Free debt collection letter template

Use this simple debt collection letter template to professionally address overdue payments and maintain a respectful tone while asserting your rights. The template is designed to help you clearly communicate your intentions, encouraging timely payment without escalating the situation unnecessarily.

Begin by stating the outstanding amount and providing a clear due date. Be direct but polite–remind the recipient of their obligations and offer a final opportunity to settle the debt. It’s important to outline the consequences of non-payment, such as additional charges or the involvement of a collection agency.

Include a specific deadline for payment and provide clear instructions on how to pay, ensuring that the process is as straightforward as possible. Always express your willingness to discuss any concerns or payment arrangements, as this can often result in a quicker resolution.

By using this letter, you set a professional standard for communication, helping both parties avoid misunderstandings and complications. Use it as the first step in the process of debt recovery, while keeping your approach respectful and clear.

Here’s the revised version without repeated words:

To create a strong debt collection letter, use clear and direct language. Make sure each paragraph contains essential information only. Keep sentences concise, and avoid redundancy by removing unnecessary words. Provide specific details such as the amount owed, the due date, and any payment methods available. Address the reader respectfully while maintaining a firm tone. Ensure that the letter is easy to read, with no repeated phrases or jargon. Organize the content logically, with a clear opening, body, and closing statement.

Tips for Clarity

Focus on key details: who owes what, when, and how they can resolve the situation. Avoid over-explaining or adding extra context that doesn’t aid in conveying your message. Each paragraph should serve a clear purpose, keeping the letter focused and to the point. This approach helps ensure that the reader understands their obligation and the next steps without unnecessary distractions.

Be Direct, Yet Professional

Avoid using overly casual language or making threats. A direct, professional tone conveys authority and respect. The goal is to encourage payment, not to alienate the reader. Be polite but firm, and maintain a straightforward approach throughout the letter.

- Free Debt Collection Letter Template

A debt collection letter should be clear and direct. Start by stating the exact amount owed and the due date for the payment. Include the original invoice number or account details for reference.

Structure of the Letter

Your letter should follow a simple, formal structure. Open with a polite yet firm reminder of the outstanding balance. Next, specify a payment deadline, which typically ranges from 7 to 14 days, depending on the situation. If the payment isn’t made by the deadline, mention any consequences, such as additional fees or legal actions.

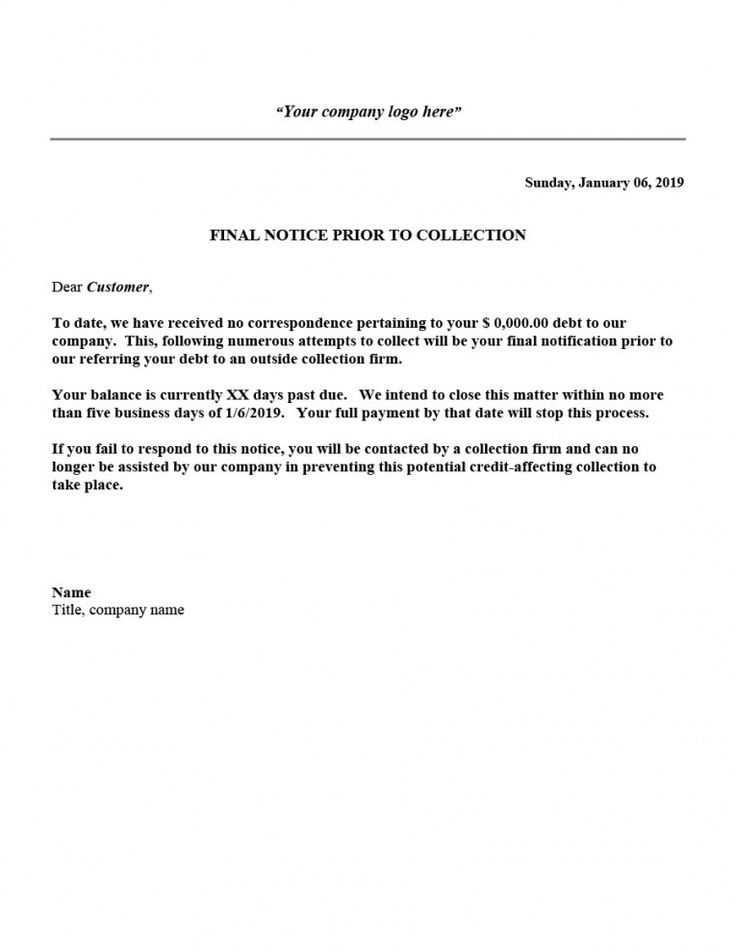

Sample Letter

Dear [Debtor’s Name],

We are writing to inform you that your account with [Your Company Name] is currently overdue. According to our records, the balance of [Amount Due] remains unpaid. The payment was due on [Due Date]. Please make arrangements to pay the amount in full by [New Deadline Date] to avoid further action.

If you have already made this payment, please disregard this notice. Otherwise, please contact us immediately to settle the outstanding balance or to discuss any concerns you may have regarding your payment.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

[Contact Information]

Begin the letter with a clear identification of the debt. Include the amount owed, the original creditor’s name, and any relevant account number or reference. This gives the reader an immediate understanding of the issue at hand.

Next, make sure to clearly state the payment terms. Specify the due date or the timeline within which the payment should be made. This helps avoid confusion and sets clear expectations for both parties.

Provide your contact information in a prominent location. This makes it easy for the recipient to reach out with any questions or concerns about the debt or the payment process. Ensure that your phone number, email address, and mailing address are easy to find.

Include a polite yet firm request for payment. Use a tone that conveys seriousness without being overly aggressive. Express the need for timely resolution, while maintaining professionalism throughout the letter.

Lastly, mention any potential consequences of non-payment. Whether it’s reporting to credit bureaus or legal action, make sure to clearly state the next steps should the debt remain unpaid. This adds a sense of urgency and encourages prompt action.

Tailor your collection letter depending on the debtor’s situation and the stage of the collection process. A one-size-fits-all approach will not be effective in every case.

For First-Time Debtors

When you’re sending a letter to someone who hasn’t paid their bill yet, use a polite and professional tone. Gently remind them of the amount due and include clear instructions on how to settle the debt. It’s best to show understanding but also express the importance of resolving the matter quickly. A brief payment deadline will encourage prompt action.

For Debtors with Ongoing Delays

If payments are consistently delayed, your tone should shift to one of urgency. Acknowledge the previous delays, but firmly request immediate payment or a proposed repayment plan. Clearly state the consequences of continued non-payment, such as added interest or potential legal action. Be firm, but still maintain a respectful tone.

For repeat offenders or those who are unresponsive, consider increasing the level of formality and detail. Clearly outline the history of their payments, any previous communication, and the outstanding balance. Ensure they understand the seriousness of the situation.

Specify a precise payment deadline in your debt collection letter. This avoids ambiguity and sets clear expectations. Make sure the date is reasonable, offering enough time for the debtor to respond, but not too long to delay payment unnecessarily. A typical deadline is 10-14 days from the date of the letter. Adjust this based on your circumstances.

Be Direct and Unambiguous

Use straightforward language, such as “Please make your payment by [insert date].” Avoid phrases like “soon” or “at your earliest convenience,” as these lack the urgency needed in a collection letter.

Offer Payment Options If Necessary

If you’re open to partial payments or installments, mention these options within the deadline. For example, “Please make the full payment by [date] or contact us to arrange a payment plan.” This gives the debtor a clear path to compliance without feeling overwhelmed.

What to Do if the Debtor Ignores Your Letter

If the debtor does not respond to your letter, take the following steps:

- Send a follow-up letter. Keep the tone firm but polite. Remind them of the amount owed and the due date. Clearly state that failure to pay will lead to further action.

- Consider calling the debtor. A direct conversation may encourage them to act, especially if they haven’t opened or read the letter. Keep the call professional and objective.

- Offer a payment plan. If the debtor claims financial difficulty, offering a manageable payment option could increase the chances of recovery.

- Seek legal advice. Consult a lawyer about your options. A lawyer can guide you on the next steps, including sending a formal legal notice or pursuing court action.

- Evaluate your collection options. If the debt remains unpaid, you may want to consider involving a collection agency or taking the debtor to small claims court.

Staying persistent and organized will increase the likelihood of getting your money back. Keep a record of all communications and actions taken throughout the process.

Clearly state the legal consequences of non-payment, including the possibility of legal action or reporting the debt to credit agencies. Make sure the language is firm yet respectful to avoid escalating the situation unnecessarily. Be specific about deadlines for payment or communication, and outline any legal steps that may be taken if the debt remains unpaid after the specified period.

Include relevant legal references or laws that pertain to the debt collection process. This may include citing the Fair Debt Collection Practices Act (FDCPA) if applicable. This helps both parties understand their rights and obligations in the situation.

If you plan to take further action, such as filing a lawsuit or hiring a collection agency, inform the debtor in a clear and straightforward manner. However, ensure your tone remains professional, as any aggressive language can have legal implications.

Be transparent about any fees or interest that may accrue due to late payments. These should align with any pre-existing agreements and be clearly outlined in the letter. Always check for compliance with state or national laws governing debt collection practices before including such fees.

Send a follow-up letter if there has been no response within 7-10 days after the initial communication. This timeframe shows you’re serious about resolving the matter without being too aggressive.

In your letter, be clear and concise. Start by gently reminding the recipient of the outstanding debt and the previous correspondence. Then, state the action you expect them to take next.

- Use a professional but firm tone.

- Reference specific details: amount owed, invoice number, and due date.

- Offer a resolution, such as payment options or a payment plan, if appropriate.

- Set a clear deadline for the next step or payment.

Example structure:

- Subject: Follow-up on Outstanding Debt [Invoice #12345]

- Dear [Recipient’s Name],

- We hope this message finds you well. We are following up regarding the outstanding balance of [amount] for [service/product], which was due on [due date].

- We kindly ask that you settle the payment by [new deadline]. Please refer to the original invoice [#12345] for payment details.

- If you need assistance with payment, don’t hesitate to contact us to discuss options.

- Thank you for your prompt attention to this matter.

- Best regards, [Your Name/Your Company]

Clearly state the terms of repayment, including the amount due and the due date. Be specific about the actions you’ll take if the debt remains unpaid, but avoid sounding threatening. Use a polite and firm tone to maintain a professional relationship.

Key Elements to Include:

| Element | Description |

|---|---|

| Amount Due | Include the exact balance owed, with any interest or fees added. |

| Due Date | State the exact deadline for payment. Be clear about any grace periods. |

| Consequences | Outline the next steps if payment is not received, such as legal action or reporting to credit agencies. |

Be concise, but don’t leave any room for misinterpretation. Keep the language simple and direct so that the recipient understands the situation without ambiguity.