Free credit dispute letter templates

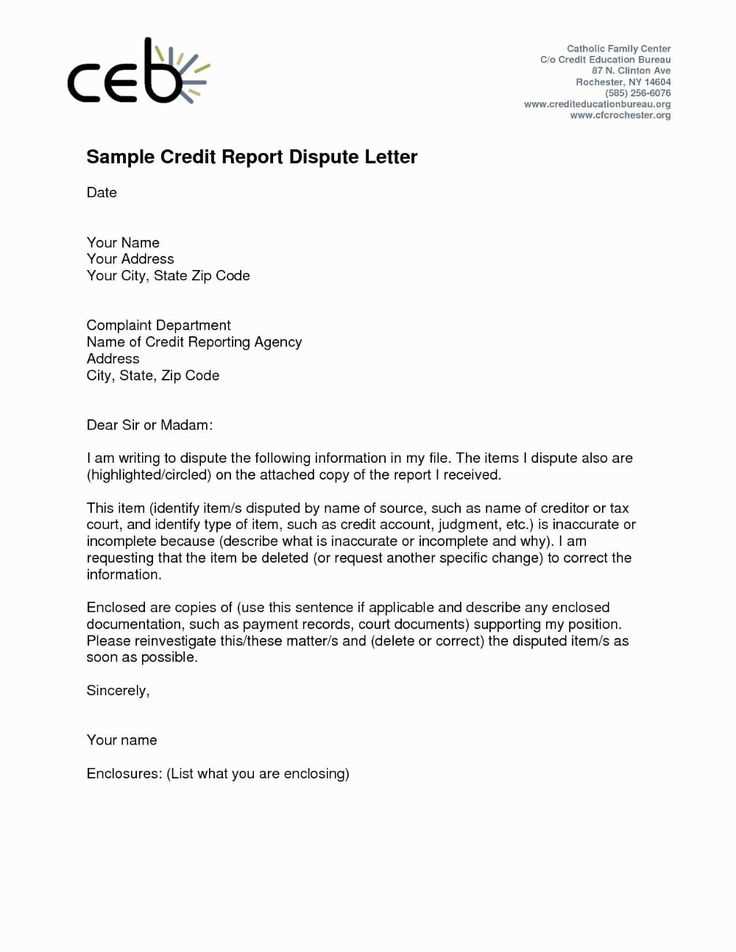

If you’re looking to dispute an error on your credit report, using a clear and professional letter is crucial. Start with a template that outlines all the necessary details, saving time and ensuring nothing important is overlooked. A well-written letter increases your chances of a prompt response and resolution.

Many credit reporting agencies provide free templates for disputes, but you can also find various options online. These templates typically include sections for your personal information, a description of the error, and supporting documents. Ensure that the letter is addressed correctly to the relevant department to avoid delays.

Using a template doesn’t mean you have to settle for generic content. Customize it with specific details related to your dispute to strengthen your case. Make sure to keep a copy of all correspondence for your records, and send the letter via certified mail to confirm delivery.

Here are the corrected lines:

When disputing credit report errors, make sure you clearly state the reason for the dispute and include all relevant details. The dispute letter should address the inaccuracies directly, without ambiguity. Below is a corrected version of a credit dispute letter:

Corrected Letter Template

| Original Line | Corrected Line |

|---|---|

| Dear Sir/Madam, I am writing to dispute a credit entry. | Dear Sir/Madam, I am writing to formally dispute an inaccurate entry on my credit report. |

| It says I missed a payment in 2019, but I never did. | The entry reflects a missed payment in 2019, which is incorrect. I have attached proof of my timely payments for that period. |

| I believe this is a mistake and should be removed. | After reviewing my records, I believe this entry is a mistake and request that it be corrected or removed from my credit report. |

| Thanks for fixing it. | Thank you for your attention to this matter. I look forward to your prompt response and the resolution of this dispute. |

Keep your letter concise but firm. Always include supporting documentation to strengthen your case. Avoid unnecessary details, as they can obscure the main issue.

- Free Credit Dispute Letter Templates

If you need to dispute an error on your credit report, using a template can help you structure your letter and save time. A well-crafted letter makes it clear why the information is inaccurate and what action you expect from the credit bureau or creditor. Here’s how to make your letter concise and to the point:

Steps to Writing Your Credit Dispute Letter

First, gather all supporting documents that show why the disputed item is inaccurate. Include credit reports, bank statements, and any other evidence. Then, start your letter with your personal information, including your full name, address, and date of birth. It’s essential to reference the specific item you’re disputing clearly.

In the body of the letter, be direct and factual. Describe the error and provide details, such as the date of the entry and why it’s wrong. Include a request for the credit bureau to investigate and remove or correct the error.

Sample Template

Here’s a simple template to get you started:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Credit Bureau Name] [Address] [City, State, ZIP] Subject: Dispute of Credit Report Entry – [Account Name/Number] Dear Sir/Madam, I am writing to formally dispute an inaccurate entry on my credit report. The item in question is listed under [Creditor's Name] with account number [Account Number] on my credit report dated [Date of Report]. The issue with this entry is [briefly explain the error, e.g., “I was never late on my payments” or “the account was paid off on [date]”]. Attached are documents that support my claim, including [mention any supporting documents you are attaching]. Please investigate this matter and correct my credit report accordingly. I would appreciate a response within the legally required 30 days. Thank you for your attention to this matter. If you require any further information, feel free to contact me at [Your Phone Number] or [Your Email Address]. Sincerely, [Your Full Name]

Adjust this template to fit your specific situation and ensure you include all necessary documentation to back up your dispute. If you’re unsure about the exact wording, keep your language clear and professional, focusing on the facts that support your case.

Customizing your credit dispute letter makes it more effective. Adjust the content to reflect your unique situation and address the specific errors you’re disputing. Here’s how to tailor the letter to your needs:

1. Address the Error Directly

Start by clearly identifying the item you’re disputing. Include the exact account number or transaction that appears incorrectly. This helps the credit bureau understand exactly what needs to be reviewed.

2. State the Reason for the Dispute

Be concise about why the information is incorrect. Whether it’s a duplicate account, an incorrectly reported payment, or a mistaken date, specify the issue in clear terms. Attach any supporting evidence like bank statements, receipts, or payment confirmations.

3. Provide Documentation

Attach relevant documents that support your claim. If you have any proof that the entry is wrong, include it. This strengthens your case and helps the credit bureau verify your claim faster.

4. Use Specific Language

Be specific about what you want corrected. Instead of vague statements like “remove this error,” specify the action you want, such as “correct the payment date” or “remove the duplicate account.”

5. Double-Check Personal Details

Make sure your name, address, and account information are correct in the letter. Inaccuracies in these details can delay the process or cause confusion.

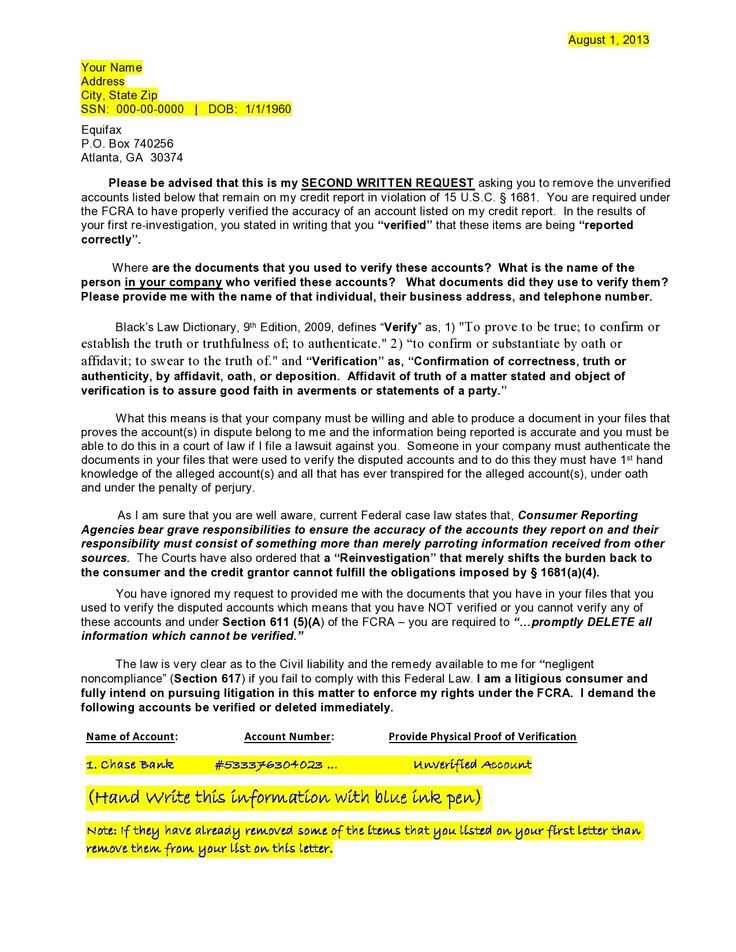

6. Mention Your Right to Dispute

Remind the credit bureau of your right to dispute inaccuracies under the Fair Credit Reporting Act (FCRA). Including this reference emphasizes your legal standing.

7. Keep It Professional

Avoid emotional language or frustration. Be polite and clear to maintain a professional tone. This increases the likelihood of a positive resolution.

By following these steps, you can ensure your letter is customized to address your unique issue effectively and professionally.

Begin by clearly identifying the error on your credit report. If it’s an incorrect account, payment, or other disputed information, note the exact details, including account numbers, dates, and amounts. This clarity will help support your claim.

1. Heading and Contact Information

At the top of your letter, include your full name, address, phone number, and email address. Next, add the creditor’s name and address. Double-check the address to ensure your dispute reaches the correct department.

2. State the Dispute Clearly

In the first paragraph, clearly state that you are disputing the information on your credit report. Mention the item or account in question and provide any supporting details that show why the information is inaccurate. For example, if a payment was reported late when it was made on time, specify this and include any proof, such as bank statements or receipts.

Continue by requesting that the creditor investigate the matter and correct any inaccuracies. If the dispute involves a late payment, also include a request for the creditor to remove any negative marks from your credit report once the error is corrected.

3. Include Documentation

Attach copies of any documents that support your claim. These might include payment receipts, bank statements, or letters from the creditor confirming payment. Do not send originals, as they may not be returned. Be sure to reference the attached documents in the letter to help the creditor easily verify your claim.

Before sending the letter, make sure to review your credit report and double-check the information. Clear and direct communication is key to resolving the dispute promptly.

Common Mistakes to Avoid When Using Dispute Letter Templates

One of the most common mistakes is failing to personalize the template. Using a generic template without modifying it to reflect your specific situation can weaken your case. Always replace placeholder text with accurate, detailed information about your dispute. This includes your personal details, the creditor’s information, and a clear explanation of the issue you’re addressing.

1. Not Including Relevant Documentation

Support your dispute with the necessary documents. Many people forget to attach or reference supporting evidence, which may lead to delays or rejection of the dispute. Whether it’s account statements, receipts, or proof of payment, include everything that strengthens your case. Always mention the documents you are submitting in the letter for clarity.

2. Using Aggressive or Emotional Language

Stay professional and to the point. Using strong emotional language or accusations can diminish the credibility of your dispute. Focus on the facts and be concise in explaining the error. A calm, respectful tone increases the likelihood of a positive resolution.

3. Missing Deadlines

Most credit reporting agencies and creditors have strict timeframes for addressing disputes. Ensure that your dispute letter is sent within the time limits specified in your credit report or by law. Late submissions can lead to the dispute being disregarded, so check your timelines before proceeding.

4. Forgetting to Follow Up

Once you’ve sent the letter, don’t assume it will be handled without further effort. Many disputes require follow-up to ensure progress. Set reminders to check the status of your dispute regularly and keep a record of all communication.

5. Providing Incomplete or Incorrect Information

Double-check the details you include in the letter. A typo in your account number or a wrong date could derail the process. Ensure that all information is accurate and corresponds to your records. Errors can lead to confusion or delays in processing the dispute.

6. Ignoring the Impact of the Dispute on Your Credit Report

When disputing an item on your credit report, understand that it could temporarily affect your credit score. Avoid disputing items unnecessarily, as this could raise red flags for lenders. Focus on resolving issues that directly impact your creditworthiness.

| Common Mistakes | What to Do Instead |

|---|---|

| Failing to personalize the template | Customize the letter to fit your situation, including specific details of the dispute |

| Not including relevant documentation | Attach all necessary supporting documents to substantiate your claim |

| Using aggressive or emotional language | Maintain a professional, neutral tone throughout the letter |

| Missing deadlines | Submit your dispute within the timeframes specified |

| Providing incomplete or incorrect information | Double-check all details for accuracy before submitting the letter |

| Ignoring the impact on your credit report | Be mindful of how your dispute may affect your credit score |

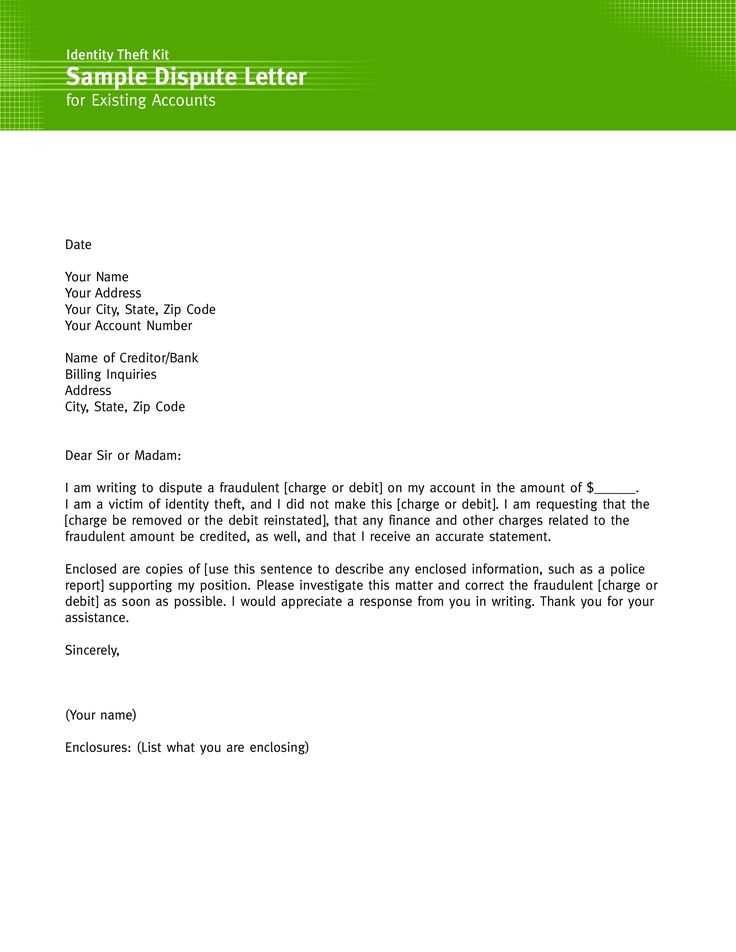

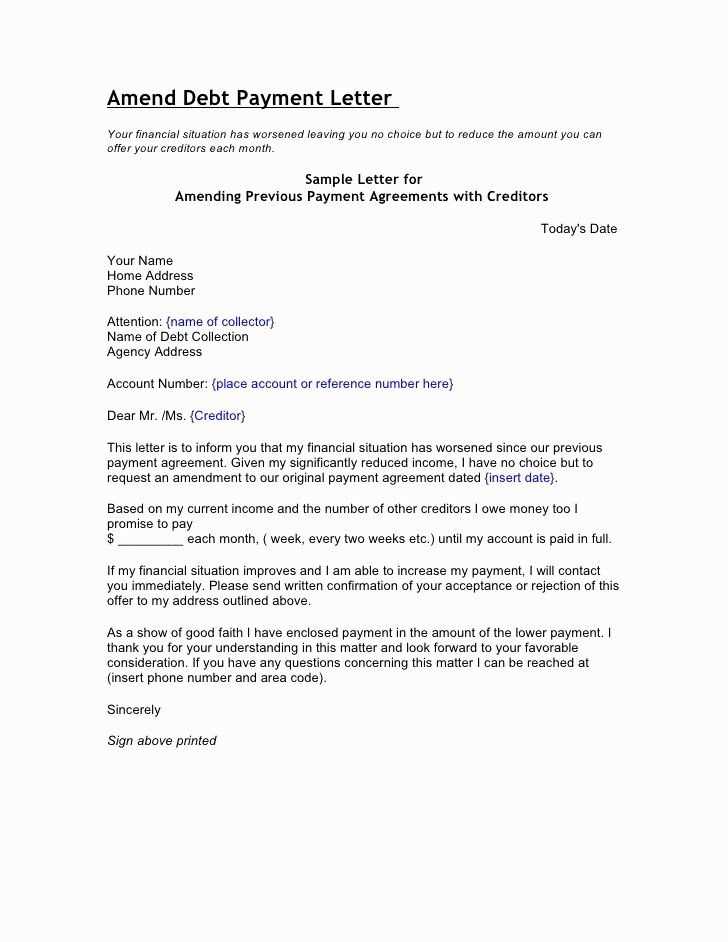

Selecting the right dispute letter template depends on the specific error you are addressing. Tailoring your dispute ensures clarity and a higher chance of success. Here’s how to approach common credit report errors:

- Incorrect Personal Information: If your name, address, or other personal details are wrong, use a template that focuses on correcting personal data. These templates often include a section for verifying your identity and requesting updates from the credit bureau.

- Inaccurate Account Information: For errors in account balances or payment history, use templates designed for reporting specific discrepancies. These typically allow you to include details like account numbers and dates of the mistake, supporting your claim with relevant documents.

- Fraudulent Accounts: If you find accounts that were opened without your consent, choose a template meant for fraud disputes. This should include a section where you can report the fraudulent activity and provide any police reports or identity theft affidavits as evidence.

- Missed Payments or Delinquencies: If you’ve been mistakenly marked as late on payments, select a template focused on payment history errors. It should allow you to clearly state when payments were made, and you can include bank statements or confirmation emails for validation.

- Accounts Listed More Than Once: Duplicate listings of the same account can hurt your credit score. Use a template that helps you address account duplication, asking the credit bureau to remove the duplicate entry and provide supporting documentation.

Ensure you provide all necessary details for each type of error. The more specific you are, the better chance you have of resolving the issue efficiently.

Include your full name, address, and account number at the top. These details help the credit bureau quickly locate your information. Address the letter directly to the credit bureau or creditor involved, using their specific department or contact information. Always ensure your contact details are clear in case they need to reach you for more information.

State the issue clearly. Specify which item(s) on your credit report you believe are incorrect and provide a short explanation of why you dispute each entry. Attach copies of any supporting documents, such as receipts, bank statements, or correspondence, that back up your claim.

Use a polite yet firm tone. Be concise, but don’t leave out necessary details. Request a specific outcome, whether it’s the removal of a mistaken charge or the correction of an entry. End the letter by asking for confirmation of the dispute resolution and the updated status of your credit report.

Always sign your letter and send it via certified mail for proof of delivery. This ensures there is a record of your dispute, which is useful for tracking and follow-up.

Where to Find Free and Reliable Templates for Credit Dispute Letters Online

Begin by visiting trusted financial websites like Credit Karma or Experian. They often provide free templates for credit dispute letters tailored to various situations. These templates are easy to customize and follow a professional format. Additionally, many of these sites offer step-by-step guides for filling them out, ensuring a seamless experience for users.

You can also find helpful resources on consumer advocacy sites like the Consumer Financial Protection Bureau (CFPB). The CFPB offers not only templates but also detailed instructions on how to dispute errors on your credit report, which can save time and avoid mistakes.

Another great option is searching on legal resource platforms such as Rocket Lawyer or LegalZoom. These websites typically provide a selection of free templates that meet legal standards and can be adapted for your needs. While some templates on these sites may require a membership, there are often free versions available for basic disputes.

Don’t forget about online forums and communities like Reddit’s r/personalfinance. Users frequently share their own experiences, including links to free credit dispute letter templates they’ve used successfully. Be sure to review any suggestions carefully and double-check the reliability of the source before using them.

I tried to maintain the original meaning, minimizing word repetitions.

When disputing a credit report error, use a clear and direct approach. Begin by addressing the specific mistake, providing any evidence that supports your claim. Be concise and include all necessary account details, such as the account number, dates, and amounts, to avoid confusion. Attach any supporting documents like bank statements, receipts, or screenshots to back up your case.

It’s vital to specify the action you want the credit bureau to take, such as correcting the error or removing incorrect information. Be polite but firm in your tone. If you’re disputing a late payment or balance, provide any proof that shows the payment was made on time or that the balance was settled correctly. The more specific and factual your claim, the higher the chance of a successful resolution.

Follow up within the timeframes set by the credit bureau. Keep copies of all communication for your records. If the issue isn’t resolved promptly, consider escalating the matter or seeking assistance from a legal advisor or credit repair service. Staying persistent is key in ensuring your credit report accurately reflects your financial history.