Donation Receipt Letter for Tax Purposes Template

receiving the contributions, ensuring that all legal and procedural requirements are met while also fostering a sense of trust and community between both parties.

Guidelines for Acknowledging Charitable Contributions

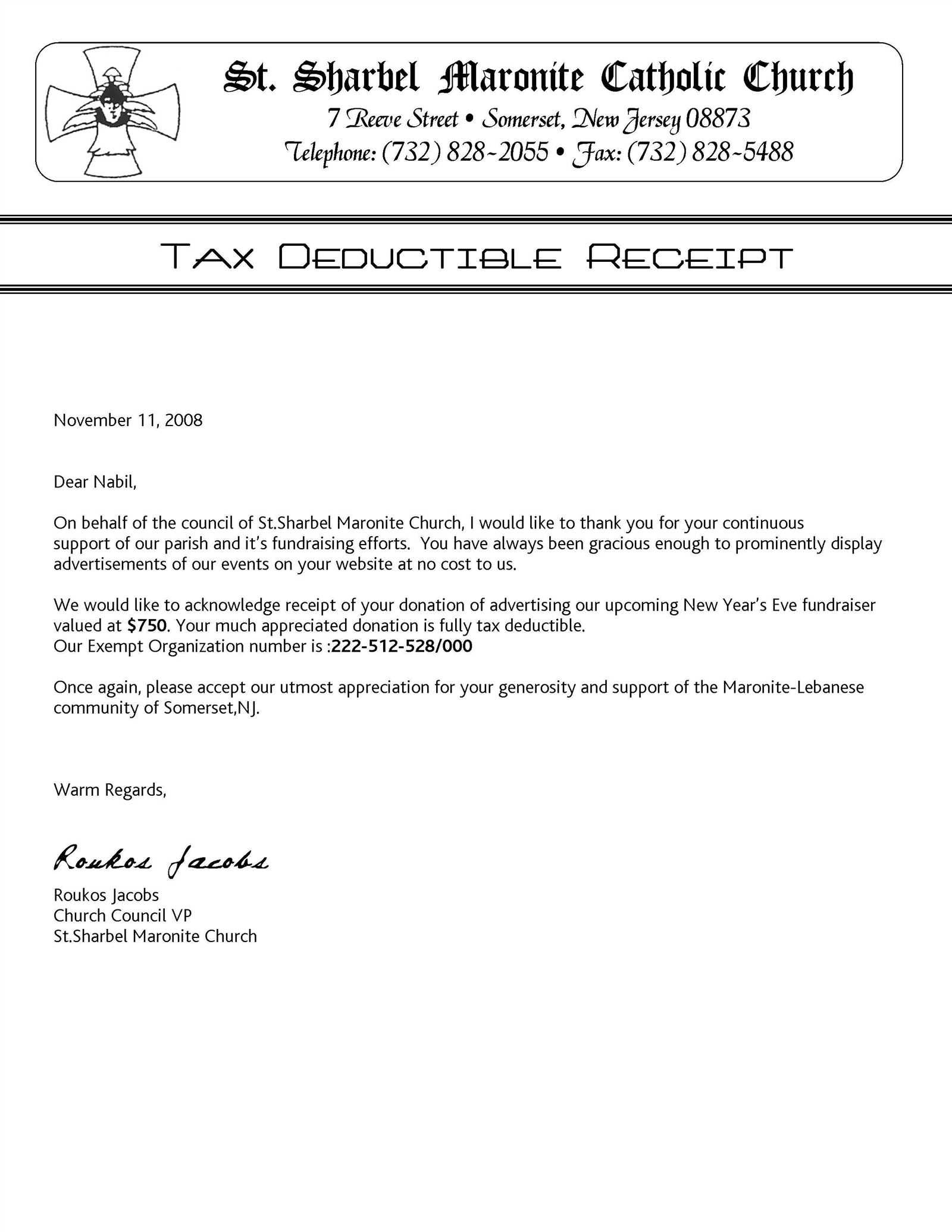

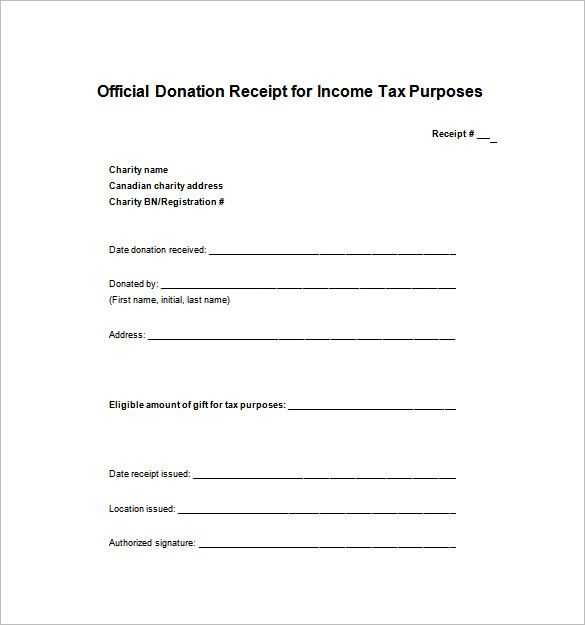

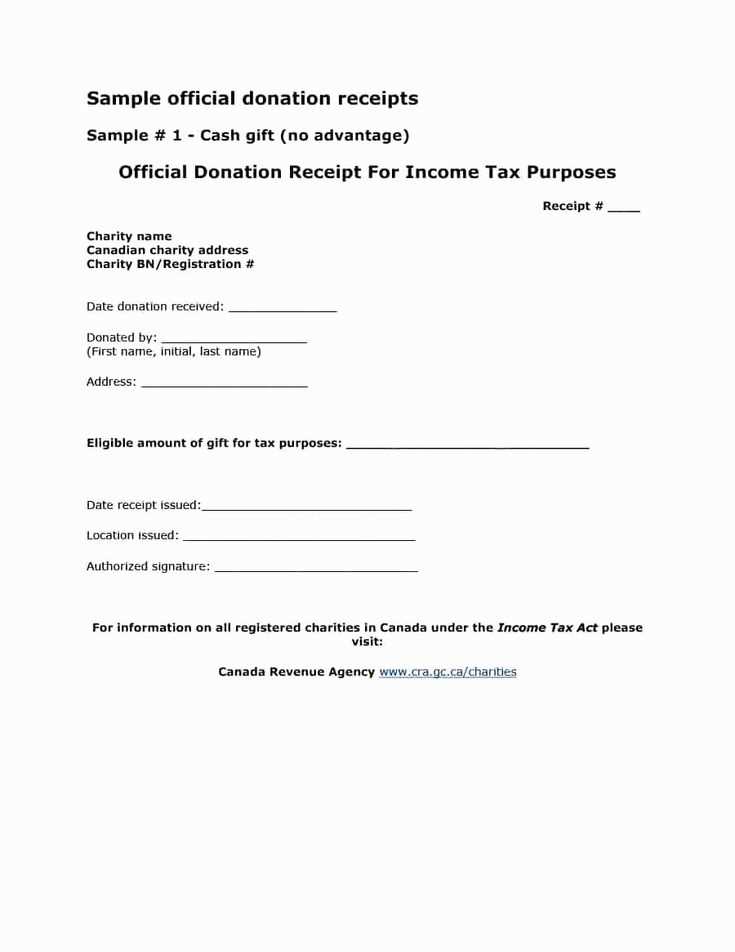

When individuals make charitable gifts, formal recognition of these contributions is essential. This acknowledgment not only serves as a way to show appreciation but also ensures that both the donor and recipient follow the necessary guidelines. It is crucial that the document be properly structured and contain all the key details that will allow for transparency and compliance with applicable regulations.

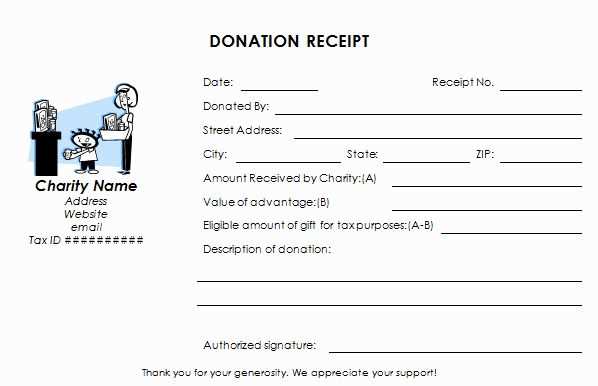

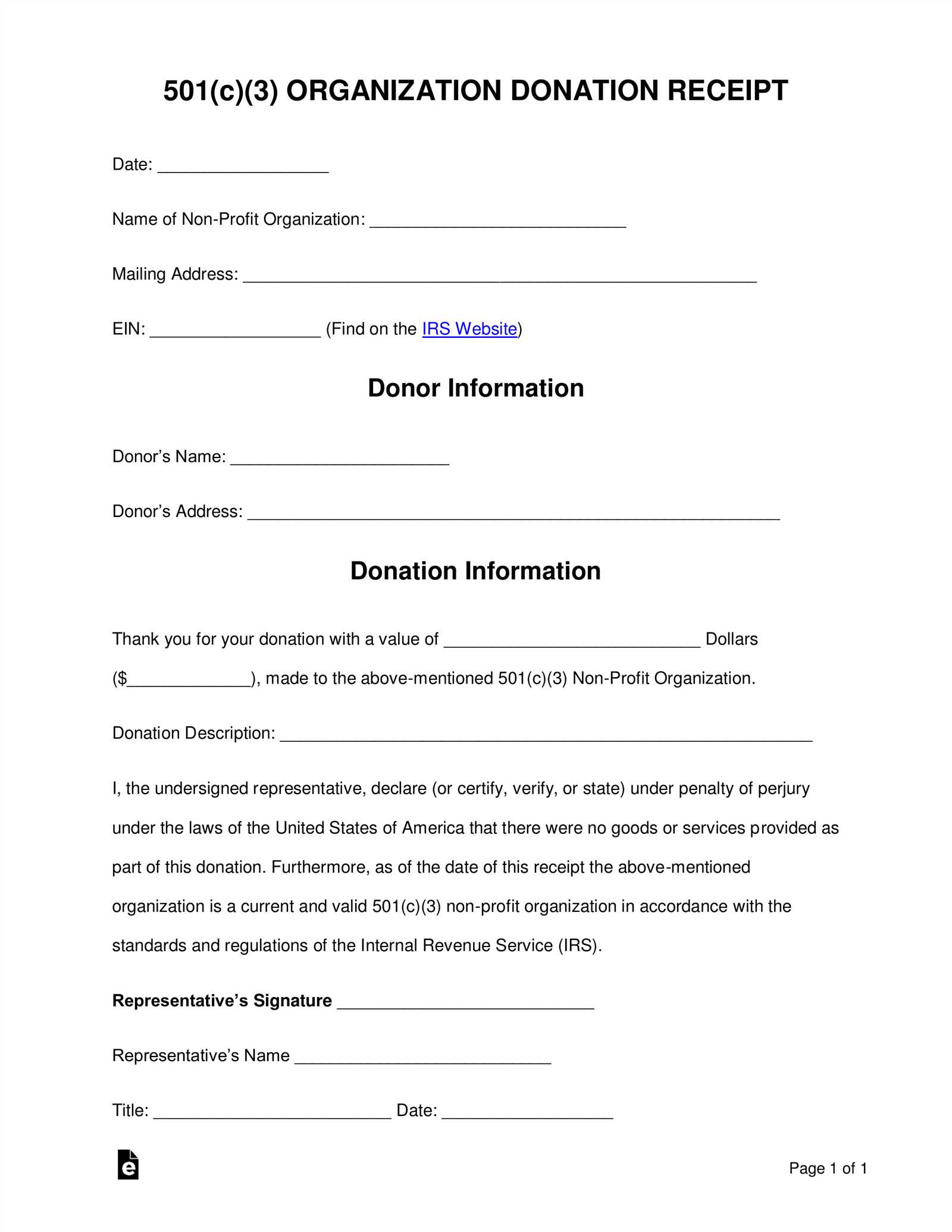

Essential Information to Include

For an effective acknowledgment, make sure the following details are clearly mentioned:

- Donor’s details: Name and contact information of the individual making the gift.

- Contribution description: A brief mention of the donation, whether monetary or in-kind.

- Organization’s details: Name, address, and contact information of the entity receiving the gift.

- Contribution date: Exact date when the donation was made.

- Estimated value: If applicable, include the value of the donated goods or services.

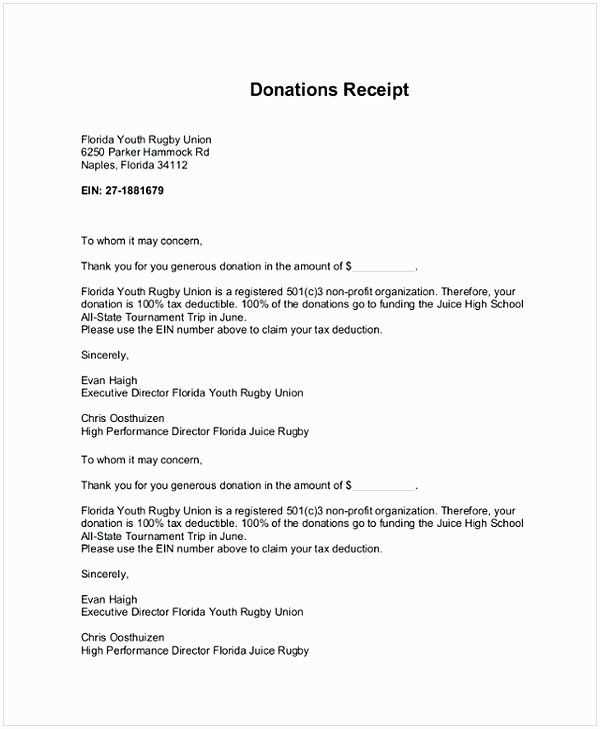

Steps to Craft an Acknowledgment

To draft an appropriate acknowledgment, follow these simple steps:

- Address the donor personally at the beginning of the document.

- Provide a brief description of what was given.

- State the value or estimated worth of the contribution, if applicable.

- Thank the donor for their generosity and continued support.

- Ensure compliance with any legal requirements by including a formal closing statement and authorized signature.

By incorporating these elements into your recognition document, you can foster positive relationships with donors and ensure that all regulatory requirements are met. Proper acknowledgment also encourages further contributions and transparency between the donor and recipient organization.