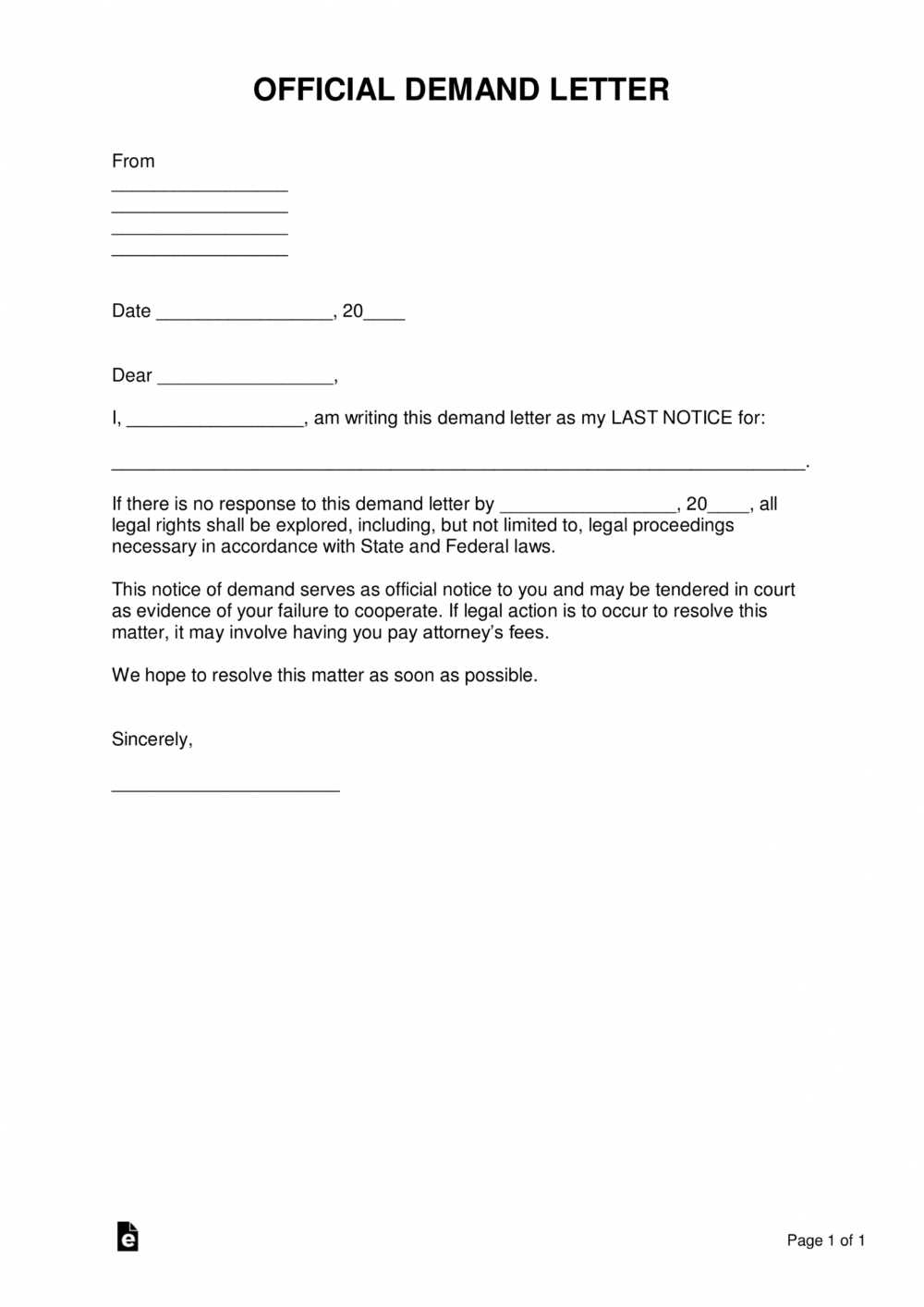

Final Demand Letter Template Before Legal Action

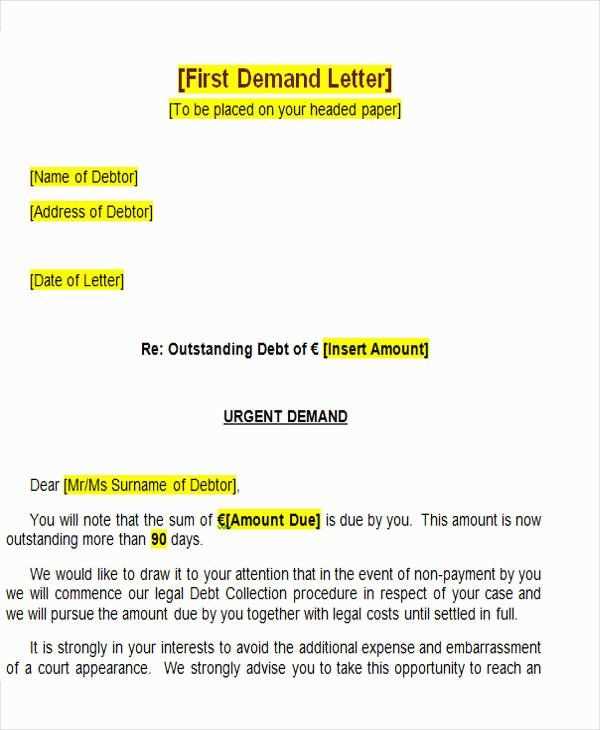

When a financial obligation remains unpaid, it often becomes necessary to take a step toward resolving the issue. This action can serve as a clear signal that the situation is serious and requires immediate attention. A well-crafted written notice can serve as a final reminder, urging the recipient to fulfill their commitments promptly to avoid further complications.

In such circumstances, crafting an appropriate communication is critical. The message must be clear, firm, and professional to convey the urgency of the matter. By outlining the next steps and potential consequences, it helps set the tone for future actions while still offering a resolution without escalating the situation.

Knowing how to compose this type of document ensures that all necessary elements are included. Understanding the format, content, and timing can make all the difference in prompting a timely response and avoiding further disputes.

Why Send a Formal Payment Reminder

When efforts to resolve an outstanding financial issue have failed, sending a formal communication can be a decisive step. This action serves not only as a reminder of the debt but also as a clear indicator that the situation must be addressed without further delay. It provides the recipient with an opportunity to fulfill their obligation before the matter escalates.

Such a message is crucial because it emphasizes the seriousness of the situation and outlines the possible consequences of non-payment. It also helps maintain professionalism, which is important if the dispute ultimately needs to be settled through other means.

| Benefits | Consequences of Not Sending |

|---|---|

| Offers a last chance to resolve the matter amicably. | Can lead to more expensive and lengthy dispute resolution processes. |

| Clearly states expectations and timeframes. | Risk of damaging business relationships or losing the payment. |

| Shows willingness to settle without formal proceedings. | Failure to act can lead to legal consequences. |

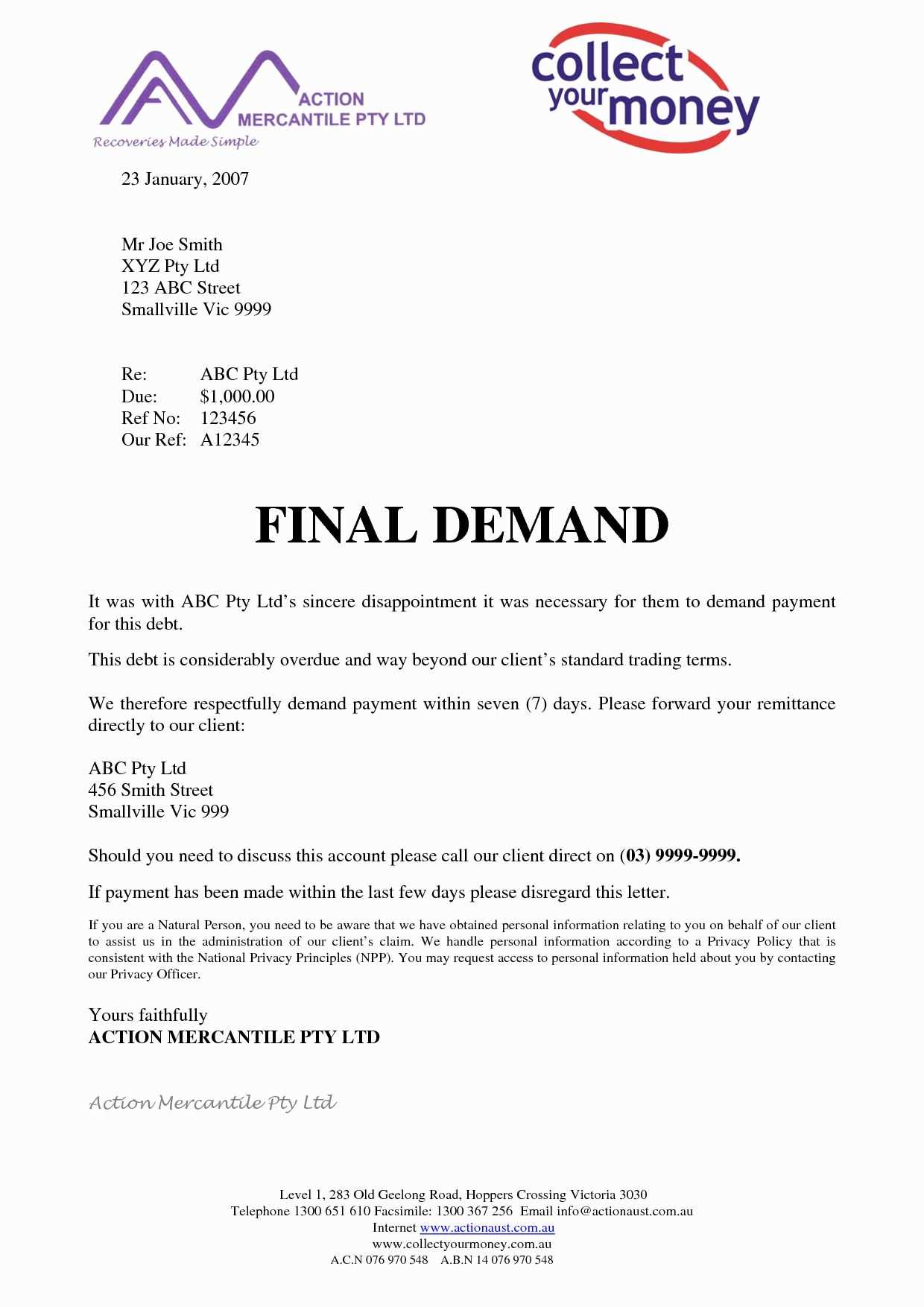

When Formal Measures Become Necessary

At times, despite multiple attempts to resolve a payment issue through informal means, the debtor may still fail to meet their obligations. When it becomes clear that further communication will not lead to a resolution, it may be time to consider more formal measures. These steps are designed to reinforce the seriousness of the matter and protect your interests.

It is important to assess whether all reasonable efforts have been exhausted before proceeding with any formal actions. In some cases, a strong warning may prompt the recipient to take the matter seriously and make payment. However, if no resolution is achieved, you may need to move forward with the next appropriate steps.

Taking formal measures often means that a financial dispute can no longer be resolved through simple negotiation. Once these steps are taken, the process becomes more structured and may involve legal channels, which can be costly and time-consuming. It is essential to understand when such measures are necessary and to be prepared for the potential consequences.

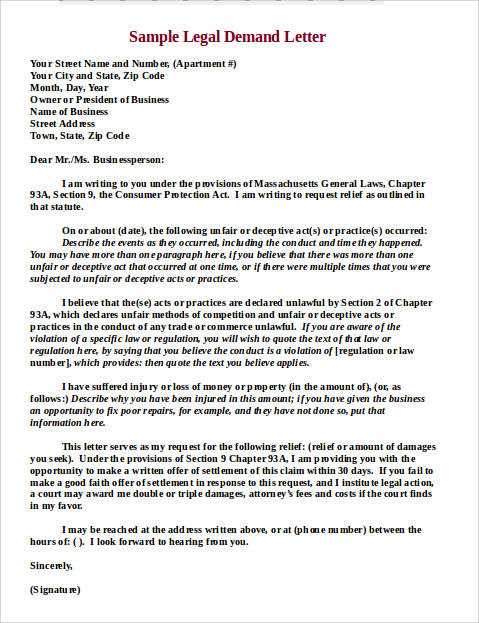

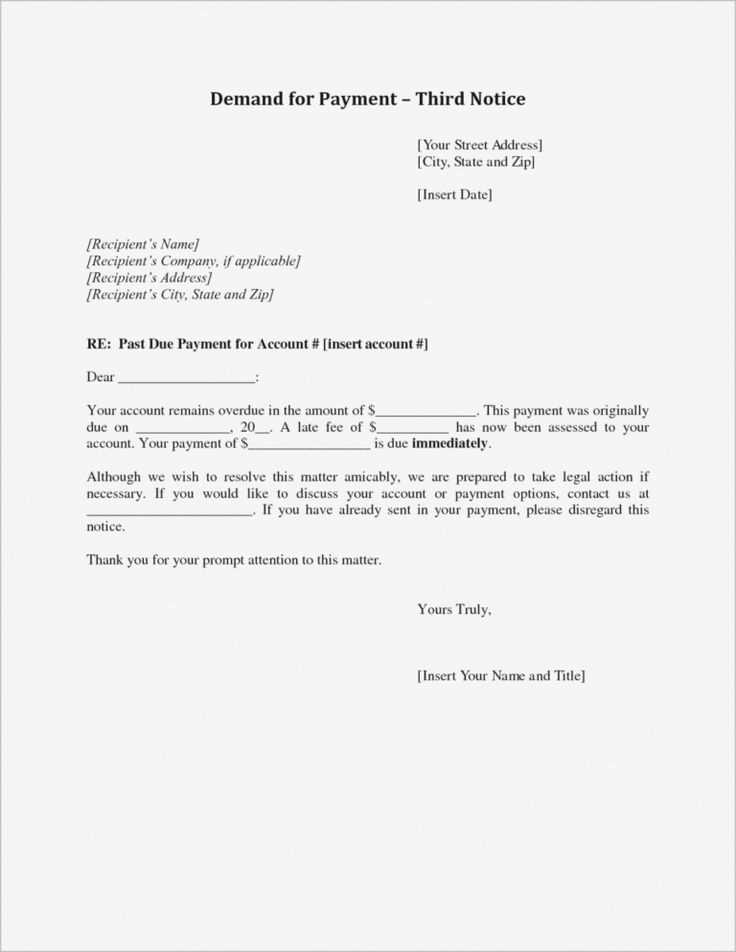

Key Elements of an Effective Communication

Creating a strong and clear message is essential when requesting payment or addressing an outstanding issue. An effective communication must contain specific components to ensure that the recipient understands the seriousness of the situation while also providing them with a chance to resolve the matter without further complications. The tone should be firm but professional, leaving no room for misunderstanding.

Important Components

- Clear Identification of the Debt – Ensure the amount owed and any relevant details about the transaction are clearly stated.

- Specific Deadlines – Provide a clear timeframe for when the payment or action must be completed.

- Consequences of Non-Compliance – Outline the potential consequences if the issue is not resolved by the stated deadline.

- Contact Information – Include a method for the recipient to respond or discuss the matter further.

- Professional Tone – Keep the language respectful and direct to avoid any potential escalation or conflict.

Additional Considerations

- Evidence of Communication – Retain a copy of the communication for future reference in case the matter escalates.

- Clear and Concise Language – Avoid unnecessary jargon or complicated phrasing to ensure clarity.

How to Customize the Document

Personalizing your communication is crucial to ensure that it is both relevant and effective in addressing the specific issue at hand. By tailoring the content, you can make sure it speaks directly to the recipient while highlighting the key details of the situation. Customizing the message allows you to maintain professionalism while ensuring that all important elements are included.

Step-by-Step Process

- Start with Basic Information – Include the debtor’s name, address, and any reference number to help them quickly identify the issue.

- Detail the Specifics of the Obligation – Clearly outline the amount owed, the nature of the transaction, and any important dates associated with the debt.

- Adjust the Tone – Depending on the relationship with the recipient, you may want to adjust the level of formality or firmness in your communication.

- Include Relevant Dates – Be sure to specify deadlines and timelines for repayment or resolution.

- Provide Clear Instructions – Indicate the steps the recipient should take next, including payment methods or contacting you for further discussion.

Additional Customization Tips

- Personalize the Salutation – Address the recipient by name to create a more direct and professional approach.

- Be Precise with Legal References – If applicable, mention any specific contractual clauses or obligations to reinforce the seriousness of the matter.

Common Mistakes to Avoid

When addressing overdue payments or unresolved issues, it’s crucial to ensure your communication is effective and clear. Mistakes in phrasing, tone, or structure can lead to confusion or worsen the situation. Avoiding common errors can help maintain professionalism and increase the likelihood of a positive outcome.

Typical Errors to Watch Out For

- Vague Language – Being unclear about the amount owed, deadlines, or expected actions can lead to misunderstandings and delays.

- Overly Harsh Tone – While the situation may be urgent, using aggressive or threatening language can escalate the conflict rather than resolve it.

- Failure to Provide Clear Instructions – Not outlining the next steps or how to make the payment can confuse the recipient and delay resolution.

- Ignoring the Importance of Documentation – Not keeping a copy of the communication may hinder your ability to pursue further steps if necessary.

- Setting Unreasonable Deadlines – Giving an unreasonably short timeframe for payment can lead to frustration and a breakdown in communication.

How to Avoid These Mistakes

- Be Precise and Concise – Clearly state the issue, the amount owed, and the expected action, using simple language.

- Maintain a Professional Tone – Even if the matter is urgent, always approach the recipient with respect and courtesy.

- Give Adequate Time – Allow the recipient a reasonable timeframe to respond or settle the matter before escalating.

Next Steps After Sending the Communication

Once your message has been sent, it’s important to be prepared for a variety of responses. The recipient may take action immediately, or they may request more time or clarification. Having a clear plan for what to do next can help you manage the situation effectively and decide on the most appropriate course of action based on the recipient’s response or lack of it.

What to Expect

- Immediate Payment – The recipient may settle the debt or resolve the issue upon receiving your notice.

- Request for Extension – The debtor may ask for more time, especially if they are experiencing financial difficulties.

- No Response – If there is no response within the given timeframe, you may need to consider further steps to ensure resolution.

Taking Action Based on the Response

- If Payment is Made – Confirm receipt of payment and close the matter, ensuring all parties are satisfied.

- If Extension is Requested – Consider negotiating a new deadline, but document the agreement for future reference.

- If No Response is Received – Consider escalating the matter, such as through mediation or further formal steps to resolve the issue.