Free Proof of Income Letter Template for Easy Use

When you need to confirm your financial status for rental agreements, loan applications, or job opportunities, having a well-organized document can simplify the process. A properly drafted statement can serve as reliable evidence of your financial capacity, making it easier for others to assess your eligibility. This guide offers a comprehensive overview of how to create a professional statement quickly and efficiently.

Why You Should Use a Structured Format

Opting for a clear and organized structure helps present your financial information in a concise way. Using a pre-designed structure can reduce the risk of errors and save time. This approach ensures that all necessary details are included without any confusion, making it easier for recipients to review your information.

Benefits of Using a Predefined Structure

- Streamlined process: You don’t have to start from scratch every time.

- Consistency: Keeps the document looking professional across different situations.

- Clarity: Ensures all required details are included without unnecessary information.

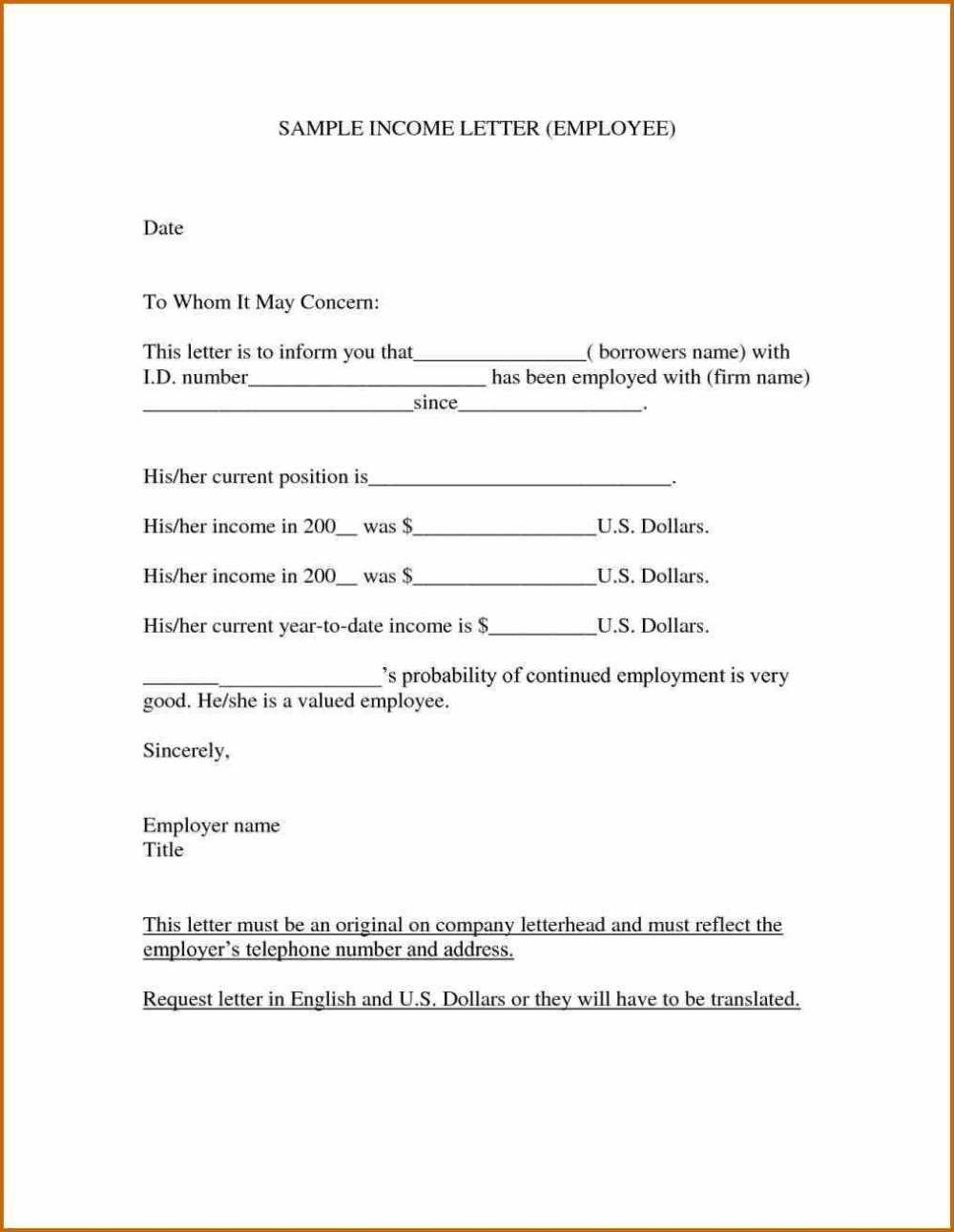

Essential Components to Include

While every situation may require slight adjustments, certain details remain essential. These include the statement of employment, the amount of earnings, the time period covered, and the contact information of the person verifying the data.

Key Details to Provide

- Employment Information: Company name, job title, and employment dates.

- Financial Details: Monthly or annual earnings, bonuses, and other compensation.

- Verification Contact: Name and contact details of the individual responsible for confirming the data.

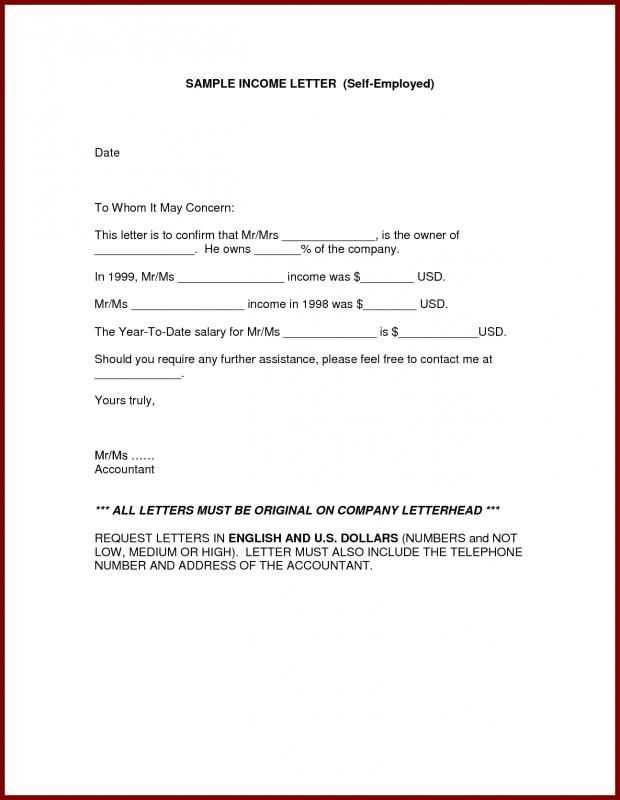

Customizing for Your Specific Needs

Depending on the purpose, you might need to adjust the content to suit specific requirements. For example, a document needed for a rental agreement may focus on steady income, while a loan application may require more detailed financial data, including bonuses or additional income sources.

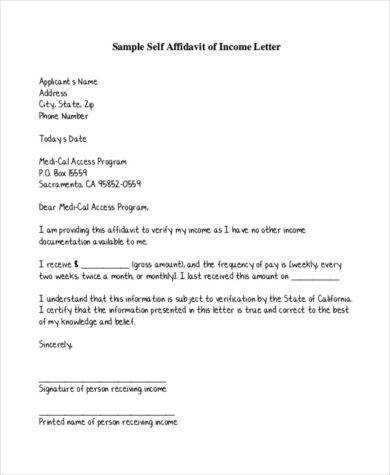

Common Pitfalls to Avoid

Even with a structured approach, certain mistakes are easy to make. Double-checking your work is crucial to avoid leaving out important details or including unnecessary information. Be sure to review the document for accuracy before submission.

Typical Errors to Look Out For

- Missing dates or unclear employment periods.

- Omitting key financial details or compensation types.

- Inaccurate contact information for verification.

With these steps and considerations, you can easily create a well-structured document that meets your needs and helps you present your financial status clearly and professionally.

What is an Earnings Verification Document

When you need to confirm your financial stability for different purposes, such as applying for a loan or securing housing, having a properly structured document can make all the difference. This document acts as official evidence of your earnings, simplifying the review process for landlords, employers, or financial institutions. The goal is to present accurate and clear details to prove your ability to meet financial obligations.

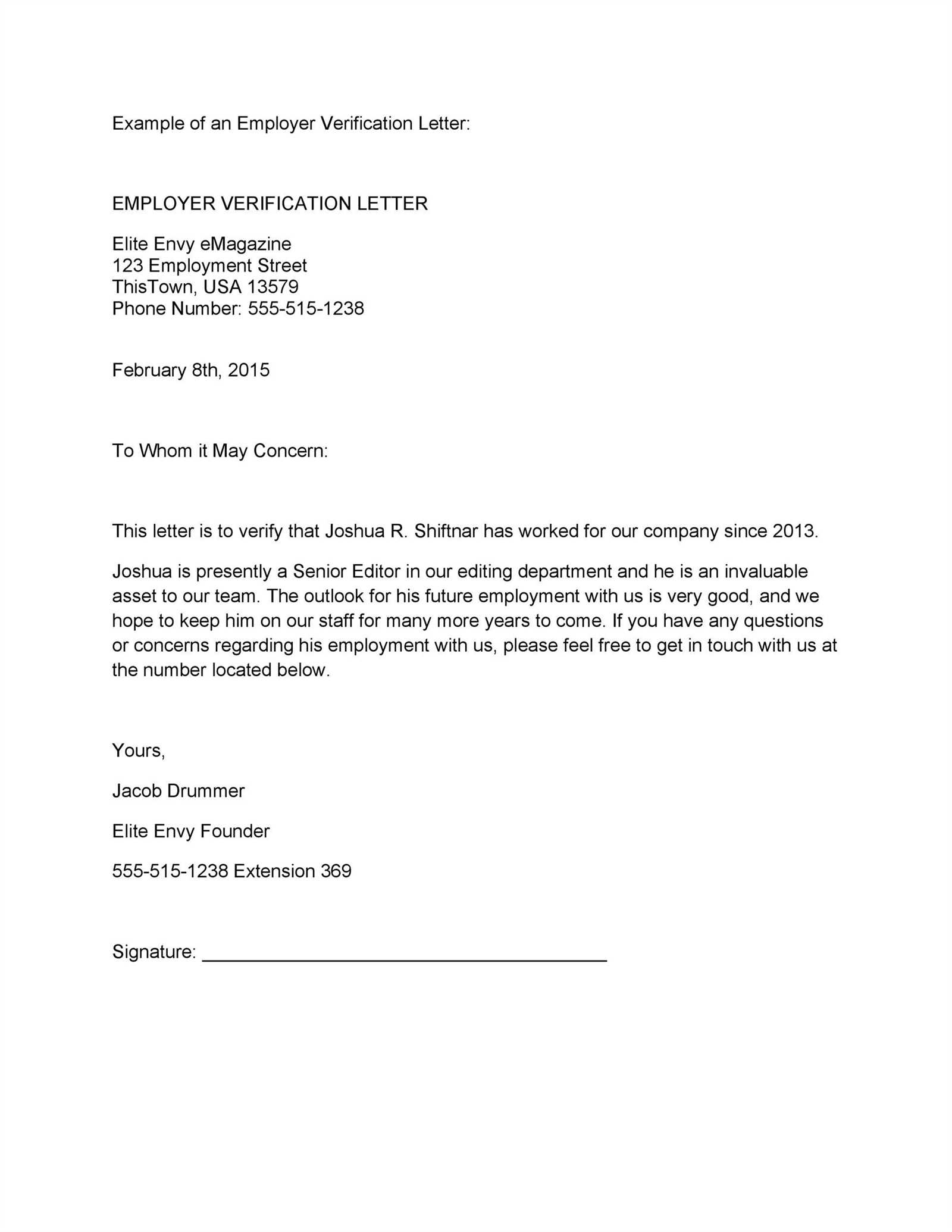

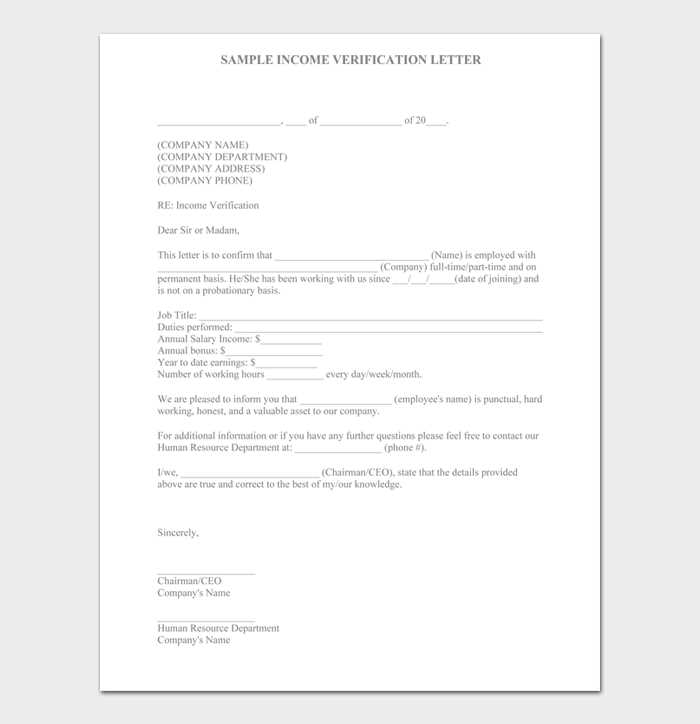

How to Create a Financial Verification Document

To create an effective statement, it is important to ensure that the information you provide is clear and complete. Start by outlining your employment details, followed by your earnings information. The format should be simple, with easy-to-read sections that address all key points. Make sure to include the date, income sources, and contact details for verification.

Why Opt for a Pre-Structured Document Format

Using a predefined structure can save time and reduce the chances of missing crucial details. By following a simple yet organized format, you ensure that your document looks professional and meets the expectations of those reviewing it. It allows you to present your financial data in a standardized manner that is easy to understand and process.

Key information should always be included to make sure the document serves its purpose. This typically involves providing clear employment details, specifying the amount of earnings, and offering a way for the recipient to verify the provided information.

How to Customize the Document for Your Needs

Adjust the content based on the situation. For instance, when applying for a rental property, you may want to emphasize your regular monthly income and job stability. On the other hand, for a loan application, you might need to add more comprehensive financial details, including bonuses or additional sources of revenue. Tailoring the document to each specific requirement ensures it is more effective in meeting your goals.

Common Mistakes to Avoid

Even with a solid structure, there are some common pitfalls that can undermine the clarity or usefulness of the document. Make sure to double-check all the information for accuracy, especially the dates, financial amounts, and contact information for verification. Missing or incorrect details can delay the process or even result in your document being rejected.