Documentary Letter of Credit Template Overview

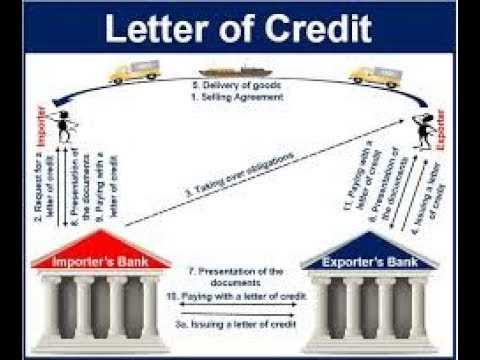

When engaging in cross-border transactions, it’s crucial to have a formalized agreement ensuring payment and performance obligations are met. This type of document serves as a safeguard for both buyers and sellers, providing security and clarity in international commerce.

Key Features of Trade Agreements

These financial instruments are structured to guarantee that the seller receives payment upon fulfilling certain conditions, while the buyer’s interests are protected by predefined terms. Understanding their fundamental components is essential for smooth transactions.

Conditions for Activation

- The seller must fulfill agreed-upon conditions, such as shipment or delivery of goods.

- The buyer must ensure funds are available and conditions met before payment is made.

- Third parties, such as banks, often play a role in verifying compliance with terms.

Common Uses in Global Trade

These instruments are widely used in various sectors including manufacturing, agriculture, and technology, particularly in transactions involving large sums or international parties. Their application ensures that both parties are legally bound by the agreed terms and reduces the risks associated with global trade.

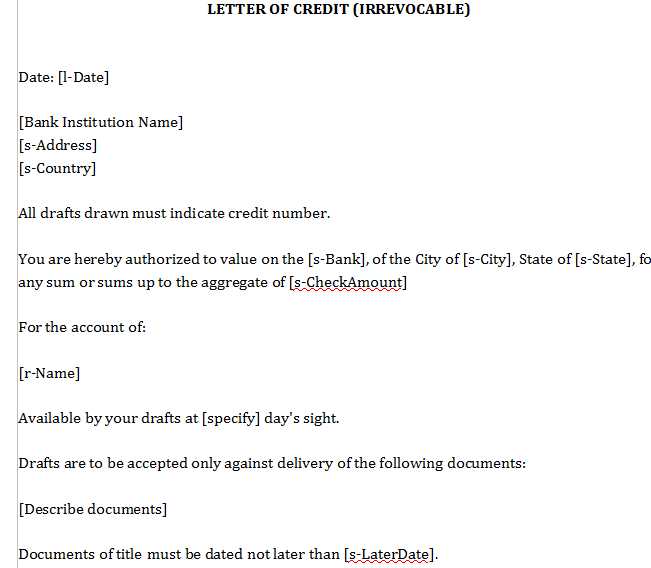

Creating and Customizing Financial Agreements

Drafting a comprehensive agreement requires attention to detail and an understanding of the involved parties’ needs. These documents are not one-size-fits-all and can be tailored to suit the specifics of each deal.

Steps to Formulate an Agreement

- Identify the parties involved and their obligations.

- Specify the terms of payment and the performance conditions.

- Include provisions for dispute resolution, if necessary.

Modifying Templates for Specific Deals

Customization allows for flexibility, ensuring that terms reflect the unique aspects of each transaction. Whether it’s adjusting payment terms or specifying additional documents, each element of the agreement can be adapted to the specific trade situation.

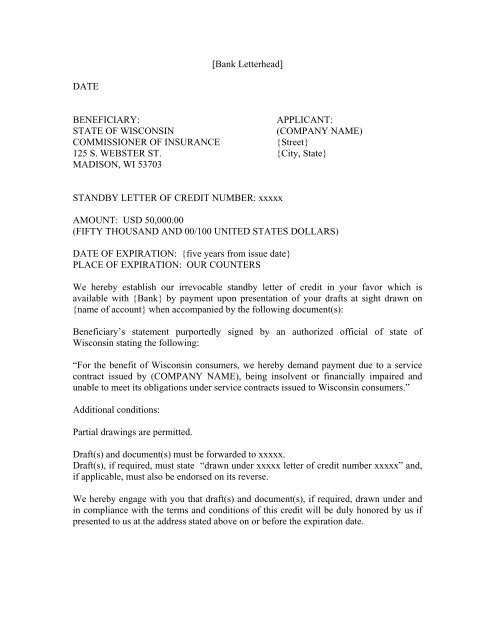

Benefits and Protection for Both Parties

These instruments offer a level of assurance to both buyers and sellers, ensuring that all conditions are met before funds are exchanged. This process significantly minimizes risks and encourages trust between international trade partners.

Minimizing Risk

By utilizing such agreements, both parties can confidently enter into business arrangements knowing that their interests are legally protected. In cases where obligations are not met, provisions exist to resolve disputes or trigger enforcement actions.

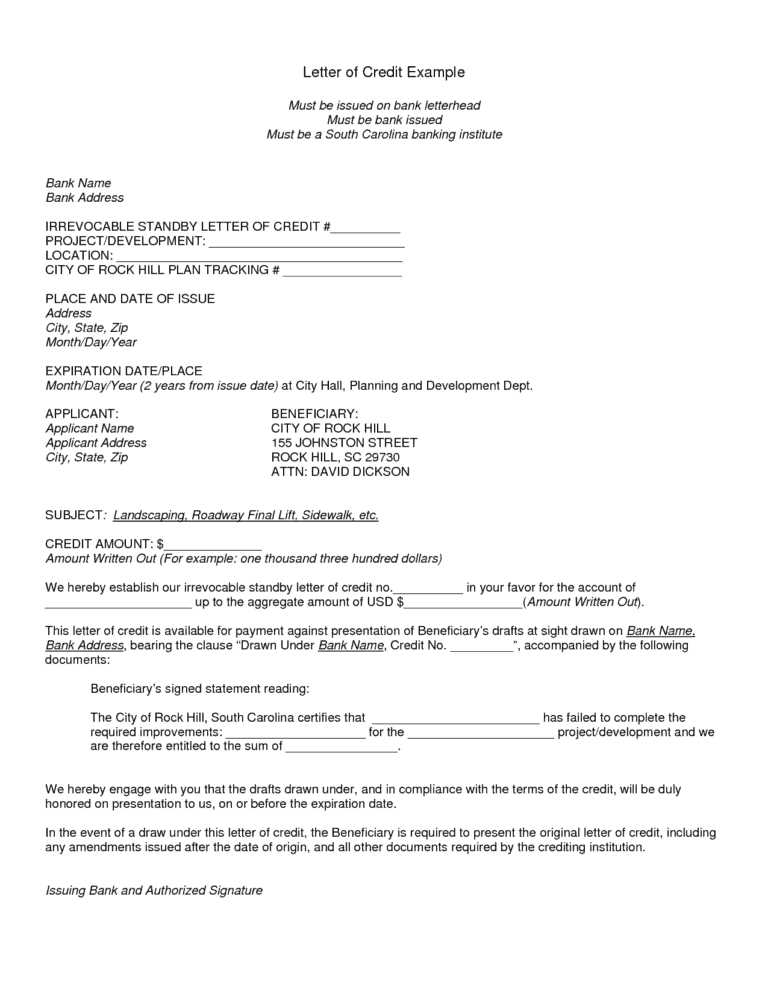

Understanding Financial Instruments for Secure Transactions

In global trade, it’s vital for both buyers and sellers to have a clear, enforceable document that ensures compliance with agreed terms. This structured agreement serves as a safeguard, ensuring both parties fulfill their obligations before financial exchanges occur.

Key Features of Trade Agreements

These agreements are designed to guarantee that sellers receive payment upon meeting specified conditions, while buyers are assured that the goods or services meet the agreed-upon standards. Each component plays a critical role in safeguarding both parties’ interests throughout the transaction process.

Creating and Customizing Trade Instruments

Formulating such agreements requires careful drafting to include all necessary terms. Whether adjusting payment schedules or outlining conditions for delivery, these documents can be tailored to each specific trade situation, making them flexible and adaptable to the needs of all parties involved.