Medical insurance letter template

To create a clear and concise medical insurance letter, start with addressing the insurance company directly. Include your full name, policy number, and any relevant case or claim number. This helps the recipient easily identify your information and respond promptly.

Next, outline the purpose of the letter. State whether you are requesting coverage for a medical procedure, submitting a claim, or following up on a previous communication. Be specific about the treatment or service in question and include any supporting documents, such as medical bills or physician’s notes.

Keep the tone formal but straightforward. Avoid unnecessary details or jargon that could confuse the recipient. Provide clear dates, details about your medical condition, and the expected outcome of your request. Make sure to request a response within a reasonable time frame.

Finally, conclude the letter with your contact information and a polite request for assistance. Always review the document for accuracy before sending it, as this can help prevent delays or complications in processing your request.

Here’s the corrected version with minimal repetition:

Ensure your medical insurance letter is clear and direct. Address the recipient properly and include all necessary details without redundancy. Keep the tone polite and professional throughout.

- Introduction: Clearly state the purpose of the letter. Example: “I am writing to request coverage for medical treatment that I recently received.”

- Details of the Treatment: Specify the medical services rendered, including dates and provider names. Avoid unnecessary elaboration.

- Request for Coverage: Make your request concise and to the point. Example: “Please review my case and confirm whether the treatment is covered under my policy.”

- Contact Information: Include any relevant contact details, such as your phone number or email address, for follow-up.

Conclude with a polite closing statement. For instance: “I look forward to your response and thank you for your time.”

- Medical Insurance Letter Template

When writing a medical insurance letter, clarity and accuracy are key. Your letter should clearly outline your request and include all necessary details to avoid confusion. Follow this structure to ensure that your message is clear and professionally presented.

Key Components of a Medical Insurance Letter

Start with your personal information at the top of the letter, followed by the insurance provider’s contact details. Include the date, policy number, and a brief statement regarding the reason for your letter. If you are seeking reimbursement or approval for a specific treatment, clearly state the medical procedure and the date it occurred. Be sure to mention any supporting documents you are attaching, such as medical bills or doctor’s notes.

Sample Medical Insurance Letter Template

| Section | Example |

|---|---|

| Your Information | John Doe 123 Main St. City, State, ZIP Code Email: [email protected] Phone: (123) 456-7890 |

| Insurance Provider’s Information | XYZ Insurance Company Claims Department 456 Insurance St. City, State, ZIP Code |

| Date | February 1, 2025 |

| Subject | Request for Reimbursement – Medical Treatment on January 15, 2025 |

| Body | Dear XYZ Insurance Claims Department,

I am writing to request reimbursement for medical services rendered on January 15, 2025. I underwent a procedure at [Hospital Name], and the total cost was $500. Attached are the relevant documents, including the itemized bill and the doctor’s report. Please process this claim at your earliest convenience. Thank you for your attention to this matter. Should you require any additional information, feel free to contact me at (123) 456-7890 or via email at [email protected]. Sincerely, |

By using this template, you ensure that your letter includes all relevant information and is presented in a professional manner. Tailor it as needed to your specific situation and insurance provider’s requirements.

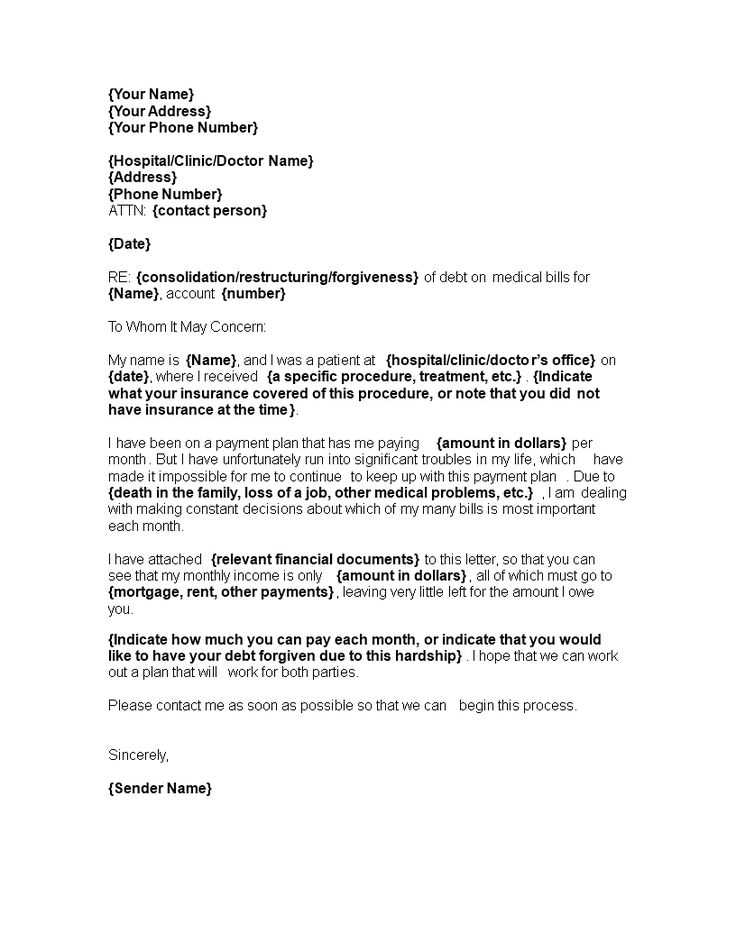

Start by clearly stating your intent to submit a medical claim in the opening paragraph. Include your name, policy number, and the date of the treatment to ensure the insurance company can quickly identify your case.

Provide a Detailed Explanation of the Treatment

Describe the medical service you received, including the name of the healthcare provider, the specific treatment or procedure, and any relevant diagnoses. Mention any referrals or prior approvals if applicable. Attach all relevant bills, invoices, and medical records that support your claim.

Specify the Amount Being Claimed

Clearly state the total amount you are requesting to be reimbursed. Break down the charges if possible, indicating which portion is covered by your insurance plan and which part may require additional documentation.

In the closing section, mention your contact information and express your willingness to provide any further details if necessary. Be polite but firm in requesting a timely resolution of your claim.

Ensure your letter covers the following points for clarity and accuracy:

- Your full name and contact information: Include your full name, address, phone number, and email. Make it easy for the insurer to reach you.

- Policy number: This is the reference number associated with your health insurance plan. It’s vital for identifying your coverage.

- Date of service or event: Clearly state the date when the medical service was provided or the event that triggered the need for the claim.

- Healthcare provider details: Provide the name, contact information, and credentials of the doctor, hospital, or clinic that provided the service.

- Type of treatment or service: Describe the medical services you received, including any procedures, tests, or medications administered.

- Cost breakdown: Include a detailed list of charges, including the total cost and any payments you’ve already made. This can include medical tests, consultations, or treatments.

- Diagnosis or medical condition: If applicable, mention the diagnosis or medical condition that required the treatment. This helps the insurer understand the necessity of the service.

- Request for reimbursement or coverage: Clearly state your request for reimbursement or insurance coverage for the provided services. Specify any amount you’re seeking and why.

- Attachments: Include any relevant documents, such as receipts, medical records, or bills, that support your claim or request.

Double-check that all information is accurate and that the letter is free from errors to avoid delays in processing your claim.

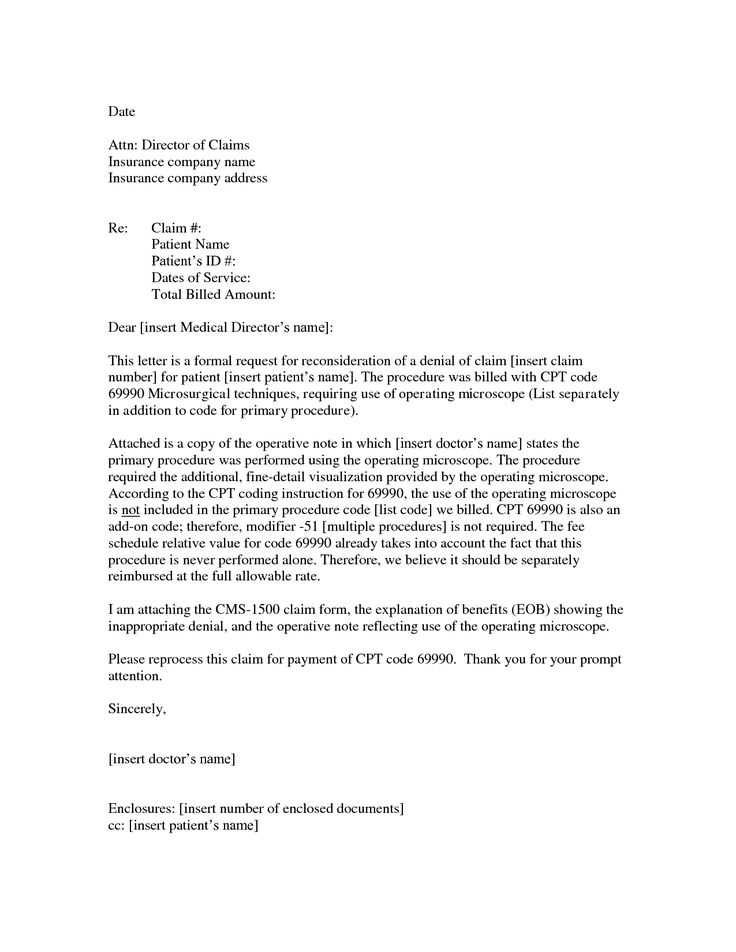

Begin by addressing the letter to the appropriate person or department within your insurance company. Use their full name, title, and the company’s contact details. If you are unsure of who to direct it to, check the insurance provider’s website or contact their customer service.

Clearly state your request at the beginning of the letter. Specify whether you are asking for coverage approval or reimbursement, and provide the reason for the request. Be concise and direct to avoid any confusion.

Next, provide all necessary details about your medical situation. This includes the date of treatment, medical provider’s name, and the nature of the service provided. Attach relevant documents such as invoices, medical records, or receipts that support your claim. These will help to substantiate your request.

If your insurance policy has specific terms for reimbursement or coverage, reference these terms directly in the letter. For example, mention any clauses that apply to your case, such as emergency services or out-of-network treatment, to strengthen your argument.

Explain any extenuating circumstances that may support your claim. This could include situations like medical urgency, lack of availability of in-network providers, or any other relevant context that can clarify your need for coverage or reimbursement.

End the letter by requesting a timely response, specifying your preferred method of contact (email or phone), and expressing your hope for a positive resolution. Include your contact information and any additional details the insurance provider may need to reach you.

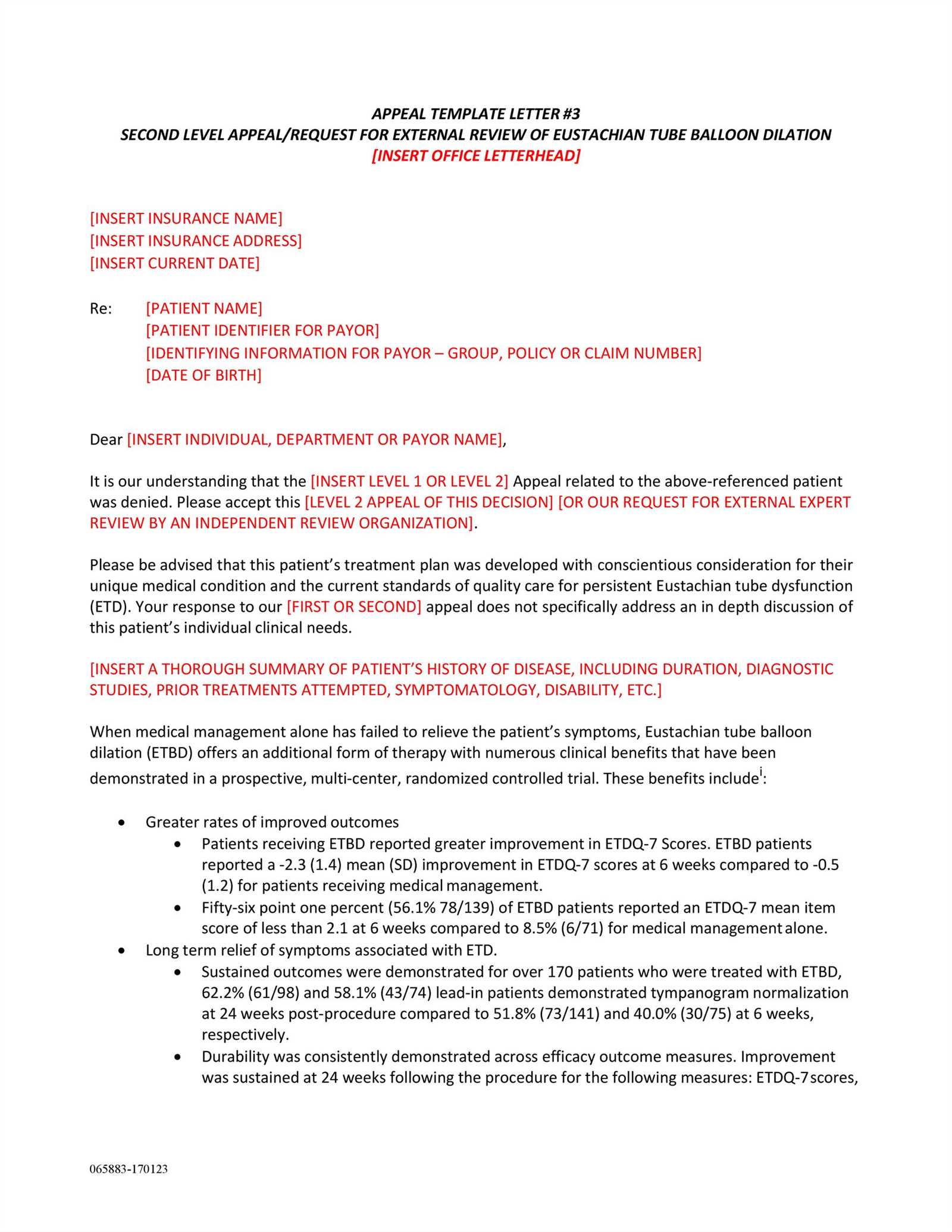

Begin by stating your purpose clearly: to appeal the denial of your claim. Address the specific reasons the insurance company provided for the denial, referencing the exact section or code from their letter. Be factual and direct in your response, without adding unnecessary details. Highlight any discrepancies or misunderstandings that may have led to the denial.

Provide any supporting documents that clarify or correct the information. This could include medical records, bills, or any other relevant paperwork that supports your case. Organize the documents in a clear, logical order and reference them in your letter.

If you believe the denial was based on incorrect information or an oversight, politely request a re-evaluation. Use specific examples of how the circumstances may have been misunderstood. Maintain a professional tone, focusing on resolving the issue rather than expressing frustration.

It may help to restate the terms of your policy that support your claim. Show how your situation aligns with the coverage provided. If the denial was related to a misunderstanding of your policy or procedure, clarify these details in a straightforward manner.

Conclude the letter by requesting a prompt review and resolution. Include your contact information and offer to provide any additional details if needed. Express your hope for a fair reconsideration of the claim.

Clarity is key. Avoid using overly complex language or technical jargon that can confuse the recipient. Stick to straightforward, easy-to-understand terms, especially when explaining medical treatments or coverage details. A clear letter ensures the reader understands your request without needing to interpret complex phrases.

1. Missing Key Information

Omitting essential details can delay the insurance process. Always include the necessary personal information, policy number, date of service, and a detailed explanation of the request. If applicable, add supporting documents such as medical bills or doctor’s notes.

2. Lack of Proper Formatting

Organize your letter logically. Use headers and bullet points where appropriate to break up large blocks of text. This makes it easier for the insurance representative to find the relevant information quickly. A well-structured letter reduces the chance of misunderstandings and increases the likelihood of a timely response.

| Key Information to Include | Explanation |

|---|---|

| Personal Details | Name, contact information, and policy number |

| Date of Service | The specific date the medical service was provided |

| Explanation of Request | A clear description of the service or coverage being requested |

| Supporting Documents | Medical bills, doctor’s notes, or other relevant records |

Ensure you provide all the information needed upfront to prevent unnecessary follow-ups. Incomplete letters will only delay the process.

3. Overloading the Letter with Unnecessary Details

Avoid including irrelevant information. Stick to the facts and focus on what is required for your claim. Insurance companies may not have time to sift through irrelevant details, so only include what is necessary to support your request.

4. Not Proofreading Before Sending

Always proofread your letter before sending it. Spelling or grammatical errors can make your letter appear unprofessional, and unclear language can lead to misunderstandings. Taking a few minutes to review your writing can ensure your request is taken seriously.

By avoiding these common mistakes, you ensure your insurance letter is clear, professional, and effective in conveying your needs.

Submit your medical insurance letter with clarity. Ensure it includes all necessary details: policy number, patient’s full name, provider’s information, and the specific medical services requested. Verify that you have signed the letter before sending it to avoid unnecessary delays.

Double-check the format and structure of your letter. Organize the content logically, using headings or bullet points for easy navigation. Make sure your handwriting is legible if the letter is handwritten, or use a clean, professional font if it’s typed.

Keep a copy of the letter and any supporting documents for your records. This can be helpful if there are any follow-ups or disputes regarding your claim. Also, confirm the submission method–whether it’s via mail, email, or an online portal–to ensure it’s directed to the correct department.

Verify all contact information, including the recipient’s name and title, so your letter reaches the right person. If submitting electronically, check file sizes and formats to comply with the insurance company’s requirements.

Finally, consider sending your letter via a traceable method to track its delivery and avoid the possibility of it being lost or overlooked. This adds an extra layer of accountability for both you and the insurance provider.

When writing a medical insurance letter, include a clear and direct subject line. Specify the purpose of the letter upfront, such as a claim request or policy inquiry. Follow with relevant personal details like your full name, policy number, and contact information. Make sure to reference the specific treatment or medical service for which you are seeking reimbursement or assistance.

Keep the tone professional and concise. Avoid unnecessary elaboration, sticking strictly to the facts. Include any supporting documents, such as medical bills, prescriptions, or treatment records, and mention that they are enclosed for reference. Specify any deadlines or urgency related to the matter at hand to help prioritize your request.

Conclude with a polite closing, ensuring that you express gratitude for their attention and cooperation. Indicate your willingness to provide further information if necessary and include your preferred contact method for follow-up. Always review the letter before sending to confirm accuracy and completeness.