Steps for Verifying Your Credit Report Information Before Disputing

How to Select the Appropriate Reason for a Credit Dispute

Understanding the Timeline for Dispute Resolution

What to Do if Your Dispute is Denied or Overlooked

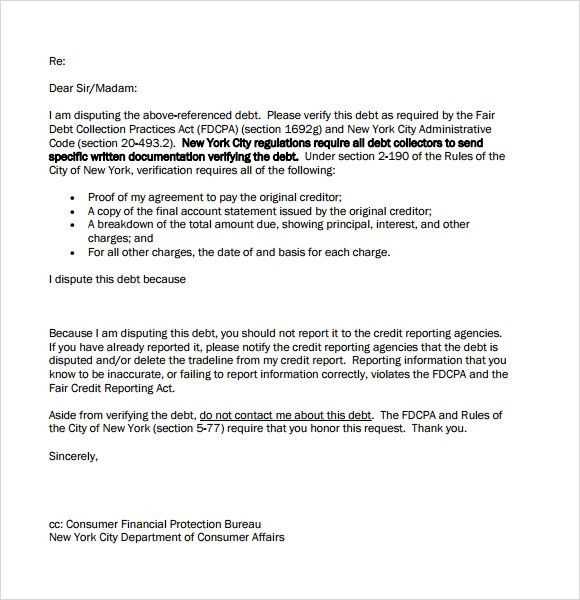

To address a credit dispute, begin by identifying the correct agency responsible for the error. Typically, this will be one of the major credit bureaus: Equifax, Experian, or TransUnion. Check your credit report for the contact details of the bureau reporting the disputed information.

Key Details to Include in a Dispute Letter

Your dispute letter should clearly present your case. Here’s what to include:

- Your full name, address, and contact information

- A description of the error or discrepancy you’ve found

- Any supporting documentation that can help validate your claim (e.g., receipts, bank statements)

- The specific correction you are requesting

- Your signature

Steps for Verifying Your Credit Report Information Before Disputing

Before disputing any information, verify its accuracy. Compare the details on your credit report with your personal records, such as bank statements or payment receipts. Ensure there are no mistakes related to your payment history, credit limits, or personal information.

If you find a discrepancy, gather all the relevant documents to prove the error, such as transaction records or proof of payment. This evidence will strengthen your dispute.

Next, review your credit report for other errors or outdated information that may require updating. It’s helpful to address all issues in one go rather than submitting multiple disputes over time.

Once you’ve confirmed the mistake and gathered supporting documents, you are ready to file your dispute with the correct agency.

How to Select the Appropriate Reason for a Credit Dispute

Be specific when selecting the reason for your dispute. Whether it’s a misreported payment, incorrect balance, or fraud, ensure your reason aligns with the error you’re challenging. Using the correct reason will help the agency process your dispute quickly and accurately.

If the issue relates to identity theft or fraud, indicate this clearly in your letter. The agency will require additional steps to verify your identity and address the problem.

Understanding the Timeline for Dispute Resolution

The credit agency typically has 30 days to investigate your dispute. If they require more time, they must inform you. During this period, the agency will review your documentation, contact the creditor, and investigate the validity of the information in question.

If the investigation is completed and the error is confirmed, the agency will correct your credit report. You will receive a written result of their findings once the dispute is resolved.

What to Do if Your Dispute is Denied or Overlooked

If your dispute is denied, don’t give up. Review the agency’s findings to understand why they rejected your claim. You may need to provide additional documentation or clarify your initial submission.

If your dispute is ignored or unresolved within the 30-day window, follow up with the agency. If the issue persists, consider escalating the matter by contacting the Consumer Financial Protection Bureau (CFPB) or filing a complaint with your state’s attorney general.

The meaning remains intact, and word repetition is reduced.

Ensure clarity by removing unnecessary phrases that add little value to your message. Avoid excessive repetition, especially of key terms. Focus on conveying the dispute points concisely. For example, instead of repeatedly stating “I disagree with the charge,” try varying the wording or eliminating redundant phrases entirely.

Use straightforward sentences that directly address the issue. Each paragraph should focus on one key element of the dispute, allowing the reader to follow the reasoning easily. Reword similar ideas in different ways to maintain the flow of the letter while keeping the message clear.

By trimming unnecessary details and eliminating redundant words, the tone of your letter will remain professional, and your arguments will be presented more effectively. Keep your points focused on what needs to be corrected or resolved, ensuring the recipient can quickly understand and act upon your concerns.