Medical Collection Letter Template for Effective Debt Recovery

Handling overdue payments is a critical aspect of managing a healthcare practice or facility. The ability to professionally address outstanding balances helps maintain financial stability while preserving patient relationships. Having a clear and structured approach can facilitate smoother resolution of these matters.

In order to communicate effectively with patients regarding unpaid bills, it’s essential to adopt a respectful and legally sound strategy. Crafting an appropriate message ensures the request is both firm and empathetic, fostering trust while encouraging timely settlement. The key is balancing professionalism with courtesy.

Understanding the importance of the communication’s tone, content, and timing is crucial. A well-constructed message can motivate prompt action and clarify any misunderstandings related to billing. By being transparent and direct, healthcare providers can increase the likelihood of receiving payments promptly, keeping the business on track.

Why Medical Collection Letters Matter

Effective communication with patients regarding unpaid bills is an essential part of maintaining a healthy financial system in healthcare. When patients fall behind on payments, it’s important for providers to reach out in a professional and respectful manner to facilitate resolution. The use of structured notifications can make a significant difference in the speed and success of debt recovery efforts.

Building Trust and Encouraging Payments

Clear and respectful communication shows patients that their financial obligations are taken seriously while also preserving the provider’s reputation. A well-crafted message conveys the importance of resolving outstanding amounts without jeopardizing the relationship between the provider and the patient. This approach helps encourage timely payments and minimizes the chances of further issues.

Minimizing Financial Risks for Providers

Delaying the recovery of unpaid debts can lead to significant financial strain on healthcare organizations. Prompt communication helps avoid this risk by addressing the issue early, before it escalates. By setting clear expectations and deadlines, providers can ensure that payments are made, which in turn supports the organization’s financial stability.

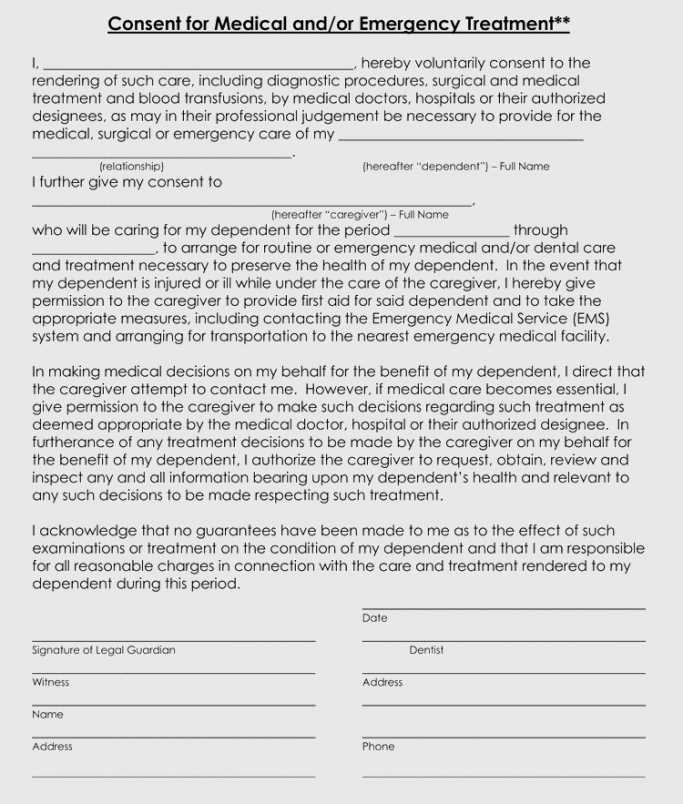

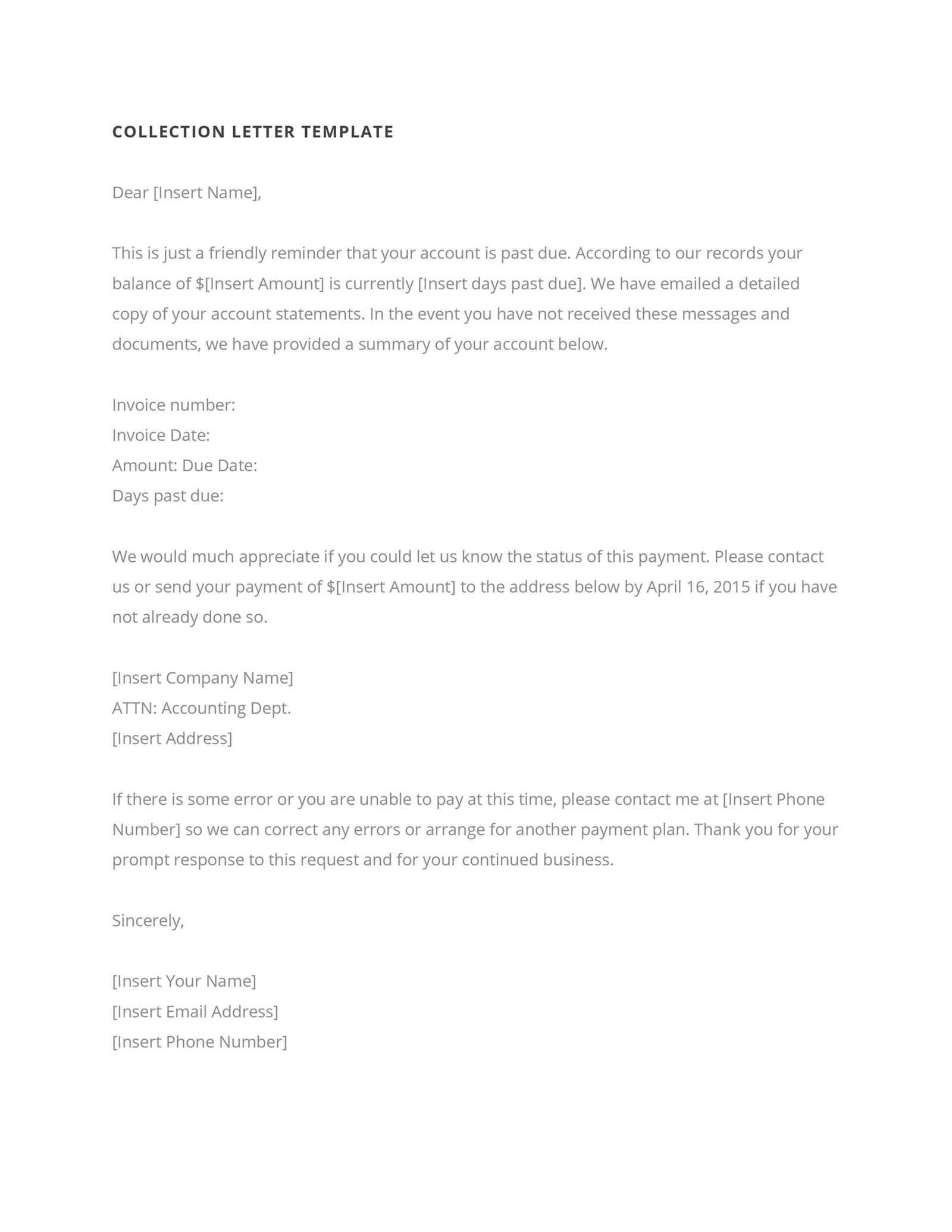

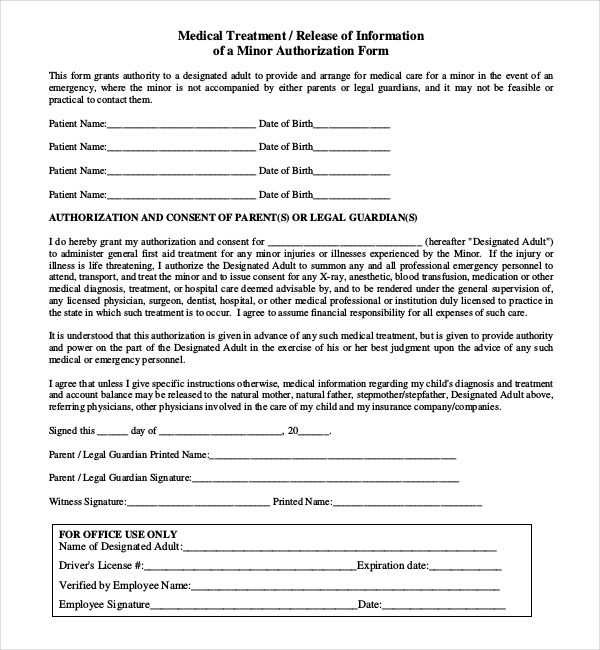

Creating a Professional Collection Document

When dealing with outstanding financial obligations, it’s crucial to craft messages that are clear, polite, and direct. A well-written communication not only conveys the seriousness of the matter but also shows respect for the recipient. Structuring the content in a professional manner increases the chances of payment and maintains a positive relationship with patients.

Essential Components of a Formal Request

Each message should include specific key elements to ensure clarity and effectiveness. These include a clear statement of the amount owed, the due date, and the consequences of non-payment. Additionally, offering payment options and providing contact information for further queries can help facilitate prompt resolution. The following table outlines the key components:

| Component | Description |

|---|---|

| Introduction | Politely remind the patient of the outstanding balance and the purpose of the communication. |

| Details of the Debt | Clearly state the amount due, the services rendered, and the original due date. |

| Payment Instructions | Provide clear instructions on how to make the payment, including any available payment plans. |

| Contact Information | Ensure the recipient knows how to reach the provider for questions or further discussions. |

Maintaining Professional Tone

While it’s important to be firm about the debt, the tone of the communication should remain polite and professional. Using respectful language helps maintain the patient’s dignity and prevents any unnecessary conflicts. Balancing clarity and courtesy can make a significant difference in the outcome of the debt resolution process.

Key Elements of an Effective Letter

To ensure that communication about unpaid balances is both professional and effective, certain elements should be included. Each piece of correspondence should clearly outline the necessary information in a structured way. Providing all relevant details allows the recipient to understand their obligations and act accordingly, which increases the likelihood of timely payment.

First, the message must clearly state the amount owed and any outstanding balances. This provides transparency and avoids any confusion about what is expected. Additionally, offering payment instructions or options helps recipients understand how they can settle the amount and makes the process smoother for both parties.

Furthermore, setting a clear deadline for payment is crucial. This creates a sense of urgency and shows the importance of addressing the issue within a specific time frame. Including contact information for inquiries or concerns is also vital, as it ensures the recipient knows how to reach out if they need assistance or further clarification.

htmlEdit

Best Practices for Medical Debt Recovery

Successfully recovering outstanding balances from patients involves a balance of tact, transparency, and consistent follow-up. It is essential to maintain a professional approach while ensuring that patients feel respected throughout the process. Adopting well-defined procedures contributes to smoother financial operations for healthcare providers, while fostering trust with clients.

- Clear Communication: Always inform patients about their balance and due dates in a timely and straightforward manner.

- Flexible Payment Plans: Offering flexible payment options can help patients settle their debt without feeling overwhelmed.

- Document Everything: Keep a record of all correspondence and payment arrangements for accountability.

- Professional Tone: Maintain a polite and professional tone in all interactions, even when addressing overdue payments.

- Monitor Progress: Regularly check in on payment progress to avoid further delays and to show continued support.

- Know the Legal Boundaries: Understand local regulations to avoid crossing legal limits when handling overdue amounts.

htmlEdit

Best Practices for Debt Recovery in Healthcare

Recovering overdue balances requires a balanced approach that combines professionalism with empathy. Building trust with patients while managing outstanding payments is essential for maintaining a positive reputation and ensuring financial stability. By implementing clear procedures and fostering open dialogue, healthcare providers can effectively address past-due amounts while preserving long-term relationships.

- Clear Communication: Maintain consistent and transparent conversations with patients regarding outstanding balances. Regularly update them on their obligations and offer assistance if needed.

- Flexible Payment Options: Provide a variety of payment plans to accommodate different financial situations. This increases the likelihood of receiving full payment without causing undue hardship.

- Prompt Follow-Ups: Act quickly when a payment becomes overdue. Early intervention allows for more opportunities to settle debts without escalation.

- Maintain Professionalism: Always approach the situation with a respectful tone. Ensuring that all interactions are courteous helps preserve relationships and encourages timely payments.

- Documentation and Tracking: Keep detailed records of all communication and transactions. This provides clarity for both parties and can be valuable in case of disputes.

htmlEdit

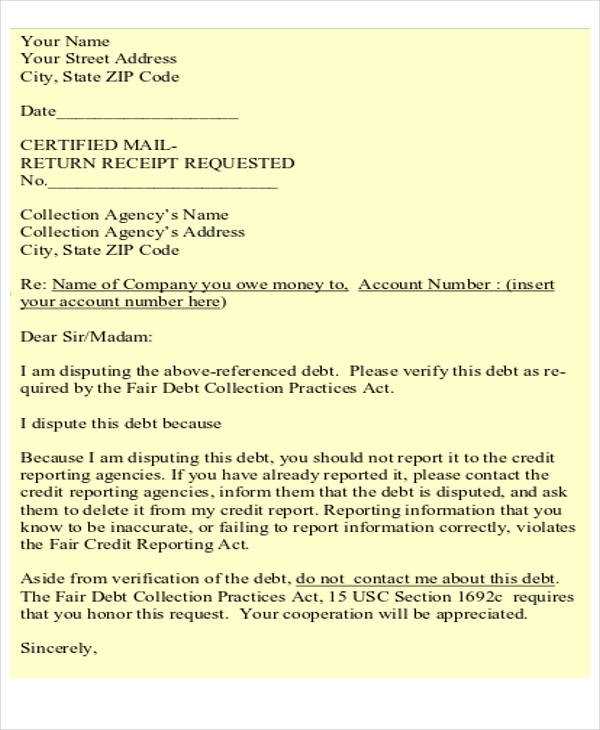

Legal Considerations in Debt Recovery Communications

When seeking to recover unpaid amounts, healthcare providers must be aware of the legal implications surrounding their actions. Adhering to laws and regulations ensures that the process remains fair and respectful to both the provider and the patient. Understanding the boundaries of what is permissible helps avoid potential legal disputes and preserves the integrity of the process.

Compliance with Consumer Protection Laws

It is essential to comply with local and national regulations aimed at protecting consumers. These laws dictate how and when providers can contact patients, what information must be included, and the tone that should be used. Violating these rules can lead to legal consequences and damage the provider’s reputation.

Privacy and Confidentiality

All patient information must be treated with the utmost confidentiality. Disclosures or discussions regarding outstanding payments should only occur with the consent of the patient and in accordance with privacy regulations. Ensuring that sensitive information is kept secure is crucial to maintaining trust and avoiding legal issues.