Collection notice letter template

Creating a collection notice letter requires clarity and professionalism. This letter serves as an important step in communicating outstanding debts to clients, ensuring that the terms are clear and that the next steps are understood. To be effective, the letter must be direct and polite while providing all necessary details regarding the amount due and the payment deadline.

Structure your collection notice letter with key information: Start with a clear subject line that outlines the purpose of the letter. Address the recipient with respect and provide specific details, such as the invoice number, outstanding amount, and any previous communications. Clearly state the date by which payment is expected and any potential consequences for non-payment, like late fees or legal actions.

Tone and clarity play a critical role in how the letter is received. Avoid language that could be perceived as overly aggressive, but ensure that the urgency of the matter is communicated effectively. It is also helpful to offer the recipient options for making the payment and to provide clear instructions on how to do so. This will increase the likelihood of timely action while maintaining a professional relationship.

Here’s the revised version, minimizing redundancies while maintaining meaning and accuracy:

Begin with a clear and direct statement regarding the outstanding balance. Mention the due date and the amount owed, ensuring that it is easy for the recipient to understand. Be concise but informative. In the following paragraphs, detail the payment methods available, including options such as credit card payments, bank transfers, and online portals. Make sure to provide the necessary instructions or contact details for each option to avoid any confusion.

Payment Reminder

Remind the recipient of the importance of timely payment to avoid late fees or further actions. Clearly state any penalties for non-payment, but in a neutral, non-threatening manner. It’s key to remain firm yet respectful throughout this section.

Contact Information

Provide a dedicated contact for payment inquiries, whether it’s an email address or phone number. This ensures the recipient has a direct line to resolve any issues or ask questions, reducing the chance of delays.

| Payment Method | Details |

|---|---|

| Credit Card | Visit our online payment portal at [website]. |

| Bank Transfer | Account Number: [number]. Bank: [bank name]. |

| Online Portal | Log in to [portal name] to complete the payment. |

End the letter with a polite reminder of the action needed, thanking the recipient for their attention to this matter. Maintain a professional tone throughout while ensuring all key information is clear and easy to follow.

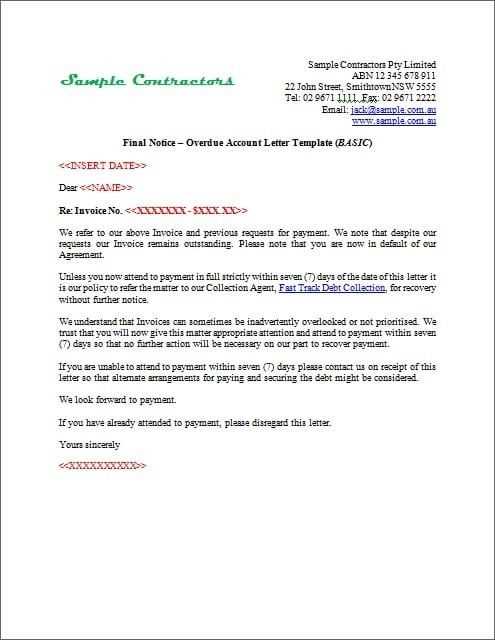

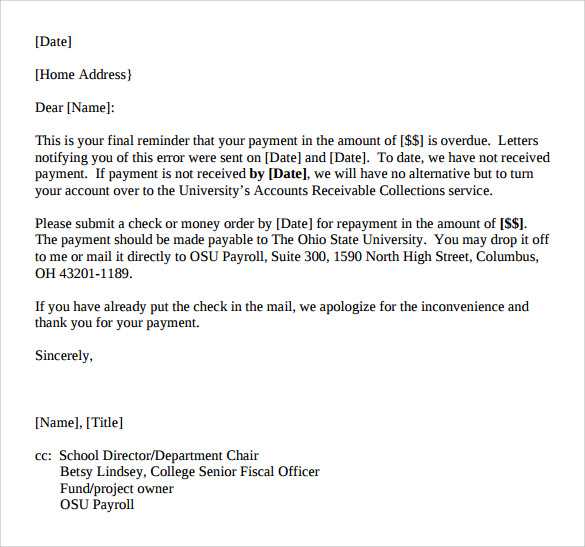

- Collection Notice Letter Template

A collection notice letter informs a debtor about their outstanding balance and requests payment. It is concise and direct, providing clear instructions on how to resolve the issue.

- Header: Include your company’s name, address, phone number, and email. Add the debtor’s name, address, and other contact details.

- Subject Line: Write a simple subject line, such as “Payment Due: Immediate Attention Required.”

- Greeting: Use a formal salutation, such as “Dear [Debtor’s Name].”

- Account Information: Mention the account number and the outstanding amount owed. Be clear about what the debt relates to (e.g., unpaid invoice for services rendered).

- Outstanding Balance: Specify the total amount owed and include the due date. If possible, provide a breakdown of the charges.

- Request for Payment: Politely but firmly ask for payment by a specific date. Specify the methods of payment accepted (e.g., bank transfer, online payment portal).

- Late Fees (if applicable): State if any late fees have been applied or will be applied if the payment is not made by the due date.

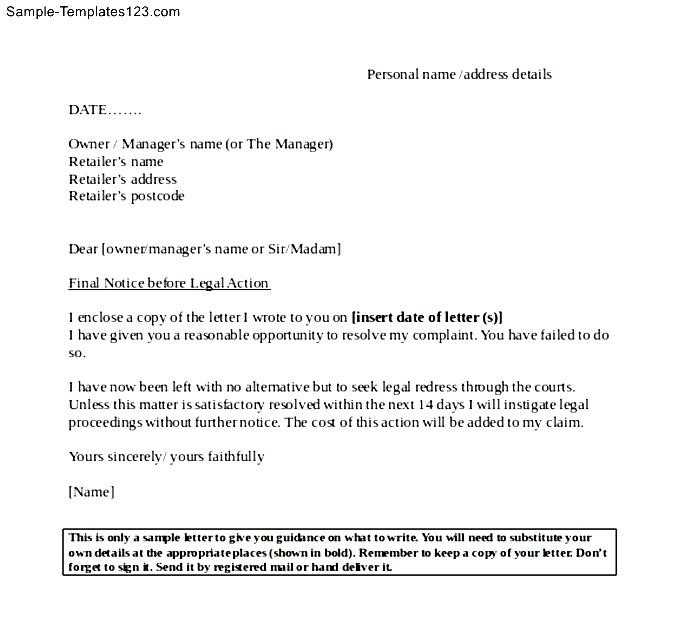

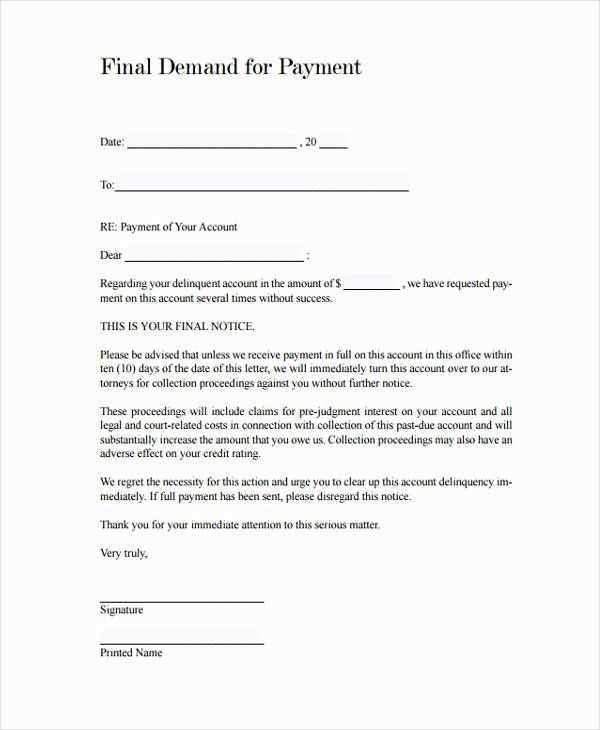

- Consequences of Non-Payment: Briefly mention the next steps if the payment is not received, such as further collection efforts or legal action.

- Closing: Close the letter with a professional sign-off such as “Sincerely,” followed by your name and position.

- Attachments: If needed, attach any documents like invoices or receipts that support your claim.

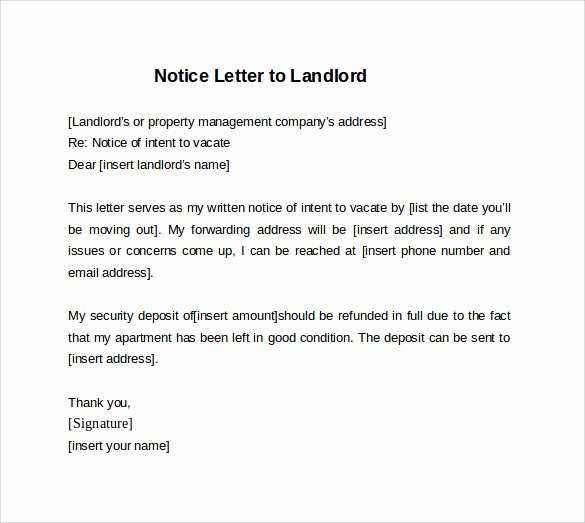

Here’s an example template:

[Your Company Name] [Your Company Address] [Your Company Phone Number] [Your Company Email Address] [Debtor’s Name] [Debtor’s Address] Subject: Payment Due: Immediate Attention Required Dear [Debtor's Name], This letter is to inform you that your account with [Your Company Name] is past due. Your outstanding balance of [Amount Owed] is due on [Due Date]. Please refer to the following details: Account Number: [Account Number] Outstanding Balance: [Amount Owed] Invoice Number: [Invoice Number] Due Date: [Due Date] We kindly request that you remit payment by [Due Date] to avoid further action. Payments can be made via [Payment Methods]. Please note that a late fee of [Late Fee Amount] will be added if payment is not received by the due date. If payment is not received by [New Due Date], we will proceed with [next steps, e.g., referring the account to collections or pursuing legal action]. If you have any questions or need assistance, feel free to contact us at [Your Company Phone Number] or [Your Company Email Address]. Sincerely, [Your Name] [Your Position] [Your Company Name]

Begin with clear identification of the sender and the recipient. Include the full name, address, and contact information of both parties. This ensures the recipient can easily recognize the source of the notice. Make sure to use accurate and up-to-date details for both the debtor and the creditor to avoid any confusion.

Key Details to Include:

| Section | Details |

|---|---|

| Sender Information | Include your full name or company name, address, phone number, and email address. |

| Recipient Information | Include the debtor’s full name, address, and any other relevant contact information. |

| Subject Line | Clearly state the purpose of the letter, e.g., “Collection Notice for Outstanding Debt.” |

| Date | Always include the current date to indicate when the letter was sent. |

| Reference Number | Provide a reference number related to the debt, such as an account number, invoice number, or other identifiers. |

Debt Amount and Details

Next, specify the exact amount owed. This should include the original debt, any interest, and additional fees or charges. Be precise about the figures and offer a breakdown if necessary to avoid any confusion. This transparency shows professionalism and helps the debtor understand the total balance due.

Ensure your letter is clear and professional, avoiding common errors that can lead to confusion or legal issues.

- Vague Language – Be specific about the debt amount, the due date, and the action required. Using vague terms like “immediate payment” or “soon” can cause uncertainty.

- Ignoring Legal Requirements – Make sure to include the required disclosures about the debtor’s rights, such as the option to dispute the debt. Failing to do so could result in a non-compliant notice.

- Using Aggressive or Threatening Tone – Avoid using language that can be seen as threatening, like “We will take you to court” or “You will regret this.” Keep the tone neutral, focusing on resolution.

- Misspelled Information – Double-check the debtor’s name, account number, and the amount owed. Small mistakes can damage your credibility and delay the process.

- Unclear Payment Instructions – Provide exact details on how the payment should be made, including the accepted methods and payment address. Lack of clarity can lead to payment delays.

- Sending Multiple Notices Too Soon – Bombarding the debtor with several notices in a short period can seem harassing. Allow some time between each reminder to give the debtor a chance to respond.

- Not Documenting Communication – Always keep a record of all communications. Failure to do so can leave you unprepared in case of a dispute or legal action.

Clearly stating a payment deadline in your collection notice prevents confusion and encourages timely payment. Set a specific date by which the payment must be made, and avoid vague terms like “soon” or “as soon as possible.” A precise deadline, such as “Payment is due by February 15, 2025,” gives the recipient a clear understanding of their responsibility.

Make the Deadline Realistic

Ensure that the payment deadline allows enough time for the recipient to respond. A typical period is 7 to 14 days from the date the letter is sent, but this can vary depending on the situation. Avoid setting an unrealistically short deadline, as this could hinder the chance of receiving payment and may damage your professional relationship.

Consider Legal Implications

When setting the deadline, keep in mind any legal requirements or regulations that may apply in your jurisdiction. In some regions, laws govern the length of time you must wait before sending a collection notice or taking further action. Be aware of these rules to ensure your notice complies and remains enforceable.

Clear and accurate legal language is vital in collection letters to avoid misunderstandings. Use straightforward terms, but make sure they align with legal standards to communicate seriousness without being overly complicated.

1. Use Precise Terminology

Choose legal terms carefully to reflect the seriousness of the situation. Terms like “outstanding balance” or “delinquent account” are less likely to be misinterpreted than vague terms. Avoid using jargon that may confuse the recipient.

2. Specify Actions and Consequences

- Clearly outline the steps the recipient should take, such as “payment within 30 days” or “contact our office for alternative payment arrangements.”

- Explain potential consequences of inaction, like “failure to resolve this debt may result in further legal action” or “your account may be referred to a collections agency.”

By being direct, you set clear expectations and minimize the risk of disputes later.

3. Avoid Overly Aggressive Language

Though legal terms are important, avoid sounding threatening or overly forceful. Stick to professional language and avoid phrases that could be perceived as harassment, such as “final warning” or “we will pursue all legal means immediately.” Maintain a tone that encourages resolution without aggression.

4. Include Relevant Legal Rights

Ensure the letter includes a reference to the recipient’s rights under debt collection laws. For example, “You have the right to dispute this debt within 30 days.” This gives the recipient the legal option to challenge the claim if needed, ensuring the letter complies with regulations like the Fair Debt Collection Practices Act (FDCPA) in the U.S.

Follow up within 7 to 10 days after sending a collection notice. A polite reminder can prompt a quicker response from the debtor. Make sure to address any questions or concerns they may have about the outstanding balance.

If there’s no response, consider calling the debtor. A phone conversation can often lead to more immediate resolutions and may uncover any misunderstandings or issues preventing payment. Keep the tone professional and respectful, emphasizing the need for resolution.

If the debtor expresses difficulty paying, be open to negotiating a payment plan. Offer flexible terms that could help them settle the debt while maintaining your cash flow. Ensure that any new agreements are documented in writing.

Should you still receive no response, a final notice or legal action may be required. Before moving to that step, ensure that all communications have been properly documented and that you’ve followed the relevant procedures outlined in the collection notice. This will help protect your position if you need to escalate the matter legally.

Respond quickly to any disputes raised by the debtor. Acknowledge their response in writing and clarify your position with supporting documentation. If the debtor challenges the amount owed, provide an itemized statement detailing the debt and any previous communications. Stay firm but respectful in your tone.

If the debtor claims they do not owe the debt, ask them to provide evidence supporting their claim. Evaluate the situation objectively and seek a fair resolution, such as offering a payment plan or adjusting the payment terms if necessary. Keep all correspondence professional and document every interaction.

If the dispute escalates, consider mediation as an alternative to litigation. Present the benefits of mediation to the debtor, including the opportunity to resolve the matter efficiently without the costs of legal action. Maintain open communication throughout the process, ensuring both parties feel heard.

Document all responses carefully, noting the date, content, and any actions taken. This record will be valuable should the situation progress to formal collections or legal proceedings.

Ensure your collection notice letter is clear, concise, and professional. Start with a friendly yet firm tone to encourage prompt payment without sounding overly harsh. The purpose is to remind the recipient of their outstanding balance while offering them a reasonable path to resolve the situation.

Include Key Details

Clearly state the amount owed, the due date, and the nature of the debt. This ensures that there is no confusion about the specifics of the claim. Include an invoice number or reference for easy identification. Providing a breakdown of the charges can help prevent misunderstandings.

Provide Payment Instructions

Offer clear instructions on how the recipient can make the payment, including acceptable methods (e.g., bank transfer, online payment portal). If there are any late fees or consequences for non-payment, mention them politely but firmly.

End the letter by offering assistance if needed, such as providing a contact number or email for any questions or disputes. This shows your willingness to resolve the matter amicably while keeping the tone professional.