Hardship Letter Template for Creditors Assistance

When facing unexpected financial difficulties, it can become challenging to meet your repayment obligations. However, many financial institutions may be open to negotiating terms if they understand the situation. A well-structured communication outlining your current struggles and asking for temporary relief could be the key to managing your debts effectively.

Effective communication with your lender is crucial during this time. Clearly explaining your circumstances can increase the chances of reaching a favorable agreement. It’s essential to convey your challenges while providing sufficient information about your ability to recover and resume regular payments once the situation improves.

In this article, we will guide you on how to craft a professional and persuasive request to lenders. By following a simple format, you can ensure that your appeal is taken seriously and that you are positioned to receive the assistance you need during a tough financial period.

What Is a Financial Request to Lenders?

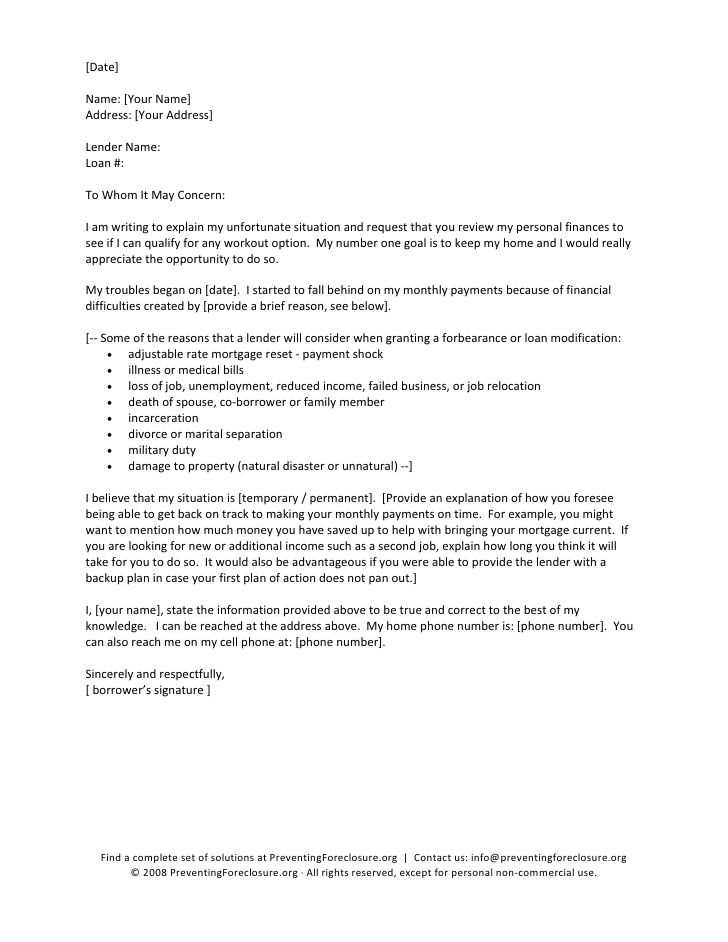

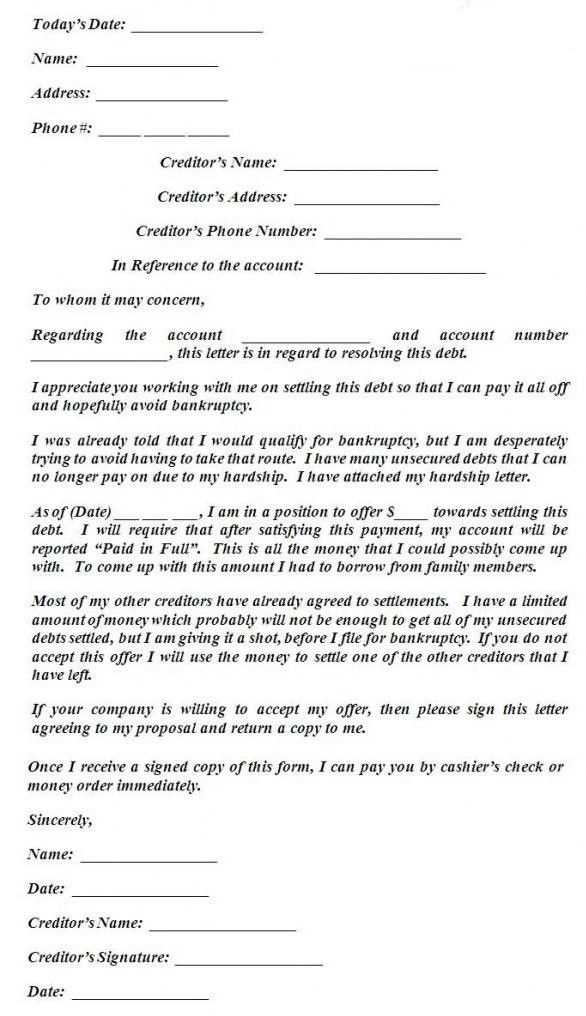

In times of financial difficulty, it may be necessary to communicate with those you owe money to, explaining your situation and requesting adjustments to your payment terms. This type of communication serves as a formal request to seek temporary relief, offering insight into your struggles and asking for understanding. Crafting this message in a clear, concise manner is crucial for its effectiveness.

Such a request typically includes a few key elements:

- Clear explanation of the financial challenges you’re facing

- Details on how the situation arose (e.g., job loss, medical issues, etc.)

- Proposed plan for resolution or a request for specific adjustments

- A commitment to returning to regular payments once the situation improves

Understanding the proper way to structure this request can significantly improve the likelihood of a positive response. By showing both transparency and responsibility, you demonstrate your commitment to resolving the issue while asking for the necessary flexibility during tough times.

Why Lenders Request Financial Assistance Communication

When individuals face unforeseen financial challenges, it is common for them to approach lenders with a request for temporary relief or a modification of payment terms. Financial institutions, in turn, may ask for a formal statement from the borrower, which helps them understand the nature of the issue and determine how best to proceed. This request is a way for lenders to assess the situation and decide if they can offer any adjustments, such as payment extensions or reduced rates.

Key Reasons for Requesting This Communication

| Reason | Purpose |

|---|---|

| Transparency | To provide lenders with a clear understanding of the borrower’s situation and intentions. |

| Negotiation | To explore potential adjustments to payment plans or loan terms. |

| Commitment | To demonstrate the borrower’s willingness to eventually return to regular payments. |

Building Trust and Communication

By submitting this request, borrowers show that they are proactive and responsible, which helps build trust with lenders. It also provides an opportunity for both parties to work together towards an achievable solution. Lenders, on their part, benefit from knowing how long the issue may last and whether the borrower intends to recover financially in the near future.

Starting Your Communication with Lenders

The first step in addressing your financial struggles with lenders is to initiate the conversation clearly and professionally. Opening your request with a brief and respectful introduction sets the tone for the rest of your message. A concise beginning helps the lender quickly understand the purpose of the communication and prepares them for the details that follow.

Begin by stating your current situation and the reason for reaching out. It’s essential to be honest and transparent about the challenges you are facing. A clear and direct approach will make it easier for lenders to assess your request and consider possible adjustments to your repayment terms.

For example, you could start with a statement such as: “I am writing to inform you of a temporary financial difficulty that has affected my ability to meet the current payment schedule. Due to [reason], I am requesting a modification to my payment terms.” This opening creates a respectful and factual context, allowing the lender to understand your request immediately.

Essential Details to Add in Your Request

When reaching out to your lender for temporary relief or an adjustment to your payment terms, including the right information is crucial for making a strong case. The details you provide will help the lender assess your situation and determine the most suitable course of action. Be sure to include relevant facts that clearly explain your financial challenges, your current status, and any plans you have to recover.

Here are the key points to cover in your message:

- Explanation of the situation: Briefly describe the circumstances that led to your current financial difficulty, such as job loss, illness, or other unexpected events.

- Current financial status: Provide an overview of your current financial situation, including income, expenses, and any other debts you may have.

- Requested assistance: Clearly state what type of relief you are seeking, whether it’s a temporary reduction in payments, a longer repayment period, or another form of accommodation.

- Commitment to resolve: Emphasize your intention to resume regular payments once the situation improves, and mention any steps you’re taking to recover financially.

Including these details will help the lender understand the full scope of your circumstances, making it more likely that they will consider your request favorably. The more transparent and well-organized your message is, the better the chances of reaching a beneficial agreement for both parties.

Key Mistakes to Watch Out For

When requesting financial adjustments or extensions, the way you present your situation plays a significant role in how your request is received. Avoiding common mistakes in your communication can increase the chances of a positive response from your lender. Clear, respectful, and concise messaging will help ensure your request is taken seriously and processed efficiently.

Common Pitfalls

- Vague explanations: Avoid being unclear or overly general about your situation. Provide specific details about the issue, such as the cause (job loss, medical expenses, etc.), to help lenders understand the severity of your circumstances.

- Failing to show intent to repay: Don’t forget to express your commitment to eventually resume regular payments. Lenders are more likely to offer relief if they see you plan to recover financially and fulfill your obligations in the future.

- Overly emotional language: While it’s important to convey your struggles, try to maintain a professional tone. Avoid using emotional appeals or dramatic language that may undermine the seriousness of your request.

- Missing or incomplete information: Ensure all necessary details are included, such as your current financial situation, your request, and a proposed solution. Incomplete or missing information could lead to delays or a rejection of your request.

- Making unrealistic demands: Be reasonable with your expectations. Lenders are more likely to help if your request aligns with what is feasible for both parties.

Tips for Avoiding Mistakes

- Proofread your message for clarity and accuracy before sending it.

- Be honest and transparent about your situation.

- Remain respectful and professional in tone throughout.

By avoiding these common mistakes and presenting a well-thought-out request, you improve your chances of receiving the assistance you need during challenging times.

Steps to Follow Up After Sending

Once you’ve submitted your request for financial relief or adjusted payment terms, it’s important to follow up in a timely manner. This ensures that your communication has been received and gives you an opportunity to check on the status of your request. Proper follow-up demonstrates your commitment and can help keep your request on track.

When to Follow Up

It’s crucial to allow enough time for your lender to review and process your message. A general guideline is to wait about 7 to 10 days after sending your initial communication. If you haven’t received a response by then, it’s appropriate to follow up politely to inquire about the status of your request.

How to Follow Up Effectively

- Be polite and professional: Start your follow-up by thanking the lender for their time and reiterating your appreciation for their consideration of your situation.

- Restate the purpose: Briefly remind them of the request you made and provide any necessary reference numbers or details to make it easy for them to locate your previous communication.

- Ask for an update: Politely inquire about the status of your request and if there are any further steps you need to take to facilitate the process.

- Keep a record: Document all interactions, including dates of communication and any responses you receive. This will help you stay organized and ensure you have a clear record of the process.

By following these steps, you can maintain open communication with your lender and ensure that your request is processed in a timely manner. A respectful follow-up can help foster a positive working relationship and increase the likelihood of receiving the assistance you need.