Letter of Explanation for Employment Gap for Mortgage Template

When applying for a loan, especially a home loan, it’s common for financial institutions to carefully assess your work history. Any time away from the workforce could raise questions, and lenders often require a clear and detailed account of these periods. Understanding how to present this information is essential to keep your application on track.

Providing an honest and well-structured account of any time spent out of work can help ease the concerns of potential lenders. It’s important to demonstrate that your absence did not affect your financial stability or your ability to repay the loan. In this guide, we’ll walk through how to effectively communicate these breaks, ensuring that you meet the lender’s expectations and increase your chances of approval.

Understanding Employment Gaps for Mortgages

When applying for a loan, lenders often scrutinize your work history to evaluate your financial reliability. Time spent away from the workforce can raise concerns about stability and income continuity. Understanding how lenders view these periods is key to managing your application effectively.

Breaks in your career don’t necessarily disqualify you, but lenders want to understand the reasons behind them. Whether due to personal circumstances, health issues, or career transitions, providing context can reassure lenders of your ability to manage your finances. Clear communication of the situation helps demonstrate that any absence did not undermine your long-term earning potential.

Why Lenders Care About Employment Gaps

Lenders assess your ability to repay a loan by looking at your financial history, which includes your work record. Interruptions in your career can signal potential risks, making lenders cautious. Understanding the rationale behind these breaks is crucial to addressing their concerns effectively.

Risk Assessment and Income Stability

Financial institutions primarily focus on income stability. A steady income stream reduces the risk of loan default. If there’s a noticeable break in your professional life, lenders may question whether you have the capacity to manage future payments. Demonstrating financial responsibility during such periods helps reassure them of your overall stability.

Commitment to Future Financial Obligations

Lenders also want to know if you can sustain your earning power moving forward. Any disruption could raise doubts about your long-term commitment to maintaining a steady income. By clarifying the reasons behind these pauses, you help lenders gauge your financial consistency and long-term planning ability.

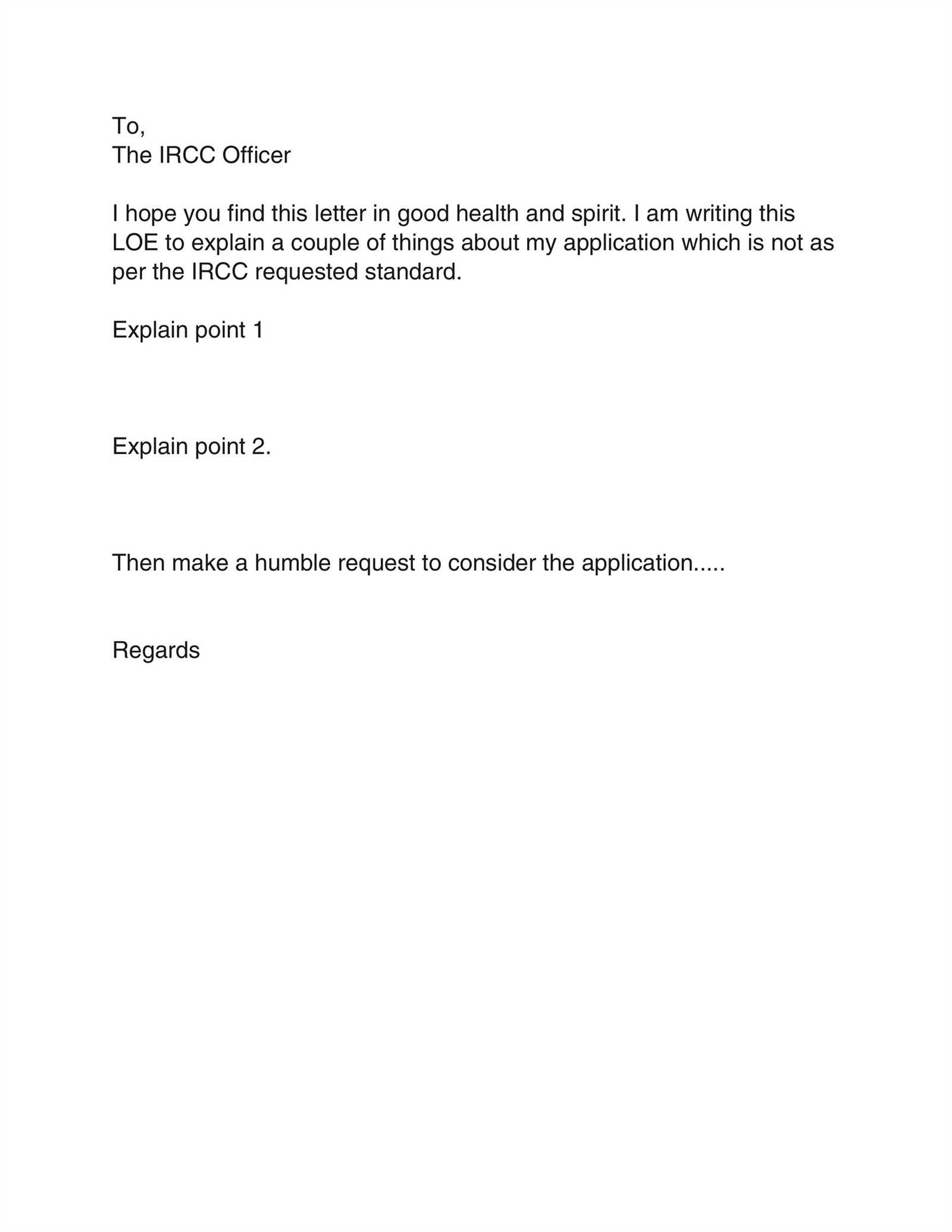

How to Write a Clear Explanation

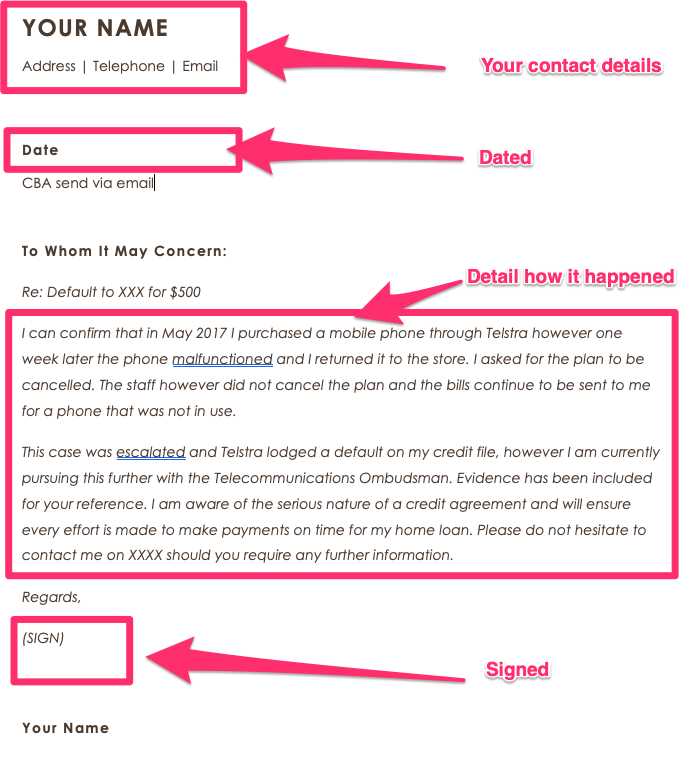

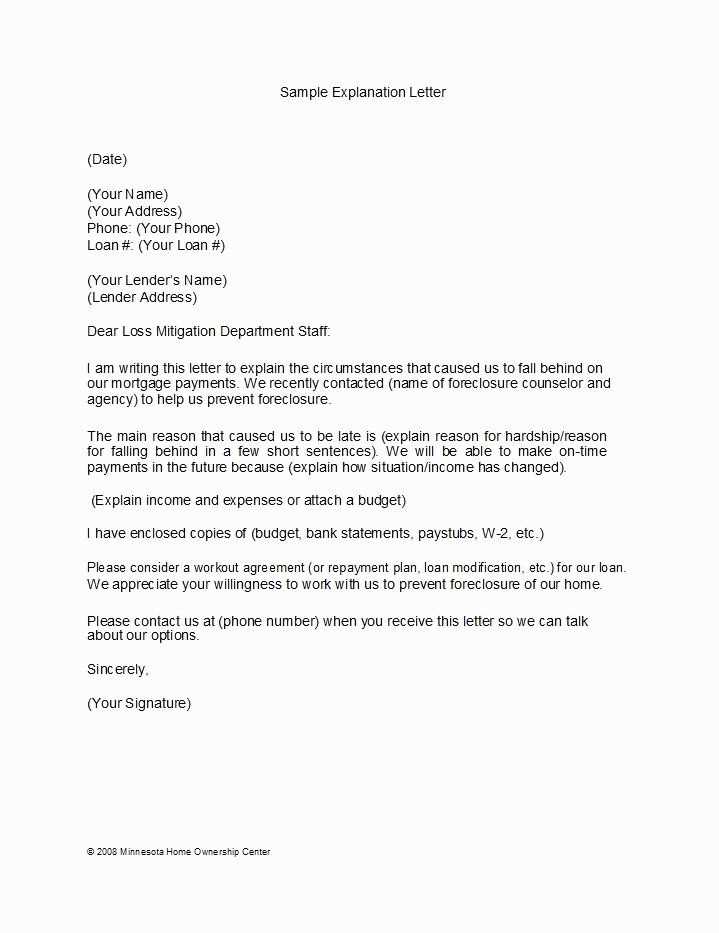

When addressing periods of time without work, it’s essential to provide a well-structured and concise narrative. Your goal is to explain the circumstances behind your absence in a way that reassures lenders of your reliability and financial responsibility. A clear and honest approach will help build trust with the institution reviewing your application.

Start by briefly describing the reason for the break. Be straightforward and avoid over-explaining, as clarity is key. It’s important to convey the length of the interruption and how you managed financially during that time. End with a statement that emphasizes your current stability and ability to meet future financial obligations. A professional and honest tone throughout the letter will enhance its effectiveness.

Key Information to Include in Your Letter

To ensure your message is clear and effective, there are specific details that you must highlight when explaining a break in your work history. By providing the right context, you can help lenders understand your situation and make an informed decision. Below are the key elements you should include:

- Reason for the Break: Clearly state why you were not working during that period. Whether it was due to health, family, personal development, or other reasons, be honest and concise.

- Duration of the Absence: Mention the exact time frame of your break. Specify the start and end dates, and make sure this aligns with your employment history records.

- Financial Stability During the Break: Describe how you maintained your financial stability during this period. This could include savings, investments, or other income sources that ensured you could handle financial responsibilities.

- Current Employment Status: Reinforce your current situation by mentioning your ongoing employment or business activity, and any job-related achievements that demonstrate your stability and future income potential.

- Commitment to Financial Responsibility: Explain how you plan to maintain your financial obligations moving forward, emphasizing your commitment to repaying the loan.

Including these critical details will provide lenders with the necessary information to make a confident decision about your application.

Common Mistakes to Avoid in Your Letter

When explaining a break in your work history, it’s important to be mindful of the details you include and how you present them. A few common mistakes can undermine your credibility or create confusion, so it’s essential to avoid these pitfalls. Below are some key errors to watch out for:

- Being Vague: Avoid vague or unclear descriptions. Providing too little information can leave lenders with more questions than answers.

- Over-Explaining: While it’s important to be honest, over-explaining can come across as defensive or unnecessary. Keep your explanation brief and to the point.

- Omitting Key Details: Failing to mention the length of the break or the reason behind it can make your statement seem incomplete or evasive.

- Inconsistent Dates: Ensure that the dates you mention align with your official records. Any discrepancy between your letter and your employment history can raise doubts.

- Being Negative: Avoid using negative language or focusing too much on hardships. Instead, emphasize your resilience and how you’ve overcome challenges.

- Making Excuses: While it’s important to explain the reasons for your time away, avoid making excuses. Take responsibility for the situation and show how you’ve grown or improved from the experience.

By steering clear of these mistakes, you can craft a more effective and professional explanation that will help strengthen your application.

Tips for Crafting a Strong Explanation

When explaining a break in your career, it’s essential to strike the right balance between providing enough detail and remaining concise. A well-crafted response can highlight your reliability and reassure lenders of your financial responsibility. Below are some tips to help you create a compelling and confident statement:

Keep it Clear and Professional

A professional tone is crucial. Avoid using overly casual language or sounding defensive. Stick to the facts, provide context, and remain focused on how your time away does not affect your ability to meet future financial obligations.

Be Honest but Positive

Honesty is key, but the way you frame the situation matters. It’s important to acknowledge the reason for the break without dwelling on negative aspects. Focus on how you handled the period and what you learned from it, highlighting any personal growth or lessons gained during the time away from work.

| Do | Don’t |

|---|---|

| Be concise and to the point. | Provide irrelevant details that distract from the main message. |

| Clearly state the time frame of the break. | Leave out important dates or make them unclear. |

| Emphasize your current stability and reliability. | Focus too much on past hardships or challenges. |

| Be honest about the reasons for the break. | Make excuses or sound defensive. |

Following these tips can help you craft a strong, well-received statement that enhances your loan application and presents you as a reliable borrower.