Formal collection letter template

To begin writing a formal collection letter, focus on clarity and politeness. Address the recipient directly and make sure the tone remains professional yet firm. Use clear language and avoid unnecessary complexity. Clearly state the purpose of the letter: requesting payment for an outstanding debt.

Start by including the necessary details. Mention the amount due, the original due date, and any previous attempts to resolve the issue. A direct reference to the agreement or contract can help provide context. Be sure to keep the tone respectful, as this helps maintain a positive relationship with the recipient while still conveying the seriousness of the matter.

Explain the next steps and indicate your expectations. Outline any penalties for non-payment or further actions that will be taken if the debt is not settled. Providing a specific deadline can create a sense of urgency without being overly aggressive.

Conclude by offering a resolution. If possible, propose a way to settle the debt, such as suggesting payment plans or offering alternative payment methods. This shows your willingness to work with the debtor while still making it clear that action is needed.

Of course! Here’s the revised version:

When creating a formal collection letter, clarity and professionalism are key. Keep the tone firm but polite, and ensure the request for payment is clear without being aggressive. Below are important steps to structure your letter effectively:

Structure of a Formal Collection Letter

- Introduction: Start by addressing the recipient directly. Mention the purpose of the letter clearly, referring to the outstanding balance or overdue payment.

- Details of the Debt: Include the invoice number, due date, and the amount owed. This provides a clear reference and helps avoid confusion.

- Request for Payment: Politely but firmly request that the recipient settle the outstanding amount by a specific date.

- Consequences of Non-Payment: Briefly mention potential actions, like late fees or referral to a collection agency, if payment is not made by the deadline.

- Closing Statement: End the letter with a courteous remark, such as thanking the recipient for their prompt attention to the matter.

Tips for Effective Communication

- Keep the language professional and polite.

- Be specific about the payment terms and deadlines.

- Follow up with a reminder if necessary, but ensure the tone remains respectful in subsequent communication.

- Formal Collection Letter Template

For a formal collection letter, clarity and directness are key. Use a polite yet firm tone to remind the recipient of their outstanding debt, offering a clear path for resolution. The letter should be structured with specific details about the amount owed and the due date to avoid confusion. Be sure to include a call to action, such as a request for payment or an invitation to discuss a payment plan if necessary.

Basic Elements to Include

Your collection letter should include the following elements:

- Clear identification of the debtor and the sender

- Specifics of the outstanding balance

- The due date for payment

- Consequences of continued non-payment

- A professional closing statement

Example Structure

Start with a formal salutation, then state the purpose of your letter. Provide the details of the outstanding amount and specify the payment terms. Remind the recipient of any previous communications, if applicable, and encourage prompt action to avoid further steps. Conclude with a polite yet firm request for payment or a discussion on possible arrangements. Always end with your contact information for further inquiries.

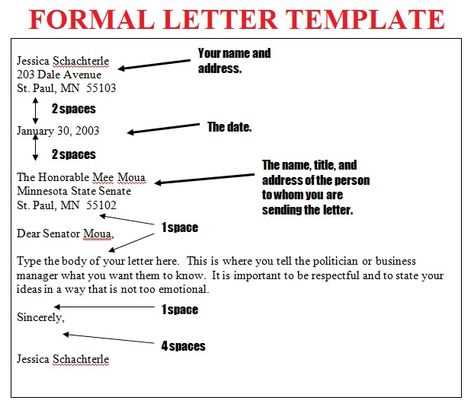

Begin the letter with a polite, professional greeting. Address the recipient by their full name, or use the appropriate title and last name, such as “Dear Mr. Smith.” This shows respect and sets a formal tone right away.

State the Purpose Clearly

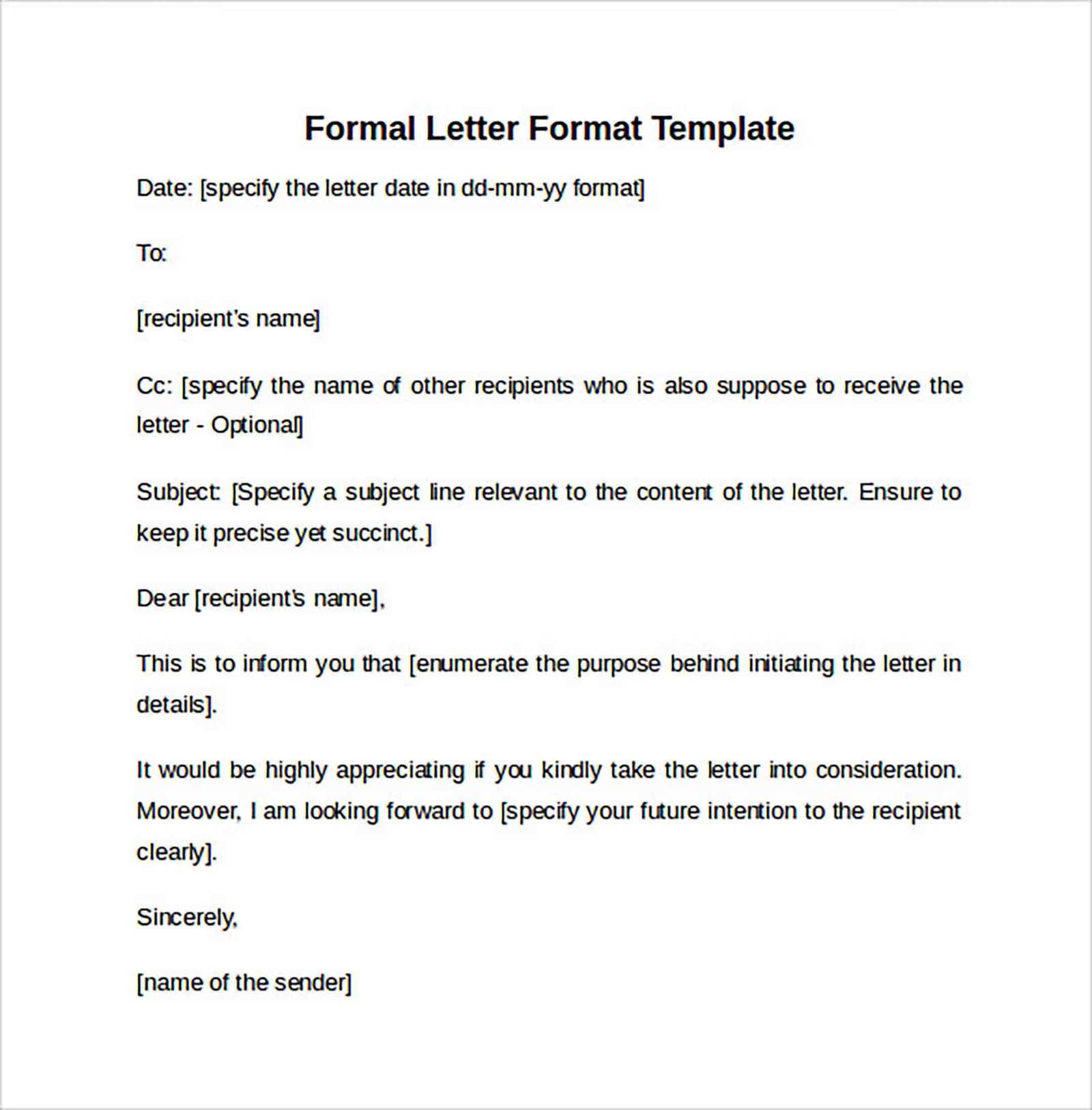

Immediately after the greeting, clarify the purpose of the letter. Keep the message direct and unambiguous: “I am writing to notify you about an overdue payment for your account with us.” This ensures there’s no confusion about the subject matter.

Reference the Outstanding Debt

Provide specific details of the debt. Mention the original amount, the date of the transaction, and any relevant invoice or account number. This gives the recipient clear context and helps them identify the exact issue. For example: “The amount of $500, due on January 15, 2025, remains unpaid.”

Start your letter with the correct contact details. Include the recipient’s full name, title, company, and address at the top of your letter. Below this, place your own contact information in a similar format to make it easy for the recipient to respond.

Clear Statement of Purpose

Clearly state the reason for your letter right away. Whether you’re reminding someone about an overdue payment or seeking clarification, get straight to the point. This will avoid any confusion and set the tone for the rest of the letter.

Specific Request or Action

Describe what you want the recipient to do. Be direct and specific about the action you expect. Whether it’s paying a bill, providing information, or scheduling a meeting, ensure the recipient understands exactly what is required.

Conclude with a polite but firm request for a response. Include a deadline if appropriate, and remind them of the consequences of non-compliance, if necessary. The tone should remain respectful but assertive to ensure clarity and prompt action.

Maintain a respectful and clear tone by addressing the recipient politely. Start with a formal greeting and use their correct title and name. If unsure about the person’s title, “Dear [Full Name]” works best.

Use Clear and Direct Language

Avoid ambiguity and keep sentences concise. Focus on delivering the message without unnecessary embellishments. Using direct language ensures your point is made without confusion or delay.

Avoid Emotional Language

Stay objective and steer clear of emotional expressions, such as frustration or anger. Stick to the facts and address issues logically, which will help maintain a professional demeanor throughout the letter.

Be cautious with humor or colloquialisms, as they may not translate well in professional settings. Instead, choose language that conveys respect and professionalism at all times.

Be Mindful of the Closing

End the letter with a courteous closing, such as “Sincerely” or “Kind regards.” These sign-offs contribute to a tone of professionalism and politeness, reinforcing the respectful nature of your communication.

Set a firm payment deadline in your collection letter. A clear date creates certainty for the recipient, avoiding delays or confusion. Specify the exact day, month, and year by which the payment must be made. This removes any ambiguity regarding when payment is due.

Include a reminder in the body of your letter about the consequences of missing the deadline, such as late fees or further action. It’s vital that the recipient understands the importance of adhering to the deadline.

| Action | Suggested Timeline |

|---|---|

| Initial Payment Reminder | Immediately after the due date has passed |

| Final Payment Reminder | 7-10 days after the initial reminder |

| Legal Action Notification | 15-30 days after the final reminder |

This table provides a clear sequence of steps to follow after the payment deadline has passed, ensuring a structured approach to collections. Always communicate these steps upfront to avoid misunderstandings and encourage timely payments.

Contact clients promptly once a payment becomes overdue. Begin with a polite reminder, outlining the outstanding amount and the due date. If no response follows, escalate the communication by sending a formal letter or email that includes the specifics of the debt, such as invoice number, due date, and amount. Specify any late fees or interest that have been applied according to your agreement.

If payments remain outstanding after the second contact, consider offering a payment plan. This approach can help maintain a positive relationship while ensuring that you recover your funds. Be clear on the terms of the plan and the expected timeline for full payment.

If these steps fail, it might be time to explore other options like engaging a collection agency or pursuing legal action. Before doing so, review the agreement with your client and any applicable laws regarding debt recovery in your jurisdiction. Be sure to weigh the potential impact on future business relationships when considering these steps.

Moving forward, establish clearer payment terms in future contracts. Specify penalties for late payments and outline a clear process for handling overdue accounts. This can help mitigate future delays and protect your business from similar issues.

Clearly state your expectations or next steps to wrap up the letter. Make it clear if you expect a response or action within a certain timeframe. Be direct but polite in indicating the urgency or desired outcome, without being forceful.

For example: “I would appreciate it if the payment could be made by the end of the month.” This leaves no ambiguity about your expectations.

Provide your contact details, ensuring that the recipient knows how to reach you. Include your phone number, email address, or any other preferred method of communication, making it as easy as possible for them to respond or seek clarification.

For example: “Please feel free to contact me at (555) 123-4567 or email me at [email protected].” This ensures they know how to get in touch with you promptly.

To craft a successful formal collection letter, focus on clarity and professionalism while keeping the tone firm yet polite. Ensure the letter is structured well, making it easy to follow and respond to.

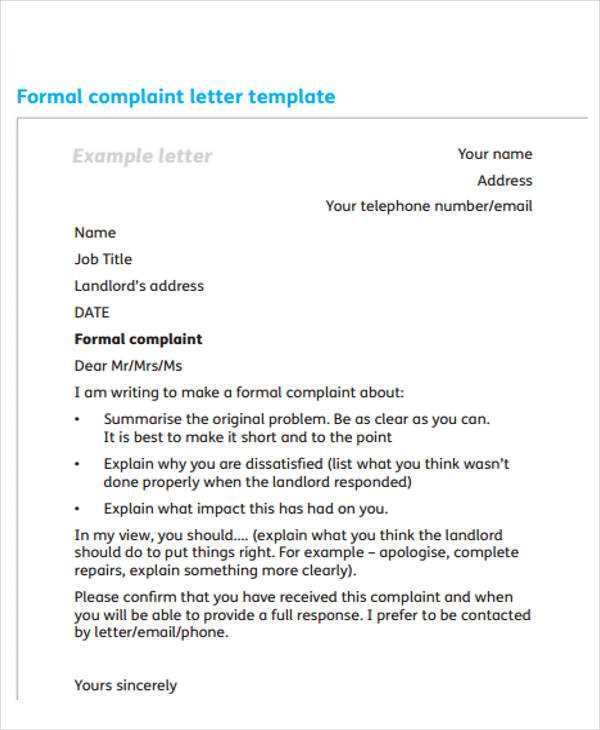

Key Components of the Letter

- Subject Line: Clearly state the purpose of the letter (e.g., “Payment Reminder for Invoice #12345”).

- Introduction: Start with a respectful greeting and a brief reminder of the outstanding payment.

- Details of the Debt: Include the amount owed, invoice number, and the due date to help the recipient identify the issue quickly.

- Consequences of Non-Payment: Mention any applicable late fees or actions that will follow if the payment isn’t made promptly.

- Request for Payment: Politely but firmly ask for the outstanding amount to be paid by a specific date.

- Contact Information: Provide clear instructions on how the recipient can make the payment or contact you for further clarification.

- Closing: Thank the recipient for their attention to this matter and end with a professional closing phrase.

Tone and Language Tips

- Polite yet Firm: While it’s important to remain polite, make sure your request is clear and leaves no room for ambiguity.

- Professional Language: Avoid informal language and maintain a respectful tone throughout the letter.

- Clear Instructions: Avoid jargon or complex sentences; ensure your message is easily understood.

- Avoid Apology: Do not apologize for sending the letter. You are simply following up on an overdue payment.