Free Security Deposit Return Letter Template

When a tenant vacates a rental property, landlords often need to ensure proper communication regarding the reimbursement of amounts paid upfront. This process requires formal documentation that outlines the conditions of the agreement and any deductions made. A well-crafted document serves to clarify the financial settlement, helping both parties understand their responsibilities.

Creating a clear and professional document is essential to avoid confusion or disputes. By using a structured approach, landlords can provide transparency and maintain a good relationship with tenants. This process is not only about legality but also about fostering trust and respect between both parties.

Being aware of common practices and utilizing readily available resources can simplify this task. There are many options for landlords looking to draft an appropriate communication, whether it’s for a standard case or a more complex situation. With the right information, crafting an effective statement can be straightforward and efficient.

Understanding the Security Deposit Process

The process of reimbursing a tenant after they vacate a rental unit involves several key steps. Landlords must assess the condition of the property, calculate any necessary deductions, and communicate the final amount to the tenant. This procedure ensures that both parties are aware of their financial obligations and that the transaction is handled fairly and transparently.

Assessing Property Condition

Before initiating the financial settlement, it is essential to evaluate the state of the property. This typically includes checking for damage, cleanliness, and any necessary repairs. The agreement between the tenant and landlord will usually specify the conditions that the unit should meet upon move-out. A detailed inspection helps to avoid misunderstandings and provides a clear basis for any deductions from the refundable amount.

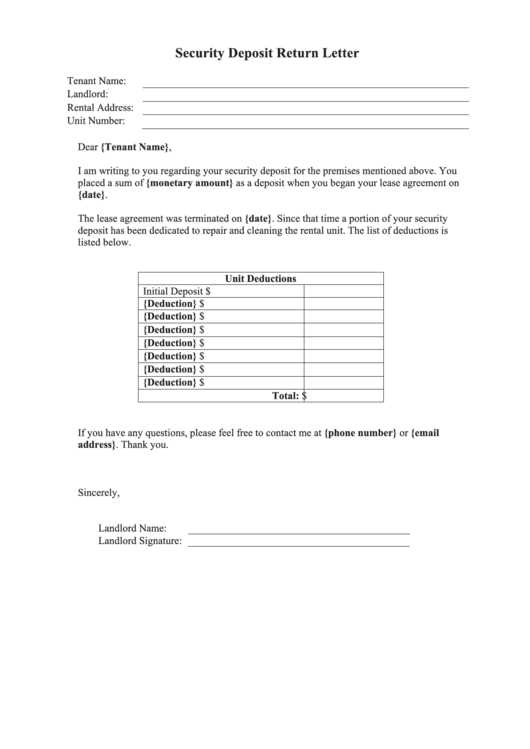

Communicating the Final Settlement

Once the evaluation is complete, landlords must provide tenants with a summary of the financial calculations. Clear communication is key to ensuring transparency and reducing potential disputes. By outlining the reasons for any deductions and offering a formal statement of the amount to be refunded, landlords can foster a professional relationship with the tenant and ensure that both parties are satisfied with the outcome.

Why a Return Letter is Important

Proper documentation plays a vital role in the process of reimbursing a tenant. A formal document serves as proof of the agreement between both parties, outlining the final financial settlement. This step is crucial to avoid confusion and to maintain professionalism in the rental process.

Establishing Clear Communication

By providing a well-structured document, landlords ensure that tenants are fully informed about the financial transaction. It helps clarify the amount to be refunded and any possible deductions. This transparency fosters trust and reduces the chances of disputes. Here are some key reasons why this document is necessary:

- Clear explanation of deductions

- Documentation of the agreed-upon amount

- Proof of compliance with rental agreements

Legal and Financial Protection

Such documents also provide legal protection for both the landlord and tenant. In case of disputes or legal action, having a formal record of the transaction can act as evidence. It also ensures that both parties are adhering to the terms of the rental agreement, reducing the potential for misunderstandings or conflicts in the future.

Key Elements of a Return Letter

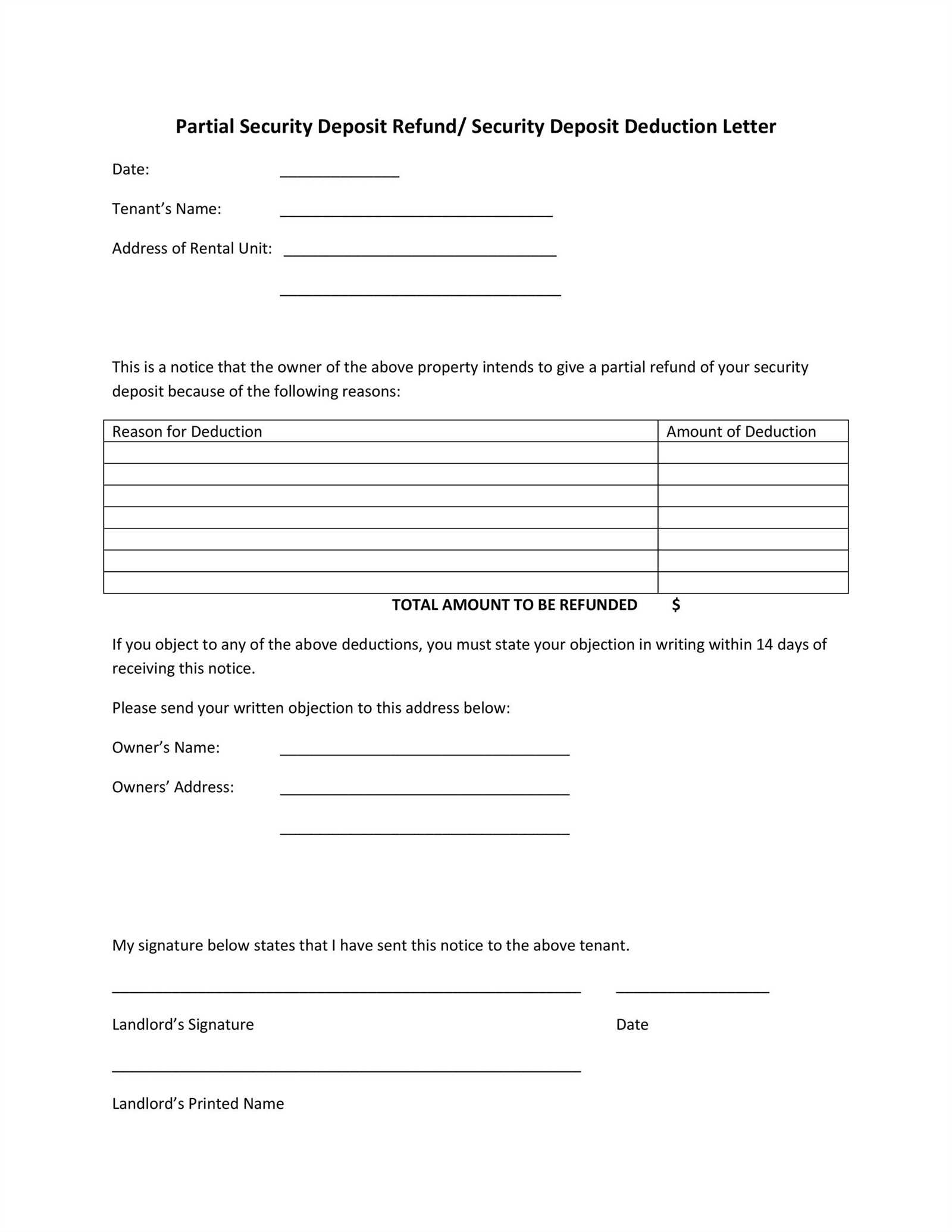

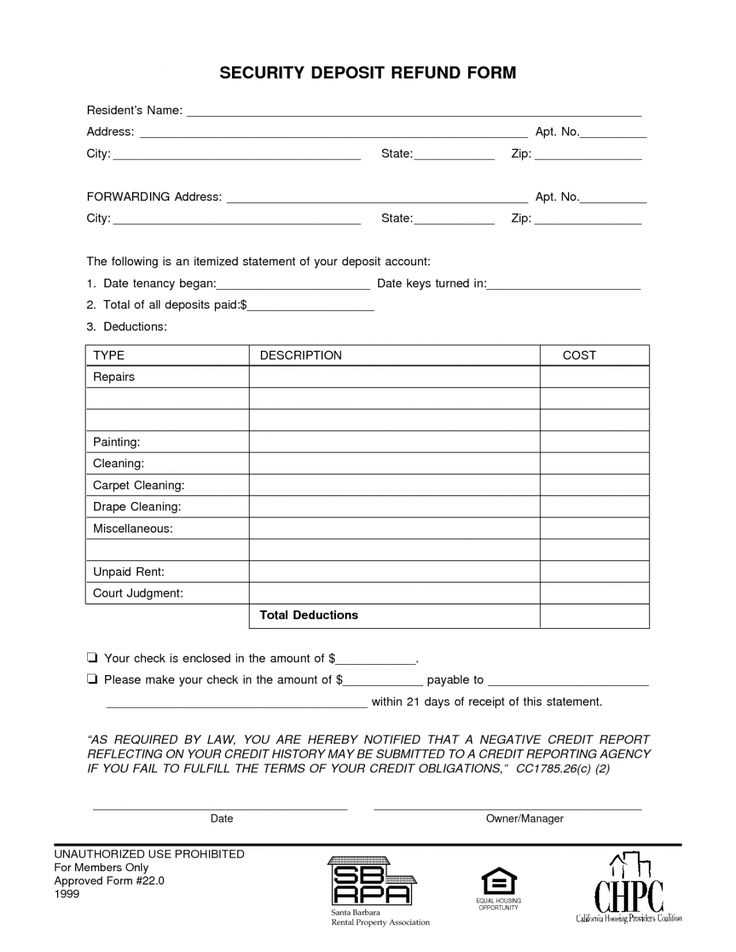

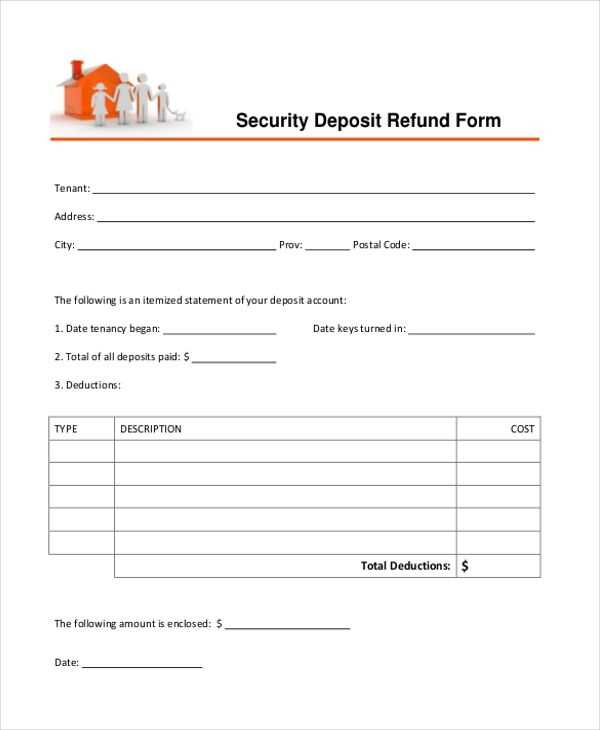

For a comprehensive and professional document, certain details must be included to ensure clarity and proper communication. These components provide the necessary context for both the landlord and tenant, ensuring that the transaction is handled smoothly and in accordance with the original agreement.

Essential Information to Include

To avoid confusion, the following details should always be present in any formal correspondence regarding the financial settlement:

- Tenant’s and Landlord’s Information: Full names and addresses of both parties.

- Property Details: Address of the rented unit and move-out date.

- Itemized List: A breakdown of any deductions made from the total amount.

- Final Amount: The exact sum to be refunded.

- Payment Method: Information on how the refund will be processed.

Professional Tone and Language

Maintaining a formal and respectful tone is essential when drafting such documents. Using polite and professional language can help reduce the likelihood of misunderstandings. Additionally, clearly stating the terms of the agreement and any deductions ensures that both parties are on the same page.

How to Customize the Template

Adapting a standard form for your specific situation is key to ensuring that the document accurately reflects the details of the financial arrangement. Personalizing it allows you to address the unique circumstances of each tenant and rental agreement, making the communication both clear and relevant.

To begin, ensure that all basic information is tailored to the tenant, property, and rental period. This includes adjusting the names, addresses, and move-out dates. Additionally, consider adding specific notes about any property conditions or issues that may have impacted the financial settlement.

Furthermore, if there are any deductions from the refund, provide a detailed explanation for each one. This transparency will help prevent confusion and ensure that the tenant understands why certain amounts are withheld. Make sure to adjust the final amount and payment method according to the chosen method of reimbursement.

Common Mistakes to Avoid in Letters

When drafting formal documents related to the reimbursement process, small errors can lead to confusion or disputes. It is crucial to be mindful of the language and information provided, ensuring that everything is clear, accurate, and professionally written. Avoiding common mistakes helps to maintain trust and transparency with the tenant.

Incomplete or Vague Information

One of the most frequent errors is leaving out important details such as the total amount being reimbursed or a clear breakdown of deductions. Failing to provide this information can create misunderstandings and lead to dissatisfaction. Always ensure that every aspect of the financial transaction is outlined explicitly and clearly.

Using Informal Language

Another common mistake is using informal or casual language. While the process may seem routine, it is still a formal interaction between two parties. Maintaining a professional tone throughout the document ensures that both sides take the process seriously and minimizes the chance of it being misinterpreted.

Legal Considerations for Deposit Returns

When handling the reimbursement of funds after a rental period, landlords must adhere to specific legal guidelines to ensure fairness and compliance with local laws. Understanding these regulations is crucial to avoid legal disputes and ensure that the process is conducted correctly and transparently.

Compliance with Local Laws

The laws surrounding financial reimbursements can vary significantly depending on the jurisdiction. It is important for landlords to familiarize themselves with the regulations governing such transactions in their area. These laws typically address timelines, permissible deductions, and required documentation. Below is a general overview of key legal aspects:

| Aspect | Legal Requirement |

|---|---|

| Timeline for Return | Funds must be returned within a specific time frame (usually 30 days). |

| Permissible Deductions | Only damages beyond normal wear and tear can be deducted. |

| Documentation | Detailed accounting for any deductions must be provided. |

Handling Disputes

In the event of a disagreement between the landlord and tenant regarding the amount reimbursed, it is crucial to have thorough documentation. Having clear, well-documented justifications for any deductions, along with a timely response to the tenant’s concerns, can help resolve disputes amicably and avoid legal action.

Where to Find Free Templates Online

Many online resources provide editable forms for various financial communications, including those related to tenant reimbursements. These forms can help ensure that all necessary information is included, making the process smoother for both landlords and tenants. Knowing where to find reliable templates can save time and effort when drafting such documents.

Popular Websites for Templates

Several websites offer a wide range of customizable forms that can be used for this purpose. Below are some of the best platforms where you can find suitable documents:

- LegalZoom: A trusted source for customizable forms, including those for financial agreements.

- Rocket Lawyer: Offers professionally crafted documents with easy-to-follow instructions.

- Template.net: A platform with various templates for all kinds of legal and financial communication.

- LawDepot: Provides a selection of customizable forms for rental agreements and financial transactions.

Other Sources for Custom Forms

In addition to the above sites, several other options are available to help you find editable forms:

- Government Websites: Local government websites often have free resources for landlords and tenants.

- Real Estate Blogs: Many property management blogs provide downloadable templates tailored to rental agreements.

- Document Sharing Platforms: Websites like Scribd and Google Docs often host user-uploaded templates.