Lexisnexis Freeze Letter Template Guide

Freezing your credit report is an essential step to protect your personal information from unauthorized access. If you believe your data might be at risk, it’s important to initiate this process by notifying the relevant agencies. This action prevents others from accessing your financial history without your permission. In this guide, we will walk you through the steps of submitting a request to block access to your credit profile and the necessary information to include in your communication.

Steps to Block Access to Your Report

To initiate the process of restricting access to your report, follow these key steps:

- Identify the agency you need to contact.

- Prepare the necessary details to verify your identity.

- Draft a formal request to submit to the agency.

- Send the request using the appropriate channel.

- Wait for confirmation of your request’s processing.

Required Information

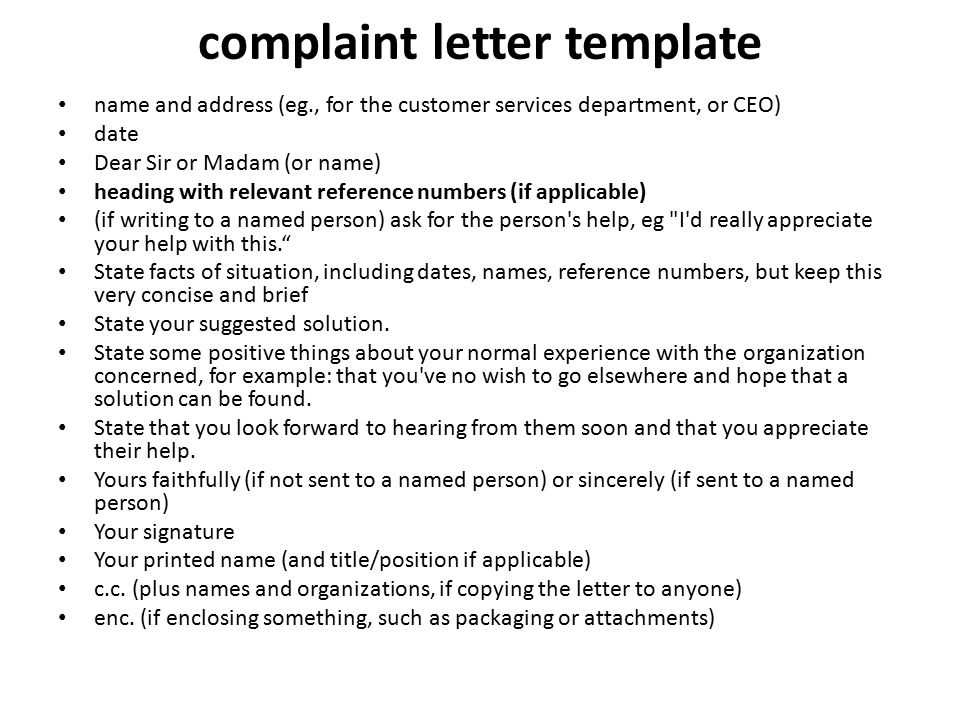

Make sure to include all relevant details in your request to avoid delays in processing. Here are some of the key pieces of information to provide:

- Your full name and address

- Details of your identification (such as Social Security Number or date of birth)

- Any other documents the agency may require for identity verification

Common Mistakes to Avoid

When sending your request, be cautious of the following common errors:

- Missing required identification details

- Failing to send the request through the correct channel

- Not confirming receipt of your request with the agency

Processing Time and Next Steps

The time it takes for the agency to process your request may vary, but it typically ranges from several days to a few weeks. Once the process is complete, you will receive confirmation that access has been restricted. Afterward, monitor your credit report periodically to ensure your information remains protected.

How to Block Access to Your Credit Report

When you want to restrict access to your financial records, it’s necessary to submit a formal request to the relevant agency. This process ensures your personal data remains secure and inaccessible to unauthorized parties. In this section, we will guide you through the essential steps involved, from drafting the request to understanding the time it takes for the action to be completed.

What is a Credit Access Block Request?

A credit access block request is a formal action that prevents third parties from reviewing your financial history without your consent. This protection is especially important when you suspect fraud or want to safeguard your data from potential identity theft. It essentially places a barrier on your credit report, making it unavailable to lenders or other entities that might seek it.

Steps to Draft a Request

Drafting a request to block access to your credit information requires clear and precise language. Follow these steps:

- Identify the agency you need to send the request to.

- Prepare your personal information for verification.

- Write a clear and formal statement requesting to block your data access.

- Submit the request to the correct address or through the agency’s online platform.

Essential Information to Include

For your request to be processed smoothly, make sure to include:

- Your full name, address, and contact information.

- Verification details such as Social Security Number or birth date.

- Any additional supporting documents that might be required for identity verification.

Common Mistakes to Avoid

To ensure your request is not delayed or rejected, avoid the following common mistakes:

- Leaving out necessary personal information.

- Sending the request to the wrong department or address.

- Not providing adequate proof of identity.

How Long Does the Process Take?

The time required for processing your request can vary depending on the agency. Typically, it may take anywhere from a few days to a couple of weeks for the request to be completed. It’s important to follow up if you do not receive confirmation within the expected timeframe.

What Happens After Blocking Access?

Once your request is processed, you will receive confirmation that your financial data is now secured. At this point, you can monitor your credit reports to ensure no unauthorized parties attempt to access your information. This protection will stay in place until you decide to lift the restriction.