10 day demand letter template texas

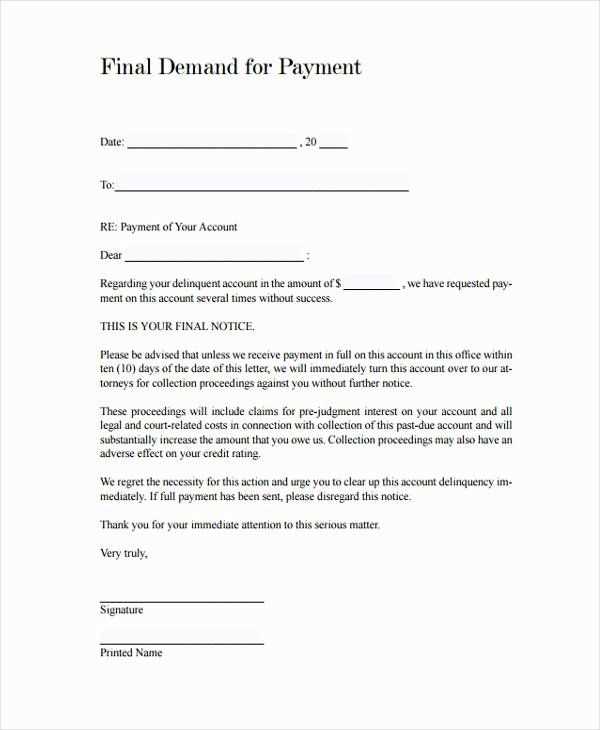

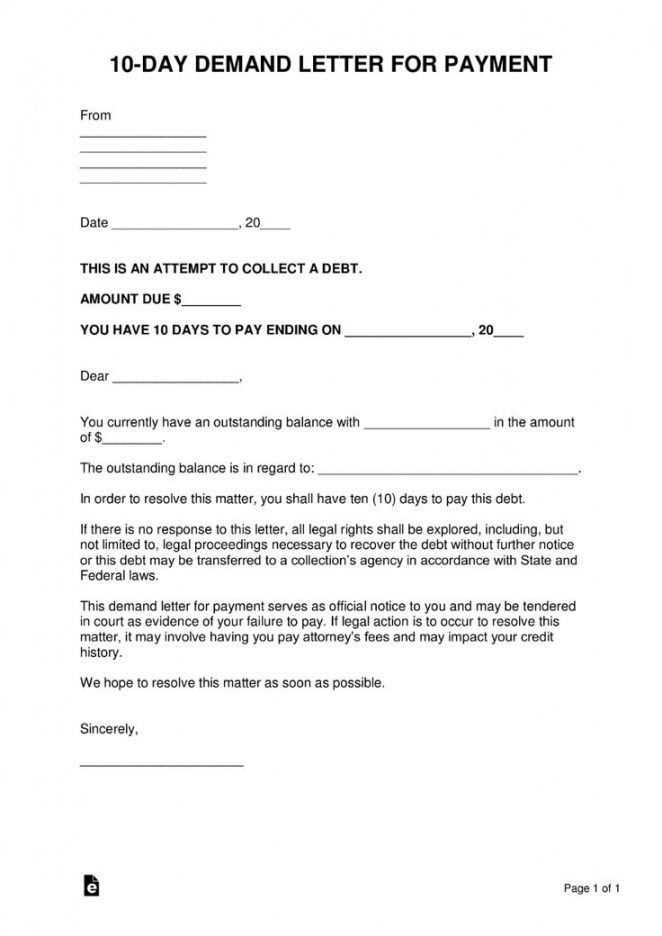

To ensure clarity and prompt action, a 10-day demand letter is a vital step when seeking resolution of a financial or contractual issue in Texas. This letter serves as a formal request for payment or resolution within a specified 10-day period. When crafting your letter, it’s important to include all relevant details about the debt or issue, as well as a clear statement of what you expect from the recipient.

Start by addressing the letter to the appropriate party and include their full name, business name, and contact information. Be direct and specific about the amount owed or the issue that needs to be addressed. Reference any agreements or contracts that relate to the matter at hand, and provide supporting documentation if available.

Clearly state that the recipient has 10 days to resolve the matter, and make sure to include a specific deadline. Emphasize the consequences of non-payment or non-compliance, such as legal actions or reporting to credit bureaus. This approach is designed to give the recipient a reasonable chance to resolve the issue before further steps are taken.

End the letter by requesting a prompt response and providing your contact information for any questions or discussions. A polite yet firm tone helps to maintain professionalism while conveying the urgency of the situation.

Here is the revised version:

Begin with a clear statement of the amount owed and the specific date by which payment must be made. Ensure the recipient knows that failure to pay within 10 days will lead to further legal action. Keep the language straightforward and avoid any unnecessary legal jargon. Outline the steps the recipient should take to resolve the issue, such as contacting your office or making payment through a specified method. Be firm yet professional in tone, and provide a clear deadline for response. Consider adding a reminder of the consequences for non-payment, but keep it concise.

Ensure that the letter includes your full contact information, and specify how you wish the payment to be made (e.g., bank transfer, certified check). Make it easy for the recipient to reach you by including a phone number or email address. Always sign the letter personally and consider sending it via a method that confirms receipt, like certified mail, to ensure accountability.

- 10-Day Demand Letter Template Texas

A 10-day demand letter in Texas is a formal request for payment or action from a party before pursuing legal remedies. This letter provides a clear deadline for resolving the issue and specifies the amount owed or action required.

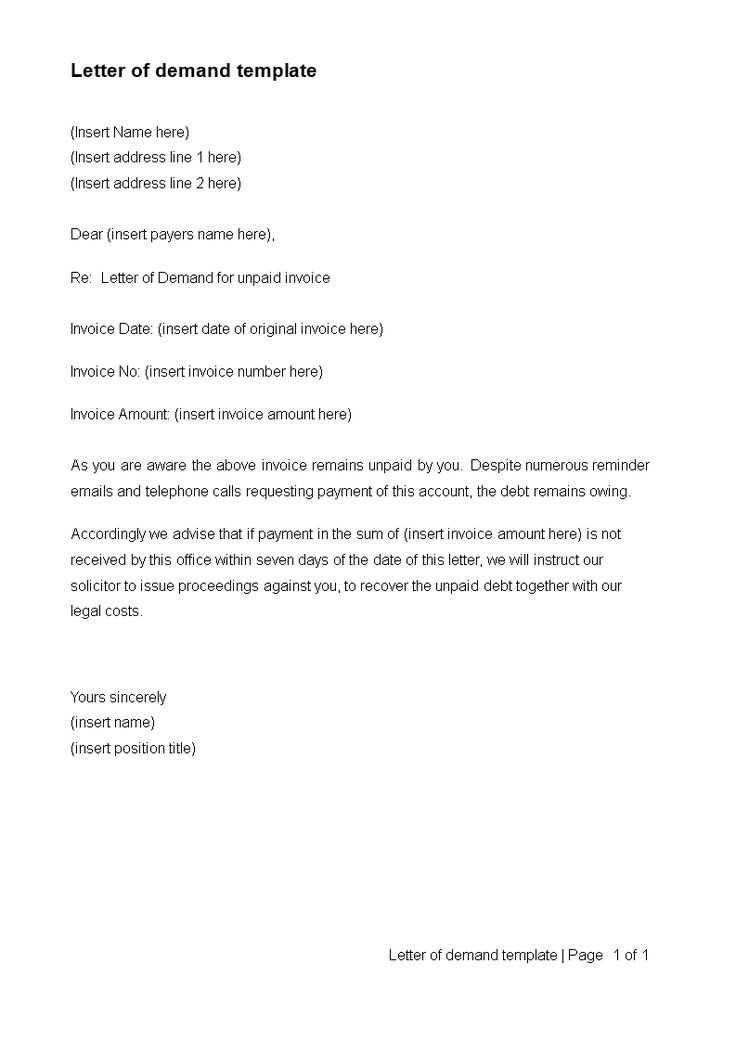

Follow these steps to create an effective 10-day demand letter:

- Header: Start with your full name, address, phone number, and email address at the top of the letter. Include the date the letter is being sent.

- Recipient’s Information: Clearly state the name and contact details of the person or business you’re addressing.

- Subject Line: State the purpose of the letter, such as “Demand for Payment” or “Request for Action.”

- Opening Statement: Begin with a direct statement of your intention to resolve the issue and indicate that this is a formal demand.

- Details of the Claim: List the specifics of the amount owed or the action required. Be concise and reference any previous communications or agreements.

- Deadline: Set a 10-day deadline for the recipient to take action. Be clear about the consequences if the deadline is not met, such as legal action.

- Conclusion: Politely state that you expect immediate attention to the matter and include a reminder of the 10-day timeframe.

- Signature: Sign the letter with your full name and include any relevant documentation or receipts as supporting evidence.

Be sure to send the letter via a trackable method, such as certified mail, to ensure delivery confirmation. If the recipient fails to respond within the 10 days, you may need to take the next steps, including seeking legal advice or filing a lawsuit.

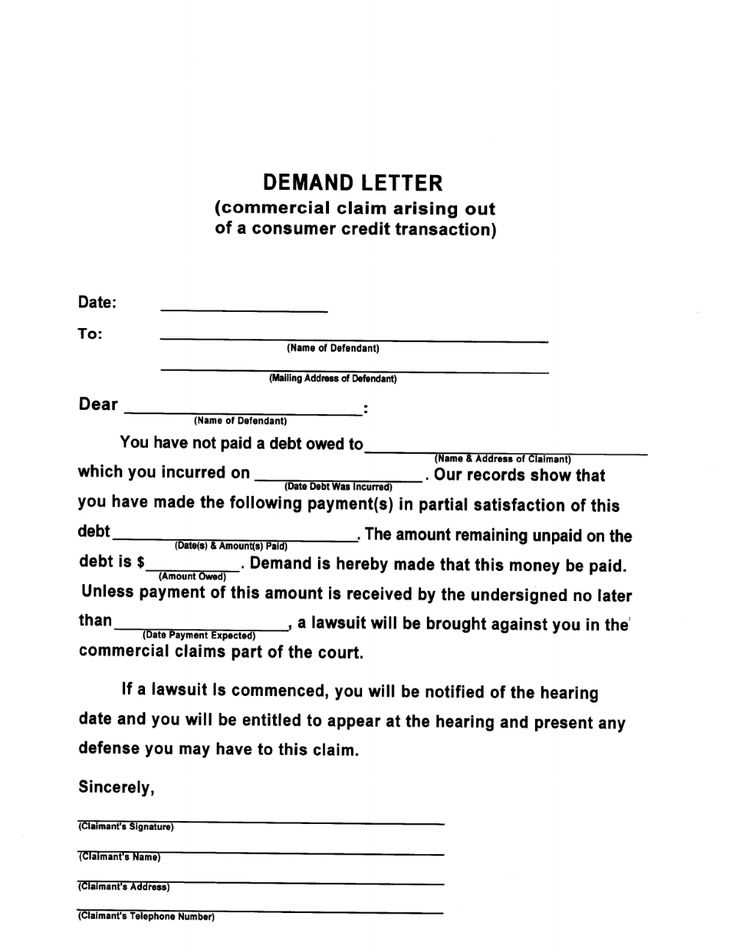

In Texas, a 10-day demand letter is a formal notice sent to a debtor, requesting payment of a debt within ten days. This letter is an important step in the debt collection process, and failing to follow the correct procedure could delay the legal actions that follow. Ensure your letter clearly identifies the amount owed, the purpose of the debt, and the consequence of non-payment within the given timeframe.

Key Elements of the Letter

The letter should include specific details such as the creditor’s full name and contact information, a description of the debt, and a statement specifying the 10-day payment deadline. It must also mention the legal actions that may occur if the debtor does not comply, which could include filing a lawsuit or pursuing further collection efforts.

Formatting and Delivery

While the 10-day letter does not require a particular format, it should be professionally written and include a return receipt option to confirm delivery. Mailing the letter through certified mail with return receipt is recommended to establish proof of receipt, which could be important if the matter escalates to court.

Begin with a clear header that includes the date and the recipient’s full name and address. Specify the sender’s information below. Ensure that the letter’s tone remains professional and direct, while clearly stating the purpose of the communication: to demand payment or address an outstanding obligation.

Next, include a detailed description of the debt or issue at hand. Mention the amount owed, the service or product provided, and the date of the original transaction. This section must leave no room for confusion about the specific obligation being referenced.

Include a firm but polite request for payment within a specified time frame. In Texas, a 10-day period is typical, but make sure to align this with legal requirements or agreements in place. State the consequence of failing to meet the deadline, such as pursuing legal action or reporting the matter to collections.

Conclude with a polite closing, reiterating the importance of prompt resolution. Offer contact details for any questions or clarification. This helps maintain a professional tone while keeping the focus on resolving the matter efficiently.

Begin with a clear and professional greeting, such as “Dear [Full Name]”. If you know the person’s formal title, use it, like “Mr.”, “Ms.”, or “Dr.”. Avoid using informal nicknames or first names unless you have an established, personal relationship with the recipient.

If the recipient holds a specific role, mention it. For instance, “Dear Mr. Smith, Managing Director”. If you are unsure of the person’s gender or title, use their full name or simply “Dear [Full Name]”.

When to Use Job Titles

- If the recipient is a business executive, lawyer, or other professional, including their job title in the greeting can add formality.

- For government officials or public figures, always use their official title to show respect and professionalism.

Addressing Multiple Recipients

- If addressing a group of individuals, use “Dear Sir/Madam” or “To Whom It May Concern” when the names are unknown.

- For known groups, such as a department or committee, address them collectively, like “Dear Finance Committee” or “Dear Customer Service Team”.

Begin by clearly listing all charges that are due. Include amounts for goods, services, and any applicable interest or penalties. To ensure accuracy, cross-check all entries against relevant agreements or contracts.

Next, calculate any late fees or interest as outlined in the contract or by Texas law. If there is no specified rate, the general interest rate for overdue payments in Texas is 18% per year unless otherwise agreed upon.

Use the following table format to organize the details of the amounts due:

| Description | Amount |

|---|---|

| Principal Amount | $500.00 |

| Late Fee (5%) | $25.00 |

| Total Amount Due | $525.00 |

Finally, include any payment terms such as the deadline for payment, acceptable payment methods, and the consequences of failing to settle the amount within the specified period. This ensures the recipient is fully aware of their obligations.

Ensure your demand letter follows state regulations to avoid complications. In Texas, a demand letter should clearly outline the amount owed, the purpose, and the consequences of non-payment. Avoid vague language and be specific about your demands and timelines.

Clear and Concise Language

Use straightforward, easy-to-understand language. Ambiguous statements could weaken your position in court if the matter escalates. Clearly state the amount owed, any agreements or terms violated, and the exact steps the recipient needs to take to settle the debt.

Timely Delivery and Record Keeping

Deliver the letter in a way that ensures proof of receipt, such as certified mail or another trackable method. Keep records of the delivery date and any responses. Documentation will serve as valuable evidence in any potential legal actions.

Consideration of Legal Precedents

Understand how Texas law views demand letters and follow legal precedents in your area. Failure to comply with basic legal practices in sending demand letters could impact your case if it moves to court.

Know Your Rights and Limits

Be aware of any legal limits to the amount of time you can give the recipient to resolve the issue. In Texas, for example, certain debts may have statutes of limitation that impact how long you can demand payment before it becomes invalid.

After sending the 10-day demand letter, it’s important to track the recipient’s response carefully. You may need to follow up if no response is received within the given timeframe. Keeping clear records of all communications will support your next steps, whether in resolving the matter or preparing for legal action.

Track Response and Deadline

Set a reminder for the 10-day mark. If the recipient has not responded, consider sending a follow-up letter or email. Document every attempt to reach out, noting dates and methods of communication.

Consider Legal Action

If there is no resolution after the 10-day period, it might be time to consult with an attorney. Legal action could involve filing a lawsuit, and it is critical to have all the documents and communications organized in case you need to present them in court.

| Action | Timeframe | Notes |

|---|---|---|

| Follow-Up Letter | Day 11–14 | Send a polite reminder or request an update. |

| Consult Attorney | Day 15+ | Review options for legal action if no response. |

| File a Lawsuit | After Day 20+ | If the issue is unresolved, initiate legal proceedings. |

10 Day Demand Letter: Texas

Ensure your demand letter is clear and concise, detailing the amount owed, the due date, and any relevant contract terms. Include all necessary evidence supporting your claim, such as invoices, contracts, or correspondence that prove the debt. Address the letter to the individual or business responsible for the debt and provide clear instructions on how to resolve the issue.

Formatting Your Letter

Begin with a polite but firm opening. State the amount due and the payment deadline. Mention the consequences of non-payment, such as potential legal action. Ensure you include your contact details, as well as instructions for making payment. Use a professional tone to maintain a strong, yet respectful stance.

Follow-Up Actions

If there is no response by the deadline, consider escalating the matter. This may include seeking legal advice or initiating small claims court proceedings. Document all communication and keep a record of your actions for future reference.