Medical Necessity Appeal Letter Template for Insurance Approval

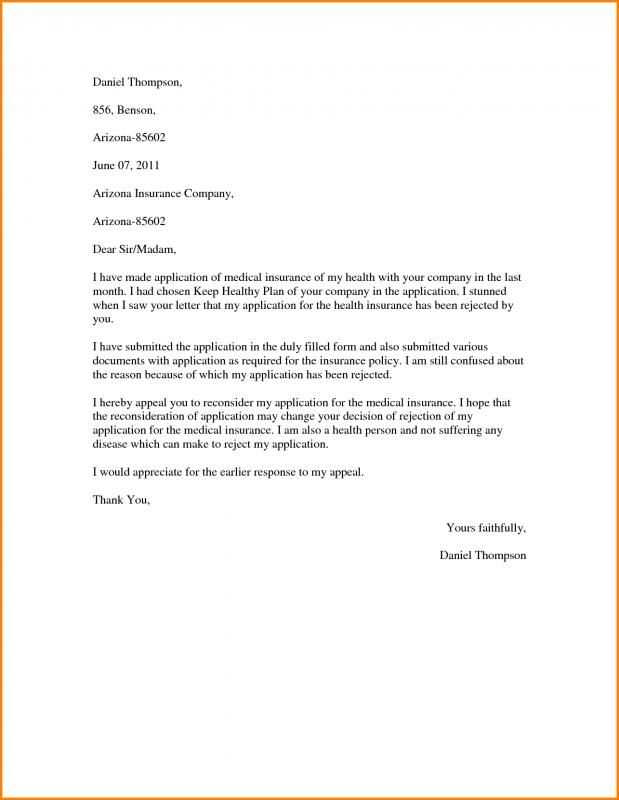

When insurance providers reject a claim for necessary care, it can leave patients feeling overwhelmed and uncertain about how to proceed. The good news is that there are formal ways to challenge these decisions, aiming to secure coverage for critical health services. With a well-structured approach, individuals can increase their chances of receiving the coverage they need.

Crafting a persuasive and detailed appeal is key to addressing the insurance company’s concerns. By providing clear evidence of why a particular treatment or service is crucial for your well-being, you can build a strong case for reconsideration. A carefully written request that highlights medical justifications and relevant supporting information plays an essential role in this process.

Understanding the components of a successful request and knowing how to present your argument can significantly improve your chances of success. This article will guide you through the process of preparing an effective appeal, ensuring that your voice is heard and your needs are acknowledged.

Understanding Insurance Reconsideration Requests

Insurance companies often refuse to cover specific treatments or services, leaving patients without necessary care. In such cases, it’s crucial to challenge the decision through a formal process. This process involves submitting a request to have the original decision reviewed, with the aim of proving that the denied service is essential for the patient’s health and well-being. By presenting a clear and well-documented case, patients can improve their chances of having the decision overturned.

Why Insurance Denies Claims

Insurance providers may refuse to approve coverage for various reasons, such as the treatment being considered too expensive, experimental, or not fitting the policy’s terms. In some cases, the provider may argue that the procedure is not deemed essential for the patient’s condition. Understanding these reasons helps in structuring a strong argument when challenging the refusal, ensuring that the denial is properly addressed.

How to Strengthen Your Case

To increase the likelihood of a favorable outcome, it is important to include sufficient medical evidence and expert opinions that support the necessity of the treatment. Detailed records from healthcare providers, along with any relevant tests or diagnoses, should be part of the submission. The more comprehensive and compelling the information, the better the chance of a successful reconsideration.

Why Insurance Denies Claims

Insurance providers may reject coverage for certain treatments or services for a variety of reasons. These denials can leave patients frustrated and uncertain about their options. Understanding the common causes of rejection is the first step in addressing and potentially overturning the decision. Insurers have strict guidelines and criteria, and any deviation from these may lead to a claim being denied.

Common Reasons for Denial

There are several common factors that can contribute to an insurance company refusing to cover a claim:

- Policy limitations: The service or treatment may not be covered under the specific terms of the insurance policy.

- Experimental or unproven treatments: Insurance providers may deem certain procedures as not proven or experimental, leading to a denial.

- Pre-existing conditions: Some insurers exclude coverage for treatments related to pre-existing health conditions, particularly if they were not disclosed during the application process.

- Insufficient documentation: If a claim lacks sufficient supporting information or medical evidence, it may be rejected.

- Out-of-network care: Receiving care from a provider outside of the insurer’s approved network can result in a claim being denied or partially paid.

Understanding the Insurer’s Perspective

Insurance companies operate within specific financial and regulatory guidelines, which often means rejecting claims that don’t meet their criteria. In some cases, providers are required to follow a strict cost-benefit analysis when determining whether a treatment is covered. While this may seem frustrating, understanding the reasoning behind these decisions can help patients better address the issue in the future.

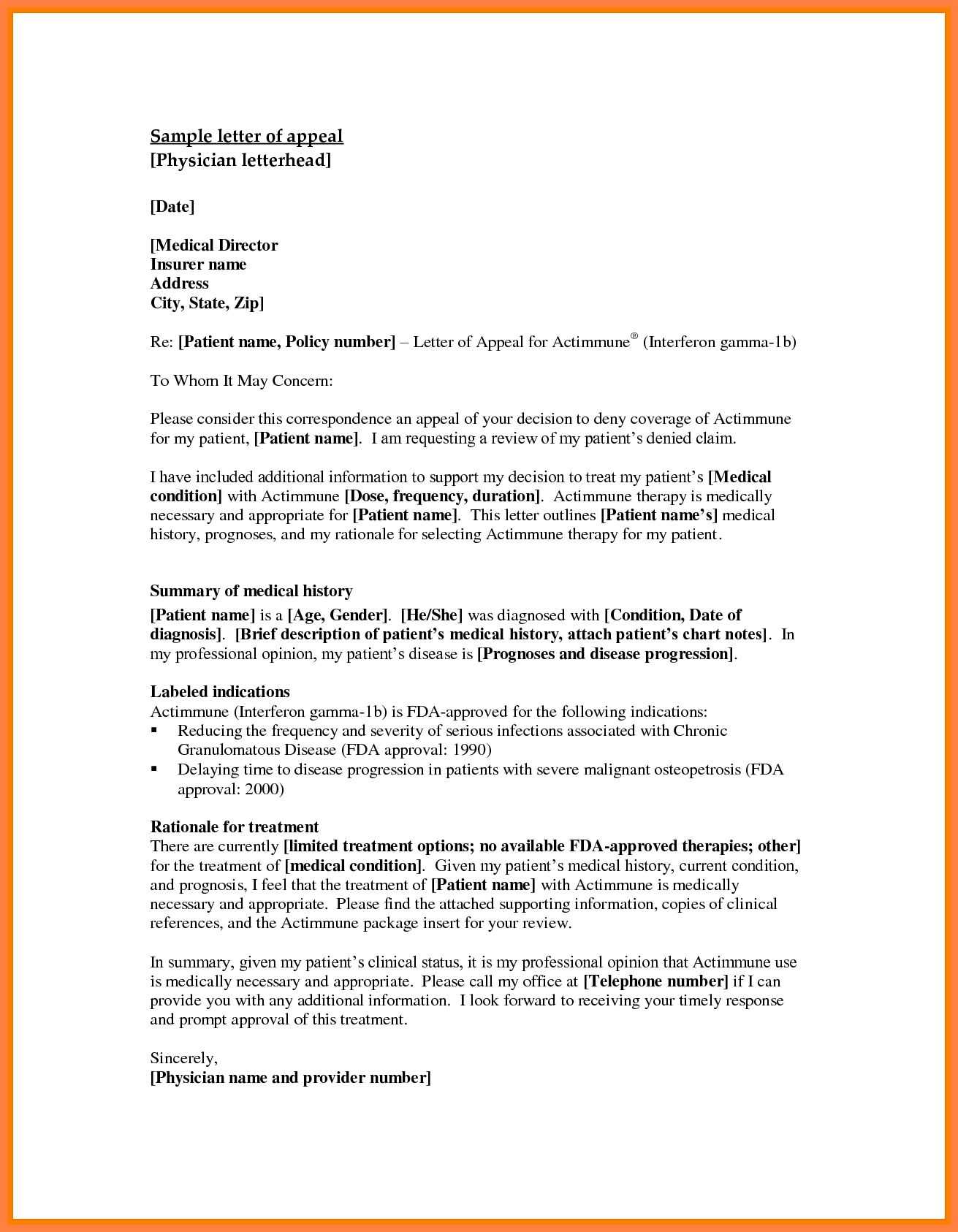

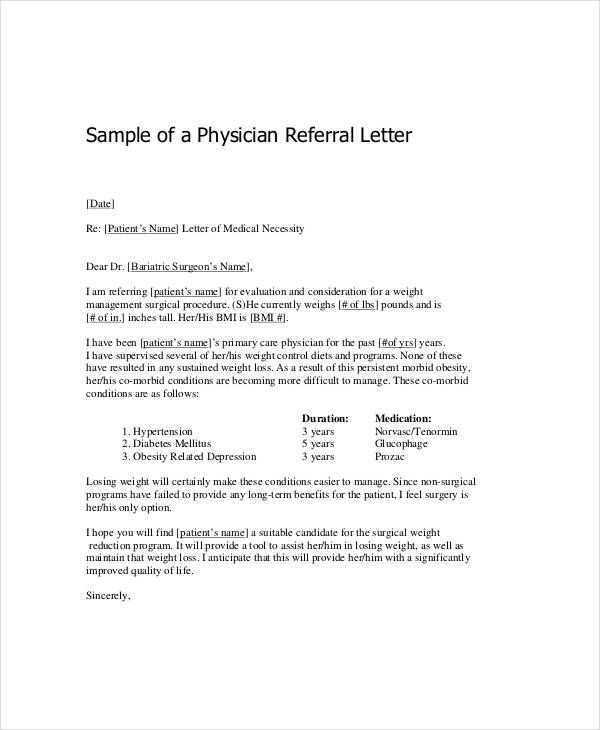

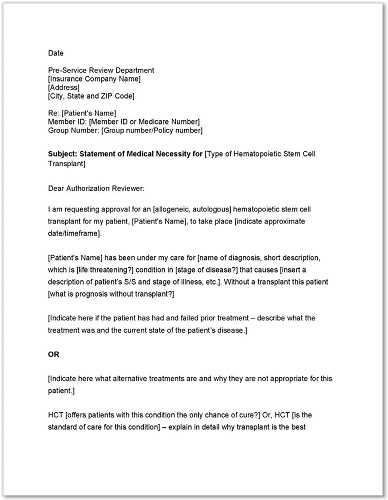

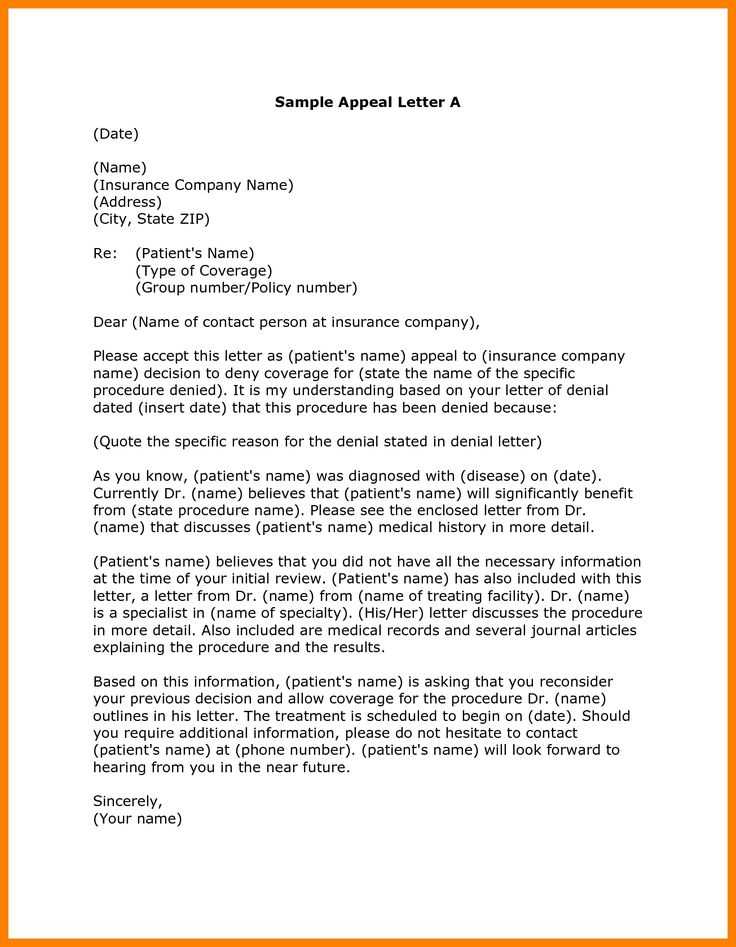

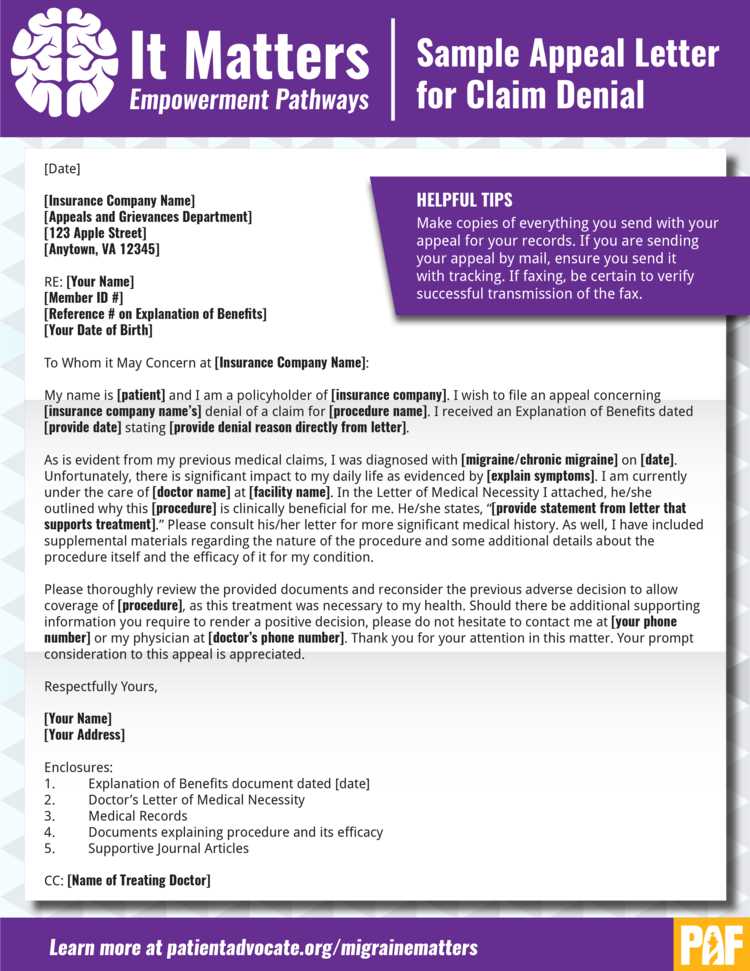

Key Elements of an Appeal Letter

When challenging an insurance decision, it’s crucial to present a well-structured and clear request that addresses the reasons behind the denial. A successful submission needs to provide sufficient information, relevant documentation, and a compelling argument for why the requested service should be covered. Understanding the key components that make up a strong appeal can significantly increase the likelihood of getting the decision reversed.

Each element of the request plays an important role in persuading the insurance company to reconsider its stance. By focusing on clarity, accuracy, and supporting evidence, the document becomes a powerful tool in addressing the insurer’s concerns and proving the necessity of the treatment or service.

Step-by-Step Guide to Writing a Request

Creating a well-organized and effective request is essential when seeking reconsideration for an insurance denial. Each section of the document should be thoughtfully crafted to present a clear and convincing case. Following a structured approach helps ensure that all critical information is included, leaving little room for misunderstanding or rejection.

1. Begin with Your Information and Policy Details

Start by including your full name, address, and contact information at the top of the document. Follow this with your policy number, claim number, and any other relevant identifiers that will help the insurer quickly locate your case. This section should be brief but clear to avoid any delays in processing.

2. State the Purpose of Your Request

In the opening paragraph, clearly state the reason for your request. Reference the denied service or treatment, including the date of the original decision, and explain that you are seeking reconsideration. It’s important to be concise while outlining the goal of your communication.

In the following sections, provide detailed explanations and supporting documentation that justify your request and strengthen your case. This structured approach ensures a professional and persuasive submission.

Common Mistakes to Avoid in Appeals

When submitting a request to reverse an insurance decision, it’s important to avoid common errors that can weaken your case or lead to unnecessary delays. These mistakes often arise from a lack of attention to detail or misunderstanding the insurer’s requirements. By knowing what pitfalls to look out for, you can ensure that your submission is as effective and professional as possible.

1. Failing to Provide Complete Documentation

One of the most frequent errors is not including all the necessary paperwork that supports your case. Insufficient or incomplete documentation can result in the denial being upheld, as the insurer may not have enough information to reconsider the decision. Be sure to include medical records, bills, and any relevant communication from healthcare providers to strengthen your argument.

2. Being Too Vague or Overly Emotional

While it’s important to express the significance of the situation, it’s equally important to remain clear and objective. Avoid vague statements or emotional language that might detract from the professionalism of your request. A concise, factual explanation of why the service is critical to your health is more likely to resonate with the insurer than an emotional appeal.

How to Increase Your Chances of Success

Securing approval for a denied claim requires more than just submitting a basic request. To improve your likelihood of success, it’s essential to approach the process with careful preparation and attention to detail. By strengthening your argument and ensuring all necessary components are included, you can increase the chances of getting a favorable outcome.

1. Provide Strong Supporting Evidence

One of the most important factors in gaining approval is providing compelling evidence that supports the necessity of the treatment or service. This may include detailed medical records, expert opinions, diagnostic test results, or any other relevant documents that validate the need for the care. The more comprehensive and specific the evidence, the stronger your case will be.

2. Be Clear and Concise

Insurance providers review numerous requests, so it’s crucial to be clear and direct in your submission. Avoid unnecessary information or overly complicated language that could obscure the main points of your argument. Present your case in a well-organized manner, and focus on the key reasons why the service is essential for your health. Clarity and simplicity can make your request more effective.