Late Payment Demand Letter Template for Effective Collections

When clients or customers fail to settle their financial obligations on time, businesses face significant challenges. It is crucial to take the appropriate steps to address these issues effectively, ensuring that the process remains professional while also safeguarding your interests.

One of the most efficient ways to approach this situation is by drafting a formal communication that clearly outlines the outstanding amount and sets clear expectations for when and how it should be settled. Such a document not only serves as a reminder but also as a formal record of your efforts to resolve the matter amicably.

In this guide, we will discuss the essential components and considerations for crafting a professional message that prompts action and encourages timely resolution. Whether you’re handling a small invoice or a more significant overdue balance, understanding the correct approach is key to maintaining positive business relationships while securing the funds owed to you.

Why You Need a Payment Demand Letter

When customers fail to fulfill their financial obligations on time, it becomes essential to take action. Having a structured and formal communication is a key step in ensuring that you can recover the amount owed while preserving business relationships. This document serves as a clear reminder and establishes the seriousness of the matter.

Here are some reasons why this approach is crucial for your business:

- Legal Protection: A written communication acts as a formal record, providing evidence in case of disputes or legal proceedings.

- Clear Expectations: It sets clear expectations for when and how the debt should be settled, reducing any confusion.

- Professionalism: A well-crafted message shows that you are serious about recovering the funds while maintaining a professional tone.

- Encourages Payment: It serves as a prompt for those who may have forgotten or overlooked their financial responsibilities.

- Time-Saving: Addressing overdue balances early with a formal document can help avoid further delays and prevent unnecessary follow-ups.

By utilizing this communication tool, you can protect your business’s cash flow while encouraging timely resolution of outstanding amounts.

Understanding the Importance of Timely Payments

Receiving funds on schedule is critical for the smooth operation of any business. Delays in settling invoices can cause a ripple effect, disrupting cash flow and hindering the ability to meet obligations to suppliers, employees, and other stakeholders. This financial stability is essential for long-term growth and success.

When payments are not received as expected, businesses often face challenges in planning and managing expenses. It can also affect your ability to reinvest in your operations, hindering future growth opportunities. This is why ensuring prompt collection of outstanding balances is a priority for any business.

Timely collection helps to:

- Maintain a healthy cash flow – Ensuring that funds are available when needed for day-to-day operations.

- Prevent financial strain – Avoiding the need to take loans or rely on credit lines to cover operational costs.

- Foster positive business relationships – Demonstrating professionalism and reliability in all financial transactions.

In the competitive landscape of business, being able to rely on a steady stream of revenue from clients can significantly contribute to your overall success and sustainability.

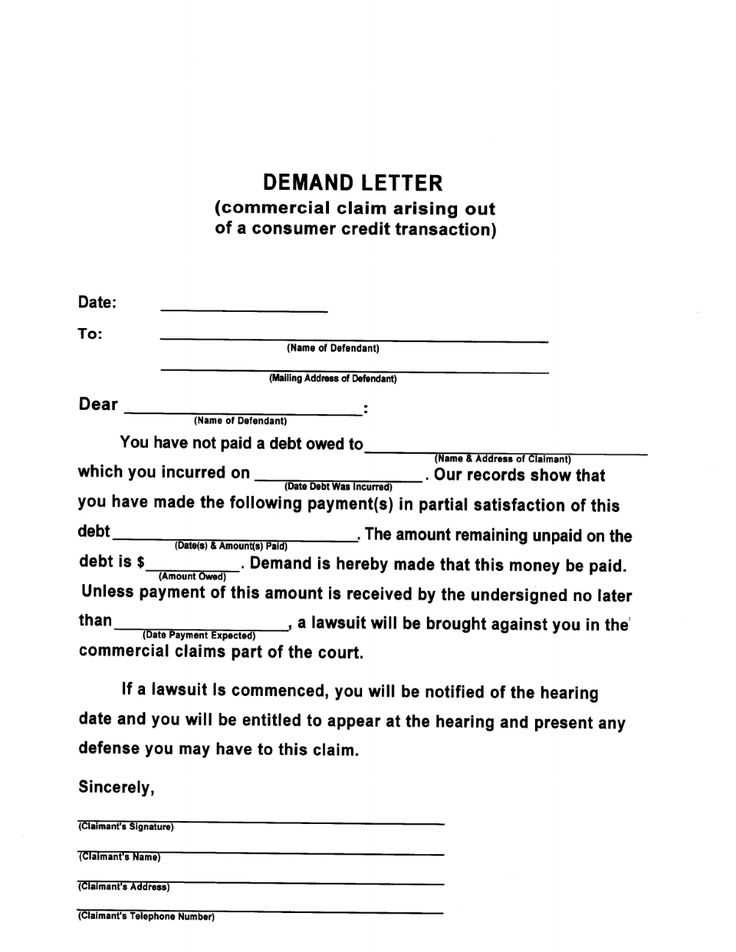

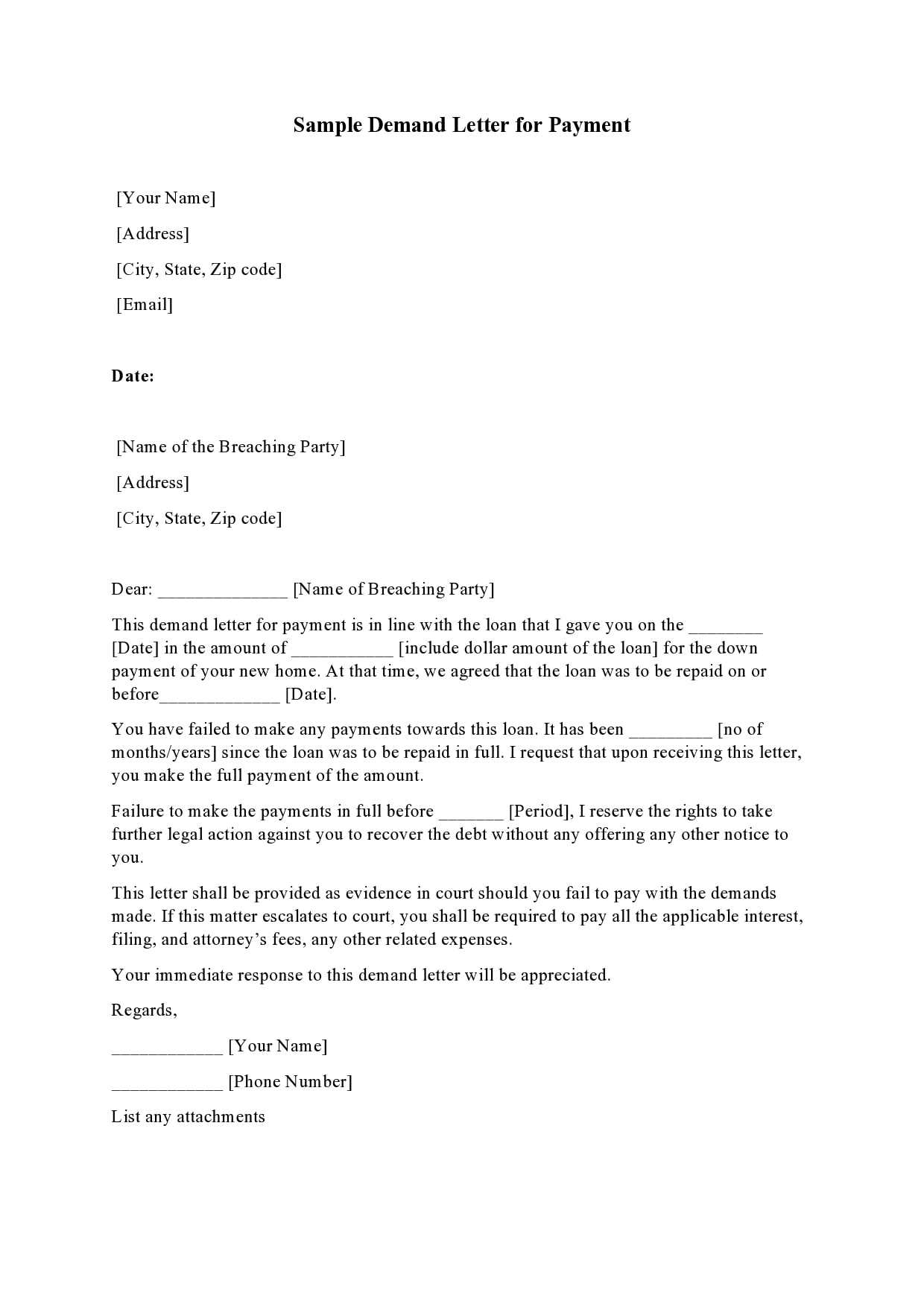

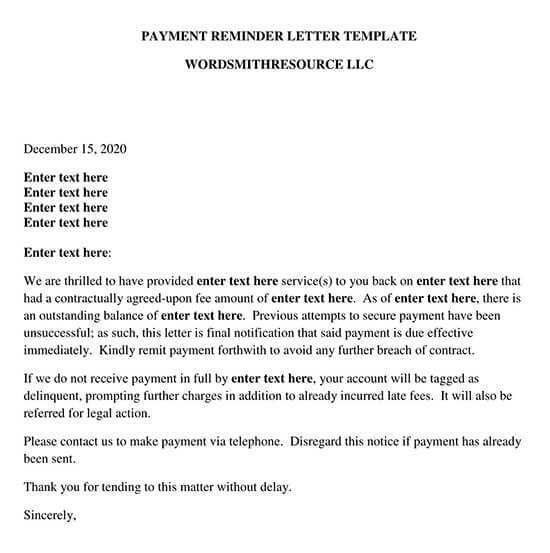

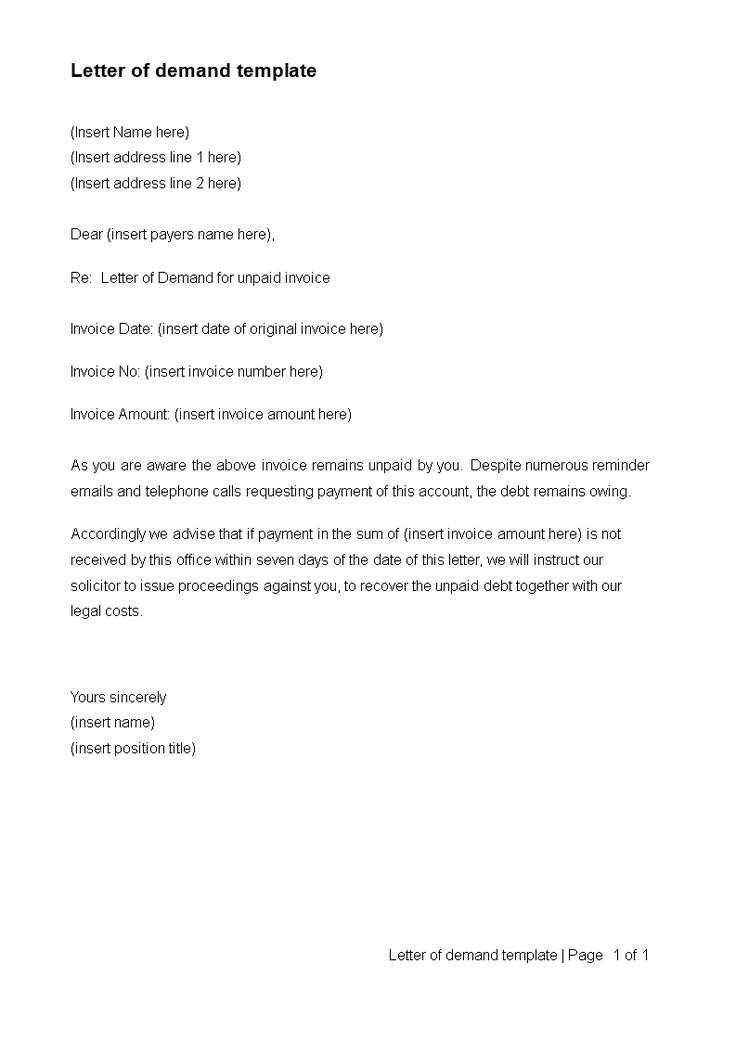

How to Write an Effective Communication

Creating a clear and professional document to address overdue balances is crucial for getting results. The tone should be firm yet respectful, and the content should be concise and direct. An effective message will encourage action while maintaining the business relationship intact.

Key Elements to Include

To ensure your communication is effective, make sure to include the following components:

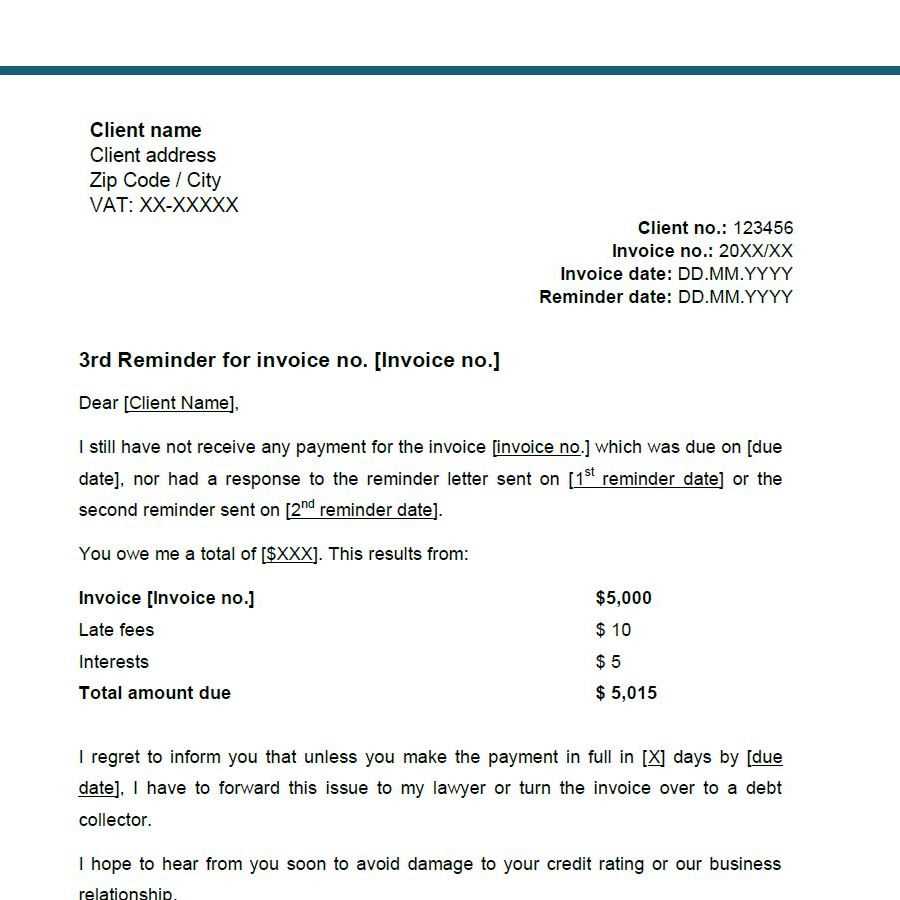

- Clear Identification of the Issue: State the outstanding amount and the due date clearly to avoid confusion.

- Specific Call to Action: Provide a clear request for how and when the outstanding balance should be settled.

- Firm Deadline: Set a reasonable deadline for payment to create a sense of urgency.

- Consequences: Briefly mention any potential actions if the matter is not resolved, such as interest charges or legal steps.

Maintain Professionalism

While it’s important to be firm, maintaining a professional tone is key to preserving the relationship. Avoid aggressive language or threats, as they can damage your reputation and hinder future business opportunities. Instead, focus on clear communication and a desire to resolve the issue amicably.

By following these guidelines, you’ll ensure that your communication is both effective and respectful, increasing the likelihood of a prompt resolution.

How to Write an Effective Letter

Creating a clear and professional communication is essential when requesting that outstanding balances be settled. An effective message should convey the seriousness of the situation while remaining courteous and respectful. The goal is to prompt the recipient to take action without causing unnecessary tension or conflict.

Key Elements to Include

To ensure that your message has the desired impact, it is important to include specific details that help the recipient understand the urgency and importance of the request. Here are the key elements to include:

- Clear Identification: Clearly state who you are, the recipient’s details, and the nature of the transaction.

- Outstanding Amount: Specify the amount due and any relevant invoice numbers, along with the original due date.

- Action Request: Politely request that the balance be settled by a certain date and explain the next steps in case the payment is not received.

Maintain a Professional Tone

It’s important to keep the tone professional, regardless of how frustrating the situation may be. Use respectful language, avoid aggressive phrasing, and offer solutions where possible. A calm and collected tone increases the likelihood of a positive response and resolution.

htmlEdit

Common Mistakes to Avoid

When pursuing overdue financial obligations, there are several common errors that can undermine the process. These missteps often lead to confusion, delays, or even potential legal complications. Understanding these pitfalls is essential to ensure a smooth and effective approach.

1. Lack of Clarity

Being vague or unclear in communication can create misunderstandings and hinder progress. Always be specific about the amount owed, due dates, and the actions required to resolve the issue. Clear and precise information helps avoid confusion and ensures both parties are on the same page.

2. Using an Aggressive Tone

An overly harsh or confrontational tone can damage professional relationships and make the situation more difficult to resolve. Striking a balance between firmness and professionalism is key. Maintaining a respectful tone encourages cooperation and can lead to quicker resolution.

3. Ignoring Previous Agreements

Disregarding any prior arrangements or discussions can create unnecessary friction. Always review any prior commitments or conversations to ensure consistency. If terms have changed, make sure to communicate them clearly and formally to avoid surprises.

4. Delaying the Process

Waiting too long to take action can lead to further complications, especially if the debt grows larger over time. Procrastination reduces the chances of recovering the owed amount and may make it harder to enforce any future actions. Acting promptly is crucial for success.

5. Not Keeping Records

Failing to document all correspondence and agreements can result in disputes over what was discussed or agreed upon. Keep copies of all communications and records of any agreements. This provides a clear trail in case the matter escalates or requires legal intervention.

htmlEdit

Best Practices for Payment Recovery

Recovering owed funds can be a delicate process that requires careful handling. By adopting the right strategies, you can increase the likelihood of getting what is owed while maintaining a professional relationship with the other party. These practices are crucial for ensuring a successful resolution.

1. Establish Clear Terms from the Start

Clear agreements at the beginning of any transaction or contract lay the foundation for successful financial exchanges. Clearly outline the expectations, timelines, and consequences for non-compliance. Having these terms documented ensures both parties understand their responsibilities, minimizing the chance of misunderstandings down the line.

2. Communicate Early and Often

Prompt communication is essential in addressing issues before they escalate. Contact the debtor early when the issue arises, keeping the tone professional and friendly. A simple reminder can often resolve the issue without further complications. Regular follow-ups are necessary to keep the matter on track, but always remain courteous and focused on finding a solution.

3. Offer Flexible Solutions

If the debtor is facing financial difficulties, offering a flexible solution, such as a payment plan or a partial settlement, can increase the chances of recovering the full amount. Showing willingness to work with them can foster goodwill and improve the likelihood of receiving payment.

4. Document Everything

Keeping a detailed record of all communications, agreements, and payments is vital. This documentation will protect your interests and serve as evidence if the situation requires legal intervention. Always retain copies of emails, phone call logs, and any written agreements made throughout the recovery process.

5. Know When to Escalate

Sometimes, despite best efforts, the issue may not be resolved amicably. Recognizing when it’s time to escalate the matter–whether through legal means or a third-party agency–can save valuable time and resources. Assess the situation carefully and consider all available options before taking further steps.