Letter of Employment Template for Bank

Creating a formal document to verify a person’s professional standing is a standard requirement in many industries, especially in finance. Such written confirmations are essential for a variety of reasons, including confirming employment status, position, and income. These documents are often needed for applications, financial transactions, or official procedures.

Key Elements of a Professional Verification Document

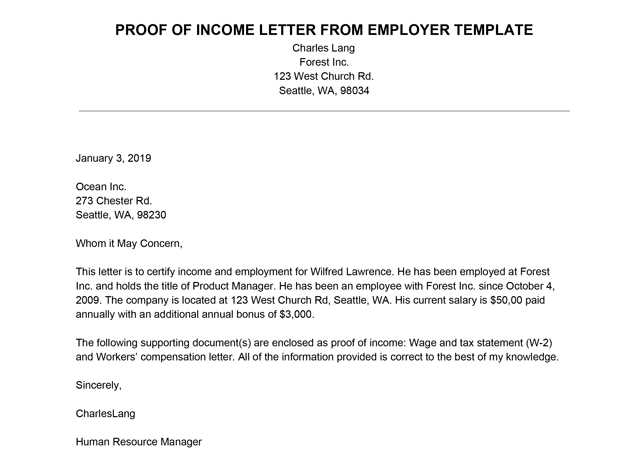

A well-structured statement includes specific details that help establish the legitimacy and authenticity of the information. The primary elements usually consist of:

- Employee’s Full Name: Clearly identified for verification purposes.

- Job Title and Role: Describes the position held within the company.

- Employment Dates: Indicates the duration of the individual’s employment.

- Salary Information: A clear breakdown of compensation, if required.

- Company Details: Information about the organization, such as its name and location.

How to Personalize a Standard Form

Customizing a general document format is crucial to match the specific needs of the recipient. Adjustments may include highlighting particular aspects of the person’s professional profile or adding additional information requested by the institution. Some of these modifications might involve:

- Including company-specific logos or letterheads for authenticity.

- Ensuring the tone aligns with the formal nature of the financial institution.

- Providing supplementary details, such as a work reference or additional endorsements.

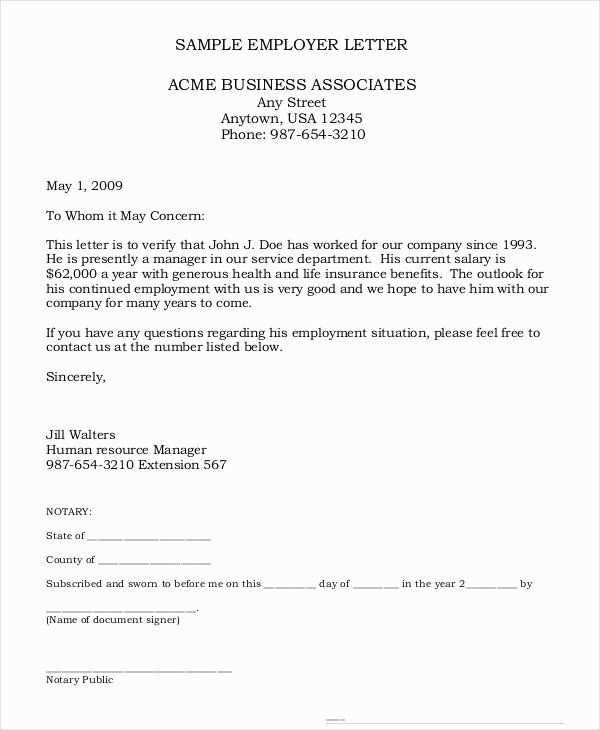

Avoiding Common Mistakes

When drafting this important document, it’s essential to avoid errors that could compromise its credibility. Common pitfalls include:

- Incorrect or outdated information about the employee.

- Failure to include necessary signatures or official stamps.

- Overlooking the proper format or legal requirements.

Legal and Ethical Considerations

Each institution may have specific guidelines regarding what can and cannot be disclosed. It’s important to be aware of these regulations to prevent violations of privacy or company policies. Additionally, ensuring that the document adheres to local labor laws and confidentiality standards is essential for maintaining legal compliance.

Best Practices for Professional Drafting

To create a reliable document, focus on clarity, precision, and professionalism. Keep the text formal, free from unnecessary jargon, and aligned with official business communication norms. If unsure, consulting a legal or human resources expert can help ensure everything is in order.

Professional Document Sample for Financial Institutions

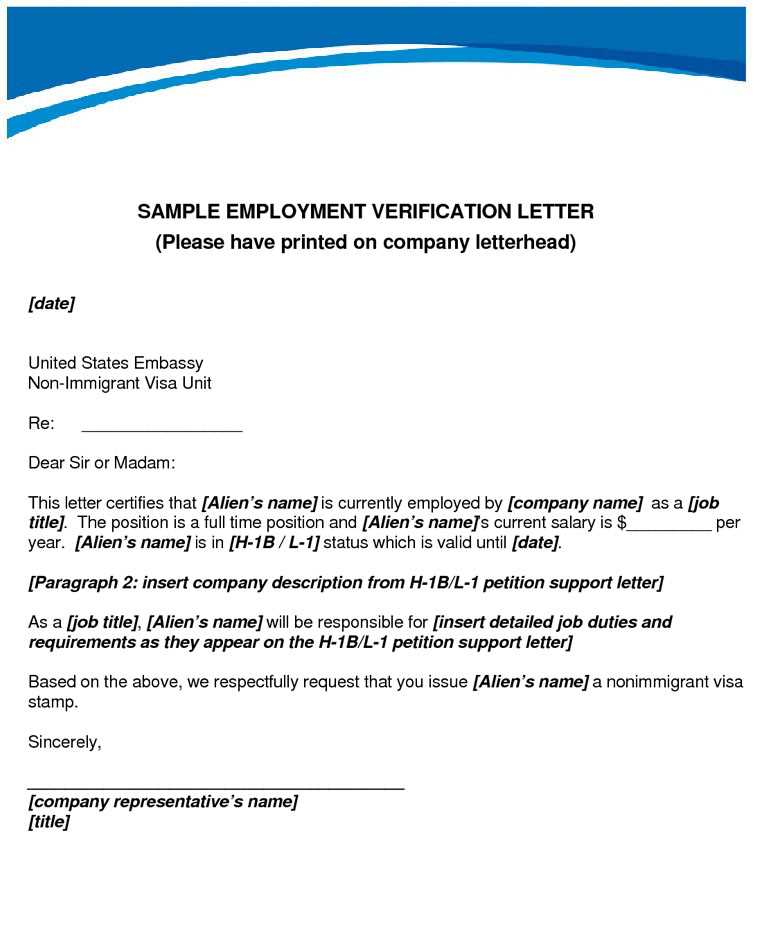

In financial transactions, having a verified written statement to confirm a person’s professional status is often a requirement. These documents serve as proof of employment and income, which are crucial for credit evaluations, loan approvals, and other formal procedures within the finance sector.

Why Such Documents Matter in Finance

These forms are vital in assessing an individual’s reliability and capacity to meet financial obligations. Financial institutions often request them to validate an applicant’s work history and current employment standing, which helps mitigate risk during lending or investment decisions.

Essential Elements of a Professional Verification Document

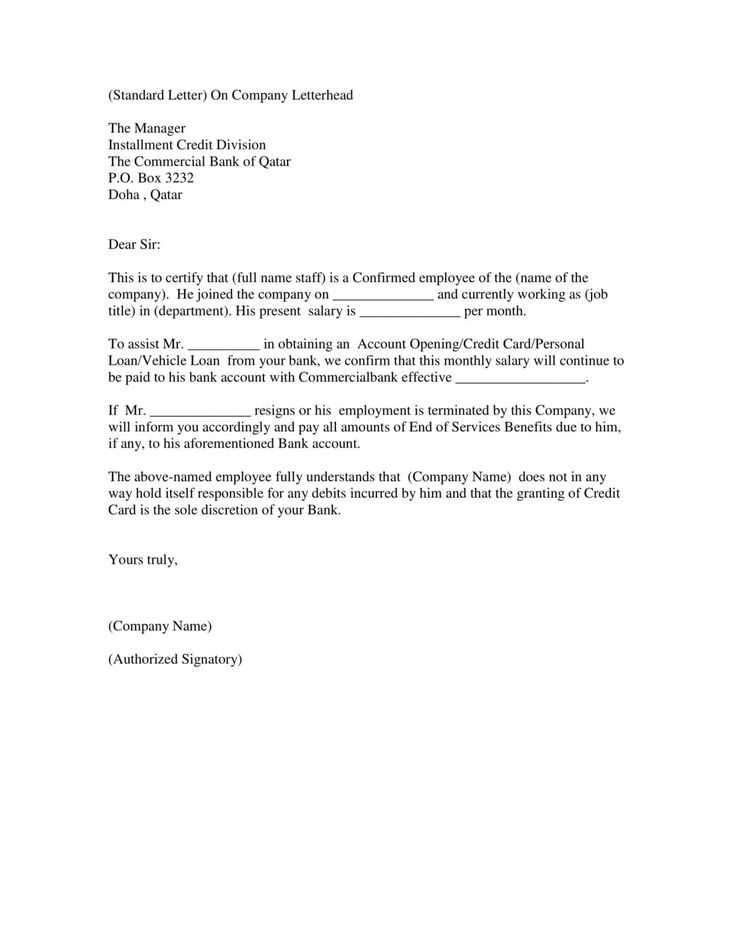

A formal verification document includes several key pieces of information, which ensure its authenticity and relevance. The crucial components typically involve:

- Full name of the individual

- Position and responsibilities held within the organization

- Employment duration

- Salary or compensation details (if needed)

- Company or institution name and contact information

Customizing Forms for Specific Financial Needs

To ensure the document aligns with the requirements of the requesting institution, it is essential to modify a standard format as necessary. This may include specifying particular roles, including income breakdowns, or adding endorsements or references that strengthen the applicant’s profile.

Avoiding Common Errors in Writing

There are common mistakes that can reduce the effectiveness of these official statements. These errors include:

- Providing outdated or inaccurate data

- Missing required signatures or seals

- Not following the format requested by the recipient

Legal Guidelines for Official Documentation

Each institution may have legal constraints that influence what can be disclosed and how the information is shared. It is crucial to adhere to privacy regulations and company policies when preparing these documents to ensure compliance and avoid potential legal issues.

Best Approaches to Crafting Professional Documents

To maintain professionalism, these forms should be clear, concise, and devoid of unnecessary language. The tone must be formal and consistent with business communication standards. Seeking guidance from legal or HR departments can further enhance the quality and compliance of the document.