Free debt dispute letter template

If you’re facing an incorrect debt listing on your credit report, writing a dispute letter is a critical first step in addressing the issue. A well-structured dispute letter can speed up the process of removing inaccurate or outdated information. Here’s a straightforward debt dispute letter template to help you get started.

First, make sure you clearly identify the debt in question, including the account number, the amount, and the creditor involved. Mention the specific error or discrepancy you’ve noticed, such as incorrect charges or a mistaken identity. Avoid using vague language–be as specific as possible to make your case stronger.

Next, state your request clearly. Whether you are asking for a correction or a full removal, the letter should outline your expectations. Attach any supporting documentation that can back up your claim, like bank statements or previous correspondence with the creditor. This will help the dispute process move forward more efficiently.

Finally, make sure to include a deadline for the creditor or reporting agency to respond. Typically, they have 30 days to investigate and resolve the issue. Keep a copy of your letter and any follow-up correspondence for your records.

With this template, you’ll be prepared to dispute any incorrect information on your credit report and work toward a resolution.

Here’s the revised version:

When disputing a debt, it’s critical to clearly state your position and provide accurate information. Use the following structure to ensure your letter is effective and well-organized:

- Begin with your details

Start by including your full name, address, and account number. This helps the recipient quickly identify your case and respond to it efficiently.

- State the debt in question

Specify the amount of the debt, the creditor, and any other relevant details (e.g., date the debt was incurred). This makes it clear what debt you are disputing.

- Express the dispute

Clearly state why you believe the debt is incorrect. Provide specific reasons, such as errors in billing, fraudulent charges, or mistaken identity.

- Provide supporting evidence

If possible, attach any documents that support your claim (e.g., payment receipts, account statements). This strengthens your position and gives the creditor a clearer picture of the situation.

- Request for resolution

Clearly outline what you expect from the creditor. For instance, request that the debt be corrected, or ask for further investigation into the issue.

- Set a timeline

Ask for a response within a specific time frame (e.g., 30 days). This shows that you’re serious and expect timely action.

- Close professionally

End the letter with a courteous closing, such as “Sincerely” or “Best regards,” followed by your name and contact information.

Make sure to keep a copy of your letter and any correspondence for your records. Always send the letter via a traceable method (e.g., certified mail) to ensure it is received.

- Free Debt Dispute Letter Template

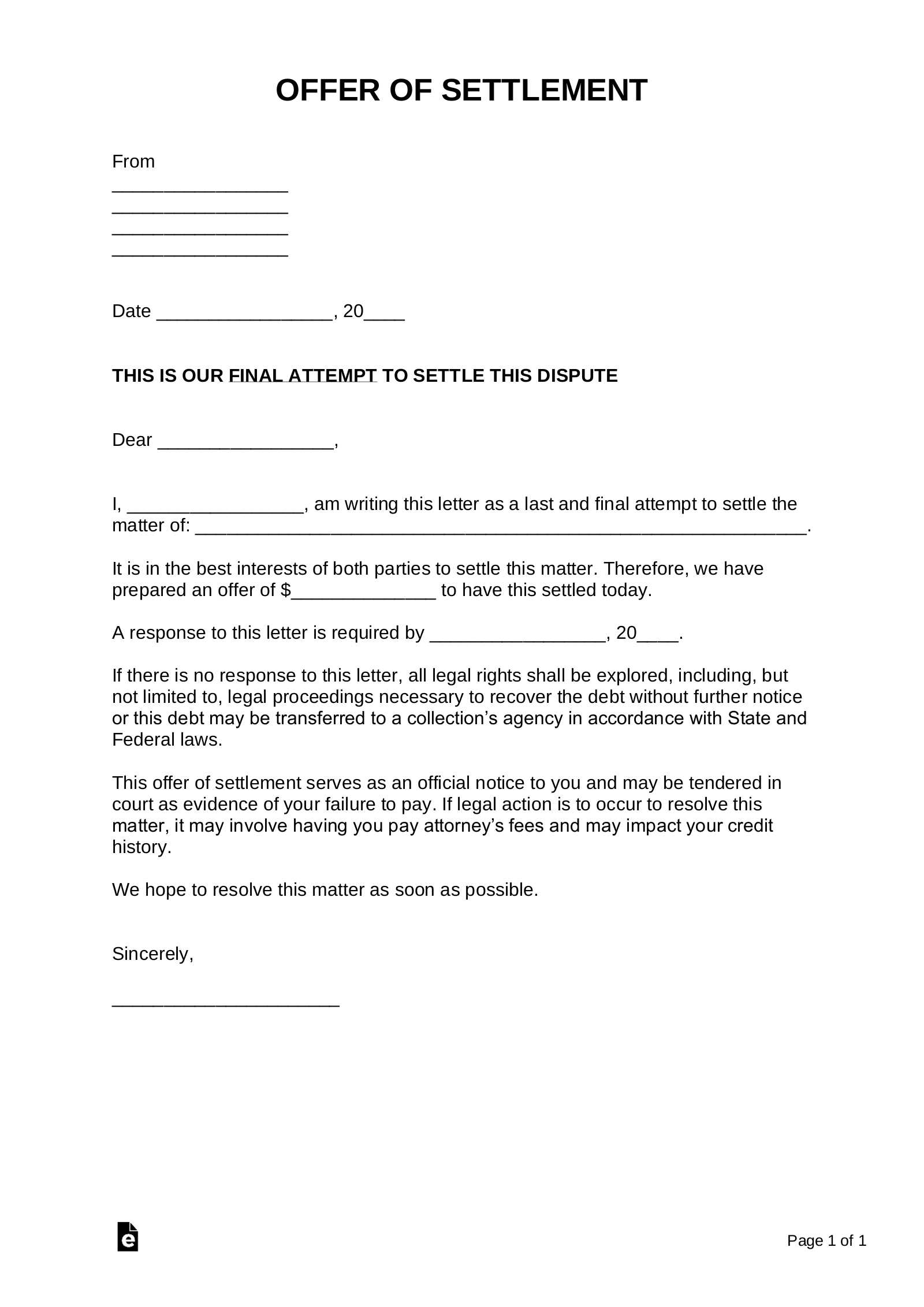

When disputing a debt, it’s crucial to address the issue in writing. A well-crafted debt dispute letter not only clarifies the misunderstanding but also serves as documentation for your records. Below is a straightforward template you can use for your debt dispute letter.

Debt Dispute Letter Template

Here’s an example of how to structure your letter:

- Your Name and Address:

[Your Name]

[Your Address Line 1]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

- Date:

[Insert Date] - Creditor’s Name and Address:

[Creditor’s Name]

[Creditor’s Address Line 1]

[City, State, ZIP Code]

- Subject: Debt Dispute

- Dear [Creditor’s Name or “To Whom It May Concern”],

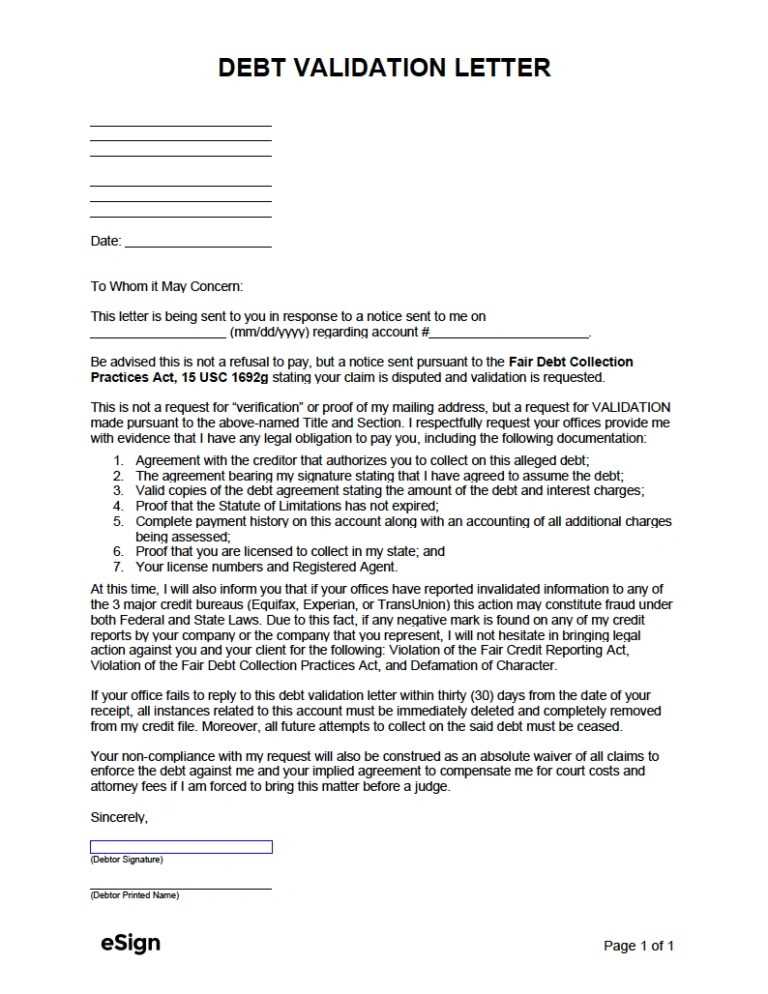

I’m writing to formally dispute the debt listed under account number [Account Number] for the amount of [Amount]. According to my records, I do not recognize this debt or believe the amount is correct. I kindly request verification of the debt as required under the Fair Debt Collection Practices Act (FDCPA). Please provide the following documentation:

- Evidence of the original debt agreement

- A complete payment history

- The name of the original creditor, if different

Until I receive this verification, I request that all collection efforts be suspended. If you cannot provide the requested documentation, I ask that you remove this debt from my credit report and cease any further collection actions.

Thank you for your attention to this matter. I look forward to resolving this dispute promptly.

Sincerely,

[Your Name]

Additional Tips

- Send the letter via certified mail to ensure delivery and retain a copy for your records.

- If possible, avoid admitting any liability for the debt in your dispute letter.

- Be clear, concise, and professional in your communication.

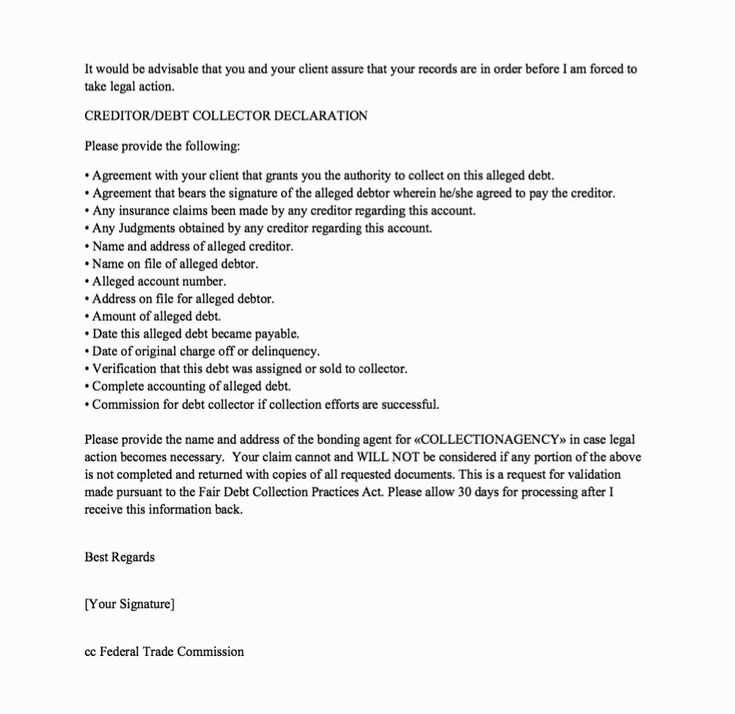

Begin by addressing the creditor or collection agency directly. Use the full legal name of the company or individual and ensure the correct mailing address. Double-check any account numbers or references that are relevant to your case.

Next, clearly state the reason for disputing the debt. Be specific about the error or misunderstanding. For example, if the debt is incorrectly attributed to you, provide the facts that demonstrate why you believe the debt is not yours. If you’ve already paid the debt, include proof, such as receipts or bank statements.

Incorporate any supporting documents that strengthen your case. Attach copies of relevant communication or records, such as previous letters, payments, or contracts. Make sure the documents are clear and legible, and only send copies, not originals.

State your desired outcome. Specify whether you want the debt marked as disputed on your credit report or request that the creditor provide further evidence of the debt. Keep your request clear and reasonable.

Finally, conclude by requesting a response within a certain timeframe, typically 30 days, and include a polite closing. Keep the tone professional but firm, ensuring your points are made without unnecessary emotion or ambiguity.

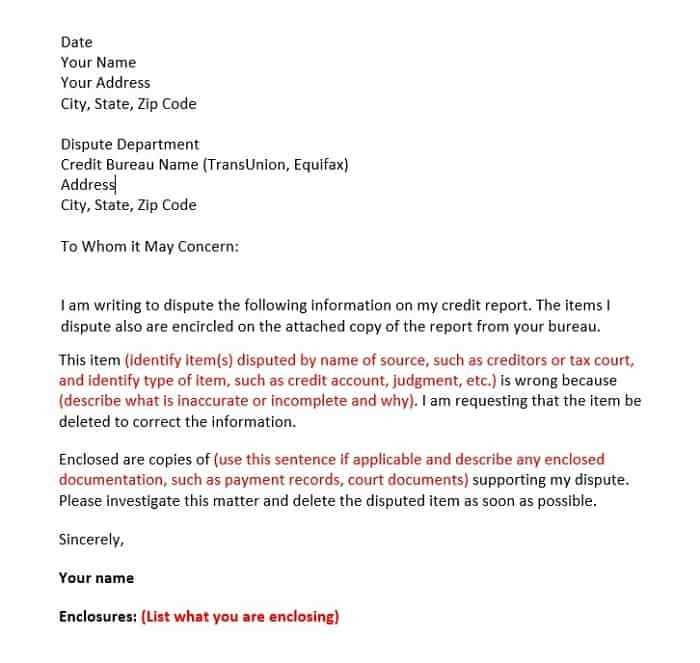

Clearly identify your contact information at the top of the letter. Include your full name, address, and phone number. This helps the creditor locate your account easily.

Next, specify the account in question by including the account number, reference number, and the name of the creditor or collection agency. Make sure the creditor knows exactly which debt you’re disputing.

State the reason for the dispute. Be direct about why you believe the debt is incorrect. Whether it’s an error in the amount, the date, or a claim that you never owed the debt, being clear will help clarify your position.

Request for verification. Ask the creditor to provide proof of the debt, including the original agreement or any relevant documentation. Without this, the claim remains unsubstantiated.

If applicable, provide supporting documents. This may include bank statements, receipts, or other paperwork that demonstrates the error. Attach copies, not originals, to avoid losing important documents.

Finally, outline your expectation. Whether you want the debt removed from your record or a correction made, state your preferred resolution clearly. This gives the creditor a clear understanding of what you seek.

Common Mistakes to Avoid When Writing a Dispute Letter

One common mistake is not being clear and specific about the issue you are disputing. Clearly identify the debt or charge in question, including the amount, date, and any relevant reference numbers. Avoid vague language that could confuse the recipient.

1. Using Unclear or General Language

When writing a dispute letter, precision is key. Avoid broad statements like “there’s an error in my bill” or “this debt isn’t mine.” Specify the exact nature of the dispute, such as “the bill I received on [date] includes an incorrect charge of [$amount].” This will help the reader understand your concern without needing to dig for details.

2. Failing to Provide Supporting Evidence

Never leave out important documentation that can back up your claims. Attach any relevant receipts, contracts, or records that validate your dispute. Without proper evidence, your dispute may lack credibility, making it harder for the other party to take action.

3. Ignoring the Formal Tone

Avoid casual language or inappropriate comments. A dispute letter is a formal document, so it’s important to maintain a respectful tone throughout. Keep your language professional, even if you are frustrated with the situation.

4. Not Keeping Copies of Communication

Never send a letter without keeping a copy for your own records. This ensures you have proof of what was sent and when, which could be crucial in case further disputes arise.

5. Overloading the Letter with Irrelevant Information

Stick to the facts. Avoid including personal opinions, unnecessary background information, or unrelated details. Keeping your letter focused on the specific dispute will make it more effective.

6. Not Being Clear About the Desired Outcome

Clearly state what you want to happen as a result of your dispute. Whether it’s a correction, a refund, or another resolution, be direct in asking for what you need. Ambiguity can delay the resolution process.

7. Missing Important Deadlines

Many companies and agencies have strict timelines for responding to disputes. Make sure you are aware of any deadlines and submit your letter within the required timeframe. Missing this step could delay or even void your dispute.

8. Not Following Up

If you do not receive a response in a reasonable timeframe, follow up. It is important to show persistence, but always remain polite and professional when doing so.

| Mistake | Why It Matters | How to Avoid It |

|---|---|---|

| Unclear language | Causes confusion and delays | Be specific and precise in your description |

| Failure to provide evidence | Weakens your case | Attach all relevant documents supporting your dispute |

| Ignoring tone | Can make your letter less professional | Maintain a formal, respectful tone |

| Not keeping copies | Loss of proof if needed for future reference | Make copies of everything you send |

| Irrelevant information | Clutters the letter and distracts from the main issue | Stick to the facts and stay on topic |

| Missing deadlines | Can result in your dispute being dismissed | Check the deadline and submit on time |

Track the delivery of your dispute letter to ensure it reaches the recipient. Keep a record of the date, time, and method of delivery. If you sent it via certified mail, retain the receipt or tracking number. This helps verify that the creditor received your letter.

Wait for a response. By law, creditors generally have 30 days to address your dispute. If you don’t hear back in that time frame, follow up. Send a polite reminder or call their customer service to check the status of your dispute.

If you receive a response, carefully review it for accuracy and clarity. Ensure that the creditor provides valid proof or documentation if they assert the debt is correct. If they can’t substantiate their claim, request further evidence or escalate the dispute if needed.

If the dispute is resolved in your favor, monitor your credit report for any changes. Ensure that the disputed account is updated or removed, reflecting the corrected information. If the creditor doesn’t resolve the dispute, you may consider filing a complaint with relevant consumer protection agencies or seeking legal advice.

Stay organized and maintain copies of all correspondence and documentation related to the dispute. This will help you track the progress and take necessary steps in case of delays or unresolved issues.

If you don’t receive a response to your debt dispute letter, follow up. Send a second letter or email within 30 days. Reference your previous communication and request an acknowledgment of receipt. Keep it professional and clear, reiterating the importance of resolving the issue.

Step 1: Send a Follow-Up Letter

Write a concise follow-up letter, stating that you have not received a response to your initial dispute. Include any relevant dates and documentation to avoid confusion. Politely ask for a resolution or further clarification within a specific time frame, usually 14 days. Highlight that you’re serious about protecting your rights.

Step 2: Consider Reporting to Relevant Authorities

If you still don’t hear back after your follow-up, you can escalate the issue. File a complaint with the Consumer Financial Protection Bureau (CFPB) or your local consumer protection agency. This might prompt the creditor to take action and respond to your dispute.

When disputing a debt, you have clear legal rights that protect you. These rights ensure that your dispute is handled fairly and transparently by creditors and collection agencies. Here’s what you need to know:

Right to Request Verification of Debt

If you receive a debt collection letter, you have the right to request verification of the debt within 30 days. This means the creditor or collector must provide evidence that you owe the debt and that they have the right to collect it. Failure to provide this verification will prevent them from pursuing further collection actions.

Protection Against Harassment

Debt collectors are prohibited from engaging in harassment, threats, or abusive practices when you dispute a debt. The Fair Debt Collection Practices Act (FDCPA) ensures you are protected against unfair practices like frequent calls, threats of legal action, or public shaming.

Right to Dispute Incorrect Information

If the debt is inaccurate or not yours, you have the right to dispute it. Your dispute should be sent in writing, and the creditor or collector must investigate and respond within a reasonable period. If they can’t prove the debt is yours, it must be removed from your records.

Right to Request Debt Cease

If you feel harassed by a collector, you can request them to stop contacting you. This request should be made in writing, and once they receive it, they can only contact you to inform you of legal actions or to confirm your request has been received.

Impact on Credit Reports

Disputing a debt does not automatically remove it from your credit report. However, if the debt is proven to be incorrect or if it’s removed by the creditor, it must be updated in your credit history. Make sure to follow up to ensure your credit report reflects accurate information.

Know Your Right to Seek Legal Advice

If you’re unsure about the debt dispute process or need help protecting your rights, you have the right to seek legal advice. An attorney specializing in consumer rights can help you understand your options and assist in addressing any legal issues related to the debt dispute.

I removed redundant repetitions of words while keeping the meaning of each heading intact.

When drafting a debt dispute letter, clarity and precision are key. Avoid excess verbiage that could obscure your message. Focus on stating the facts and explaining your position directly. Each section of the letter should serve a clear purpose: identifying the debt in question, explaining why you dispute it, and providing evidence supporting your claims.

Structure of the Debt Dispute Letter

The structure should be simple and easy to follow. A well-organized letter helps the recipient process your dispute efficiently.

| Section | Details |

|---|---|

| Introduction | Clearly state your intent to dispute the debt. Provide your full name, address, and any relevant account numbers. |

| Details of the Debt | Describe the debt you are disputing, including the amount, creditor’s name, and the reason for the dispute. |

| Evidence | Provide any documentation that supports your claim, such as payment records, bank statements, or communication with the creditor. |

| Conclusion | Request the creditor to resolve the issue or provide evidence to support their claim. |

What to Avoid

Don’t overcomplicate the language or use unnecessary details. A direct, respectful tone is far more likely to lead to a positive resolution. Stick to the facts and avoid emotions or opinions that might weaken your case.