Reverse Mortgage Letter of Intent Template Explained

When applying for a financial agreement that allows homeowners to convert their home equity into funds, certain formalities must be observed. A key component of the process is submitting a clear and well-structured document outlining the request. This formal communication plays a vital role in ensuring the lender understands the applicant’s needs and intentions, as well as securing the terms of the arrangement.

Essential Parts of the Request

To make the application process smooth and efficient, it’s important to include all the necessary details. These elements help clarify the purpose of the request and allow both parties to move forward without confusion:

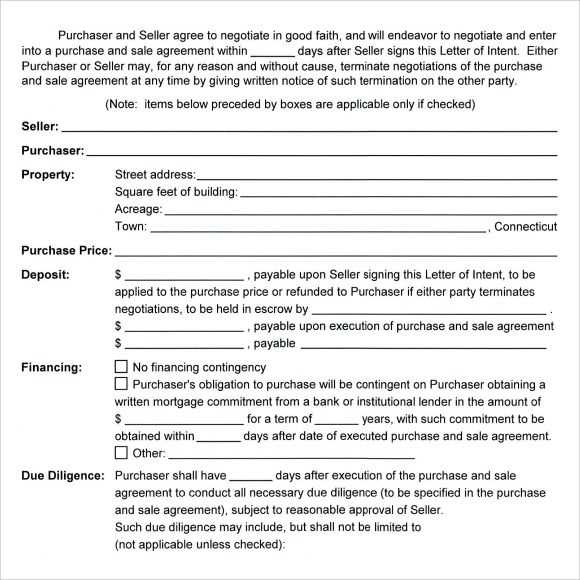

- Personal Information: Include full name, address, and contact details.

- Property Information: Describe the property involved, including its value and any outstanding debts.

- Financial Needs: Clearly outline the amount needed and the reason for the request.

- Terms and Conditions: Detail the expectations and agreements between both parties.

Why This Document Is Important

This communication acts as a clear formal statement, showing your seriousness about the transaction and providing the lender with the required information. Without this step, the process may be delayed or rejected, as the lender cannot evaluate the situation properly.

How to Personalize Your Submission

It’s crucial to ensure the document is customized to your unique situation. This personal touch demonstrates that you understand the terms and are genuinely interested in proceeding with the arrangement. Add specifics about your financial situation and future plans, making sure that all sections are relevant to your needs.

Avoid Common Errors

There are several common mistakes that applicants often make when preparing this formal request. These errors can lead to misunderstandings or delays:

- Leaving out crucial property details.

- Providing incomplete or unclear financial information.

- Failing to review the document before submission.

Final Tips for a Smooth Process

Before sending the document, double-check that all sections are complete, accurate, and well-written. Also, consider consulting a professional to ensure everything is in order. Submitting a polished and detailed document will increase your chances of a successful outcome.

Understanding the Home Equity Agreement Request

When seeking approval for a financial arrangement that allows individuals to access funds based on their home equity, it is essential to provide a formal request outlining the specific terms. This written document serves as a critical part of the application process and ensures clarity between both parties involved. A well-constructed form can help expedite the process and improve the likelihood of success.

Key Information to Include

The document should contain specific details to ensure the lender has all the necessary information to assess the situation properly. Important sections to include are:

- Personal Identification: The applicant’s full name, address, and contact information.

- Property Details: Description of the home or property involved, including its value and any liens.

- Financial Situation: A clear explanation of why the funds are needed and the amount requested.

- Terms and Conditions: A clear outline of the expected agreement, including repayment terms and any specific conditions.

How to Personalize Your Request

It is crucial to adjust the document to reflect your unique circumstances. This includes highlighting your financial needs, specific terms you require, and any special conditions related to the property. Tailoring the request ensures it is relevant and increases your chances of a successful outcome.

Common mistakes to avoid include providing incomplete property information or neglecting to double-check the details before submission. Accuracy is key, and taking the time to review the document thoroughly can prevent delays.

Once the document is complete, ensure you submit it according to the lender’s instructions. Double-checking the submission guidelines will help avoid unnecessary complications and speed up the approval process.