Free credit report dispute letter template

If you notice inaccuracies on your credit report, take immediate action by sending a well-crafted dispute letter. A dispute letter challenges any incorrect or outdated information listed under your name. The sooner you address these issues, the faster your credit score can improve. Below is a simple template to guide you in drafting a letter that is clear, direct, and effective in resolving discrepancies.

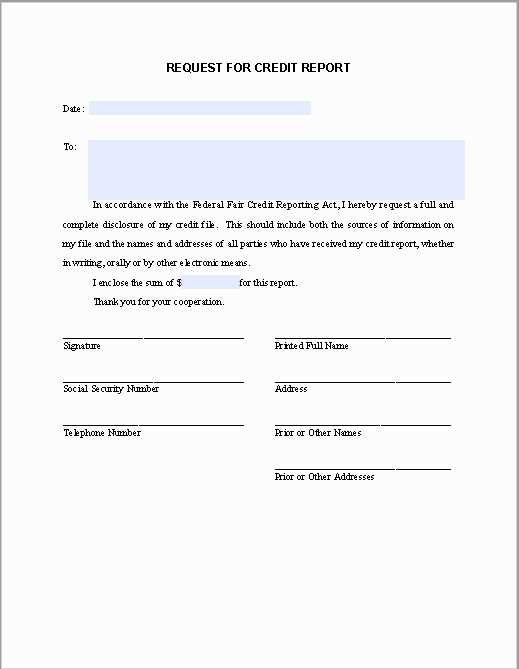

Dispute Letter Template

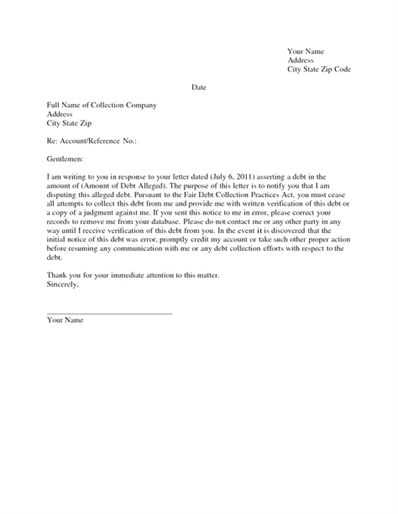

Start with your personal details, including your name, address, and contact information. Then, reference the specific account or items you’re disputing. Be precise about what is inaccurate and provide supporting evidence such as account statements or payment records. Attach any relevant documents to ensure the recipient has everything needed to investigate the claim.

Next, state clearly what you expect as a resolution, such as correction or removal of the disputed item. Request a confirmation of receipt of your letter, and be sure to mention a timeline for when you expect a response. Maintain a professional and polite tone throughout the letter. It’s also wise to send the letter via certified mail so you have proof of delivery.

Disputing errors on your credit report can be straightforward when you follow these steps. Using a well-structured letter template ensures that you cover all necessary details while keeping the process organized and efficient.

Here is the updated version with minimized repetition:

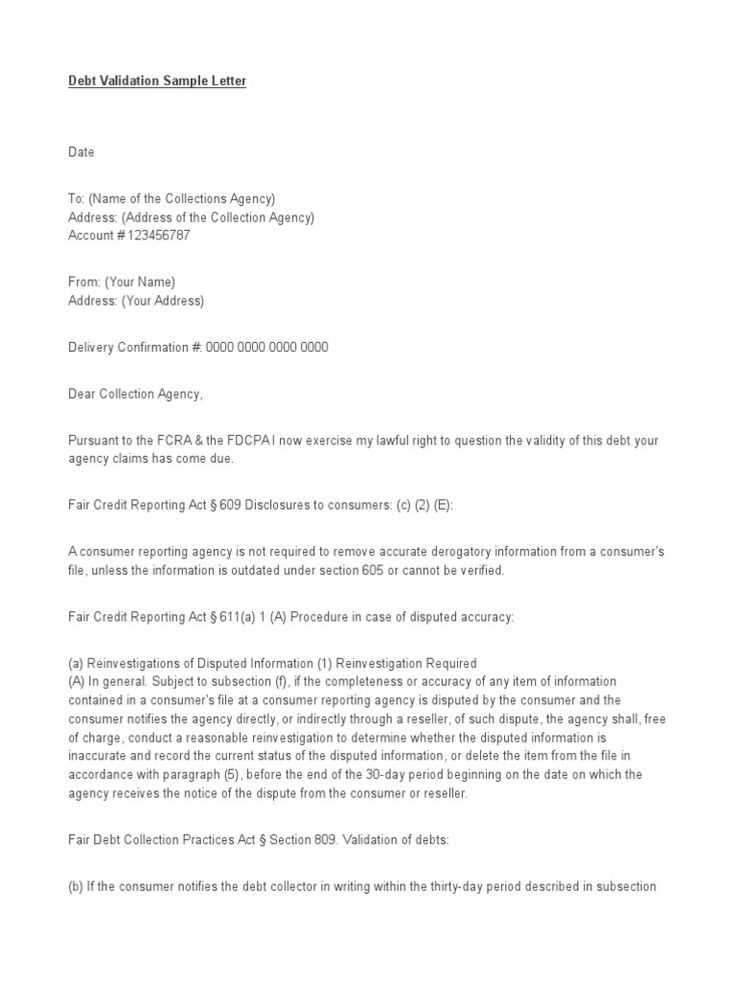

Begin by clearly stating the error you’ve identified on your credit report. Reference the specific entry and provide any supporting documents, such as receipts or statements, that confirm the error. Be concise, but ensure all the relevant details are included to help expedite the review process.

Next, explain the nature of the dispute. If it’s a case of mistaken identity, fraud, or incorrect data, specify this in your letter. The more detailed your explanation, the easier it will be for the credit reporting agency to investigate.

Key Points to Include:

- Your full name, address, and account number.

- The exact error on the report with a description of why it’s wrong.

- Any documentation or proof supporting your claim, such as invoices, contracts, or bank statements.

- A request for a correction or deletion of the incorrect information.

- A polite request for confirmation once the issue is resolved.

Make sure to send your dispute letter to the right address, as listed on the credit report, to ensure it’s processed correctly. Keep a copy of the letter and all related correspondence for your records.

Follow-up Actions:

- Track the progress of your dispute. Most agencies allow you to check the status online.

- If you don’t receive a response within 30 days, send a follow-up letter referencing the original dispute.

By clearly communicating the issue and providing supporting evidence, you help the credit reporting agency understand your dispute and resolve it more efficiently.

- Free Credit Report Dispute Letter Template

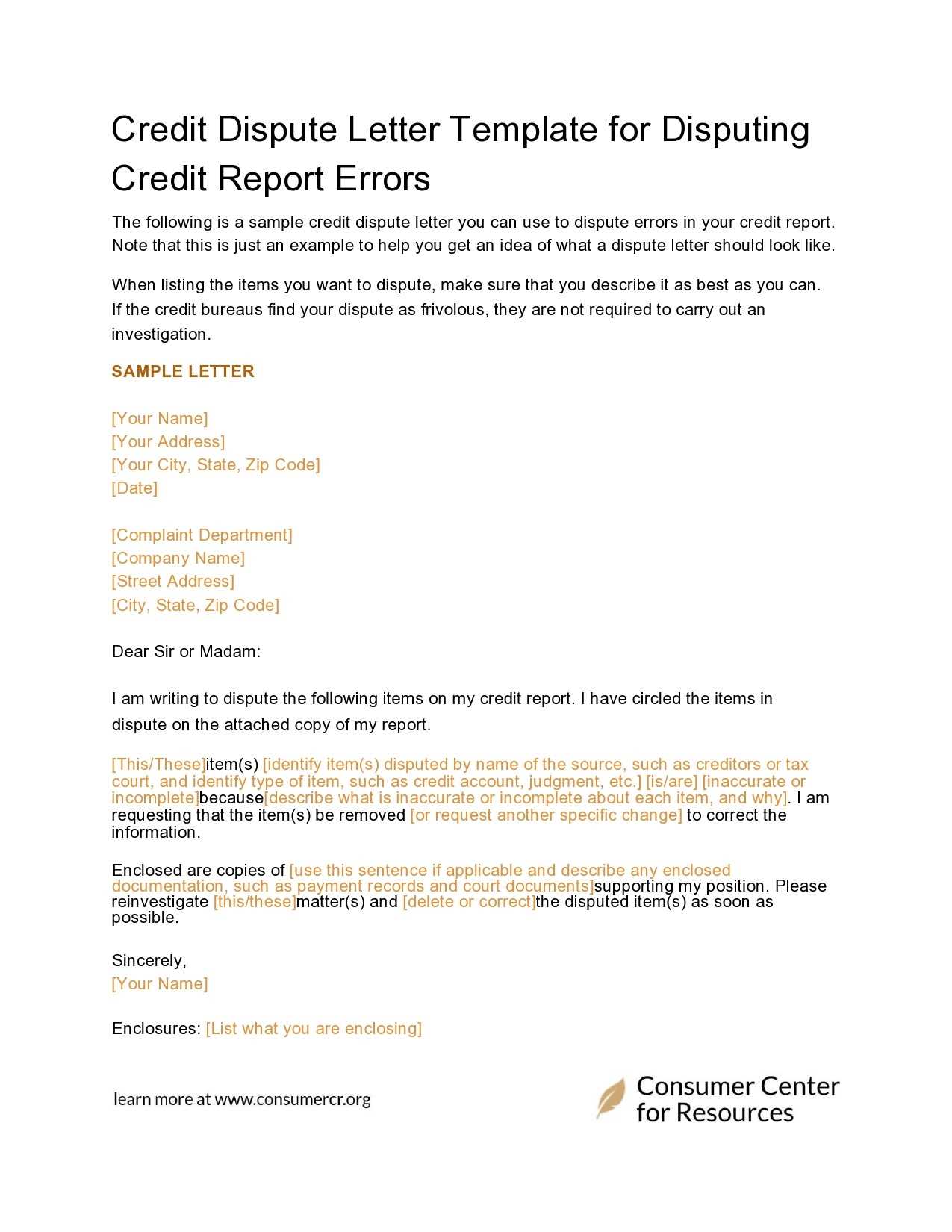

To dispute an error on your credit report, use the following template as a guide. This letter format is clear and concise, providing all necessary details for a successful dispute. Customize it with your information, and send it to the credit bureau handling your case. Ensure you include all required documents for better clarity and faster processing.

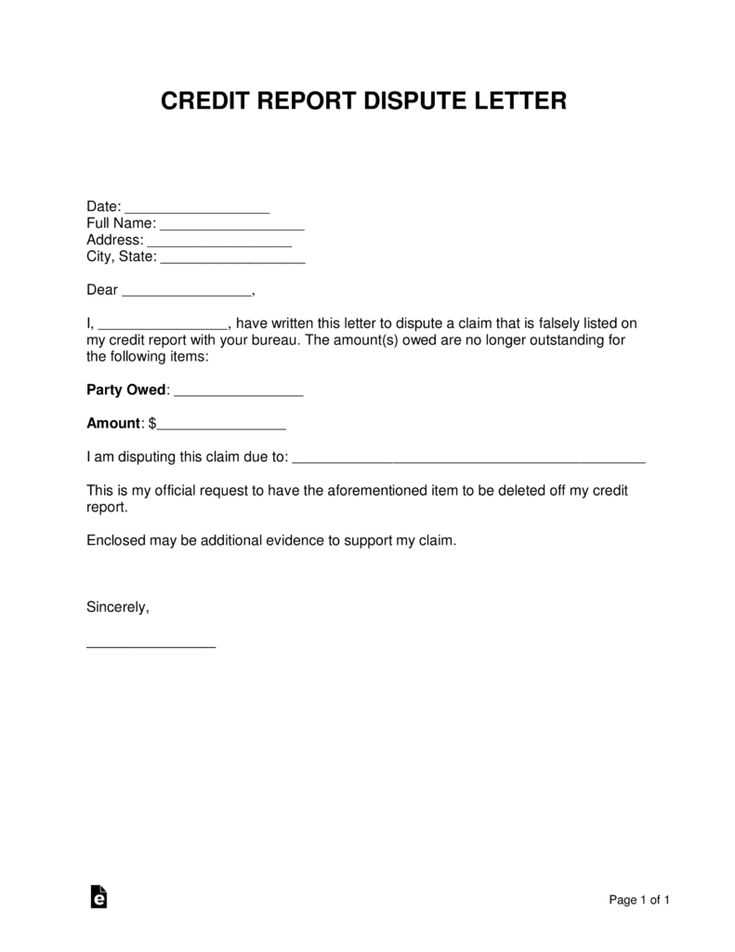

Template:

Your Name

Your Address

City, State, ZIP Code

Phone Number

Email Address

Date

Credit Bureau Name

Address

City, State, ZIP Code

Dear Sir/Madam,

I am writing to dispute an item in my credit report. I have reviewed my credit file, and I believe the following entry is incorrect:

Disputed Item:

[Name of Creditor] – [Account Number]

[Description of the error, such as late payments or incorrect balance]

According to the Fair Credit Reporting Act, I request that you investigate this issue and remove the inaccurate entry from my report. Enclosed are supporting documents to validate my claim, including [e.g., bank statements, payment confirmation letters, or other evidence].

Kindly update me with the results of your investigation. If you require additional information, please do not hesitate to contact me at the number or email provided above.

Sincerely,

Your Name

Tips for Submitting the Dispute:

- Include a copy of your credit report with the disputed item highlighted.

- Attach any supporting documentation that proves the error, such as receipts or transaction records.

- Send the letter via certified mail for confirmation that it was received.

Review your credit report thoroughly by checking all the details. Look at the personal information section, such as your name, address, and Social Security number, to ensure everything is accurate. If there’s a mistake, it can affect your credit score. Pay close attention to your account details, including credit card balances, loans, and payment history. Compare them with your receipts or bank statements to spot discrepancies.

Examine the section with credit inquiries. Sometimes, unauthorized inquiries can appear if someone applied for credit in your name. Make sure that all the inquiries are legitimate and authorized by you.

If you notice any accounts that you don’t recognize, or any late payments listed on accounts that were paid on time, these are red flags. Mark those items for further investigation.

Also, be alert for duplicate accounts or accounts that you’ve closed but still appear as active. These types of errors can distort your creditworthiness.

Lastly, review your credit limits and balances. An incorrectly reported balance or limit can impact your credit utilization ratio, which influences your credit score.

1. Gather Your Documentation

Before writing your dispute letter, collect all the relevant documents that support your claim. This includes your credit report, any supporting evidence, and details about the item you’re disputing. Ensure that you have accurate records of any payments or transactions related to the disputed entry.

2. Identify the Errors

Clearly identify the specific information in your credit report that is incorrect. Be concise and accurate, noting the account number and the nature of the error. For example, if an account shows an incorrect payment history, include the correct dates and amounts to show the discrepancy.

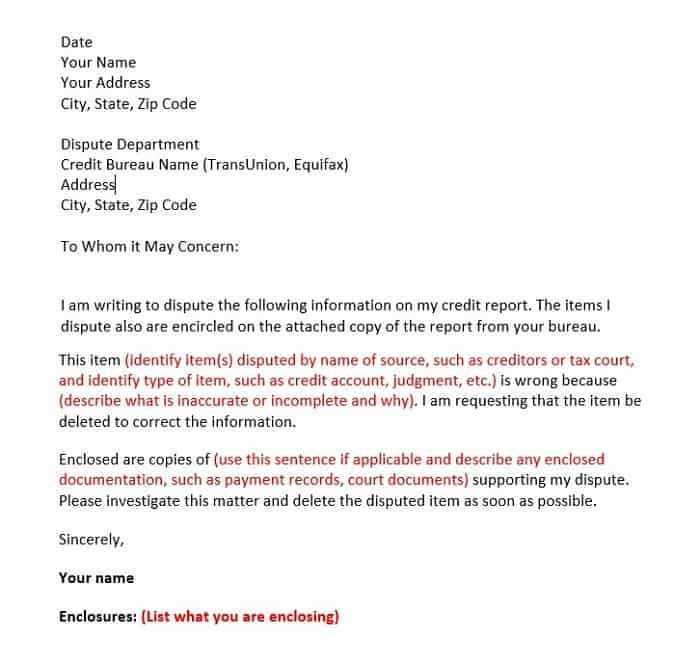

3. Address the Credit Bureau

Direct your letter to the credit bureau that provided the inaccurate report. Use their official address, which can be found on their website or the credit report itself. Make sure your contact information is included to ensure they can reach you if needed.

4. Clearly State the Dispute

Write a direct and clear statement that you are disputing the specific item. Include why you believe the information is incorrect and reference any supporting documentation that proves your case. Stay focused and professional–avoid unnecessary details.

5. Request a Resolution

Politely request that the incorrect information be corrected or removed from your credit report. You can also ask for a confirmation that the dispute has been resolved once they review your case.

6. Sign and Send Your Letter

After reviewing your letter for accuracy and clarity, sign it. Make sure to send the letter via certified mail or another trackable method, so you have proof of delivery.

7. Follow Up

If you don’t receive a response within 30 days, follow up with the credit bureau. Keep all communication records, including dates and responses, for your reference.

Include the following details in your dispute letter for clarity and accuracy:

| Information | Details |

|---|---|

| Your Full Name | Clearly state your full name as it appears on your credit report. |

| Address | Provide your current address, ensuring the credit bureau can easily reach you. |

| Social Security Number (SSN) | Include the last four digits of your SSN for identity verification. |

| Report Information | Reference the specific item(s) in question, including account numbers and dates. |

| Dispute Reason | Explain clearly why the information is incorrect or inaccurate. |

| Requested Action | Specify what action you want the credit bureau to take (e.g., remove or correct the entry). |

| Supporting Documentation | Attach any evidence (e.g., receipts, statements) that supports your claim. |

By providing these details, you make it easier for the credit bureau to process your dispute efficiently.

One of the most common mistakes is failing to include accurate information about the disputed account. Ensure that you provide correct account numbers, dates, and any other relevant details. This helps the credit bureau identify the account quickly and accurately.

Another mistake is writing a vague or unclear explanation of the dispute. Be specific about what’s wrong. Whether it’s an incorrect payment status, a duplicate entry, or a reporting error, clearly outline the issue to avoid confusion.

Using an aggressive or emotional tone is also a frequent pitfall. Stick to the facts and maintain professionalism in your tone. Refrain from using accusatory language or threats. A calm, objective approach will help keep the process on track.

Don’t forget to include supporting documentation. Without proper evidence–like bank statements, receipts, or letters from creditors–your dispute might not be taken seriously. Always attach copies of relevant documents to strengthen your case.

Be careful with sending the letter to the wrong address. Verify the correct contact information for the credit bureau or creditor before submitting the dispute. If you’re unsure, double-check online or contact them directly.

Finally, avoid submitting the letter without tracking its delivery. Using certified mail or another form of tracked delivery ensures you have proof the letter was received and can follow up if necessary.

Send your dispute letter to the credit bureaus through certified mail. This ensures you have proof of delivery and protects you in case the bureau claims they never received it. Use the address provided on the credit report for each bureau: Equifax, Experian, and TransUnion. Include a return receipt request for confirmation.

If you file online, follow the instructions on each bureau’s website. You’ll be able to upload your documents directly, which speeds up the process. However, certified mail provides more security and a paper trail. Attach copies of your supporting documents, like bank statements or payment receipts, but keep the originals for yourself.

For added clarity, write your dispute in a clear, concise manner. Avoid using jargon, and state the specific errors you’re challenging. Reference the exact items from your credit report and provide any relevant details. Attach a copy of your credit report, marking the disputed items.

Once sent, follow up within 30 days. Keep track of all your communication with the bureaus, including certified mail receipts and responses, in case you need to escalate the issue or pursue further action.

If your dispute is rejected, don’t give up. Here’s what you can do next:

- Review the Rejection Explanation: Carefully read the reason provided for the rejection. Understanding why your dispute was denied helps identify the next steps.

- Gather More Evidence: If the rejection was due to insufficient evidence, collect supporting documents, such as bank statements, receipts, or contracts, that clearly back up your claim.

- Contact the Creditor Directly: Reach out to the creditor or lender involved. Discuss the issue with them and ask for clarification or additional documentation that may resolve the dispute.

- File a New Dispute: After addressing the rejection reason and obtaining new evidence, submit your dispute again with the updated information. Ensure your dispute is clear and well-supported.

- Consider Filing a Complaint: If the dispute is still unresolved, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your local consumer protection agency. This can help escalate the issue.

- Monitor Your Credit Report: After submitting a new dispute or taking action, regularly check your credit report to ensure the issue gets resolved.

Stay proactive and organized throughout the process to increase your chances of a successful dispute resolution.

Start by addressing the credit bureau directly. Specify your full name, address, and the credit report you are disputing. Include the date of the report and clearly mention the item(s) in question.

Detail the Discrepancy

Describe the inaccurate information, providing specific details that clarify why it’s incorrect. Attach supporting evidence, such as bank statements, receipts, or communication records, to back up your claim.

State the Desired Outcome

Clearly state what action you expect the credit bureau to take. Request the removal or correction of the inaccurate information. Be direct and firm in your request, ensuring the desired resolution is clear.