Free Debt Validation Letter Template for Easy Use

When faced with a financial obligation that you believe is incorrect or not yours, it’s crucial to take the necessary steps to confirm its validity. There are situations where collections may be based on mistaken information, and knowing how to handle such claims can protect you from undue stress and financial strain.

One of the most effective ways to address questionable charges is by formally requesting verification of the claim. By reaching out to the creditor or collector in writing, you can ensure that the amount they are demanding is accurate and legally owed. Understanding the correct approach to this process is essential for maintaining your rights and avoiding potential pitfalls.

In this section, we will guide you through the process of creating a clear and concise communication, designed to request verification of a financial claim. With the right tools and knowledge, you can navigate these situations confidently and safeguard your interests.

Importance of Validating Your Financial Obligation

Ensuring that a financial charge is legitimate before taking any action is vital to protect yourself from erroneous claims. Many individuals unknowingly make payments or accept responsibility for amounts that are either incorrect or not theirs. By thoroughly confirming the authenticity of these obligations, you can avoid unnecessary financial hardship and disputes with creditors.

Protecting Your Rights and Interests

When a claim is not properly verified, you risk losing money and potentially damaging your credit history. Engaging in the verification process gives you the ability to question and challenge inaccurate or unfounded demands. This process allows you to stand firm on your rights and ensures that any amount you are asked to pay is accurate and justifiable.

Minimizing Financial Mistakes

Taking the time to confirm the legitimacy of an outstanding amount can save you from costly mistakes. Misunderstandings, fraud, or clerical errors may all lead to wrong charges. By addressing them early on, you increase your chances of resolving matters quickly and without unnecessary expenses. This proactive approach helps to avoid lengthy disputes and negative financial consequences.

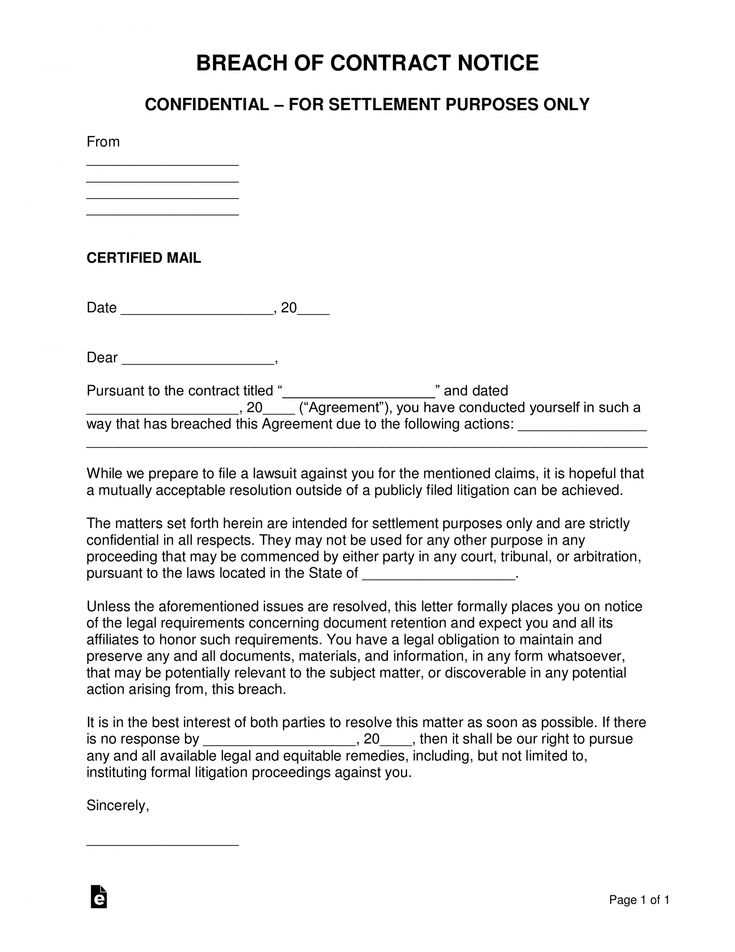

Protecting Yourself from Invalid Claims

It is essential to take the necessary steps when you suspect that a financial demand is incorrect or unfounded. Without proper verification, you could be exposed to fraudulent or inaccurate charges that can harm your financial stability and credit score. Knowing how to safeguard your interests will help you avoid costly mistakes.

To effectively protect yourself, consider the following actions:

- Request documentation: Always ask for evidence supporting the claim to ensure its authenticity.

- Keep records: Maintain detailed records of all communications and paperwork related to the dispute.

- Monitor your accounts: Regularly check your financial statements to detect any unauthorized activities.

- Know your rights: Familiarize yourself with the laws that protect you from false claims and fraudulent actions.

By following these guidelines, you reduce the risk of falling victim to incorrect or deceptive demands. Remaining vigilant and proactive will help maintain your financial security and peace of mind.

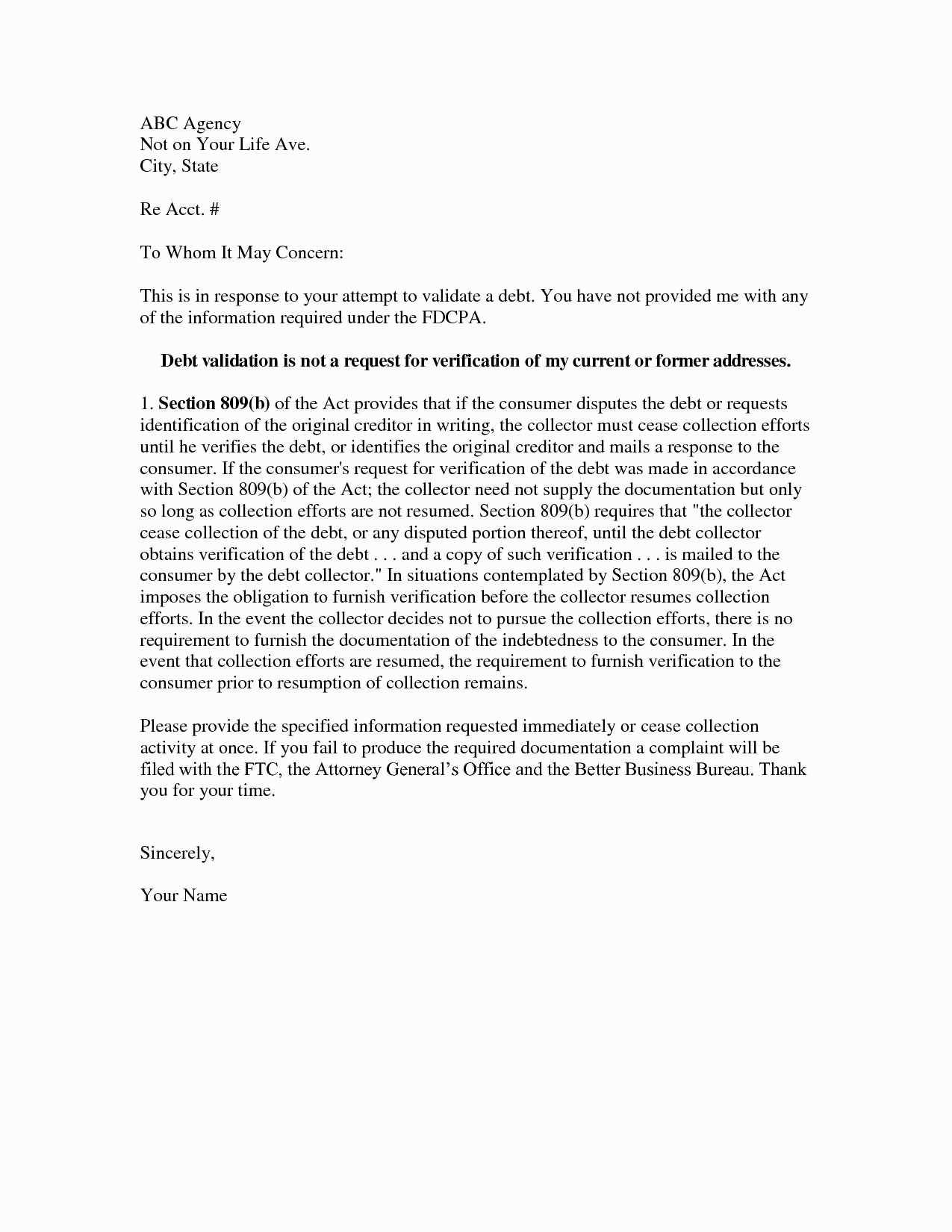

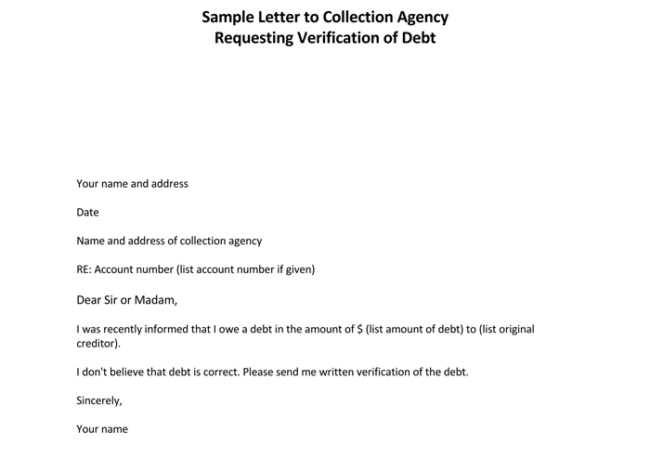

How to Write a Financial Verification Request

When questioning a financial claim, it is crucial to communicate your doubts formally and clearly. Writing a precise and professional request for proof ensures that the collector or creditor provides necessary documentation to support their demand. A well-structured inquiry helps you maintain control over the situation and protect your financial rights.

Begin by addressing the creditor or collector with a formal greeting, stating your intent to verify the amount in question. Be sure to include relevant details, such as the account number or any reference numbers related to the claim. Politely ask for specific evidence, such as original contracts, statements, or any other documents that confirm the legitimacy of the charge.

Finish the request with a clear closing, reiterating your request for confirmation and stating your willingness to cooperate. Keeping the tone respectful and professional is essential for ensuring a smooth process. Always send the request via a method that allows you to confirm receipt, such as certified mail or email with a read receipt.

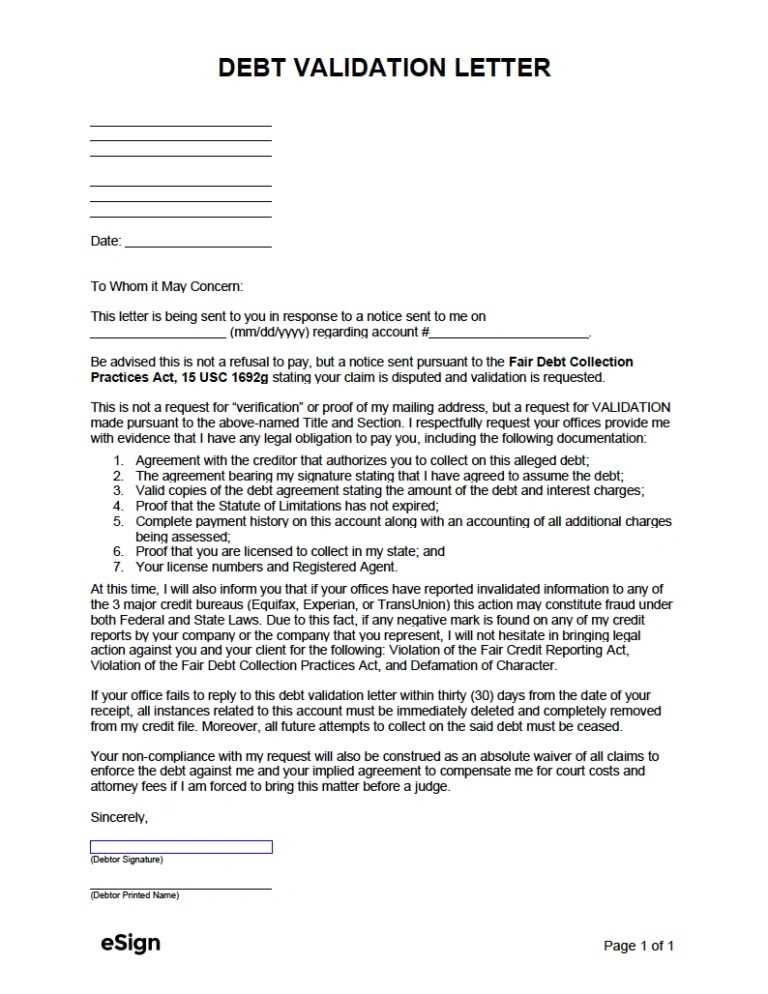

Key Components to Include in the Letter

When drafting a formal request for proof of a financial obligation, it’s important to ensure that all necessary information is included to facilitate a prompt and accurate response. A well-constructed document will help you effectively communicate your request while ensuring that the recipient understands what is being asked.

Essential details should be at the forefront, such as your personal information (name, address, and contact details) and the account or reference number associated with the claim. These details help the creditor or collector locate your file quickly.

Request for documentation should be clearly stated, specifying what evidence you need to review the claim. This may include a signed agreement, a statement, or any other proof that supports the legitimacy of the obligation.

Timeline for response is also crucial. Be sure to mention a reasonable deadline by which you expect to receive the requested information. This demonstrates that you are serious about the process and helps set clear expectations.

Lastly, it’s important to maintain a professional tone throughout the correspondence, ensuring that your request is respectful and concise. This will encourage a more cooperative response from the creditor or collector.

Free Template for Financial Disputes

If you find yourself questioning the legitimacy of a financial charge, having a clear and concise document to communicate your concerns can make all the difference. Using a structured format allows you to formally request proof, ensuring that your rights are protected while the matter is resolved. Below is a basic guide for creating your own request for verification.

Here are the key elements to include when drafting your request:

- Your Contact Information: Full name, address, phone number, and email.

- Account Details: Include the reference or account number linked to the claim.

- Clear Statement of Dispute: Politely inform the recipient that you are disputing the charge and need further verification.

- Request for Proof: Ask for documentation such as a signed agreement or original invoice to substantiate the claim.

- Timeline for Response: State a reasonable deadline for receiving the requested information.

Once your document is drafted, be sure to send it through a verifiable method, such as certified mail, to ensure that it is received and acknowledged. This proactive step ensures that you are taking control of the situation while maintaining a professional approach throughout the dispute process.

How to Customize the Template Effectively

When crafting a formal request to contest a financial claim, tailoring the document to suit your specific case is crucial. A generic approach may not address all the details necessary to resolve the issue effectively. Customizing the structure with relevant information ensures clarity and facilitates the verification process.

Step-by-Step Customization Process

Follow these steps to personalize the document properly:

| Step | Action |

|---|---|

| 1 | Include your complete contact details, including name, address, and phone number. |

| 2 | Provide the reference number or account details to ensure the creditor identifies your file quickly. |

| 3 | State the reason for the dispute in clear terms, ensuring the recipient understands your concerns. |

| 4 | Make a specific request for the documentation or evidence required to verify the claim. |

| 5 | Set a deadline for a response to maintain urgency and facilitate a timely resolution. |

Final Tips for Personalization

Ensure that the tone remains professional and respectful. Avoid using threatening language or making accusations. Clearly state that your request is for clarification, and that you are committed to resolving the issue amicably. This approach will encourage cooperation from the recipient and help streamline the process.