Letter of demand for outstanding payment template

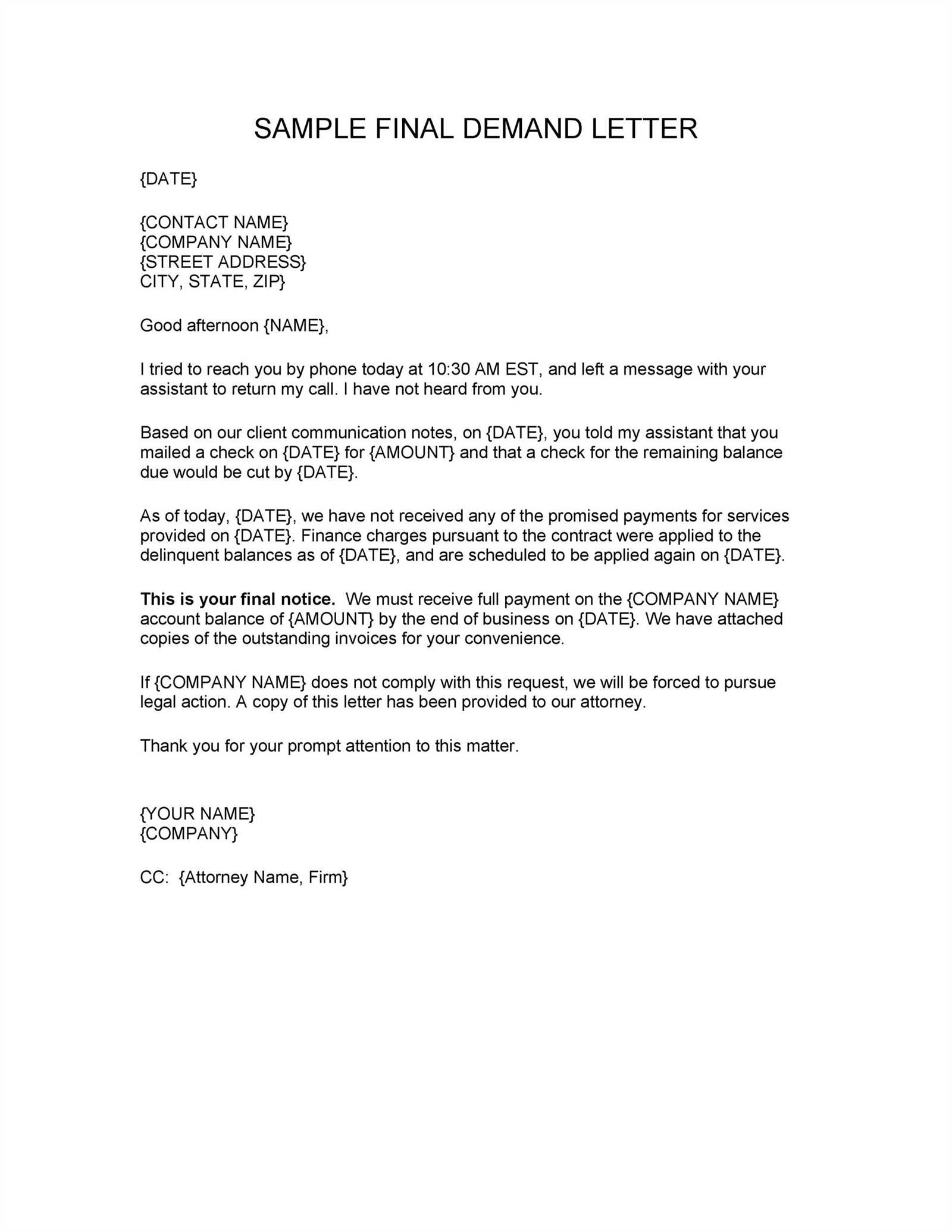

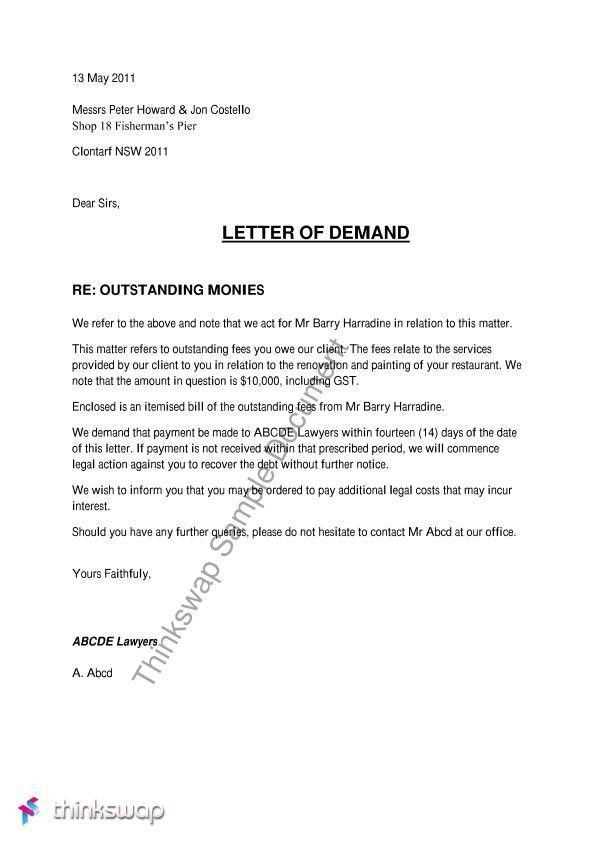

To collect overdue payments, a clear and professional letter of demand is crucial. Start by outlining the specific amount owed, the due date, and the agreed-upon payment terms. Keep the tone firm yet respectful, indicating that failure to pay will lead to further action. Ensure the recipient knows they have a defined window to settle the balance before legal steps may be taken.

A well-crafted demand letter should state the nature of the debt and refer to any relevant contract or agreement. Avoid excessive language–stick to the facts and provide clear instructions on how payment should be made. Include your contact details for any clarifications, but make it clear that prompt resolution is expected. This template can guide you in drafting a letter that gets results without unnecessary complications.

It’s important to maintain professionalism throughout. While the letter’s purpose is to demand payment, treating the recipient with courtesy can help keep the lines of communication open for resolution. Be direct, but avoid sounding confrontational. This approach increases the chances of receiving payment swiftly and without escalation.

Sure, here’s a revised version with reduced word repetition:

In a letter of demand, it’s key to remain clear and direct. Focus on the facts surrounding the outstanding payment, including the amount due and the payment deadline. Mention the original payment terms and highlight any overdue dates to emphasize urgency.

Clearly state the next steps if the payment is not received. This could include legal action, reporting to a credit agency, or other recovery methods. Use a polite but firm tone to avoid any confusion.

A concise, straightforward approach will help maintain professionalism while encouraging the recipient to act promptly. Ensure all details are correct and avoid unnecessary repetition to keep the message impactful and easy to understand.

- Letter of Demand for Unpaid Payment Template

To create a formal letter of demand for unpaid payment, follow a clear structure to ensure clarity and professionalism. This letter should detail the outstanding balance, payment terms, and request for immediate settlement. Below is a template that can be adapted for your situation.

| Section | Details |

|---|---|

| Sender’s Information | Name, address, phone number, and email address of the sender. |

| Recipient’s Information | Name, address, and other relevant contact details of the recipient. |

| Subject | “Letter of Demand for Unpaid Payment” |

| Date | The current date on which the letter is written. |

| Introduction | State the purpose of the letter, clearly mentioning the outstanding payment. |

| Details of the Debt | Include the amount owed, invoice number, and due date. If applicable, add interest or penalties for late payments. |

| Request for Immediate Payment | Provide a clear deadline for payment, typically 7-14 days from the date of the letter. |

| Consequence of Non-Payment | Outline potential actions if the payment is not received, such as legal steps or further charges. |

| Closing | Politely ask for prompt resolution and provide your contact details for any inquiries. |

By following this template, you ensure that your letter communicates the necessary information while maintaining a professional tone. It is essential to keep the language clear, concise, and focused on the payment issue at hand.

A demand notice serves as a formal request for payment, typically used when a debtor has failed to fulfill their financial obligation by the agreed-upon deadline. This document clearly states the outstanding amount, outlines the consequences of non-payment, and sets a specific time frame for settlement.

Here’s how it functions:

- Clarifies the Amount Due: It precisely lists the outstanding balance, leaving no room for confusion about what is owed.

- Establishes a Deadline: The demand notice sets a clear deadline for payment, often giving the debtor a final opportunity to pay before further action is taken.

- Warns of Consequences: It usually informs the recipient of the legal or financial consequences of failing to comply, such as legal proceedings or added interest charges.

- Formalizes the Request: By providing a written request, it helps create a formal record of communication, which may be useful in any legal context.

Sending a demand notice is often the first step in recovering a debt, serving as a clear message that the matter should be addressed promptly to avoid escalation.

Include the following key elements in your demand letter to ensure clarity and legal enforceability:

- Clear Identification of Parties: Include the full names and contact details of both the creditor and debtor. This helps avoid confusion and establishes the relationship between both parties.

- Detailed Description of the Debt: Specify the amount owed, including any interest or fees. Reference the original agreement or contract to support the claim.

- Due Date: Clearly state the payment deadline. If applicable, mention previous due dates to reinforce the urgency of the matter.

- Payment Instructions: Provide clear and simple instructions on how the debtor should make the payment. Include bank details or other payment methods if necessary.

- Consequences of Non-Payment: Outline the actions that will be taken if the debt remains unpaid. This can include legal action, additional fees, or reporting to credit agencies.

- Professional Tone: Keep the tone firm yet respectful. Avoid aggressive language, as the goal is to resolve the matter amicably without escalating the situation.

- Signature and Date: Sign the letter and date it to establish the formal nature of the demand. This ensures the letter has a clear point of reference.

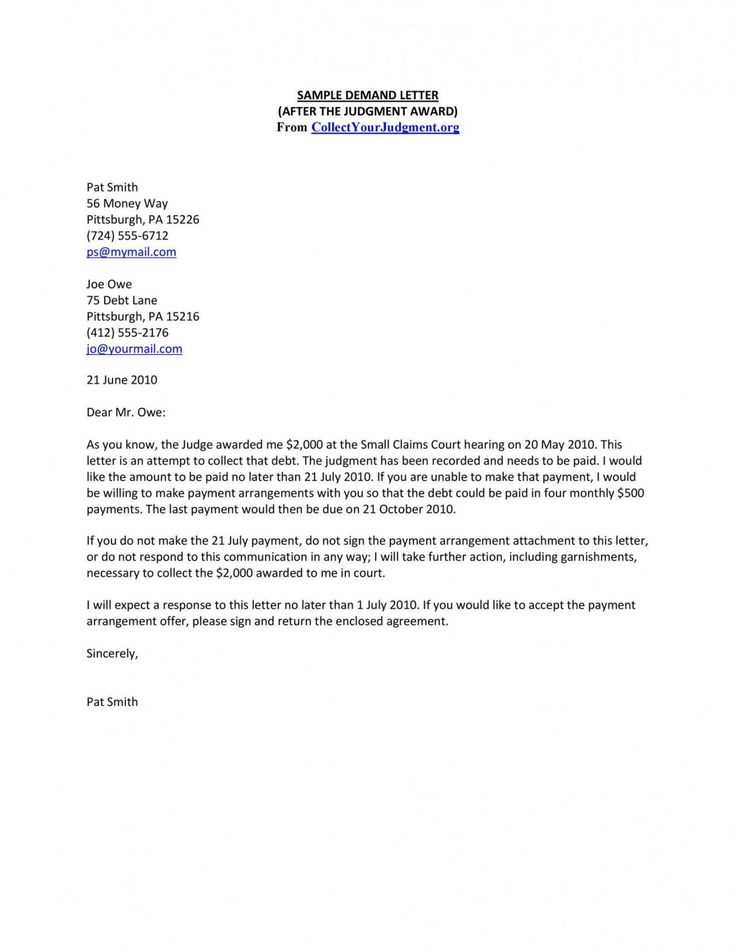

Choose a payment deadline that is both fair and reasonable for both parties. A realistic deadline allows the debtor enough time to gather the necessary funds while ensuring that the payment is made within a reasonable period. Typically, a 14 to 30-day window is common for most transactions, depending on the nature of the business and prior agreements.

Consider the Situation

Take into account the circumstances surrounding the payment. If the debtor is facing financial difficulties, you may want to offer an extended deadline. On the other hand, if the payment is significantly overdue, you might want to shorten the period to reflect the urgency of the situation.

Clarity is Key

Ensure that the deadline is clearly stated in the letter. Avoid vague phrases such as “as soon as possible” or “within a reasonable time.” A specific date helps eliminate confusion and sets a clear expectation for both parties.

Use a polite yet firm tone when writing a demand letter. Be clear and direct, but avoid sounding aggressive or threatening. Keep your language professional and straightforward to maintain a respectful dialogue with the recipient. The objective is to encourage prompt payment without creating unnecessary tension.

Opt for neutral language that focuses on facts and avoid emotional statements. Instead of saying “I am disappointed that you haven’t paid,” phrase it as “The payment due on [date] has not been received.” This helps to maintain the professional tone and keeps the letter focused on the issue at hand.

Ensure the tone is consistent throughout the letter, balancing firmness with courtesy. While expressing urgency, make sure it doesn’t come across as a personal attack. Address the issue directly, using clear deadlines and outlining consequences if the payment isn’t made by a certain time.

Be concise but thorough. Provide all necessary details regarding the amount owed, payment terms, and the original due date. Avoid using overly complex language that could confuse or alienate the recipient. Simple, clear terms are more likely to encourage action.

Clearly outline the legal actions that may follow if payment is not made. Specify deadlines and mention possible consequences like interest charges, legal fees, and collection procedures. State that unresolved debts could lead to formal legal actions, such as filing a lawsuit or reporting to credit agencies. Highlighting these outcomes can encourage timely payment, as the recipient may seek to avoid costly legal issues. It’s essential to keep the tone professional while showing the seriousness of the situation.

If the payment remains unpaid after the initial notice, follow these steps to address the situation.

1. Review the Agreement: Double-check the terms of the contract or invoice to ensure that the payment was due and that the notice was clear about the outstanding amount and deadline.

2. Send a Final Reminder: Reach out again with a formal reminder, clearly stating the overdue amount, the previous notice sent, and any late fees or penalties specified in the agreement.

3. Offer Payment Options: Provide flexible payment terms if possible, such as installment options, to encourage prompt settlement and avoid escalating the situation.

4. Seek Mediation: If the client still refuses to pay, consider using a mediator to negotiate a resolution. Mediation can often lead to a faster and less costly outcome than litigation.

5. Send a Demand Letter: If all attempts at communication fail, send a formal demand letter outlining legal actions that could be taken if the payment is not received within a specified period. Be sure to include any applicable interest charges or collection fees.

6. Consider Legal Action: If the payment remains outstanding, you may need to escalate the matter to legal proceedings. This may involve filing a claim in small claims court or hiring a debt collection agency.

| Step | Action | Purpose |

|---|---|---|

| 1 | Review the Agreement | Ensure payment terms are clear and enforceable |

| 2 | Send a Final Reminder | Encourage payment and reassert terms |

| 3 | Offer Payment Options | Provide flexibility to the client |

| 4 | Seek Mediation | Resolve issues without legal action |

| 5 | Send a Demand Letter | Warn of legal consequences |

| 6 | Consider Legal Action | Initiate formal proceedings to recover debt |

To craft a well-structured letter of demand for outstanding payment, keep the focus clear and direct. Open with the amount owed, the due date, and any reference numbers that relate to the debt. Ensure the language is polite but firm, reinforcing the urgency of settling the payment.

Key Elements

Begin by clearly stating the payment details–mention the amount due and the original due date. Provide a breakdown of the debt, if applicable, to give transparency. Avoid unnecessary elaboration or repetition, as this can dilute the impact of your message.

Consequences of Non-Payment

Outline the consequences if the payment isn’t made within a set period, such as legal action or reporting the matter to a credit agency. Keep this section factual and non-aggressive, ensuring it stays professional and respectful.