Legal Letter of Demand Template for Effective Claims

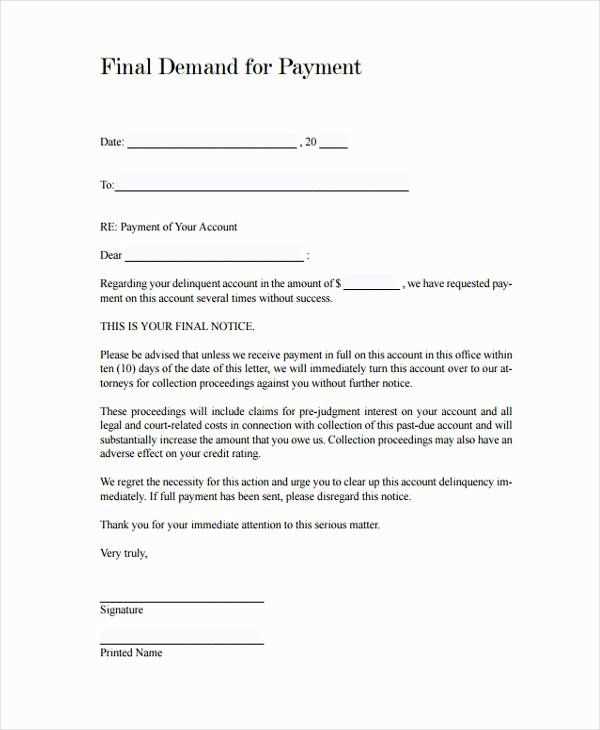

When seeking repayment for an outstanding balance, a well-crafted written request can be a powerful tool. This formal document outlines the amount owed, the due date, and the potential legal consequences if payment is not made. By structuring your message clearly and professionally, you increase the likelihood of a successful resolution.

Essential Components of a Payment Request

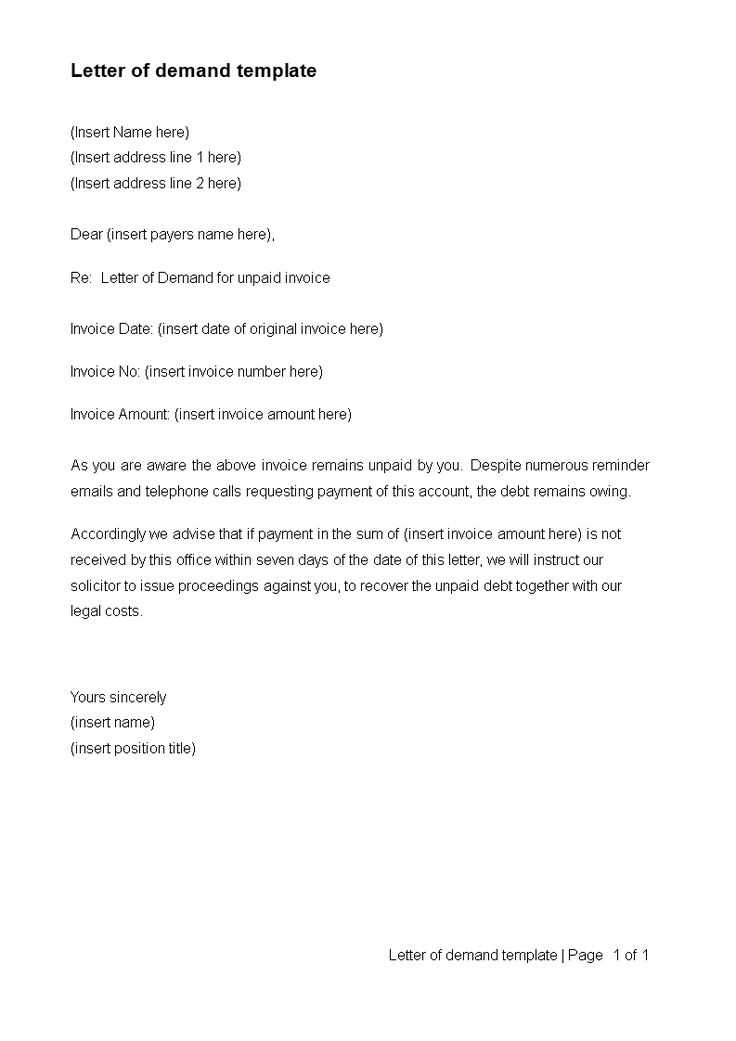

To ensure the message is clear and effective, include the following key elements:

- Recipient Information: Include the full name and address of the individual or organization you’re contacting.

- Amount Due: Clearly state the exact sum that is owed, including any applicable interest or fees.

- Due Date: Specify the final date by which payment should be made.

- Consequences of Non-Payment: Indicate what actions you will take if the debt is not settled, such as pursuing legal action or involving a collections agency.

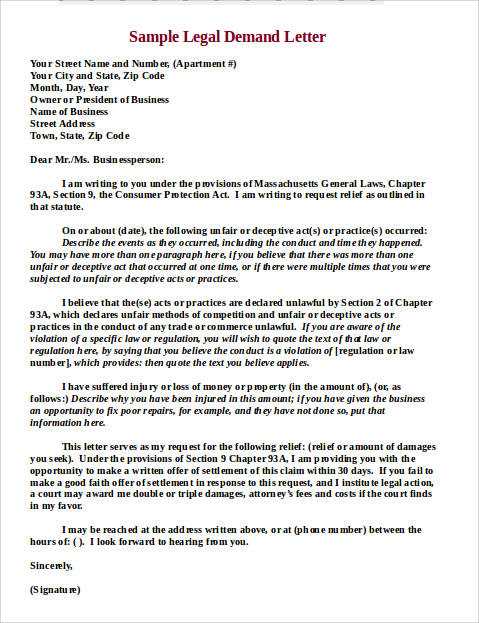

Formatting and Tone

The tone of the document should remain professional and assertive without being aggressive. The structure should be formal, with a clear introduction, body, and conclusion, ensuring the recipient fully understands the importance of their response.

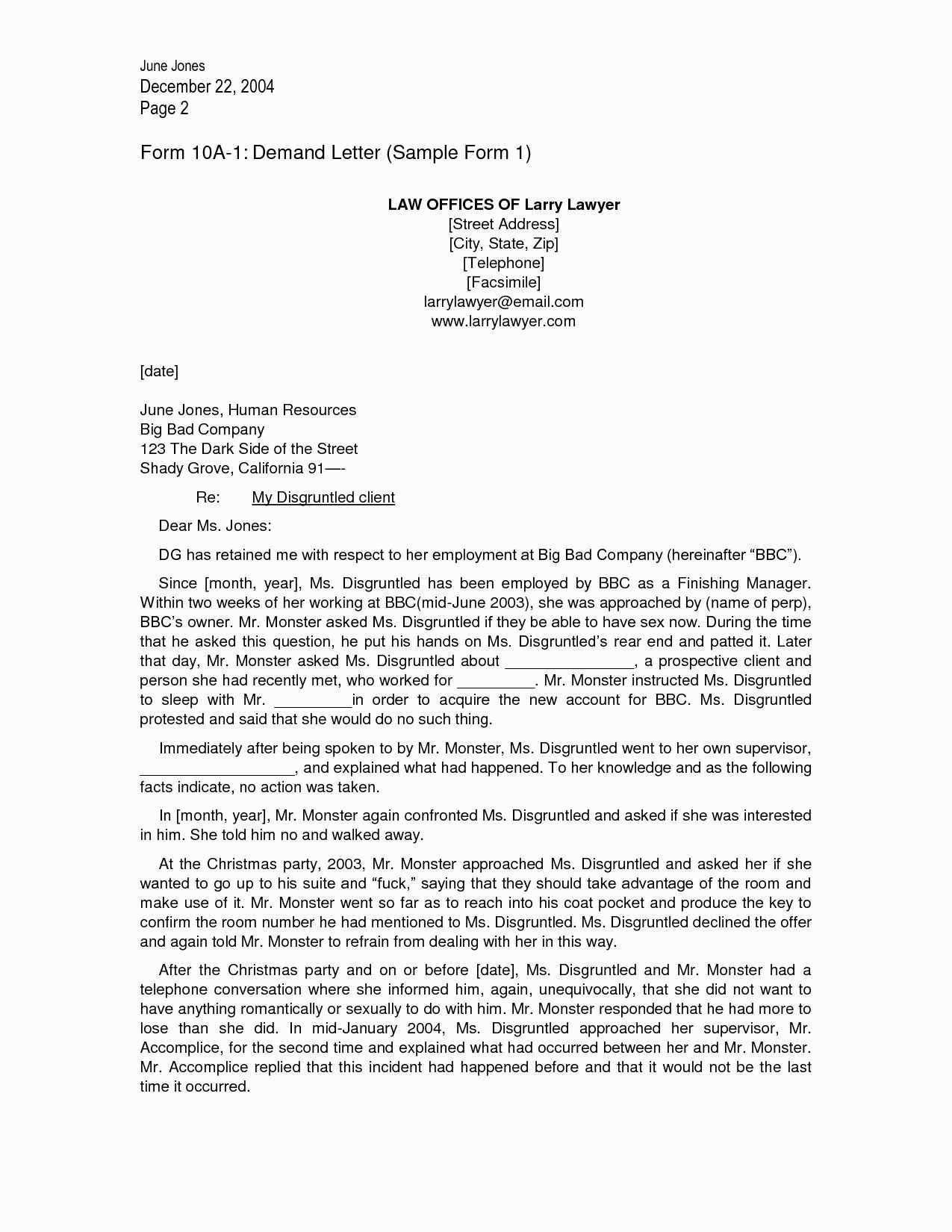

Customizing Your Request for Different Situations

Each situation may require a slightly different approach. For example, if you are dealing with a business client, a more formal tone may be necessary. On the other hand, a personal request for payment may benefit from a more polite and conciliatory tone. In either case, ensure that the content is tailored to the specific circumstances, making the request as clear and relevant as possible.

Avoiding Common Mistakes

Several pitfalls can reduce the effectiveness of a formal payment request:

- Vague Language: Be specific about the amount owed, the deadline, and any penalties for late payment.

- Lack of Documentation: Include copies of relevant contracts, invoices, or receipts to support your claim.

- Overly Harsh Tone: Maintain professionalism; threats or aggressive language can backfire.

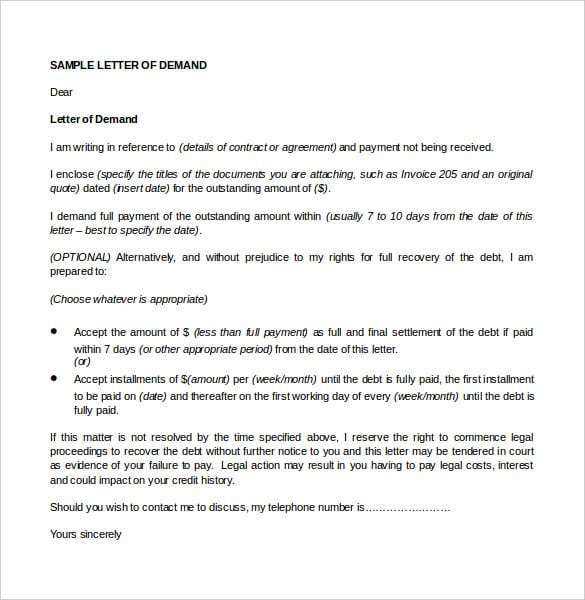

Sending Your Request

Once you’ve prepared the document, ensure it is sent through a reliable method, such as certified mail, to confirm receipt. If possible, request a signature or confirmation from the recipient. This helps protect your interests if further action becomes necessary.

What Happens After Sending the Request

If the recipient does not respond or fails to make payment by the specified deadline, you may need to take additional steps. These could include contacting a lawyer, filing a claim in small claims court, or enlisting a collection agency to recover the funds. It is important to follow up appropriately while maintaining a professional demeanor throughout the process.

Written Request for Payment Overview

Sending a formal request for payment is a crucial step in resolving outstanding financial obligations. This structured communication serves to notify the recipient of the amount due, the expected timeline for settlement, and the potential consequences of non-payment. By following a clear and direct approach, you improve your chances of receiving the payment owed.

Why a Payment Request is Necessary

Having a formal document in place helps to clarify the situation and establishes a record of the request. It sets the tone for potential legal actions, demonstrating your seriousness about recovering the funds. Without such a notice, the debtor may not understand the urgency of the situation or the consequences of their actions.

Key Components of a Payment Notice

To craft a solid written request, ensure it contains the following essential details:

- Creditor and Debtor Information: Include full names and addresses of both parties.

- Amount Owed: Clearly outline the exact sum due, including any penalties or interest.

- Due Date: Specify when the payment is expected, ensuring it is realistic.

- Consequences: Mention any legal actions or additional fees that could be imposed if the debt is not paid.

Personalizing Your Payment Request

While using a standard form is helpful, tailoring your communication to the specific circumstances makes it more effective. Adjust the tone based on the relationship you have with the recipient–whether it’s formal for a business client or slightly more cordial for personal situations. Always ensure that the terms reflect the seriousness of the situation, without being overly harsh.

Avoiding Common Mistakes

Be aware of the following errors that could weaken your request:

- Unclear Language: Ensure all amounts, deadlines, and penalties are explicitly stated to avoid misunderstandings.

- Lack of Proof: Attach relevant documents such as contracts, invoices, or proof of previous communication.

- Unprofessional Tone: Avoid using threatening or overly aggressive language, which could harm your chances of resolution.

Effective Delivery of the Request

Once your communication is drafted, send it through a reliable method to ensure the recipient receives it. Certified mail or a similar trackable service is ideal, as it provides proof of delivery. You may also request a signature or acknowledgment to further secure your position.

Next Steps After Sending the Request

If there is no response by the specified due date, follow up by reviewing your options. Depending on the circumstances, you may need to pursue additional measures, such as consulting with an attorney, taking legal action, or involving a collections agency. The key is to remain professional and consistent in your efforts.