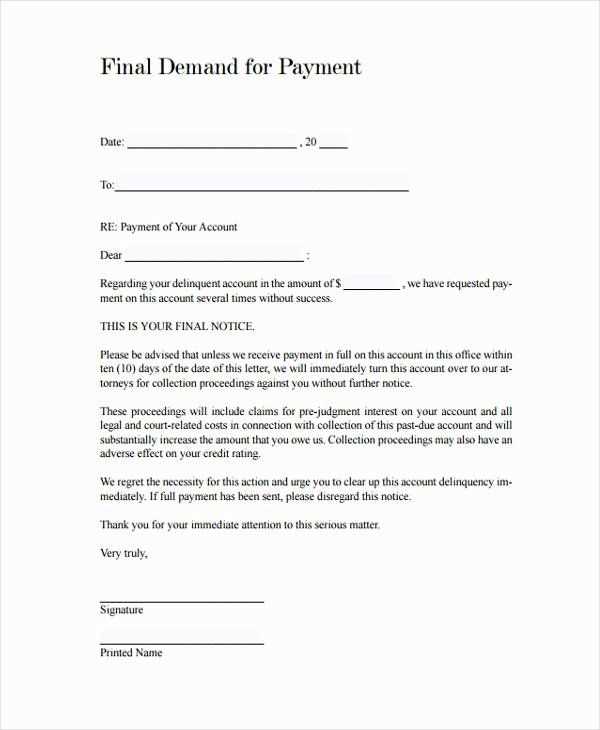

Final notice letter for payment template

Send a clear and direct final notice letter when payment is overdue to ensure prompt action. The template should include all relevant details such as the outstanding amount, due date, and consequences of non-payment. Structure your message to reflect urgency but remain professional.

Start with a brief reminder of the initial payment terms and dates. Follow this with a specific call to action, emphasizing the need for immediate settlement to avoid further action. Avoid vague language–be straightforward about the impact of non-compliance, like additional fees or legal steps.

Ensure the tone remains polite, but firm. Acknowledge the importance of resolution and offer any possible methods for payment. Clearly state the final deadline, and end by providing contact information for any questions or issues regarding the payment.

Here’s a detailed plan for an informational article titled “Final Notice Letter for Payment Template” in HTML format with six practical and focused headings:

Begin with a clear outline of the situation, identifying the amount due, the due date, and any previous attempts to resolve the issue. This will set the tone and provide clarity to the recipient. Make it direct, without sounding aggressive, as this is a formal request for payment.

1. Understand the Context of the Letter

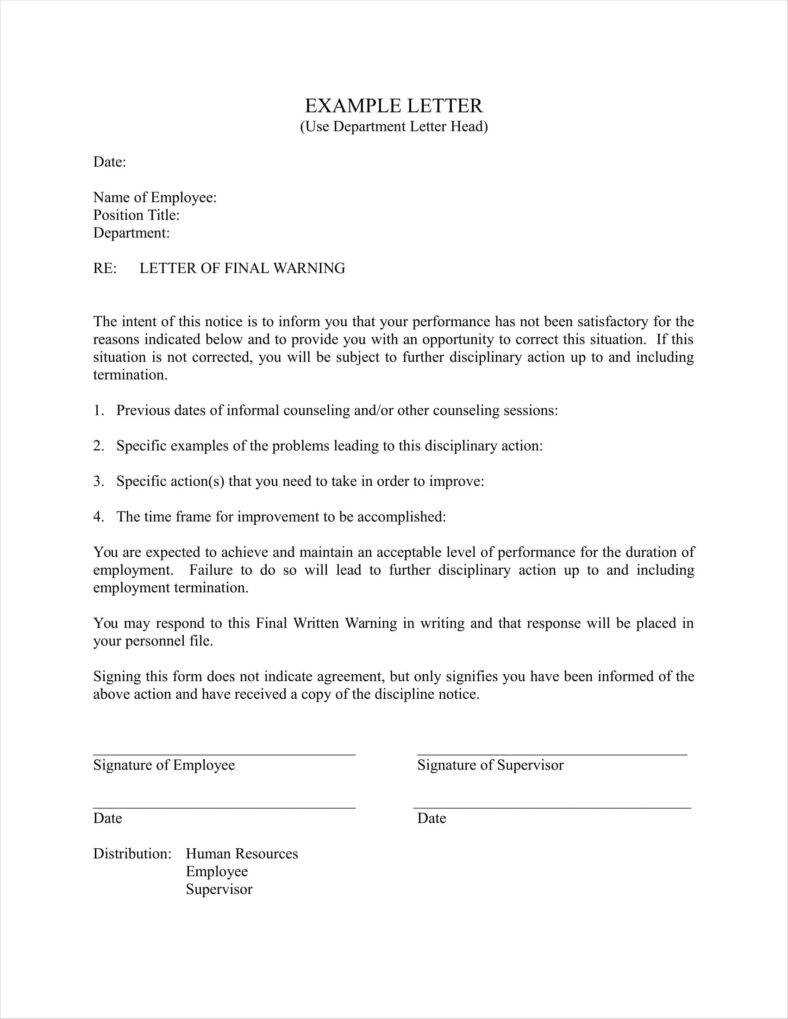

Describe the purpose of the letter: informing the recipient of overdue payments and the consequences of not addressing the issue. Mention that it is the final reminder before taking legal or financial action, offering a last chance to resolve the matter amicably.

2. Clearly State the Payment Amount and Due Date

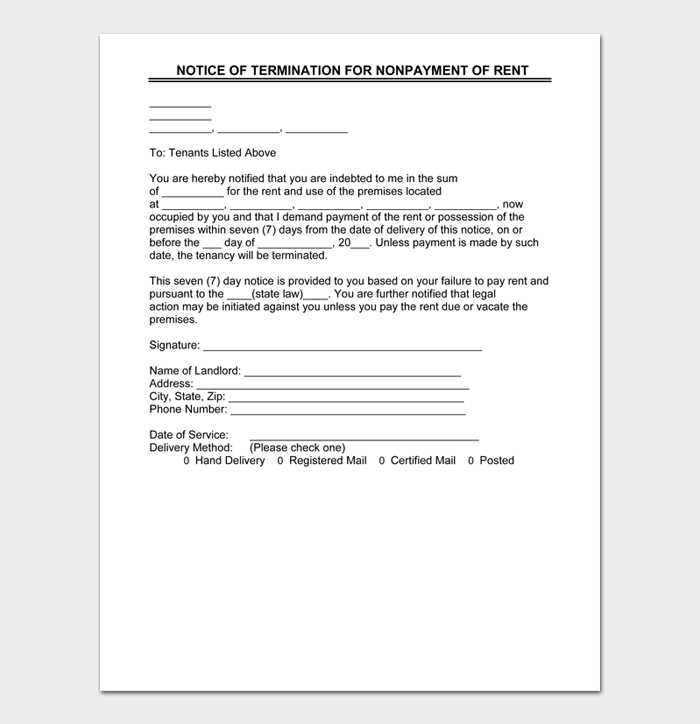

Provide the exact amount owed, including any late fees or additional charges that may apply. Specify the original due date and mention any prior communications or agreements regarding the payment.

3. Outline the Consequences of Non-payment

Be concise yet firm in stating the repercussions of ignoring the payment request. This might include legal actions, additional fees, or disruption of services. However, it should remain professional and respectful, reinforcing the urgency of the matter.

4. Offer Payment Options

Detail the methods available for payment, such as bank transfer, check, or online payment platforms. Providing multiple options makes it easier for the recipient to settle the debt.

5. Provide a Contact for Queries

Give a clear point of contact for any questions or concerns regarding the payment. Include phone numbers, email addresses, or any other relevant information to facilitate communication. This can help resolve misunderstandings or disputes quickly.

6. Close with a Clear Call to Action

Conclude the letter with a clear instruction, urging the recipient to make the payment immediately to avoid further complications. Keep the tone polite but firm, emphasizing the need for urgent resolution.

- htmlEdit Final Payment Notice Template

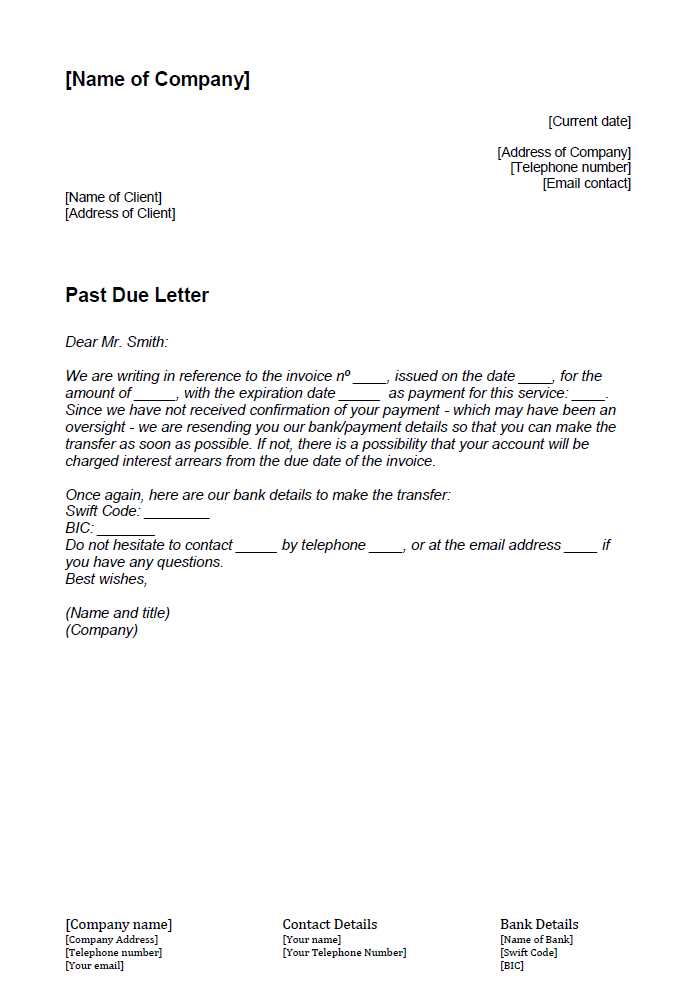

Begin the final payment notice with a clear statement regarding the overdue balance. Include the amount owed, along with the due date, and specify the payment methods available. It’s critical to maintain a tone that is firm but respectful.

Use a concise subject line for the email or letter, such as “Final Notice for Payment.” In the body, reiterate the terms of the agreement, including any previous reminders sent. This serves as a reminder to the recipient that the payment is long overdue.

Clearly state the consequences of non-payment, such as additional fees, suspension of services, or legal action, if applicable. Be sure to reference any contractual obligations that have been violated, but avoid unnecessary language that could escalate tension.

Provide specific instructions for making the payment, including the account details or payment portal link. Make the process as simple as possible to avoid further delays.

Conclude the notice by encouraging the recipient to reach out with any questions or concerns. Ensure you include a contact number or email address for easy communication. Reinforce the importance of settling the account promptly to prevent further actions.

A final reminder serves as a clear and direct signal that payment is overdue, emphasizing the urgency of settling an outstanding balance. This step is crucial in ensuring that all parties involved understand the seriousness of the situation and the potential consequences of non-payment.

- Clarifies the Deadline: A final reminder sets a specific timeline, helping to avoid confusion about when the payment must be made.

- Increases Accountability: It reinforces the need for the recipient to take action, making them aware that this is the last opportunity to pay before further actions are taken.

- Prevents Future Disputes: By providing a final warning, it reduces the risk of misunderstandings or disputes later on regarding the payment schedule or terms.

- Strengthens Your Position: Sending a final reminder ensures that you are legally protected and demonstrates professionalism in managing your financial matters.

Start with a clear statement of the outstanding payment. Specify the amount owed, the due date, and any relevant reference numbers or invoices. Be direct and transparent in listing the financial details to avoid confusion.

Reminder of Terms

Include a reminder of the terms agreed upon in the initial agreement or contract. This could involve payment deadlines, interest charges for late payments, or any additional fees applicable. Ensure these terms are clear, allowing the recipient to understand the consequences of non-payment.

Consequences for Non-Payment

Outline the next steps if payment is not made. Mention any actions you may take, such as legal proceedings or halting services. Keep this section professional but firm, indicating that further delay is not an option.

Finish with a polite call to action, offering multiple payment options and contact information for any queries. Encourage prompt resolution and maintain a courteous tone throughout the letter.

Use concise language and direct statements to convey the message clearly. Avoid unnecessary jargon or overly complex sentences that may confuse the reader. Always address the matter at hand respectfully, while maintaining authority in your request for payment. Ensure the tone stays polite, even as you communicate urgency.

Key Elements for Clarity

- State the amount due and the due date without ambiguity.

- Clearly outline the consequences of non-payment, focusing on the next steps.

- Use polite but firm language to request immediate action.

- Avoid excessive emotional language or apologetic phrasing that might dilute the seriousness of the letter.

Examples of Professional Phrasing

- “Please remit payment by [due date] to avoid further action.”

- “We kindly ask for your prompt attention to this matter.”

- “Failure to settle this account will result in [consequence], as outlined in the terms of your agreement.”

Choose precise and straightforward legal terms to avoid confusion. Use specific language that clearly defines the obligations of both parties. This ensures the recipient understands the severity of the situation and the consequences of non-payment.

Key Terms to Include

Incorporate terms like “due,” “overdue,” “outstanding,” and “default” to specify the status of payment. Terms like “remedy,” “demand,” and “settlement” should be used to emphasize the required action and the seriousness of the matter.

Avoid Ambiguities

Refrain from using vague expressions that could be misinterpreted, such as “as soon as possible” or “soon.” Define deadlines with clear dates and expectations, leaving no room for misunderstandings.

| Term | Recommended Usage |

|---|---|

| Due | To indicate the exact date when payment was expected. |

| Outstanding | To describe an unpaid amount or debt. |

| Default | To define the failure to make payment as agreed. |

| Demand | To request payment in a formal manner. |

| Settlement | To suggest the resolution or payment of the debt. |

Send the final notice using a direct and clear approach. Acknowledge the due payment in the subject line and maintain a professional tone throughout. Use concise language to avoid confusion or ambiguity. Ensure the letter includes all necessary details, such as the amount owed, payment due date, and any consequences of non-payment.

Timing is Key

Send the final notice well before any penalties or legal actions are scheduled to take place. A good timeframe is usually 7 to 10 days before the payment deadline. If the previous reminders went unnoticed, this letter should have a sense of urgency but remain courteous.

Choose the Right Communication Channel

Opt for reliable channels like email or certified mail to guarantee delivery. If the recipient tends to ignore emails, consider using a physical letter to reinforce the seriousness. Always keep a copy for your records and request a read receipt or signature to confirm receipt.

Be clear about deadlines. Setting a precise due date helps avoid confusion and ensures the recipient knows when to make the payment. Vague timelines like “soon” or “within the week” lead to delays and misunderstandings.

Avoid overly formal language. While it’s important to maintain professionalism, excessively stiff or complicated phrasing can alienate the reader. Keep the tone polite but straightforward. Simple sentences will convey your message more effectively.

Don’t make the payment amount unclear. Be explicit about the total amount due and break down any additional fees or charges. A vague statement about the balance can create confusion and hinder timely payment.

Ensure proper contact details. Incorrect or incomplete contact information can prevent the recipient from reaching out for clarification or payment. Always verify that the details provided are accurate and easy to use.

Double-check the recipient’s name and address. A simple mistake in addressing the letter can delay the process. Verify the name and mailing address to prevent unnecessary issues.

Do not use aggressive or threatening language. While you want to stress the importance of payment, using forceful language may cause tension or resentment. Keep the tone firm but polite.

Final Notice Letter for Payment

A well-structured final notice letter can significantly increase the chances of receiving overdue payments. Be clear, direct, and firm in your language while maintaining professionalism. Include all necessary details, such as the outstanding amount, the original due date, and a final deadline for payment. Specify the consequences of non-payment, such as legal action or disruption of services, to reinforce the urgency of the matter.

Key Elements of a Final Notice Letter

- Clear subject line: Use a subject that immediately conveys the purpose of the letter, such as “Final Payment Reminder” or “Urgent: Outstanding Balance Due.”

- Invoice reference: Include the invoice number and date for easy identification.

- Detailed payment information: Clearly state the amount due, the due date, and any accrued late fees.

- Payment methods: Provide clear instructions on how the recipient can make the payment (bank details, online payment options, etc.).

- Consequences of non-payment: Outline the potential legal or contractual actions that will follow if payment is not received by the deadline.

Use a polite yet firm tone to encourage timely payment, ensuring your message is clear but not confrontational. Always review the details of your letter to ensure accuracy before sending it out.