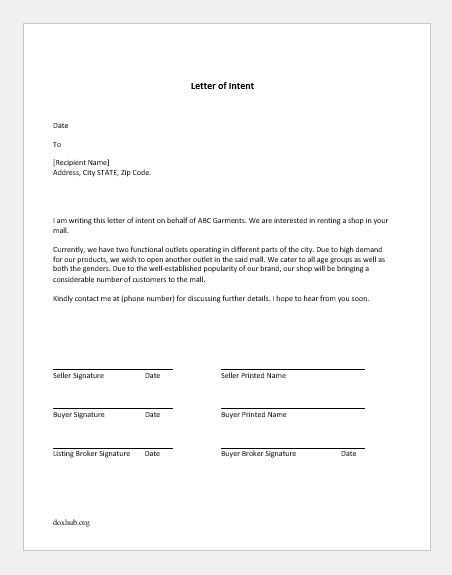

Letter of Intent to Pay Template for Debt Settlement

When engaging in financial agreements, it’s essential to formally express the willingness to settle a debt or obligation. This type of communication ensures clarity and establishes mutual understanding between parties. Whether you are the one making the payment or requesting it, such a document outlines the terms of repayment and confirms your intentions to fulfill the financial agreement.

Key Information to Include

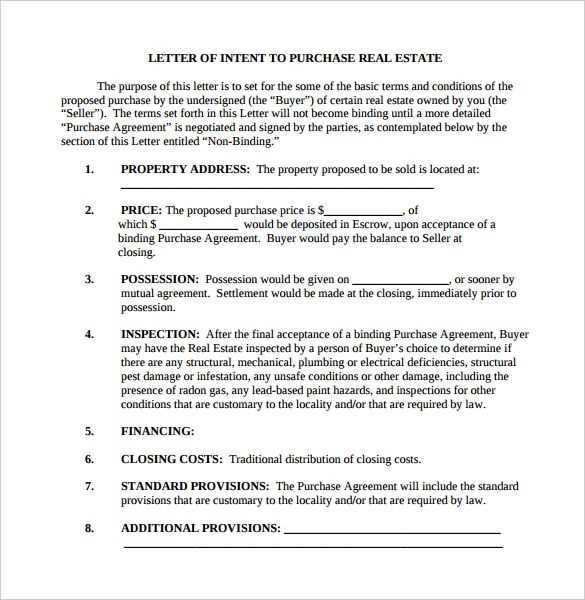

A well-drafted letter should contain certain details to avoid misunderstandings. These include the amount to be paid, the date of payment, and any terms or conditions related to the settlement. Including this information clearly shows your seriousness about meeting your financial responsibilities.

Critical Details to Mention:

- Debt Amount: Specify the total balance that needs to be paid.

- Repayment Date: Clearly state when the payment will be made.

- Payment Method: Indicate how the payment will be made, such as via bank transfer, check, or another agreed-upon method.

How to Draft a Comprehensive Document

To ensure the document is effective, use a clear and professional tone. It should reflect your commitment and intention to honor the agreement. Additionally, it is helpful to include a polite request for confirmation from the recipient, ensuring both parties are on the same page regarding the arrangement.

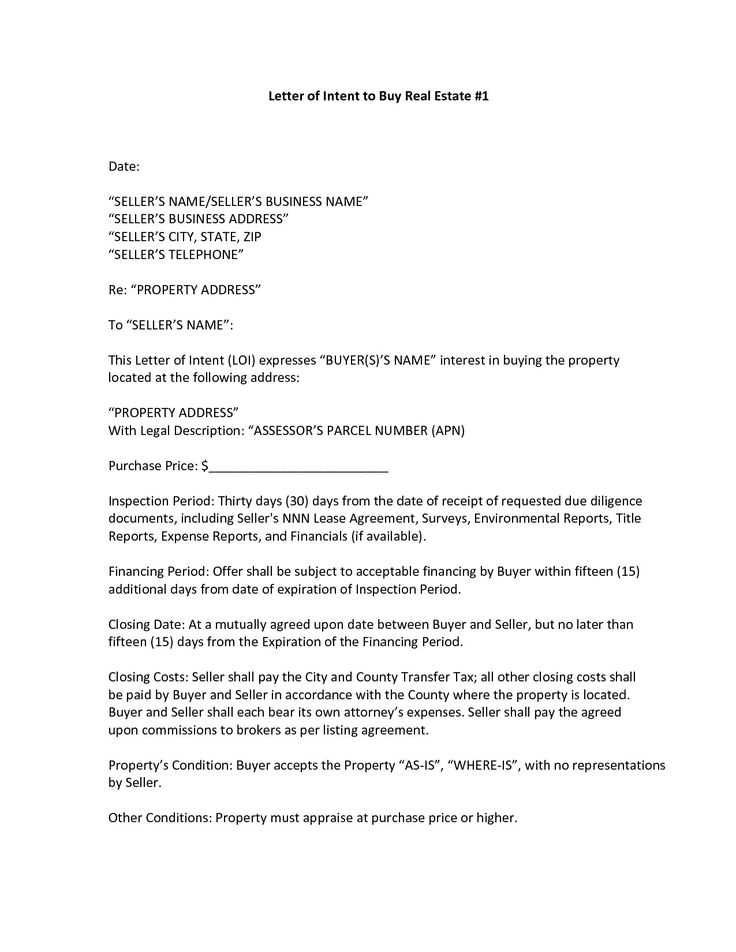

Structure of a Payment Commitment:

- Introduction: State the purpose of the letter.

- Details: Provide specifics about the amount, date, and method of payment.

- Closing: End with a polite statement requesting confirmation.

By following this simple structure, you can create an effective document that demonstrates your dedication to fulfilling your financial obligations.

Formal Document for Confirming Payment Commitment

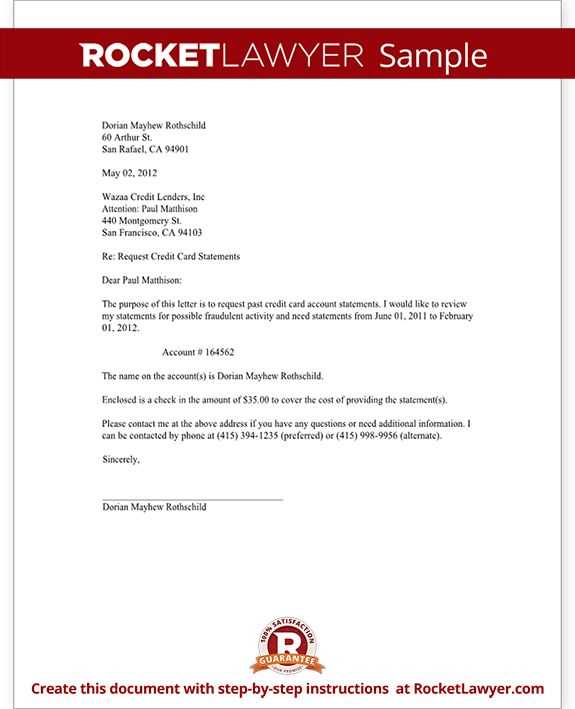

When formalizing financial obligations, it is essential to clearly express the intent to settle a debt or outstanding balance. A written confirmation serves as a clear agreement between both parties, outlining the terms and expectations for repayment. This document not only ensures transparency but also helps avoid confusion or disputes down the line.

Key Information to Include in the Document

To create an effective communication, certain crucial details must be included. These key elements help clarify the agreement and make the commitment actionable. Make sure to specify the exact amount owed, the agreed-upon date for settlement, and the method by which the payment will be completed. Additionally, include any other relevant terms, such as payment installments, if applicable.

Step-by-Step Guide to Drafting the Document

Begin by introducing the purpose of your communication. Then, proceed to list all the essential details in a clear and organized manner. Ensure the tone is respectful and professional, demonstrating both willingness and seriousness in your intent to meet the obligation. Close by asking for confirmation, if appropriate, to ensure both parties have the same understanding of the terms.

How to Tailor the Document for You

While there are general guidelines, it is important to adjust the content to your specific situation. For example, if you’re dealing with a large debt, you may wish to include a repayment schedule. If the payment is a one-time sum, then focus solely on that date and amount. Customizing the communication ensures that it matches the context of your agreement.

When to Send the Payment Commitment

Sending this document should occur as soon as both parties agree on the financial terms. Ideally, this formal communication is sent after a verbal agreement has been reached, confirming the details in writing. Sending the letter in a timely manner reinforces your commitment and helps ensure that the other party understands your intention to fulfill the obligation.

Legal Aspects and Advantages of Using This Document

Using a formal document for confirming payment obligations is not only a professional approach but can also have legal advantages. Should any disputes arise, this written record can serve as evidence of the agreement. Additionally, it provides both parties with a clear outline of their responsibilities, ensuring there are no misunderstandings. By using such a document, you protect yourself legally and help facilitate smooth communication.