Employment Letter for Mortgage Template Guide

When applying for a home loan, one of the essential pieces of documentation you may need to provide is proof of your employment status. This document is a critical part of the approval process, as it helps lenders assess your financial stability and ability to repay the loan. Understanding the correct format and content of such a document is key to ensuring your application proceeds smoothly.

Many applicants are unsure about what details should be included or how to structure this document properly. A well-written verification statement can make the difference between a smooth approval process and unnecessary delays. By following the right format and ensuring all necessary information is presented clearly, you can strengthen your position when applying for financing.

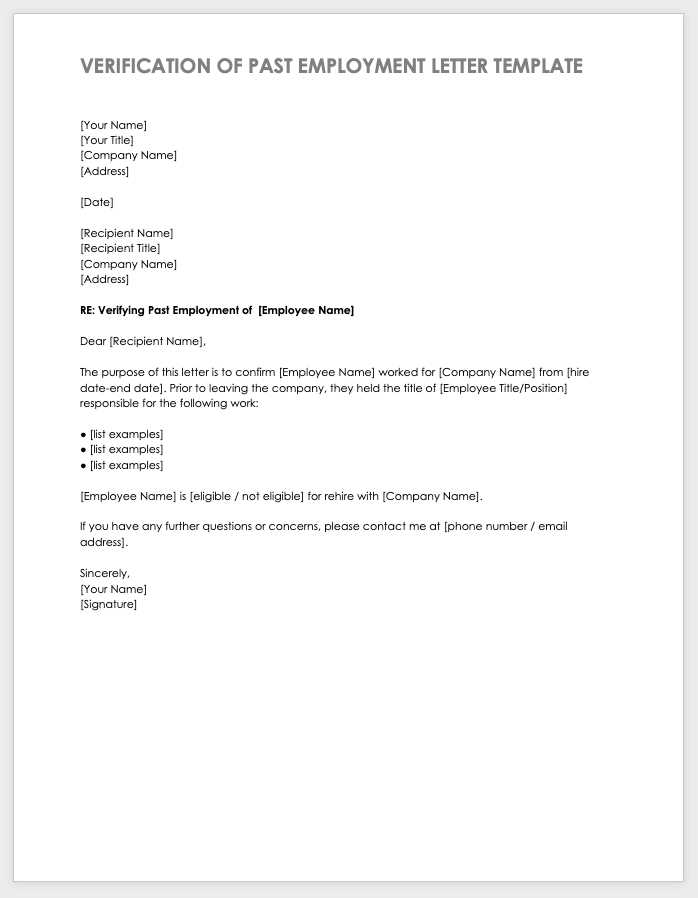

Creating a Job Verification Document for Loan Applications

When submitting a loan application, providing a clear and accurate document verifying your current job status is often required. This crucial document serves as proof of your income and stability, allowing lenders to evaluate your ability to repay the loan. It is essential that the format and content of this paperwork align with the lender’s expectations to avoid unnecessary delays.

The structure of this document typically includes details such as your job title, duration of employment, salary information, and confirmation of your current position. By organizing this information effectively and ensuring it is professionally presented, you help strengthen your case and make the application process smoother.

Why Employment Verification Matters

Providing proof of your current job status is a crucial part of the loan application process. Lenders rely on this information to evaluate your financial stability and your capacity to meet repayment obligations. Without a clear verification of your income and employment history, the lender may hesitate or delay approval, which can prolong the process and increase uncertainty.

Building Trust with Lenders

By offering a well-documented confirmation of your job, you help establish trust with potential lenders. They need assurance that you have a reliable and steady income source to reduce the risk of lending to you. This verification not only shows that you can meet your financial commitments but also provides a sense of security to the lending institution.

Streamlining the Loan Approval Process

When your job details are confirmed and clearly presented, the loan approval process can proceed much faster. Lenders are less likely to request additional documentation, saving both you and the lender time. Properly submitted job verification documents can help speed up the entire review process, improving your chances of receiving a timely response.

Essential Details to Include in the Letter

When submitting a job verification document, it is vital to ensure that all relevant information is clearly outlined. This helps lenders assess your financial reliability and evaluate the risk associated with your application. Providing the right details is crucial in avoiding unnecessary delays and complications in the approval process.

Basic Information such as your full name, job title, and the name of your employer should be prominently included. Additionally, include employment start date and current position, as well as your salary details and any bonuses or additional compensation you may receive. These details help lenders understand your current financial standing.

Contact Information for your employer or HR department is another important inclusion. This ensures the lender can verify the information provided if needed. Lastly, include a statement of job stability or confirmation that you are in good standing with your employer to further support your financial reliability.

Best Practices for a Polished Letter

Presenting a professional and well-structured document is key to making a positive impression on lenders. Ensuring clarity and accuracy is essential, as it reflects your attention to detail and commitment to the application process. Following a few simple practices can significantly improve the quality of your submission.

Here are some tips to ensure your document looks polished:

| Tip | Explanation |

|---|---|

| Use Professional Language | Maintain a formal tone throughout, avoiding slang or overly casual language. |

| Be Concise | Keep your information clear and to the point. Avoid unnecessary details. |

| Double-Check Information | Ensure all details, such as job title, salary, and start date, are accurate. |

| Proper Formatting | Use a clean and easy-to-read format, with proper spacing and paragraph breaks. |

| Include Contact Details | Provide accurate employer contact information for verification purposes. |

By following these practices, you will ensure your document is not only professional but also effective in supporting your application.

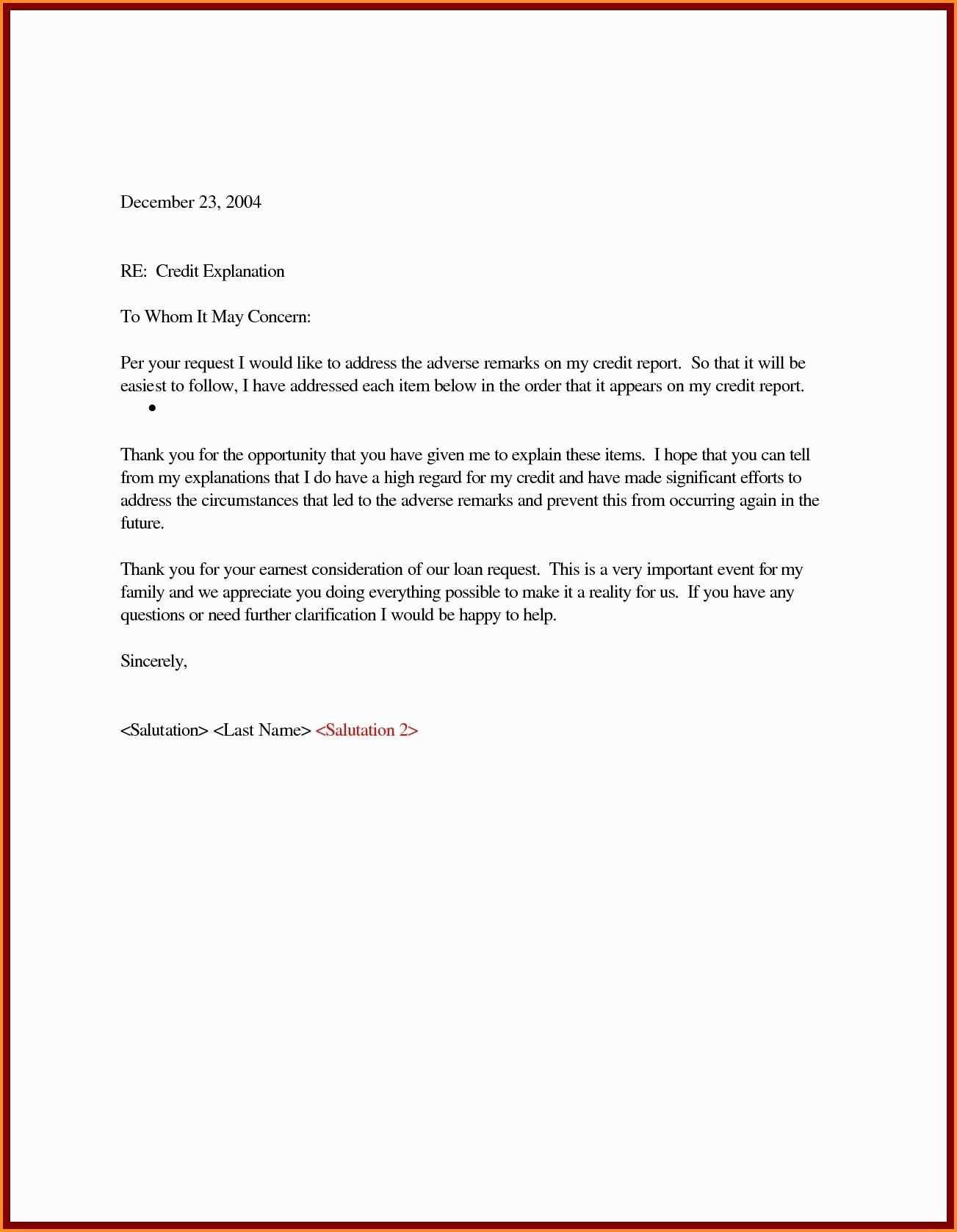

How to Customize Your Letter for Lenders

When tailoring your job verification document for a specific lender, it’s important to address their unique requirements. Lenders may have different expectations, so customizing your submission helps ensure that your document meets their standards and provides all the necessary information. A personalized approach can make your application stand out and improve your chances of approval.

Key Customization Tips

- Review Lender Guidelines: Make sure to check if the lender has any specific requirements regarding the document format, content, or additional information needed.

- Include Lender’s Name: Mention the specific lender’s name in the introduction or closing statement, showing attention to detail and professionalism.

- Highlight Relevant Information: Emphasize details that are most important to the lender, such as income, job stability, and other factors that may influence their decision.

Adjusting Tone and Format

- Professional Language: Use a formal and courteous tone, ensuring that the content aligns with the expectations of the financial institution.

- Follow Lender Preferences: If the lender prefers certain formatting styles or prefers the information to be in a specific order, make sure to comply with those preferences.

By adjusting your document to meet the lender’s specific needs, you ensure a smoother review process and increase the likelihood of approval.

Common Errors in Employment Letters

Submitting a poorly crafted job verification document can delay or even jeopardize your approval process. Understanding common mistakes can help ensure your document is both accurate and professional. Avoiding these errors will make your application process smoother and increase your chances of success.

Typical Mistakes to Watch For

- Missing Contact Information: Failing to provide employer contact details, such as phone numbers or email addresses, can hinder verification.

- Incorrect Job Title or Salary: Ensure that job titles and salary figures are correct and match official records.

- Omitting Employment Dates: Missing the start date or current employment status can raise concerns about the applicant’s stability.

- Inconsistent Formatting: A poorly structured document can be difficult to read, making it harder for the lender to process your information.

How to Avoid These Errors

- Double-Check Details: Always verify the facts before submitting the document to avoid mistakes in job titles, salary, and employment dates.

- Follow Lender Instructions: Adhere to any specific instructions or formats requested by the lender to prevent unnecessary complications.

- Proofread Carefully: Review the document thoroughly for grammar, spelling, and punctuation mistakes.

By being aware of these common errors and taking steps to prevent them, you can improve the quality of your submission and move forward with confidence.

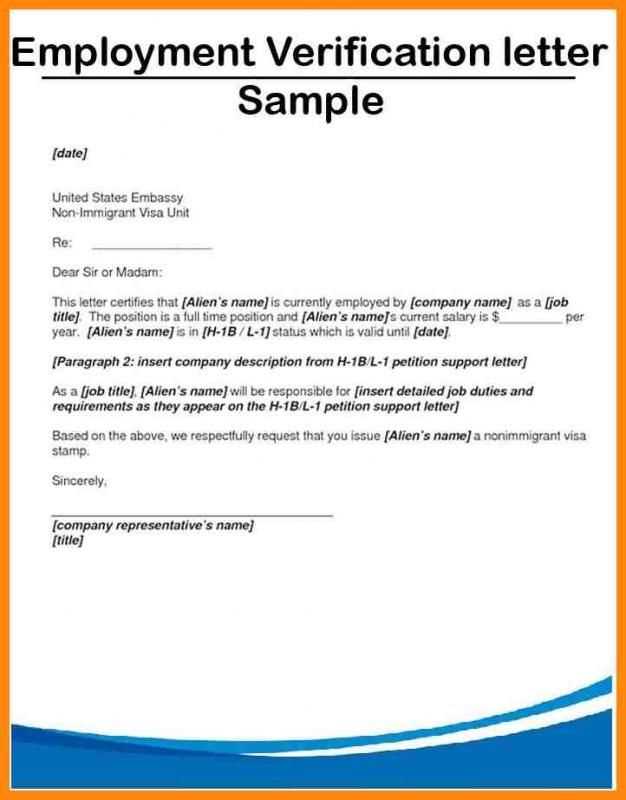

Other Documents That Enhance Your Application

While a well-prepared verification document is vital, there are other essential pieces of information that can strengthen your overall application. Submitting additional records can provide a more complete picture of your financial stability, making you a more attractive candidate. These documents demonstrate reliability and support the details provided in your primary submission.

Financial Proofs and Supporting Materials

- Bank Statements: These can help show your financial health and ability to manage finances responsibly.

- Tax Returns: Submitting recent tax filings can offer further insight into your income and overall financial situation.

- Pay Stubs: These show consistency in your income over time and complement the information provided in the verification document.

- Credit Report: A clear credit history helps demonstrate your reliability and makes it easier for lenders to assess your risk level.

Other Helpful Documentation

- Proof of Assets: Details of savings, investments, or other assets can strengthen your financial profile.

- References or Testimonials: If applicable, character references or letters from supervisors can provide additional context to your employment and reliability.

By submitting these additional documents alongside your main verification, you show that you are prepared and serious about the process. It allows lenders to make a more informed and confident decision regarding your application.