Escrow demand letter template

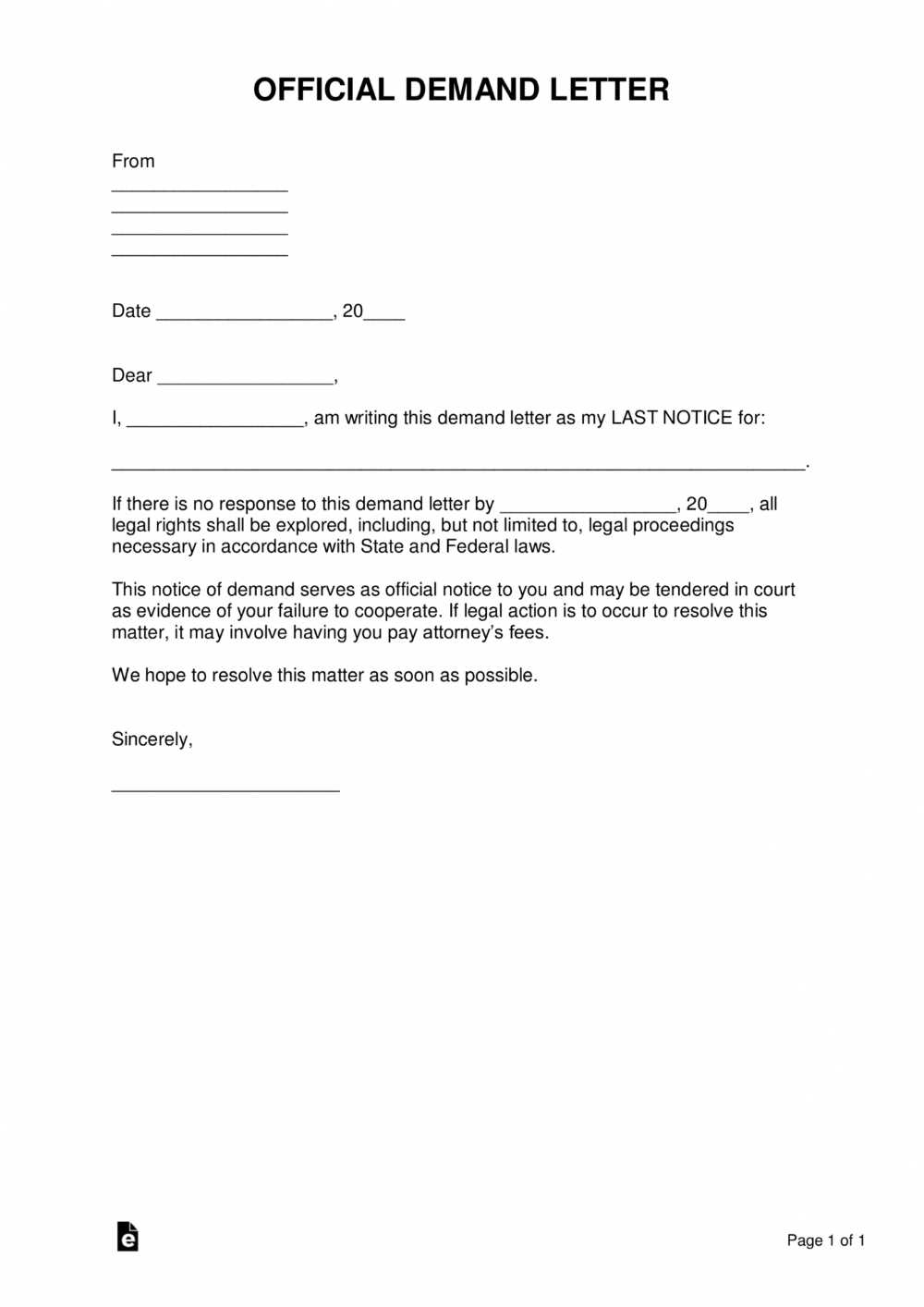

To create a clear and direct escrow demand letter, start by outlining the specifics of the agreement and the funds in dispute. State the names of all parties involved, the date the escrow was established, and the exact terms of the contract that triggered the demand. Highlight any missed deadlines or breaches that require immediate action.

Include a concise summary of the situation, explaining why the demand is being made. Be specific about the amount in question, referencing relevant contracts, invoices, or agreements to support your claim. This not only provides clarity but also strengthens the legal standing of your request.

Set a firm deadline for the recipient to respond or fulfill the demand, and specify any consequences for failing to meet this deadline, such as legal action or forfeiture of the escrowed funds. Clearly state your preferred method of resolution and ensure that the letter is professionally formatted to reflect seriousness and attention to detail.

Here’s the revised version:

Clearly structure your letter to convey the necessary information in a straightforward manner. Use clear and precise language to ensure the recipient understands your request. Begin with the core facts and follow through with actionable steps.

- Identify the parties: Specify the individuals or entities involved, including the escrow holder, buyer, and seller.

- State the amount: Mention the exact amount being disputed or requested for release from the escrow account.

- Reference the agreement: Highlight the relevant section of the escrow agreement that justifies your request for the funds.

- Set a deadline: Give a clear deadline (e.g., 10 business days) for the escrow agent to release the funds.

- Outline the consequences: Briefly explain the actions you will take if the funds are not released within the stated timeframe.

End the letter professionally with a polite request for confirmation or further communication. Provide contact details in case of questions or need for clarification.

- Escrow Demand Letter Template

To draft an Escrow Demand Letter, be clear and concise in your approach. Address the escrow agent or the party responsible for holding the funds. Clearly state the agreement and the specific terms under which you demand the release of the escrowed funds. Detail the necessary conditions, including the date and reason for the demand. Ensure that you mention any required documentation that proves the terms of the escrow agreement have been met.

Key Elements to Include

In your letter, include the following information:

- Parties Involved: Identify the buyer, seller, and escrow agent.

- Escrow Agreement Reference: Mention the escrow agreement’s date and terms for clarity.

- Amount in Escrow: State the specific amount being held in escrow.

- Demand Date: Indicate the date by which the demand is made and expected response.

- Conditions for Release: Summarize the requirements for releasing the funds, including any proofs or documents you are providing.

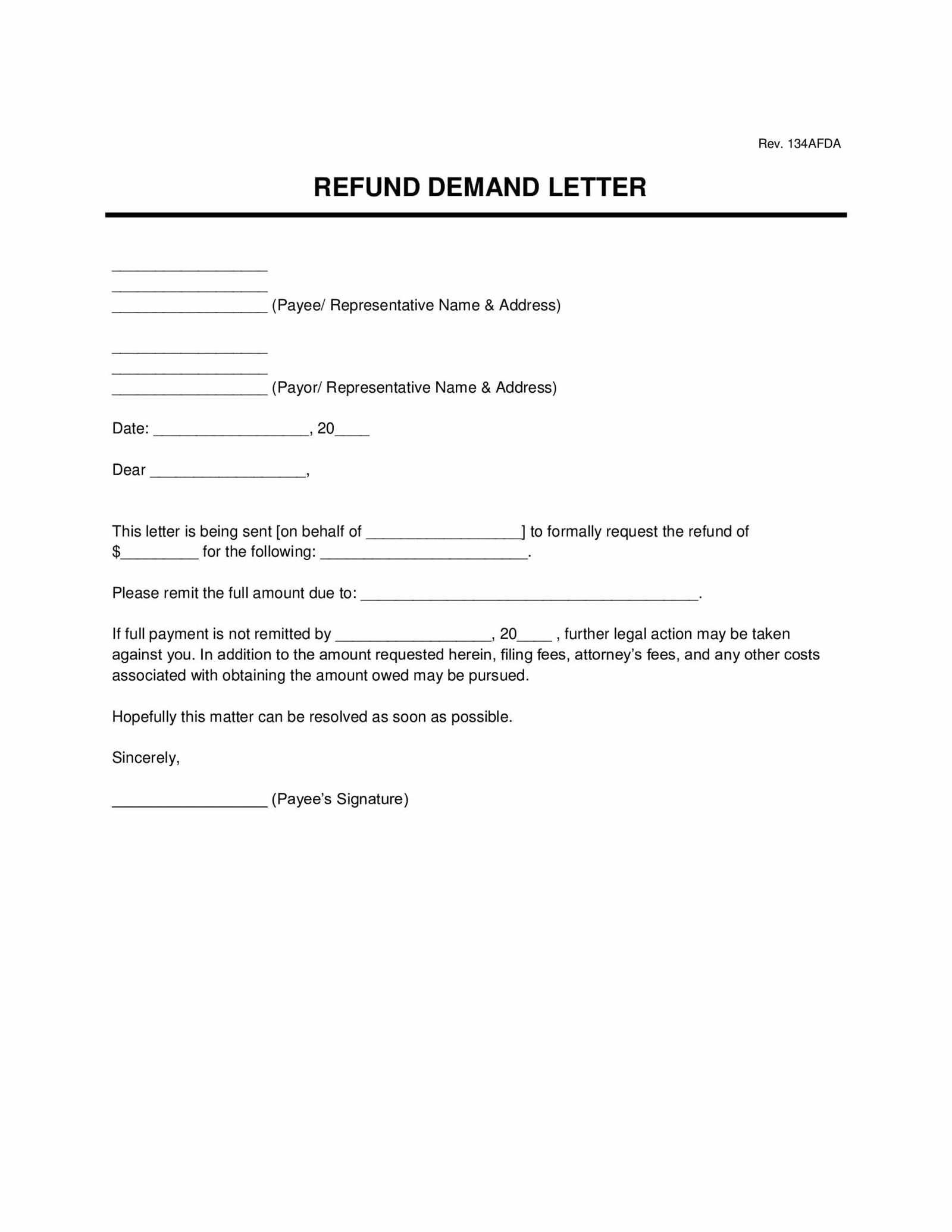

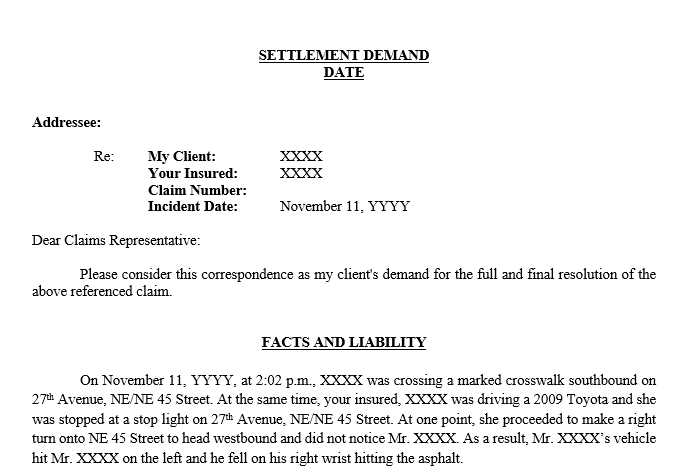

Sample Template

Below is a simple template you can customize for your Escrow Demand Letter:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Escrow Agent’s Name][Escrow Agent’s Address][City, State, ZIP]Dear [Escrow Agent’s Name],Re: Demand for Release of Escrow FundsI am writing to formally request the release of the escrowed funds in the amount of $[Amount], as per the escrow agreement dated [Date]. The terms of the agreement have been met, and all necessary conditions for the release of these funds have been satisfied.Please find attached the following documents that substantiate my request:[List of documents][Additional documents, if any]Kindly release the funds at your earliest convenience. Please confirm receipt of this letter and let me know if you require any further information.Sincerely,[Your Name]

This template can be adjusted depending on the specifics of your escrow arrangement, but ensure all details are clear and that you provide any required proof or documents for a smooth process. A direct approach helps avoid delays in the escrow release process.

An Escrow Demand Letter is a formal request made by one party involved in an escrow agreement to release funds or assets held in escrow. It typically occurs when a party believes the conditions for releasing the escrow have been met. This letter serves as the official document requesting the escrow agent or holder to take action based on the agreement’s terms.

When to Use an Escrow Demand Letter

Use an Escrow Demand Letter when the agreed-upon conditions in an escrow agreement are satisfied, and you need to request the release of funds or property. This could happen after completing a sale, fulfilling contractual obligations, or reaching specific milestones outlined in the agreement. For example, after a property transaction or the completion of a service contract, if all conditions have been met, an Escrow Demand Letter will initiate the process of fund or asset release.

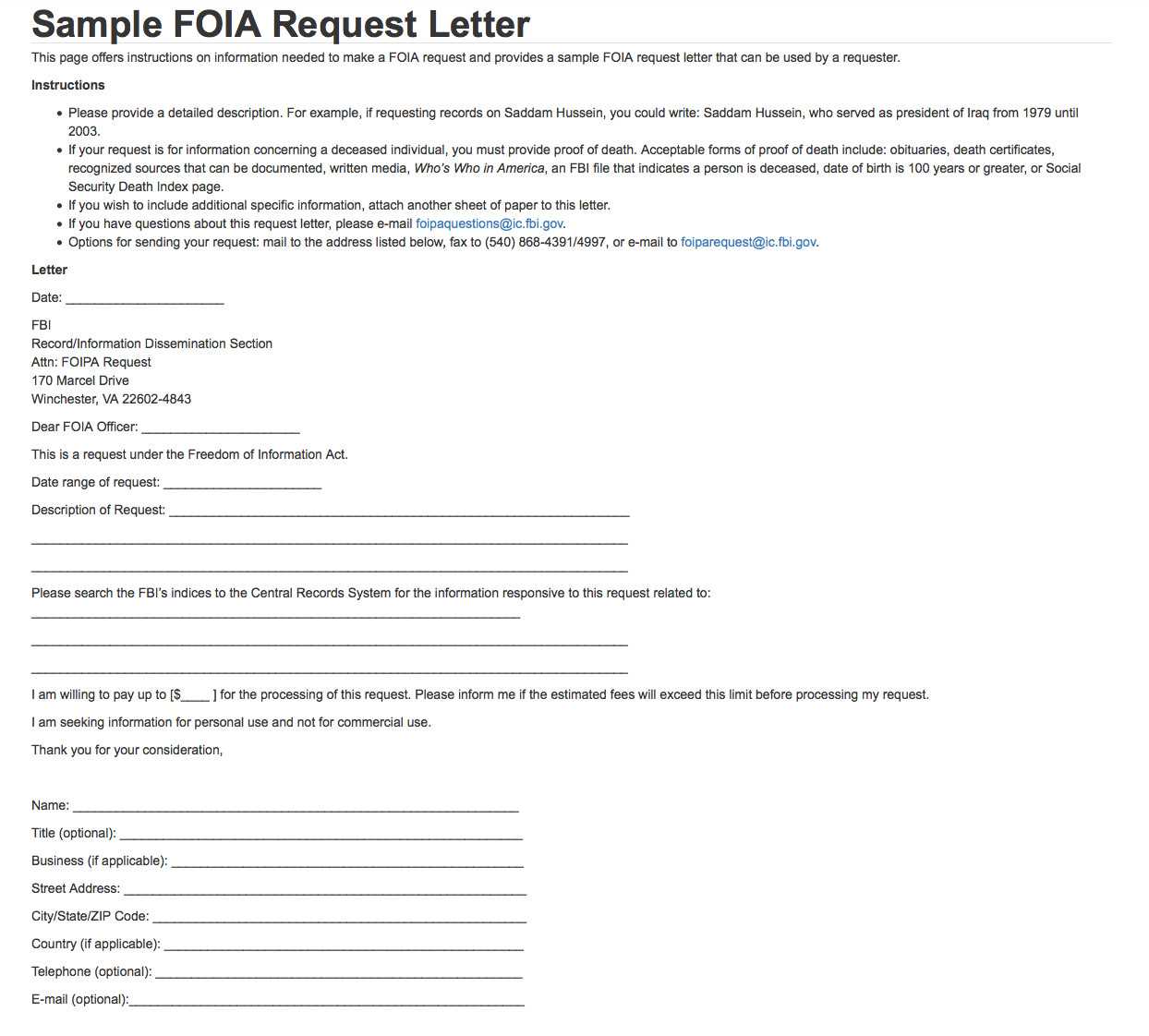

Key Elements of the Letter

The letter should clearly state the reason for the request, any supporting documentation (e.g., completed contract or receipt), and specific instructions for releasing the escrowed funds or assets. Be sure to address the escrow holder by name and include relevant agreement details such as the escrow number or contract reference.

To create a clear and professional escrow demand letter, be sure to include the following components:

1. Contact Information

List the names, addresses, and contact details of all parties involved, including the escrow agent. This ensures the letter is easily traceable and direct communication is possible.

2. Escrow Agreement Reference

Clearly reference the escrow agreement by its title, date, and any identifying numbers. This makes it easy to locate the document and tie the demand to the correct escrow transaction.

3. Specific Demand for Funds

State the exact amount of funds being requested and provide any relevant account information for the transfer. Include a brief explanation of why the demand is being made, whether it’s due to unmet conditions or the completion of required actions.

4. Deadline for Payment

Specify a clear deadline for the escrow agent or other party to release the funds. Make sure the deadline allows enough time for the necessary actions but is firm enough to prevent unnecessary delays.

5. Supporting Documentation

Attach any relevant documentation or evidence that supports the demand. This might include invoices, receipts, or a report showing that conditions of the escrow agreement have been fulfilled.

6. Consequences of Non-Compliance

Outline the potential consequences if the demand is not met by the specified deadline. Whether it’s legal action, additional charges, or other steps, being clear about the next steps helps avoid misunderstandings.

7. Signature and Date

Ensure the letter is signed by the party making the demand and dated appropriately. This verifies the authenticity and timeliness of the request.

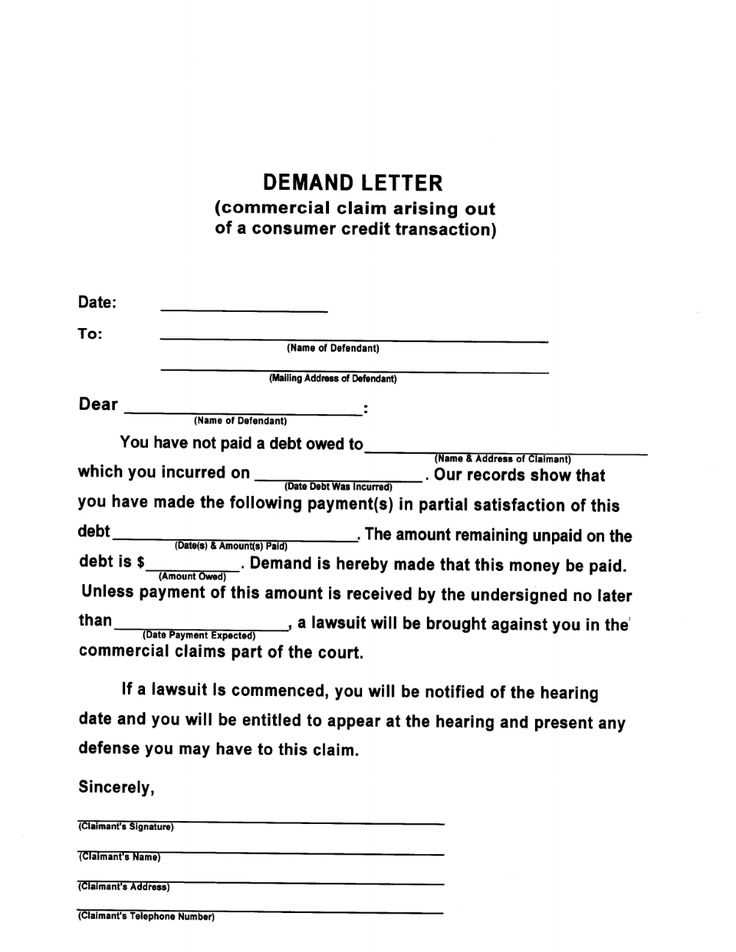

| Component | Description |

|---|---|

| Contact Information | Names, addresses, and contact details of all parties. |

| Escrow Agreement Reference | Include title, date, and identifying numbers. |

| Specific Demand for Funds | State the amount and reason for the demand. |

| Deadline for Payment | Set a firm deadline for action. |

| Supporting Documentation | Provide evidence supporting the request. |

| Consequences of Non-Compliance | Clarify what will happen if the demand is ignored. |

| Signature and Date | Sign and date to validate the letter. |

Begin your escrow demand letter by addressing the recipient directly. Clearly identify the parties involved–this includes the buyer, seller, and escrow agent. Provide specific details about the escrow agreement, including the date it was initiated and any reference numbers associated with it. This will help establish a clear context for the recipient. Keep it brief but precise, avoiding unnecessary elaboration.

1. State the Purpose of the Letter

Immediately state the reason for the letter. Indicate whether the letter is a formal request for funds, a notice of a breach, or a demand for action. This helps the recipient understand the urgency and intent right from the start. For example:

- “This letter serves as a formal request for the release of funds held in escrow as per the terms of the agreement dated [insert date].”

- “This letter is to notify you of a breach in the escrow agreement and to request immediate action.”

2. Provide Relevant Information

Include any pertinent details that provide clarity and context, such as escrow account numbers, property details, or specific conditions that have been met or violated. This ensures both parties are on the same page regarding the status of the escrow agreement.

- “The escrow account number is [insert number], and the funds are related to the purchase of the property located at [insert property address].”

- “According to the agreement, all conditions for the release of funds have been met on [insert date].”

Clearly outline the payment expectations by specifying amounts, due dates, and any other conditions. This clarity helps avoid confusion and potential disputes. Here’s how to write effective payment terms and deadlines:

1. Define the Payment Amount

State the exact amount due. Break down any partial payments, deposits, or installments, if applicable. This makes it clear for both parties what is expected to be paid.

2. Set Specific Deadlines

Include a specific due date for each payment. Use exact dates (e.g., “Payment due on March 15, 2025”) rather than vague terms like “within 30 days.” For installment payments, set deadlines for each installment.

3. Specify Accepted Payment Methods

List the accepted methods of payment (e.g., wire transfer, credit card, check). This ensures both parties are on the same page about how payments should be made.

4. Outline Late Fees or Penalties

Clarify the consequences of late payments, including any fees or interest charges. For example, “A late fee of 5% will be applied to any outstanding balance after 30 days.” This encourages timely payment and sets expectations for delays.

5. Include Terms for Early Payment Discounts

If applicable, provide a discount for early payment. For example, “A 2% discount is offered if payment is made within 10 days.” This incentivizes the other party to pay ahead of schedule.

6. Mention Payment Confirmation

State that once payment is received, the payment will be acknowledged through an invoice or receipt. This keeps the transaction transparent and assures both parties that payment has been processed.

Clarity is key when drafting an escrow letter. Avoid vague language that can confuse the recipient. Specify the conditions that must be met for the escrow to be released, including dates, amounts, and any necessary documentation. This helps all parties understand exactly what is required.

1. Not Defining the Terms Clearly

One common mistake is failing to clearly define the escrow terms. It’s vital to outline the specific conditions for escrow release. For example, include when and how the funds will be released and what milestones or actions need to be completed first.

2. Missing Signatures or Dates

Ensure that all relevant parties sign and date the letter. Missing signatures or an unclear date could delay the escrow process and create legal complications later. Double-check to make sure all signatures are in place before sending the letter.

Stay concise and focused in your language. Avoid including unnecessary details that could complicate the agreement. Stick to the facts and include only the information necessary to make the escrow process clear and manageable for everyone involved.

Wait for a response from the escrow holder or the other party. The recipient typically has a set period to acknowledge or respond to the demand. Review any reply carefully to ensure the terms align with the request. If no response is received within the designated timeframe, consider following up with a polite reminder.

Monitor the Status

Stay proactive by tracking the status of your escrow funds. If the escrow holder is involved, confirm whether they have processed the request. If a third party is responsible, you may need to engage with them directly to ensure that the matter is addressed. Keep records of all communications for reference.

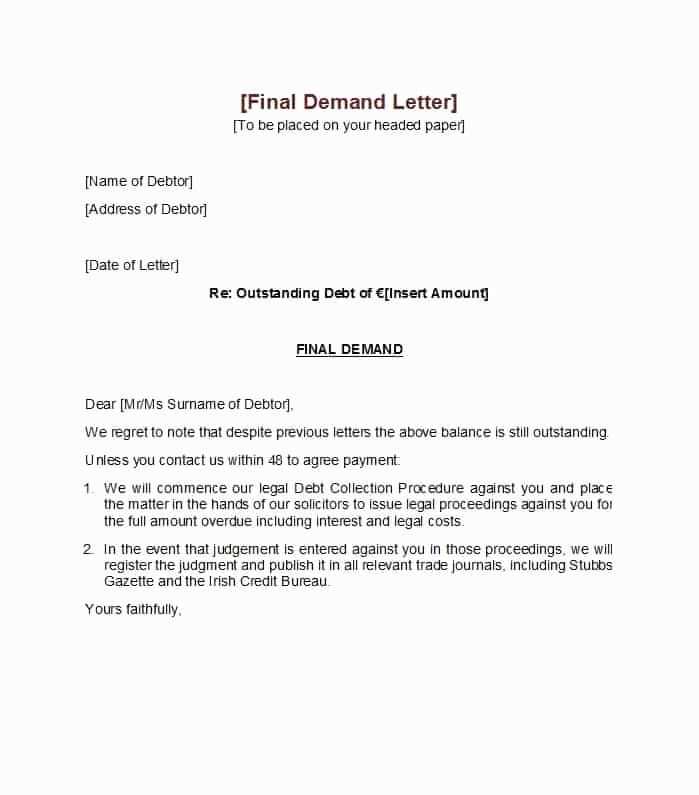

Consider Next Steps

If the demand is accepted, review the terms and ensure that all obligations are met before releasing the escrowed funds. If the demand is denied or ignored, consult a legal expert to explore your options. Depending on the agreement, you may have the right to pursue further action or escalate the matter through formal channels.

Escrow Demand Letter Template

Begin the letter by clearly identifying all parties involved in the escrow agreement. Specify the details of the escrow arrangement, including the escrow agent, amount held, and purpose of the escrow. Mention any relevant terms, such as the specific conditions that must be met for the release of funds. Be sure to reference the Escrow Demand Letter’s purpose, which is to formally request the release of funds or assets as per the agreed terms.

In the next section, restate the facts leading to the demand. Address any outstanding issues or obligations that need to be resolved before the escrow agent can act. Make sure to cite any specific clauses from the escrow agreement that justify the demand. This will reinforce the legal basis for your request and make it easier for the recipient to understand your position.

Finally, clearly state the amount or assets being requested. Specify a timeline for action and indicate that failure to comply may result in legal steps being taken. Keep your language concise and assertive, ensuring the recipient understands the urgency of your demand. End the letter by providing your contact information for further discussion if needed.