Donation letter template for tax purposes

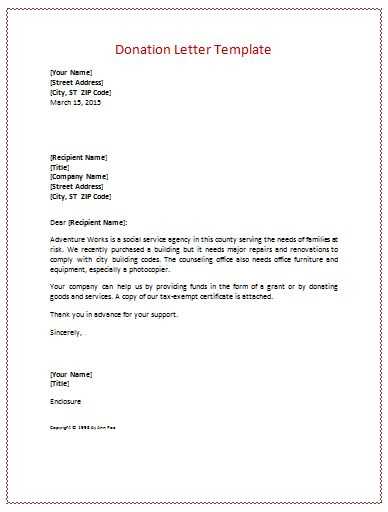

To claim a charitable donation on your taxes, ensure your letter includes specific details. First, provide a clear description of the donation, including the item or cash value. Include the organization’s name and your relationship to it, if applicable. Also, note whether you received anything in return for your donation, as this can impact your deduction.

Next, include the date of your donation. Be precise about the value of the gift and ensure it aligns with any supporting documents, like receipts or appraisals. If the donation is a non-cash gift, an itemized list with estimated values may be required for proper documentation.

Don’t forget to have the letter signed by an authorized representative of the charity. This adds credibility and verifies the donation for tax purposes. A well-organized and detailed letter will make the process of claiming deductions much smoother.

Here’s the revised version:

To ensure that your donation letter is suitable for tax purposes, include the following key elements:

Start with the donor’s name and contact details at the top of the letter. Then, mention the date of the donation and specify the exact amount or description of the items donated. For cash donations, state the exact dollar amount. For non-cash donations, provide a clear description of the items or services given.

Ensure that you include a statement confirming that no goods or services were provided in exchange for the donation. This is important for tax deduction purposes. Additionally, make it clear that the donation is tax-deductible according to applicable laws.

Provide your organization’s details, such as name, address, and tax-exempt status. This helps the donor verify the validity of the charitable donation for tax reporting purposes. Conclude with a polite expression of gratitude for the donation and offer your assistance if they need further documentation for tax filing.

Finally, make sure to sign the letter and include a contact number or email for any follow-up inquiries.

- Donation Letter Template for Tax Purposes

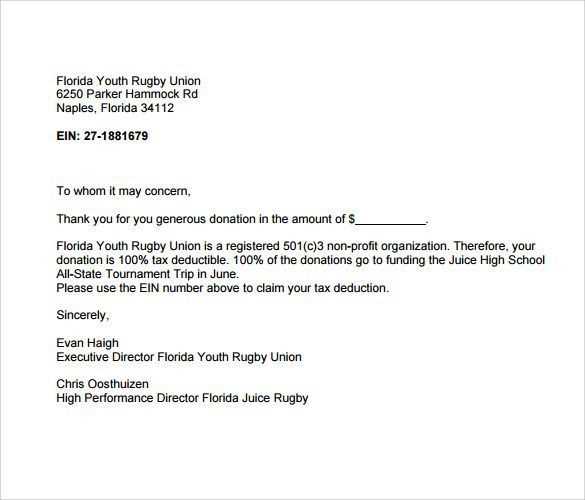

Include the donation date, donor’s name, and contact details at the top of your letter. Clearly state the charity’s name, address, and tax identification number. Specify the donation amount or item description and its fair market value. Mention whether the donation was monetary or in-kind. If it was a non-cash gift, include an accurate description of the items and their condition.

Use precise language when acknowledging the donor’s generosity, ensuring the letter reflects the value of their contribution. Also, include a statement clarifying that no goods or services were exchanged for the donation. If any goods or services were provided, list them and their estimated value.

Conclude the letter with a reminder that the donor should keep it for their tax records and that the letter serves as an official receipt for tax deduction purposes. Finally, express gratitude for the contribution, reinforcing the importance of their support.

Tax deduction letters must meet specific criteria to be considered valid by the IRS. The letter should include the donor’s name, the date of the donation, a description of the donated items or services, and the amount or fair market value. For non-cash contributions, the IRS requires a written acknowledgment for donations over $250. This document should confirm whether any goods or services were provided in exchange for the donation.

Key Elements of a Valid Donation Letter

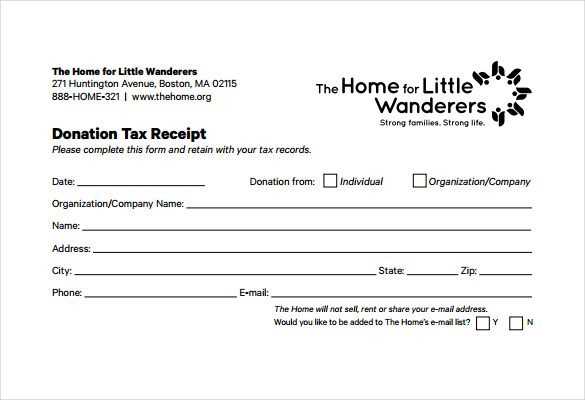

- Donor and Organization Information: The letter should clearly state the full name and address of both the donor and the receiving charity.

- Donation Description: A detailed description of the donated items or services should be included. Avoid vague descriptions like “furniture” or “clothing”; instead, be as specific as possible.

- Donation Amount or Value: Cash donations should include the exact dollar amount, while non-cash donations require an estimated fair market value, with appropriate documentation if needed.

- No Goods or Services Provided: If the donation was made without receiving anything in return, the letter should state this clearly. If there were goods or services received, their value should also be noted.

Requirements for Donations Over $250

- For contributions over $250, the letter must specify whether the donor received any goods or services in return. If so, the value of these items must be provided to ensure the donor can accurately calculate the deductible portion of the contribution.

- If the donation is in the form of a vehicle, the letter must include a description of the vehicle and its fair market value, along with any IRS-specific forms needed for deduction.

These specific details help ensure that the letter can be used as proof for tax deductions, protecting both the donor and the charity from any potential issues during the filing process.

Include the name and address of the charitable organization. Specify the date of the donation and the amount or value of the donation. If applicable, provide details on whether the donation was made in cash or in-kind.

Donation Description

Clearly describe the items donated, including their condition and estimated value, if they are non-cash gifts. For cash donations, state the exact amount and clarify whether it was a one-time donation or part of a recurring contribution.

Tax-Exempt Status Confirmation

State the organization’s tax-exempt status under IRS code 501(c)(3) or equivalent, confirming the eligibility for tax deduction purposes. This reassures the donor that their contribution is deductible.

If the donation was made anonymously, ensure this is noted in the letter as well. Conclude by mentioning any potential benefits or appreciation, including the organization’s contact information for further verification if needed.

To ensure your donation letter provides the maximum tax benefit, include specific information required by the IRS. Start by clearly stating the amount of the donation, whether it is monetary or non-monetary. For non-cash donations, include a description of the item, its condition, and an estimated value.

The donor’s name and address must be included, along with the charity’s official name, address, and tax-exempt status. This helps validate the legitimacy of the donation for tax purposes. Avoid using ambiguous terms like “miscellaneous” for non-cash donations, as clear descriptions are needed to establish the value of the gift.

Also, indicate the date the donation was made. If the donation exceeds $250, the letter should confirm that no goods or services were received in exchange for the donation, or if they were, their value should be mentioned. This prevents the donor from mistakenly deducting the value of goods or services they received.

Lastly, if the donation is above a certain threshold, a qualified appraiser’s valuation might be required for non-cash items to ensure the amount is accurate and deductible.

| Item Description | Value | Date of Donation |

|---|---|---|

| Used Furniture | $500 | January 15, 2025 |

| Clothing | $200 | January 20, 2025 |

To verify if an organization qualifies for tax deductions, first confirm its tax-exempt status with the IRS. Check if the organization is listed under Section 501(c)(3) of the Internal Revenue Code. This section includes most charitable, religious, educational, and scientific organizations eligible for deductions.

Next, request a written acknowledgment from the organization. This acknowledgment should include details such as the amount of the donation, date of contribution, and a statement confirming that no goods or services were provided in exchange for the donation.

Additionally, verify the organization’s status using the IRS’s online tool, the Tax Exempt Organization Search (TEOS). This will provide an updated list of qualifying organizations. If the organization is not listed, donations may not be tax-deductible.

Lastly, review the organization’s financial records or ask for documentation to ensure they operate within the IRS’s guidelines for tax-exempt entities. Be cautious of organizations that are not transparent about their operations or fail to provide necessary documentation.

Be specific with the donation details. Ensure the letter includes the exact amount of the donation and a clear description of the items donated. Avoid vague phrases like “various items” or “a significant sum.” Clarity reduces the risk of issues later on.

1. Missing or Incorrect Dates

Always include the correct date of the donation. This helps avoid confusion with your tax records and provides a clear timeline for both parties. Double-check the date to ensure it’s accurate.

2. Not Including Proper Identification Information

Include both the donor’s and the charity’s full names, addresses, and tax identification numbers. This establishes a formal connection between the parties, which is vital for tax purposes.

3. Failing to Acknowledge the IRS Requirements

Ensure the letter contains a statement acknowledging that no goods or services were provided in exchange for the donation, unless applicable. This is a requirement for charitable tax deductions.

4. Ignoring the Form and Format

Follow the standard letter format, including a formal greeting, body, and conclusion. The IRS expects a clear and concise format that makes the donation easy to verify.

5. Overlooking the Need for a Receipt

If the donation value is significant, a receipt should accompany the letter. The IRS requires proper documentation for larger contributions to substantiate the claim.

6. Skipping the Signature

Ensure the letter is signed by an authorized person from the charity. This gives the letter legitimacy and reinforces its credibility for tax deduction purposes.

Submit your donation letter as soon as possible after the donation is made. The letter must be sent by the end of the year in which the donation occurs if you intend to use it for tax deductions for that year. Ensure that you have all necessary information, including the amount of the donation and the nonprofit organization’s details, before submission.

For personal tax returns, attach the letter to your filing. If you are submitting the letter for business tax purposes, include it with your other supporting documents. Make sure to send it directly to the appropriate department of the tax authority or include it with your e-filing, depending on the requirements in your jurisdiction.

Donation Letter Template for Tax Purposes

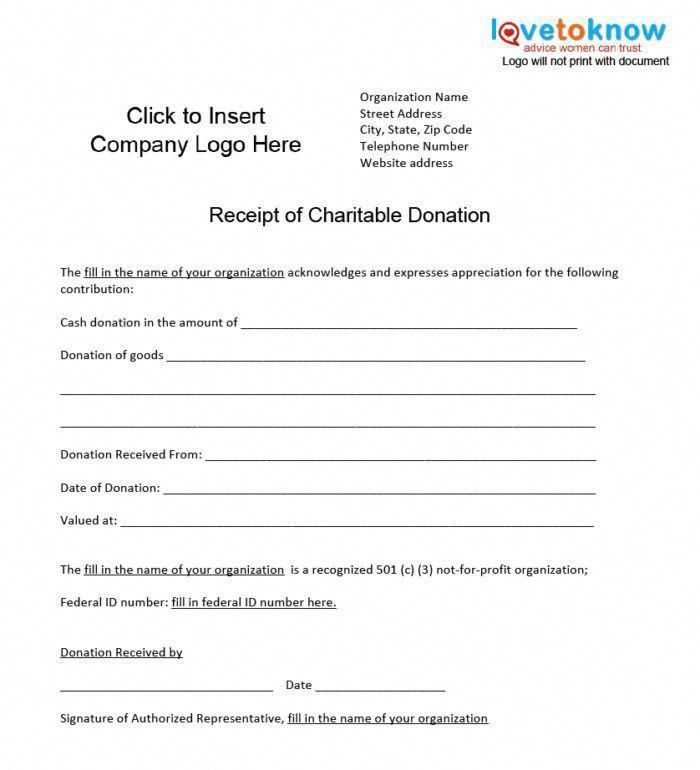

Include the full name of the recipient organization, the address, and a statement confirming the donation was made without receiving anything in return. Mention the donation’s value and the date it was made. If applicable, provide a description of the donated items or services.

Details to Include

The letter should contain specific information such as:

- The donor’s name and address

- The recipient organization’s name, address, and tax identification number

- A brief description of the donation

- The date of the donation

- The fair market value of the donation (if applicable)

- A statement that no goods or services were received in return

Tax Benefits

Clarify that the donation is tax-deductible under relevant tax laws. Always consult with a tax advisor to ensure compliance with local regulations. Provide guidance on how to obtain a receipt for donations made, as this is often necessary for tax filing.