Notice of intent to foreclose letter template

Start by drafting a clear and concise letter that notifies the recipient of the intent to foreclose on their property. This letter should be direct, respectful, and detailed, outlining the reasons for the foreclosure and the steps the recipient must take to prevent it. Include a brief description of any missed payments, contractual obligations, and the legal actions that will follow if the issue remains unresolved.

The letter should begin with the specific date of the notice and include the loan or account number for easy reference. Clearly state the amount overdue and any additional fees incurred due to the missed payments. Indicate a deadline for the recipient to take action, typically 30 days from the date of the notice, to resolve the issue before further legal steps are initiated.

Incorporate a formal request for the recipient to contact the lender or loan servicer directly to discuss possible options, such as repayment plans or loan modification. Be sure to remind them of the consequences if no action is taken, while maintaining a professional and respectful tone throughout the letter.

Conclude the letter with a strong but polite closing, reaffirming the urgency of resolving the situation. Always ensure that the contact information for the lender is clearly visible, so the recipient knows exactly where to reach out for assistance or clarification.

Here’s an improved version with less repetition:

Focus on clarity and conciseness in a notice of intent to foreclose letter. Begin by stating the purpose directly: the intention to begin foreclosure proceedings due to missed payments. Be clear about the amount due, including any outstanding fees, and specify the date by which the borrower must pay to avoid further action. Use straightforward language and avoid unnecessary jargon that may confuse the reader.

Instead of repeating similar information, streamline your wording. For example, rather than reiterating “failure to pay,” simply use “nonpayment” or “unpaid balance” once, then reference it concisely in subsequent sections.

| Key Information | Details |

|---|---|

| Amount Due | $2,500.00 (principal + fees) |

| Deadline | March 15, 2025 |

| Consequences | Foreclosure proceedings will begin after the deadline |

End with a clear call to action, urging the borrower to contact the lender before the specified date. Avoid phrases like “failure to respond will result in” or “you have no choice,” which may sound accusatory. Instead, offer a solution, such as setting up a payment plan or discussing alternatives, to maintain a constructive tone.

- Understanding the Purpose of a Foreclosure Notice

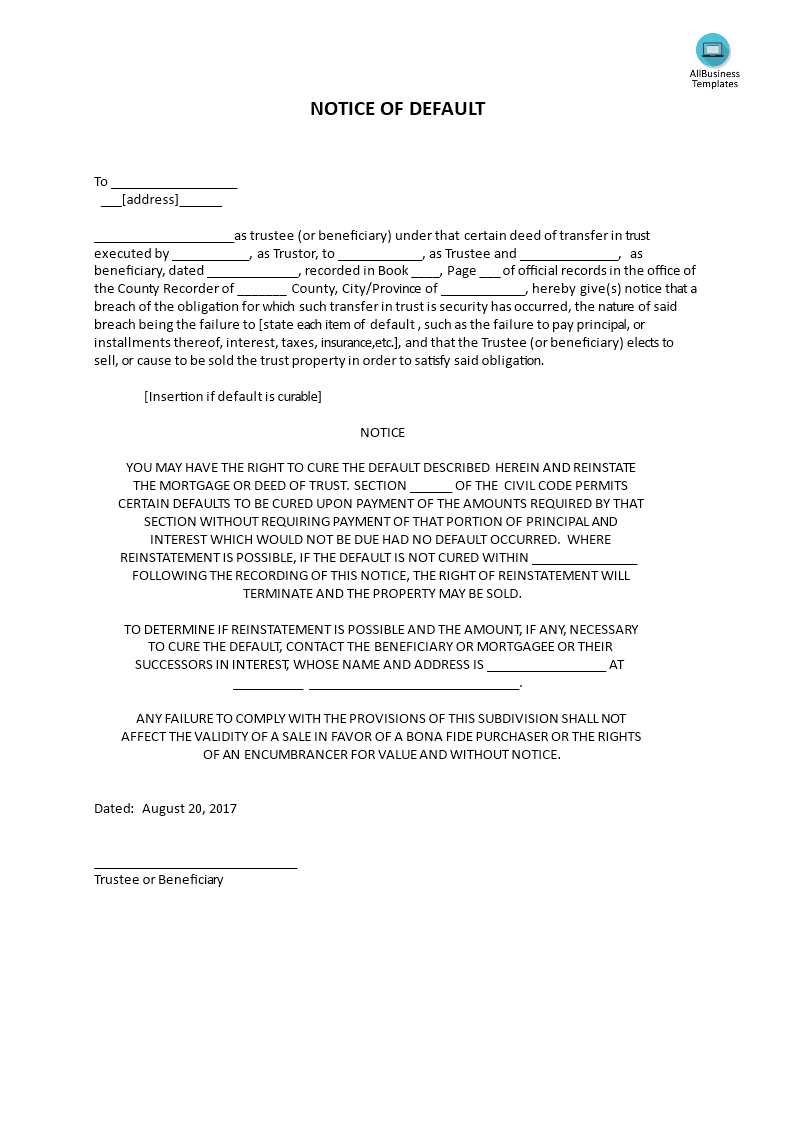

A foreclosure notice informs a borrower that the lender intends to begin the process of reclaiming the property due to non-payment of the mortgage. This letter serves as an official warning, providing the borrower a final opportunity to settle the debt before further legal action takes place.

The purpose of this notice is to ensure the borrower is fully aware of the serious consequences of their financial situation. It outlines the specific amount owed, including any accrued fees, and provides a timeline for resolving the matter. If the borrower fails to act, the lender may proceed with the foreclosure process.

- Clarifies the amount overdue and the due date

- Warns about the legal steps that may follow if payment is not made

- Offers the borrower a final chance to avoid foreclosure by paying off the debt

The foreclosure notice is not just a formality; it is an opportunity for the borrower to resolve the issue before legal proceedings escalate. Timely action can help avoid the long-term consequences of foreclosure, such as damaging the borrower’s credit and losing their home.

Begin with a clear identification of the borrower. Include their full name, address, and account number. This ensures there is no confusion regarding the loan in question.

Loan Details

Provide specific information about the loan, such as the original loan amount, current balance, interest rate, and any fees or penalties that have been added. This offers transparency to the borrower regarding the total debt owed.

Outstanding Payments

List the missed payments and the total amount overdue. Include dates and amounts for each missed payment to avoid any ambiguity. Highlight any grace periods or attempts to resolve the matter before taking legal action.

State the exact amount required to bring the loan current, and include any additional fees related to the foreclosure process. This makes it clear what the borrower needs to do to prevent further action.

Clearly mention the legal consequences if payment is not made by the specified deadline. Use plain language to avoid misunderstanding of the potential impact on the borrower’s property.

End with a direct call to action. Provide contact information for the borrower to discuss options, including payment arrangements or questions. Always offer a solution to help resolve the issue without further escalation.

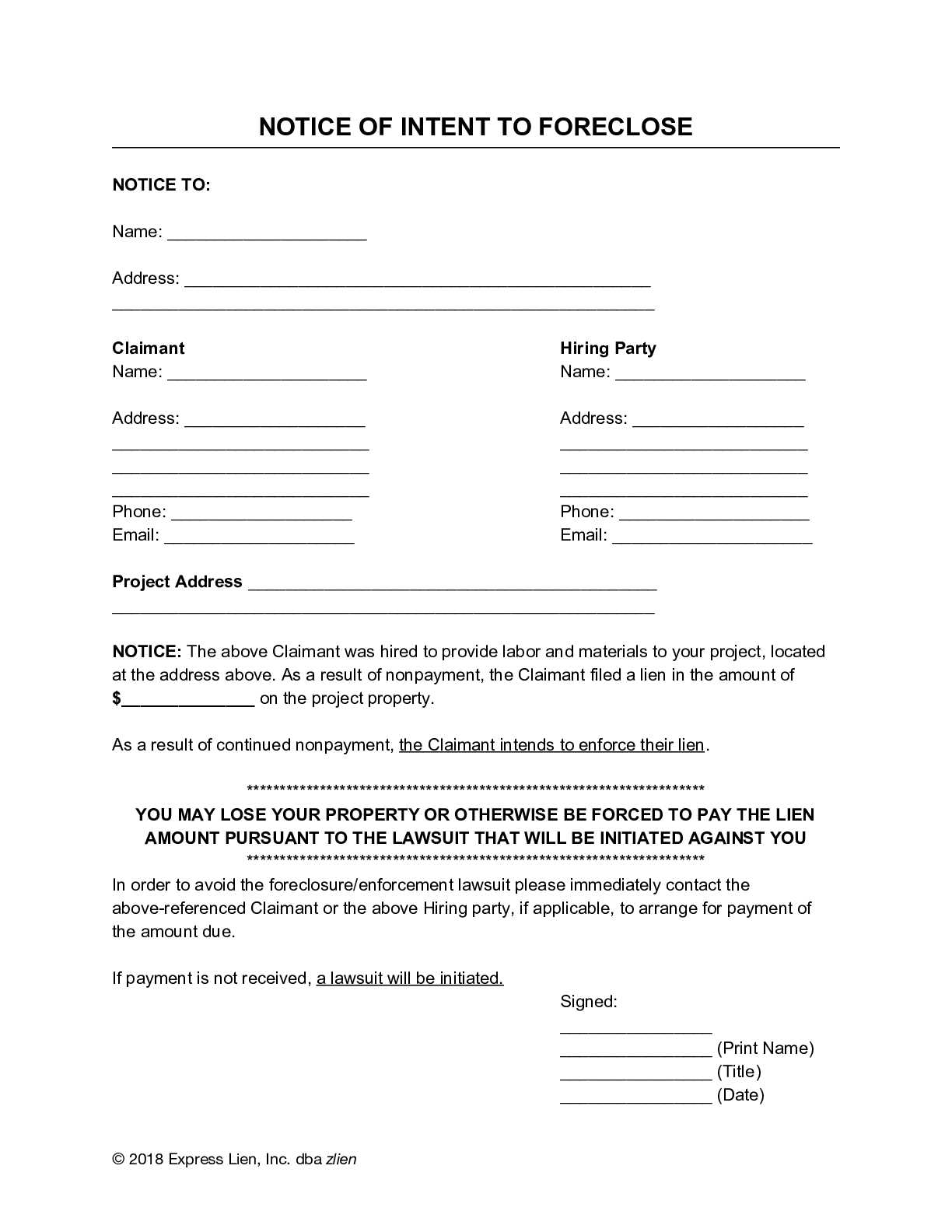

Begin the notice with a clear header indicating its purpose. A simple “Notice of Intent to Foreclose” should be prominently displayed at the top. Ensure the notice is dated, as this sets the timeline for any required actions.

Include Complete Identification Details

List the full names and addresses of both the borrower and the lender. Include the loan number or account number for reference, making it easy to locate the case in records. Also, specify the property address being foreclosed.

Detail the Amount Owed and Payment Breakdown

Clearly state the total amount due, breaking it down into principal, interest, late fees, and any other applicable charges. Be specific about the overdue payments and include dates. This helps the borrower understand the extent of the debt and the actions required to prevent foreclosure.

Conclude the letter with a direct statement of the next steps. Provide a deadline for payment or other corrective actions and explain the consequences of failing to respond.

Clarity is key. Avoid using ambiguous or overly complex language. Ensure the message is direct and to the point, detailing the reasons for the notice and the actions required. Use plain language that the recipient can easily understand.

1. Inaccurate or Missing Details

Verify all the details, such as the loan amount, account numbers, and dates. Missing or incorrect information can lead to confusion and legal challenges. Double-check that the recipient’s name and address are correct, and ensure the notice complies with state-specific requirements.

2. Lack of Proper Documentation

Ensure you attach all necessary documents supporting the foreclosure process. This includes the original loan agreement, past-due notices, and any relevant communications. Failing to provide this documentation can delay the process and make the notice invalid.

Avoid overwhelming the recipient with unnecessary legal jargon or threats. Focus on facts and make sure all communication remains respectful and professional.

Provide a clear description of the outstanding debt, including the total amount owed, interest accrued, and any applicable fees. Detail the payment history, highlighting missed payments and their dates to ensure the borrower fully understands the arrears. Clearly state the consequences of failing to resolve the issue within the given timeframe, such as foreclosure or other legal actions. Include the date by which the borrower must take corrective action to avoid further escalation. Make sure to explain any options available to the borrower to remedy the situation, such as payment plans or loan modifications.

Loan Details

List the original loan amount, interest rate, loan term, and current balance. Provide a summary of the terms, including the lender’s right to foreclose upon default. This will ensure the borrower understands the nature of the agreement and the reason for the foreclosure notice.

Actionable Steps

Provide clear instructions on how the borrower can address the issue, including whom to contact, how to make a payment, or how to request assistance if necessary. Offer information about potential alternative solutions, such as refinancing or loan restructuring, to help the borrower avoid foreclosure if applicable.

Ensure that the foreclosure notice complies with all state and federal regulations. Each jurisdiction has specific requirements for the notice format, delivery method, and timeline. Verify local laws to determine if the notice must be delivered by certified mail, posted on the property, or both.

Timely Notice

Most states require the notice to be sent a minimum number of days before initiating foreclosure proceedings. For example, many jurisdictions demand at least 30 days’ notice. Failing to meet this deadline can result in delays or dismissal of the foreclosure action. Confirm the exact timeframes for your location.

Accuracy of Information

The foreclosure notice must contain specific information about the debt, such as the outstanding balance, the property in question, and the action required from the borrower. Inaccurate or missing details could lead to legal challenges and undermine the validity of the notice. Ensure all the provided information is correct and up to date.

Finally, keep documentation of all communications with the borrower. This provides a clear record in case of disputes. Compliance with these guidelines will help prevent potential legal complications and delays during the foreclosure process.

This keeps the meaning intact while reducing redundancy.

Focus on clear and concise language in your foreclosure notice. Avoid repetition by using straightforward terms. Ensure the letter communicates the necessary details without unnecessary elaboration.

- Be direct about the purpose: specify that the letter serves as a notice of intent to foreclose.

- State the exact date by which payment must be received to prevent foreclosure.

- Outline the next steps the recipient should take to resolve the issue.

- Provide contact details for questions or clarifications.

Make the letter professional but approachable. Use a polite tone while maintaining a firm stance on the matter at hand.