Template letter to creditors after death

When someone passes away, it is crucial to notify creditors in a timely manner. Addressing financial obligations responsibly ensures that the estate can be settled properly. Begin by clearly stating the death of the individual, providing necessary information such as the deceased’s full name, date of birth, and date of death. This helps creditors verify the claim and update their records accordingly.

Include the executor or personal representative’s contact details, as they will be responsible for handling the deceased’s financial affairs. Specify any actions you intend to take or have already taken regarding the estate. If applicable, mention if the estate is in probate and include any necessary documents, such as the death certificate or legal authorization, to support your communication.

Clarify how the creditor should proceed with any outstanding balances. If the deceased had life insurance or other assets designated to cover such debts, mention these resources. Request that creditors cease further collection efforts until the estate is settled, and provide a reasonable timeline for follow-up communication. This step ensures transparency and encourages a smooth resolution of financial matters.

Sure! Here’s the revised version:

When writing to creditors after a death, it’s crucial to act quickly to notify them of the situation. Use a formal but clear tone to ensure all relevant details are included. Here’s how to proceed:

- Include a clear subject line: “Notification of Death and Account Status” helps ensure your letter is opened and reviewed promptly.

- Provide necessary personal details: Mention the deceased’s name, date of death, and any relevant account numbers. Keep it brief but complete.

- Attach the death certificate: Creditor institutions will likely require a copy of the death certificate as proof.

- Request account closure or transfer: Specify what action you’d like taken with the account. If applicable, request a statement of the remaining balance or instructions on next steps.

- Provide contact information: Include your contact details in case they need to follow up with you directly.

Keep a record of all correspondence. If you’re dealing with multiple creditors, use a similar format for each. This will help you stay organized and avoid missing any crucial steps in settling the estate.

- Template Letter to Creditors Following a Death

After the death of an individual, it’s important to notify creditors about the passing. This letter helps in communicating the situation professionally and efficiently. Here is a straightforward template to guide you:

| Part | Content |

|---|---|

| Sender’s Information | Include your full name, address, and contact details at the top of the letter. |

| Recipient’s Information | Include the creditor’s name, company, and address. |

| Subject Line | State the purpose of the letter clearly, e.g., “Notification of Death and Account Closure Request.” |

| Opening Statement | Begin by stating the name of the deceased person and their relationship to you. Example: “I am writing to inform you that my [relationship, e.g., mother], [Full Name], has passed away on [Date].” |

| Account Information | Provide relevant account details, such as account number, to assist the creditor in locating the information quickly. |

| Death Certificate | Attach a copy of the death certificate to verify the claim. Mention this in your letter, e.g., “Please find a copy of the death certificate attached.” |

| Request for Action | Clearly state the actions you request, e.g., “Please close the account and provide instructions on how to proceed with any outstanding debts.” |

| Contact Information | Provide your contact details for any follow-up or clarification, and include a polite closing. Example: “Should you require any further information, please contact me at [Phone Number or Email].” |

| Closing | Close the letter with a respectful phrase, e.g., “Sincerely,” followed by your signature and name. |

This template is designed to ensure that creditors are notified promptly, allowing for an orderly process in managing the deceased’s accounts. Adjust the content according to your situation, but maintain clarity and respect throughout the letter.

Use clear and concise language when addressing creditors. Begin by stating the purpose of your letter immediately–this helps avoid confusion and keeps your communication focused. Always address the creditor by their formal name and include the full details of the deceased, such as their full name, date of birth, and any relevant account numbers to ensure they identify the right account.

- Address the creditor using their company name or department, such as “Dear [Creditor Name] Customer Service Team” or “Dear [Creditor Name] Collections Department.”

- If the creditor is a person, use a formal greeting such as “Dear Mr. [Last Name]” or “Dear Ms. [Last Name].”

- Always mention the decedent’s full name and relationship to the writer (e.g., “I am the son/daughter of [deceased’s full name]”).

- If you’re unsure who to address, contact the creditor’s customer service to confirm the appropriate department or person.

Ensure that the tone of your letter remains respectful and professional throughout. Keep your request specific and include any documentation that may support your claims, such as a death certificate or legal proof of your authority to act on behalf of the deceased.

Provide the full legal name of the deceased. This ensures that the creditor can correctly identify the person in their records. Include any other names the person may have used, such as maiden name or aliases, if applicable. These details prevent any confusion when processing the letter.

Include the deceased’s date of birth and date of death. This helps verify the timeline and offers clear context for the creditor. Ensure that the date of death is precise, as this may impact any outstanding debts or obligations.

Relevant Contact Information

List the deceased’s last known address, along with any previous addresses if they moved recently. This allows creditors to locate relevant records or communications. If the deceased lived in a different country, include that information to clarify jurisdiction details.

Executor or Estate Representative Details

Identify the person handling the deceased’s estate, whether it’s the executor or a personal representative. Include their full name, address, and contact number. This allows creditors to direct future correspondence to the correct individual.

The executor is responsible for notifying creditors about the decedent’s passing and managing any outstanding debts. It’s crucial for the executor to act promptly in sending a formal letter to creditors to inform them of the situation and provide the necessary details for debt resolution. The letter should include the decedent’s full name, date of death, and executor’s contact information. This helps establish the executor’s authority and initiates the communication process effectively.

Key Responsibilities

The executor must ensure all debts are accounted for and paid from the estate. Communicating with creditors involves verifying outstanding balances and negotiating any claims. It is also important to keep records of all interactions, as this can be essential for finalizing the estate. Executors should avoid making personal payments without proper approval, as debts should be settled using estate funds.

Managing Disputes

If there are disagreements or disputes over the validity of claims, the executor may need to work with legal advisors. It’s critical to address any issues promptly and ensure that the estate’s obligations are met fairly. The executor plays a key role in ensuring that creditors are treated fairly while also protecting the interests of the heirs.

Begin by gathering all financial documents related to the deceased’s debts. This includes bills, loan agreements, credit card statements, and any other paperwork that outlines outstanding payments.

Next, identify the debts that need to be addressed immediately. Prioritize urgent payments, such as mortgages or utility bills, that might impact essential services or assets.

Contact the creditors to notify them of the death and request a balance statement. Make sure to inquire about any potential options to settle the debt, such as payment plans or debt forgiveness, depending on the terms of the debt and applicable laws.

Assess whether there is enough estate value to cover the debts. If the estate’s value falls short, you may need to contact a probate lawyer for assistance with debt negotiations.

If the estate has sufficient assets, distribute funds accordingly to pay off the debts. Keep a detailed record of all payments made and request confirmation from creditors that the debts have been cleared.

If debts remain after settling the most urgent ones, explore consolidation or settlement options that might reduce the total debt amount owed. Consulting with a financial advisor could provide valuable insights for managing remaining debts.

| Debt Type | Priority | Action |

|---|---|---|

| Mortgage | High | Contact lender, settle balance or arrange payment plan |

| Credit Card | Medium | Notify creditor, check for settlement or payment plans |

| Utility Bills | High | Contact service providers, settle immediately to avoid service disruptions |

| Personal Loans | Medium | Negotiate with lender for possible debt forgiveness or reduction |

Document each step of the process to ensure that all debts are managed transparently and legally. Keep copies of all communications with creditors and any settlements or agreements made.

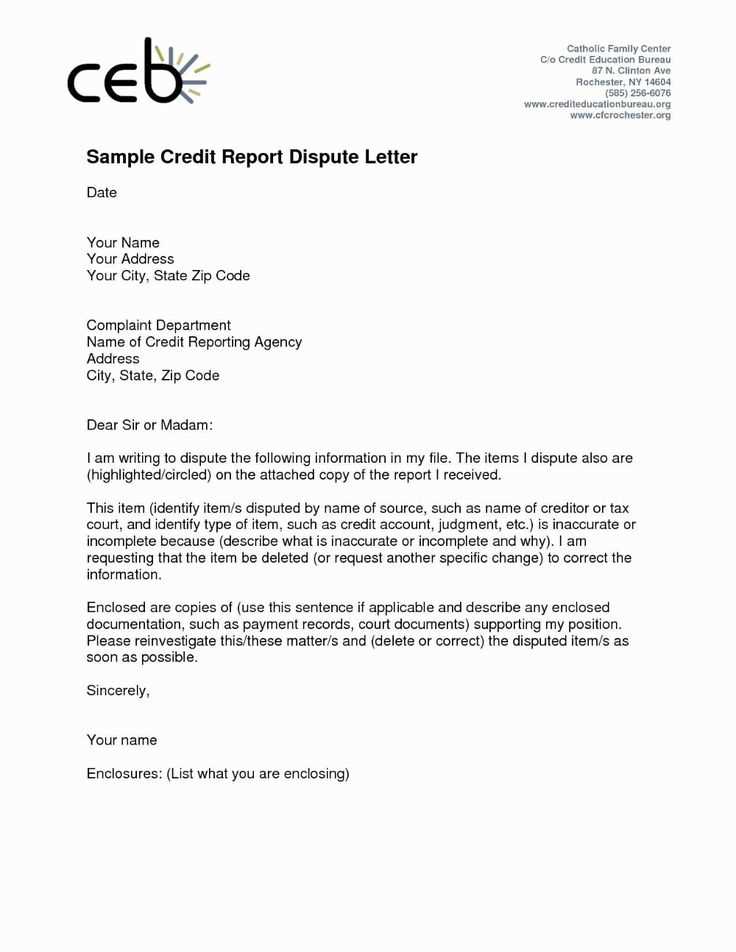

Contact each creditor directly with clear and precise information regarding the deceased’s estate. Provide them with necessary documents, such as the death certificate, proof of your authority (e.g., executor or administrator), and any other supporting paperwork that verifies the claim. Be straightforward in explaining the situation and clarify the deceased’s financial status at the time of passing.

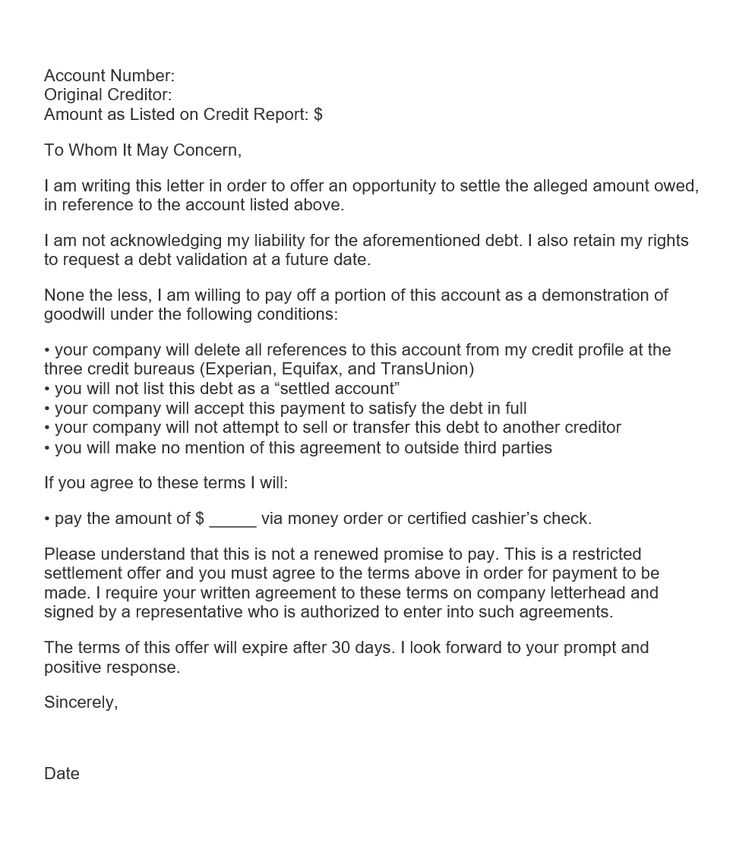

If a creditor disputes a claim, approach them calmly and respectfully. Review any terms and conditions of the debt to ensure that all facts are accurate. Request evidence of the claim, such as original contracts or invoices, and take time to verify each piece of information. If necessary, seek legal advice to help interpret complex financial agreements.

Consider negotiating with creditors to settle outstanding debts if there are insufficient assets to cover all claims. Some creditors may be willing to accept a reduced payment, or extend the terms of repayment. Keep open communication and document all agreements reached.

If an agreement cannot be reached, mediation or arbitration might be necessary. A neutral third party can help resolve disputes and avoid costly court procedures. Should legal action become inevitable, ensure all documents and communications are well-organized and transparent for the court process.

Contact creditors promptly after a loved one’s death. This will help prevent further accumulation of debt. Begin by obtaining a death certificate, which you will need to send to creditors as formal notification of the death.

Notify creditors with proper documentation

Provide a copy of the death certificate along with any relevant information such as account numbers. You may also include a letter outlining your relationship with the deceased and your role in handling their estate. This ensures the creditor recognizes your authority to discuss the deceased’s debt.

Be aware of outstanding debts and obligations

Review all financial records for any debts that may exist, including loans, credit cards, and other obligations. Understand that in most cases, debts are paid from the estate, not from personal assets unless there are co-signed loans or joint accounts. This will determine your next steps in dealing with creditors.

Contact creditors as soon as possible after the death of the individual. Make sure to inform them in writing, providing necessary documents such as the death certificate. This helps to prevent further confusion or late fees from accumulating on the deceased’s accounts.

Steps to Notify Creditors

- Prepare a formal letter outlining the death and the person’s details.

- Attach a copy of the death certificate for verification.

- Include the executor’s or estate administrator’s contact information.

- Make a list of any relevant accounts and debts the deceased had.

- Request confirmation of debt status and details on how to settle outstanding balances.

What to Expect from Creditors

- Some creditors may freeze the account while they process the information.

- Others might ask for additional documents, such as proof of executor status.

- Expect a mix of responses, from account closure to inquiries about payments.