Employee Salary Verification Letter Template

When individuals or businesses need to confirm someone’s income or job position, a well-structured document is essential. It serves as an official statement verifying key financial information and helps meet various administrative needs.

Understanding how to draft this essential paperwork is crucial. The format, content, and clarity of the information can significantly impact its acceptance and usefulness. A professional approach ensures the document fulfills its purpose effectively, providing the required details in a concise manner.

Knowing the components of such a document can simplify the process. By including necessary facts and presenting them clearly, the document can serve as a reliable reference for those requesting financial confirmation.

Making sure the information is accurate and up to date is vital. Errors or omissions can lead to delays or misunderstandings, so it is important to pay attention to every detail when composing this type of document.

Why Salary Verification Letters Matter

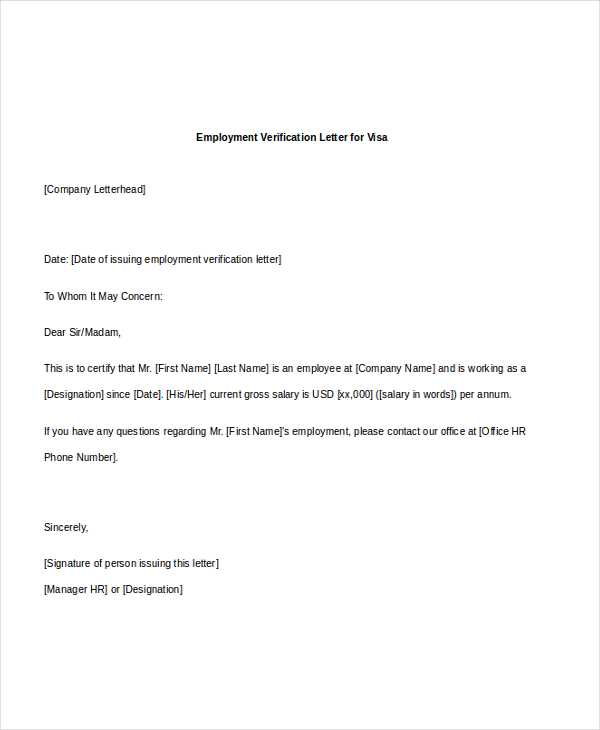

Documents confirming someone’s financial standing are crucial in various scenarios, whether for securing loans, applying for housing, or other professional requirements. These records provide an official acknowledgment of an individual’s income and employment status, serving as proof of their financial reliability.

Building Trust in Professional Transactions

Having a properly drafted statement ensures that both parties involved in a transaction can trust the provided information. This is especially important when someone needs to meet specific financial criteria. Whether it’s for a bank loan or a rental agreement, these documents provide a clear and concise way to confirm an individual’s financial stability.

Ensuring Legal and Administrative Compliance

In many industries, having a formal declaration of income is necessary to meet legal or procedural requirements. Organizations and institutions often require this type of paperwork to comply with regulations. A clear and accurate report can prevent any issues with compliance or legal disputes in the future.

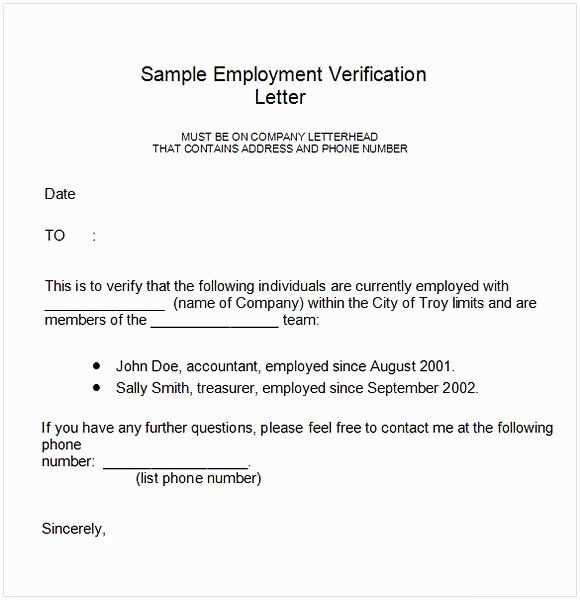

Steps to Create a Salary Confirmation

Creating a document to confirm someone’s financial details requires precision and clarity. It must include the right components to ensure that the intended purpose is fulfilled efficiently. By following a structured approach, you can ensure that all necessary information is presented in a professional manner.

Gather Relevant Information

The first step is to collect the necessary data before drafting the document. This includes details about the individual’s position, income, and employment dates. To make sure the confirmation is accurate, gather the following:

- Full name and job title

- Income details (e.g., monthly, annual salary)

- Dates of employment

- Employer’s contact information

Draft the Document

Once you have the relevant details, you can begin drafting the statement. Make sure to include:

- A clear introduction stating the purpose of the document

- Information about the individual’s position and income

- A professional closing with the employer’s contact information

By following these steps, you can create a reliable and professional confirmation that meets all necessary requirements.

Essential Elements for an Effective Template

For any document confirming financial or professional details, certain key components must be present to ensure its effectiveness. These elements provide structure and clarity, ensuring that all necessary information is conveyed accurately and professionally.

Clear Identification of the Individual is vital. The document should start with the person’s full name, job title, and contact details. This establishes the basis of the statement and ensures there is no ambiguity about who is being referenced.

Accurate Financial Information must be included. It is important to list the income details (e.g., salary or other compensation), as well as the duration of the individual’s employment. Providing these figures ensures transparency and meets the expectations of any party relying on the document.

Contact Information for the Employer should also be present. The document should end with the name and contact details of the employer or issuing party. This ensures the document can be verified or followed up on if necessary.

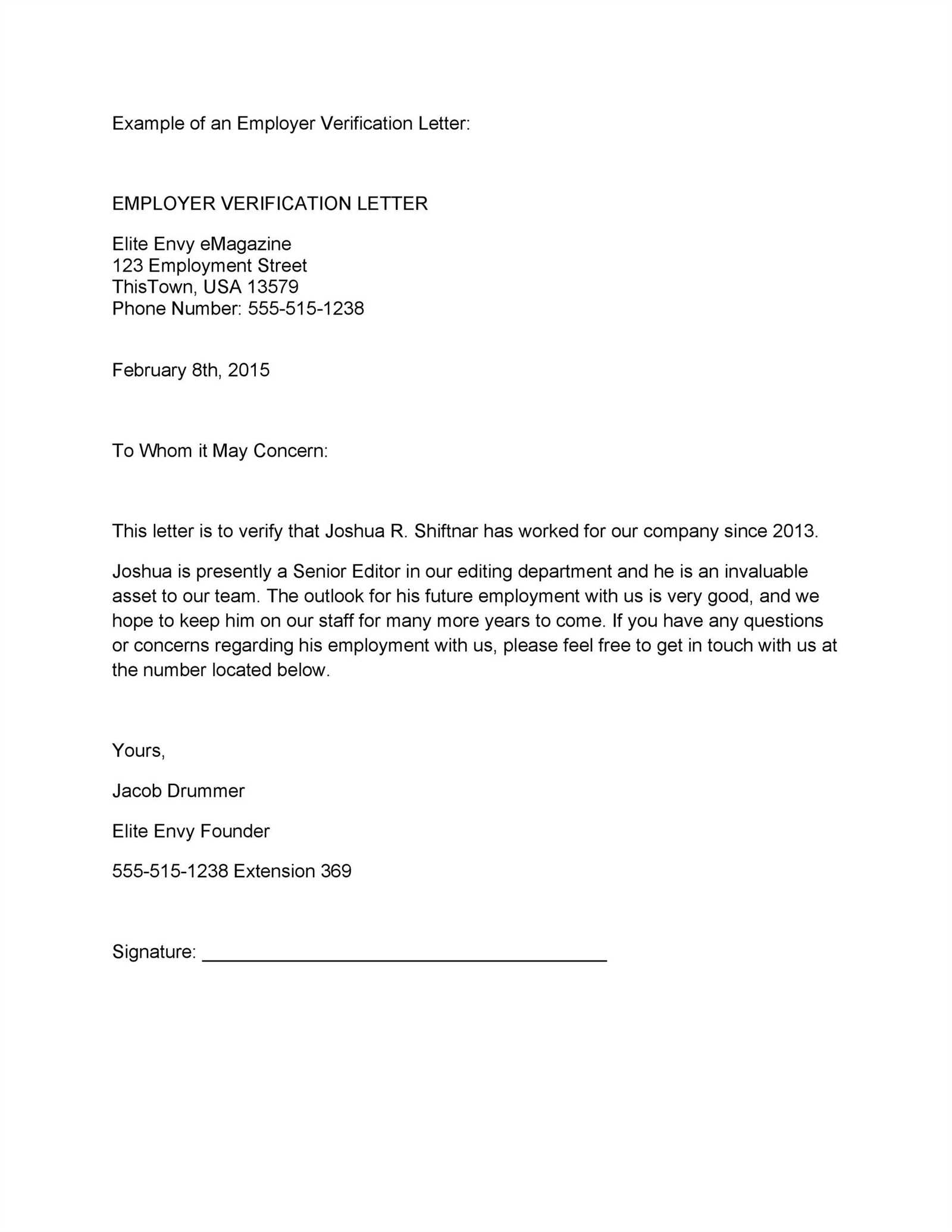

Best Practices for Writing the Document

Writing a professional document to confirm someone’s financial standing or employment details requires careful attention to detail and clarity. Following best practices ensures that the statement is both effective and credible, serving its intended purpose efficiently.

Maintain a Clear and Professional Tone

The tone of the document should always be formal and neutral. Avoid any casual language or unnecessary information. Focus on the facts and ensure that the content is straightforward and objective. Here are some key points to follow:

- Use formal language throughout the document.

- Stick to the facts, avoiding personal opinions or assumptions.

- Avoid jargon or overly complex wording to keep the document easy to understand.

Ensure Accuracy and Completeness

Ensure that all the required details are included and correct. Double-check financial figures, dates, and contact information. Any errors could undermine the credibility of the document. Follow these guidelines:

- Verify all data before including it in the document.

- Ensure consistency in format, especially with dates and numbers.

- Double-check spelling and grammar to maintain professionalism.

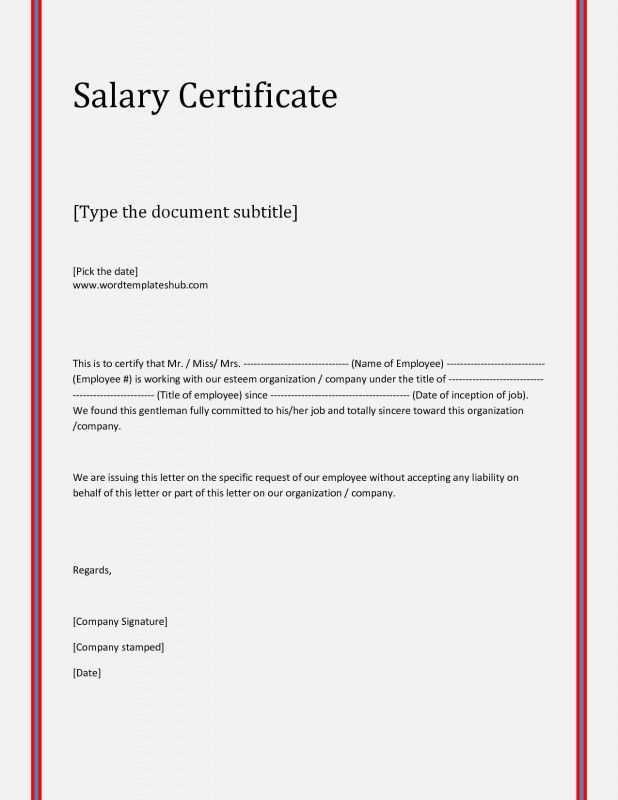

Common Errors to Avoid in Letters

When drafting documents to confirm an individual’s income and employment status, certain mistakes can undermine the document’s effectiveness and credibility. It’s important to be aware of these common errors to ensure that the statement serves its intended purpose without complications.

Inaccurate or Missing Information

One of the most significant errors in these documents is failing to include or inaccurately providing important details. Missing or incorrect data can make the document useless and cause delays or misunderstandings.

| Error | Consequence |

|---|---|

| Incorrect income figures | Misleading information that can result in financial disputes. |

| Omitting employment dates | Inability to verify the duration of employment. |

| Missing employer contact information | Lack of means to verify the document’s authenticity. |

Improper Formatting or Language

Another frequent mistake is using informal language or incorrect formatting. This can make the document look unprofessional or unclear, affecting its legitimacy. To avoid such issues, adhere to proper document structure and use a formal tone throughout.

Legal Requirements for Verification Documents

When creating documents to confirm an individual’s employment and financial standing, it is crucial to understand the legal requirements that apply to ensure the document is valid and binding. These guidelines help ensure that the information provided meets legal standards and protects both parties involved.

Adherence to Privacy Laws

Confidentiality is a major consideration in these types of documents. Personal information, such as income details or job titles, must be handled carefully and shared only with authorized individuals. Legal frameworks such as data protection laws must be followed to avoid any breaches of privacy.

Accuracy and Authenticity

It’s important to ensure that the details included in the document are truthful and verifiable. Any discrepancies or false information can result in legal consequences. This includes providing accurate employment details and financial information that can be easily cross-checked with official records.