Employee overpayment letter template

Clear Communication is Key

When addressing an overpayment situation with an employee, clarity and respect are crucial. Begin by providing a straightforward explanation of the error. Use a polite yet firm tone to ensure that the employee understands the situation. It’s best to outline the amount overpaid, the time period it covers, and how you plan to rectify it.

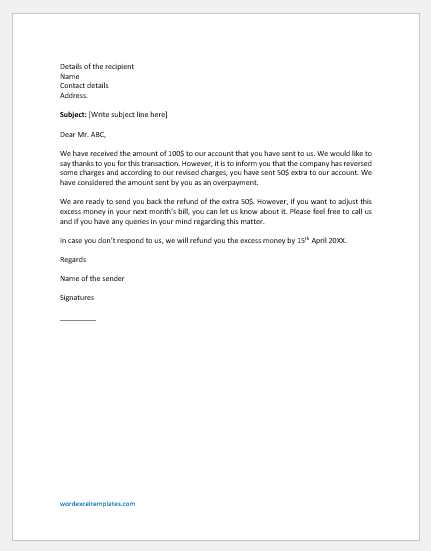

Template Example

Dear [Employee’s Name],

We have reviewed our recent payroll records and noticed an overpayment of [$amount] in your last paycheck, dated [date]. The overpayment occurred due to [reason for overpayment, e.g., miscalculation, incorrect hours, etc.].

We would like to discuss the best approach to rectify this. You can either repay the amount in full or agree to a repayment plan that suits your current situation. Please let us know your preference, and we can provide you with the necessary details.

If you have any questions regarding this, please don’t hesitate to reach out. We’re committed to resolving this issue as smoothly as possible.

Best regards,

[Your Name]

[Your Position]

[Company Name]

Important Notes

- Ensure the tone is respectful to avoid misunderstandings.

- Provide a repayment plan option to make the situation manageable for the employee.

- Be clear about the next steps for resolving the issue.

Follow-Up and Support

If the employee agrees to repay the amount, send a confirmation of the repayment plan in writing. Keep the communication open, as overpayments can sometimes lead to frustration or confusion. A follow-up ensures the employee feels supported throughout the process.

Employee Overpayment Letter Template

How to Structure an Overpayment Notification

Key Details to Include in the Letter

Common Causes of Employee Overpayment

How to Communicate the Repayment Process

Establishing a Clear Timeline for Repayment

Legal Aspects of Handling Overpayment

When creating an employee overpayment letter, start with a clear subject line to grab attention, followed by a direct and polite explanation of the overpayment. Include the exact amount overpaid, the time period during which the overpayment occurred, and the steps being taken to resolve it. Ensure that the tone remains professional yet empathetic, acknowledging the impact on the employee.

Key details should cover the overpayment specifics, such as the date the mistake was noticed and how it was calculated. It’s important to mention the employee’s right to discuss the matter further if needed. Include repayment options, whether through deductions from future paychecks or a one-time payment. Transparency at this point will minimize confusion.

Common causes of overpayments include clerical errors, miscalculations, incorrect data entry, or miscommunication between departments. Clearly stating the cause helps the employee understand the situation and prevents misunderstandings.

To communicate the repayment process, offer a clear method. Specify whether you are requesting an immediate repayment or proposing a payment plan. Be sure to mention that you are open to adjusting the schedule based on the employee’s circumstances. Being flexible demonstrates your understanding of the potential financial strain.

Establish a clear timeline for repayment. Specify the date by which the overpayment must be repaid or the schedule for deductions. This provides the employee with a sense of clarity and allows them to plan their finances accordingly. If the repayment plan extends over a period, be sure to note how much will be deducted from each paycheck.

Legally, employers must ensure they follow any local labor laws or contractual agreements when requesting repayment. Depending on jurisdiction, there may be specific limits on how much can be deducted from an employee’s wages. Always consult legal advice if unsure about the repayment terms to ensure fairness and compliance with the law.