Donation tax letter template

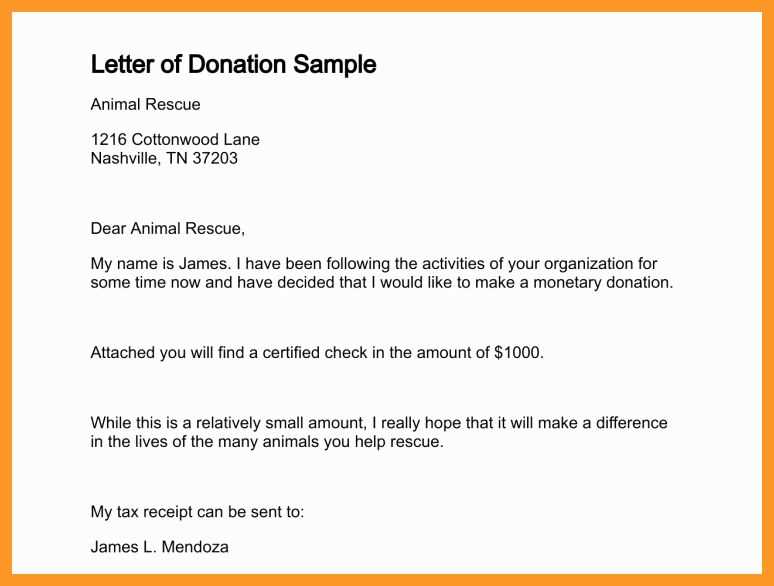

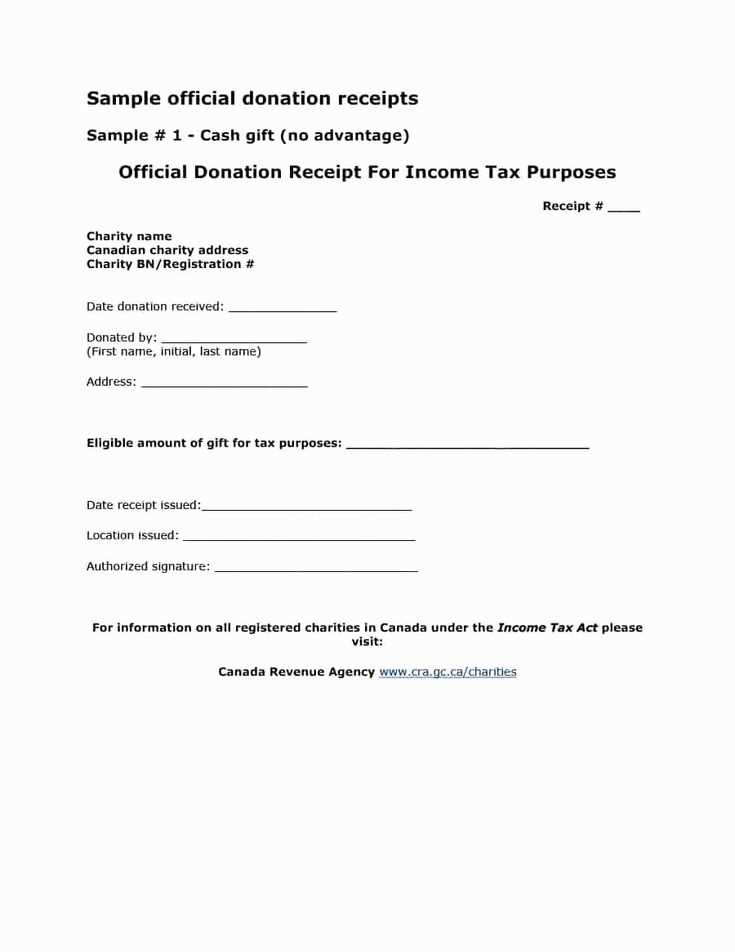

When writing a donation tax letter, focus on clarity and providing all required details. The letter should clearly state the donor’s name, the donation amount, and any other relevant information, such as the date of the donation. Be sure to mention that no goods or services were provided in exchange for the contribution, as this is a key requirement for tax purposes.

Use straightforward language and avoid unnecessary jargon. A well-structured letter ensures that the donor can easily use it for their tax records. Include your organization’s name, address, and tax-exempt status number to validate the donation and make it easier for the donor to claim tax deductions. Be sure to include a clear description of the donated items if applicable.

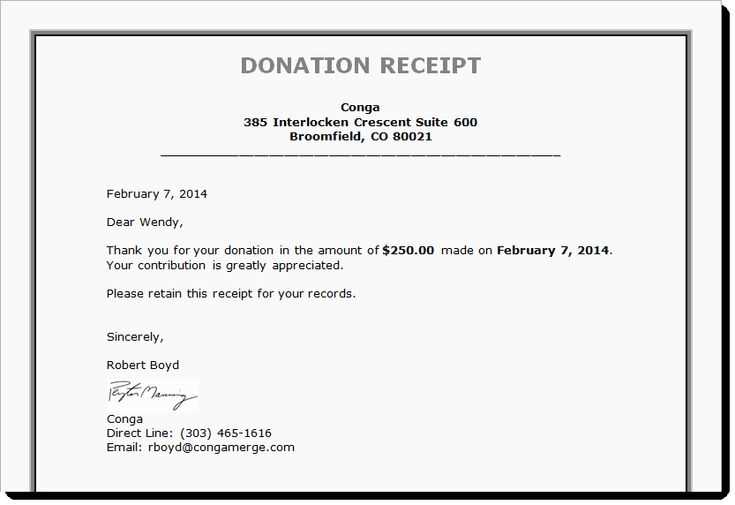

At the end of the letter, thank the donor for their generosity. A polite and sincere thank-you not only acknowledges the contribution but also fosters positive relationships with your supporters.

Here is the corrected text:

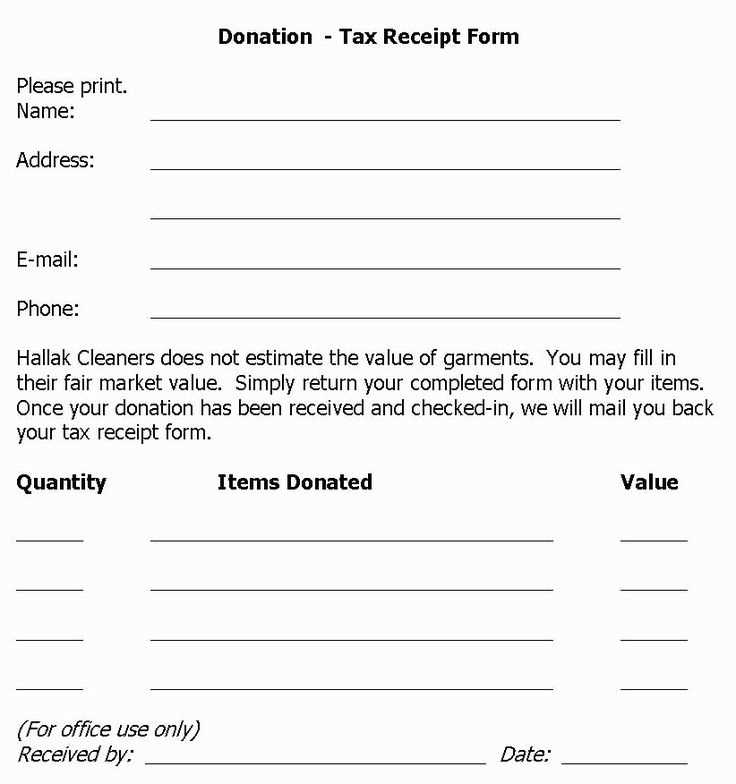

Include the full name of the donor, their address, and the date of the donation. Be specific about the value of the donation, whether it is cash or items. If the donation includes goods, describe the items clearly and state their fair market value. Acknowledge that no goods or services were provided in exchange for the donation, if applicable.

Next, list any other relevant information, such as the purpose of the donation (if specified) or the program or cause it supports. Always sign the letter at the end and provide contact information for any questions or clarifications. Keep the tone professional but warm, ensuring the donor feels appreciated for their contribution.

Donation Tax Letter Template: A Practical Guide

Understanding the Legal Requirements for Donation Letters

Key Components of a Tax Deduction Letter

How to Format a Donation Letter Properly

Common Mistakes to Avoid When Writing a Tax Deduction Letter

How to Personalize Your Donation Letter for Maximum Impact

What to Do After Sending a Donation Letter

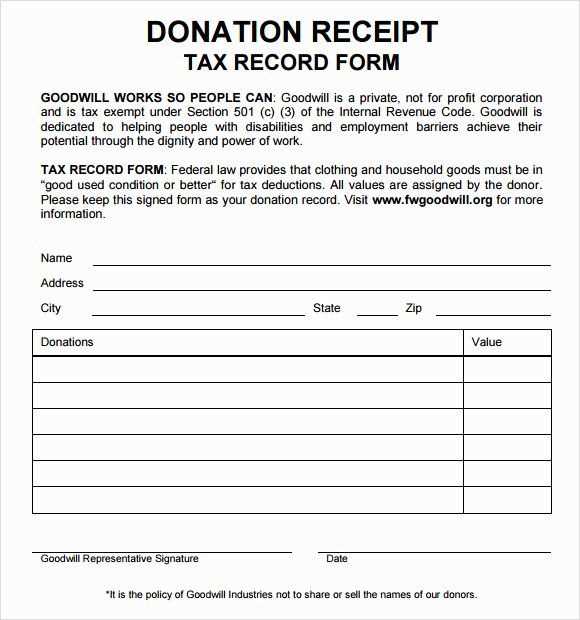

When drafting a donation letter for tax deduction purposes, the letter must include key information to ensure its acceptance by tax authorities. The IRS requires that your letter includes the amount or description of the donation, the date of the gift, and a statement confirming whether any goods or services were provided in exchange for the donation. Be sure to check for local tax laws, as requirements may vary based on your jurisdiction.

The letter should clearly outline the donation amount, specify whether it was cash or property, and describe the property in detail if applicable. If you received anything in return, like event tickets or merchandise, state its fair market value and explain that it is not deductible. The IRS also requires acknowledgment of donations of $250 or more to be documented with a written letter.

Use clear, formal language while keeping the formatting consistent. Start with a professional heading, including your contact information and the charity’s. Follow with the donation amount and description, then thank the donor. Finish by including the charity’s official tax identification number and a statement of no goods or services exchanged.

Avoid common mistakes, such as failing to include the fair market value of donated goods, neglecting to acknowledge whether any compensation was given, or leaving out necessary contact details like the charity’s EIN. Double-check for spelling errors, as a sloppy letter may raise questions about its authenticity.

Make your letter more personal by referencing the specific cause or project supported by the donation. Highlight the impact of their gift on the organization’s work, creating a deeper connection and reinforcing the importance of their contribution.

After sending the letter, keep a copy for your records and ensure the recipient has received it. It’s also helpful to track any further donations to maintain proper documentation for your tax filings. Regular follow-ups show appreciation and reinforce continued support.