Past Due Notice Letter Template for Effective Payment Requests

When dealing with outstanding balances, it is essential to communicate with clients in a professional yet firm manner. Crafting a well-structured document helps convey the seriousness of the matter while maintaining a respectful tone. This approach aids in prompting clients to settle their debts in a timely fashion, improving cash flow and maintaining healthy business relationships.

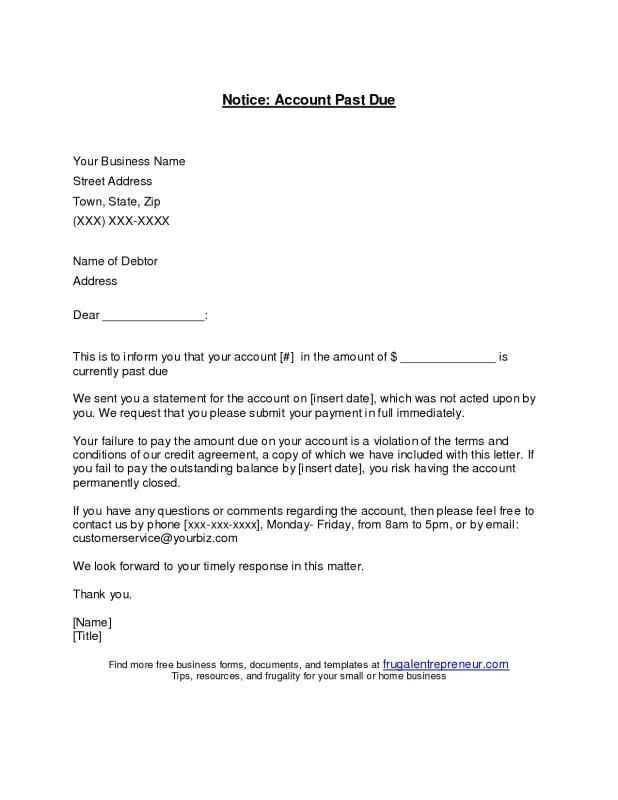

How to Construct a Professional Payment Request

Begin by addressing the recipient politely and clearly stating the reason for the communication. Ensure that the document includes relevant details such as the outstanding amount, the original due date, and the expected payment timeframe. A concise, direct tone ensures the message is understood, while being respectful to the client.

Key Information to Include

- Outstanding balance

- Original payment date

- Details about late fees or penalties (if applicable)

- New suggested payment date

Effective Delivery Methods

Choose an appropriate method for sending the request. Email is often the quickest and most efficient, but for more formal or significant debts, consider using certified mail or another method that confirms receipt.

Common Pitfalls to Avoid

One common mistake is making the language too harsh or confrontational. It’s important to strike a balance between being assertive and professional. Avoid threatening language or aggressive demands, as this can damage relationships and even lead to legal issues.

Maintain Clarity and Respect

Be clear about what is expected but always leave room for negotiation or clarification if necessary. Maintaining professionalism at all stages is key to securing payment while preserving business relationships.

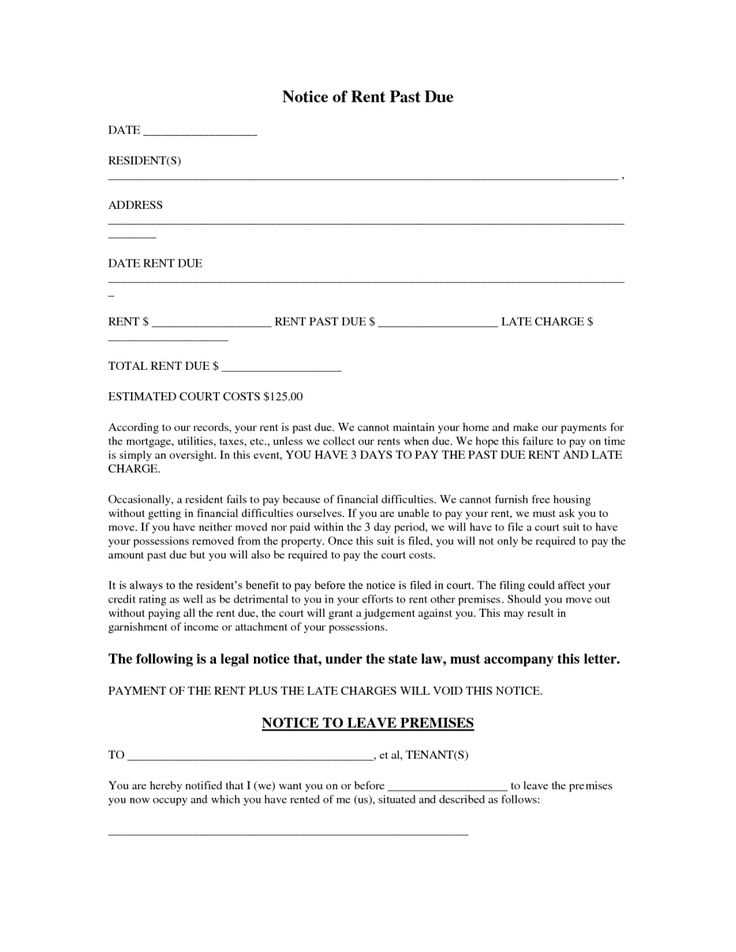

Consider Legal Boundaries

Always ensure that your requests align with local regulations regarding debt collection. If needed, consult with legal experts to ensure compliance with relevant laws before escalating matters further.

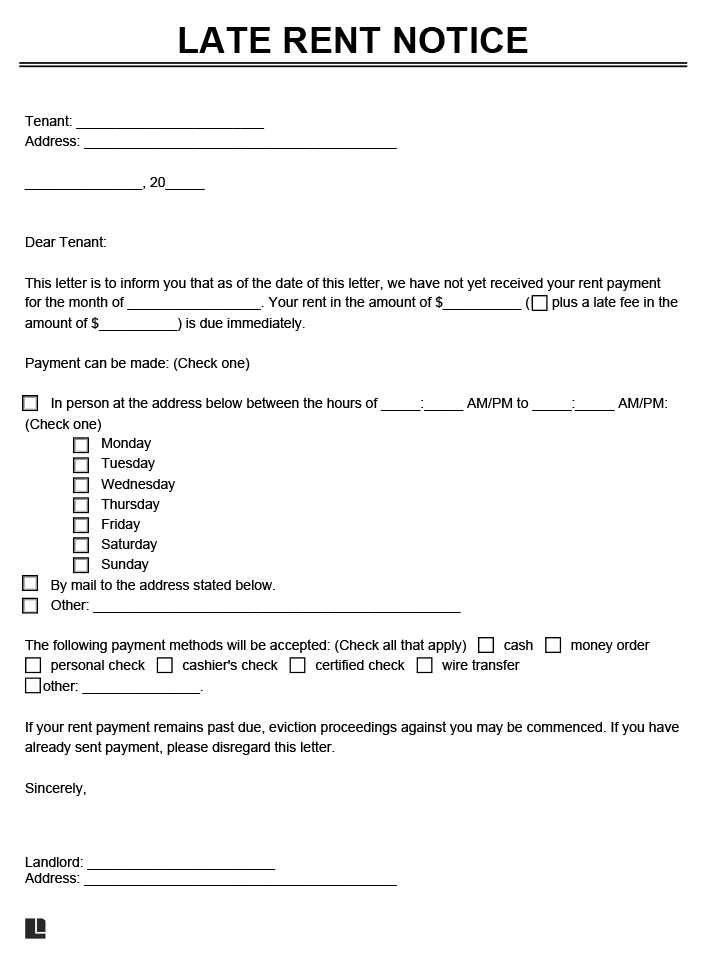

Tailoring Your Request for Each Client

Different clients may require different approaches. Some may respond better to a gentle reminder, while others might need a firmer stance. Customize your communications based on your knowledge of the client’s history and relationship with your business.

Understanding the Importance of Late Payment Reminders

Managing unpaid invoices is a critical aspect of maintaining healthy cash flow for any business. Ensuring that clients are aware of their outstanding balances in a clear and timely manner can help prompt payment without damaging business relationships. A well-crafted communication can be the difference between a smooth resolution and a prolonged delay in payment.

To create an effective reminder, it is essential to maintain a professional tone while clearly stating the amount owed and the time frame for payment. This strategy encourages customers to take prompt action without feeling cornered or disrespected. Additionally, the reminder should provide the necessary details for easy resolution, such as payment options and contact information.

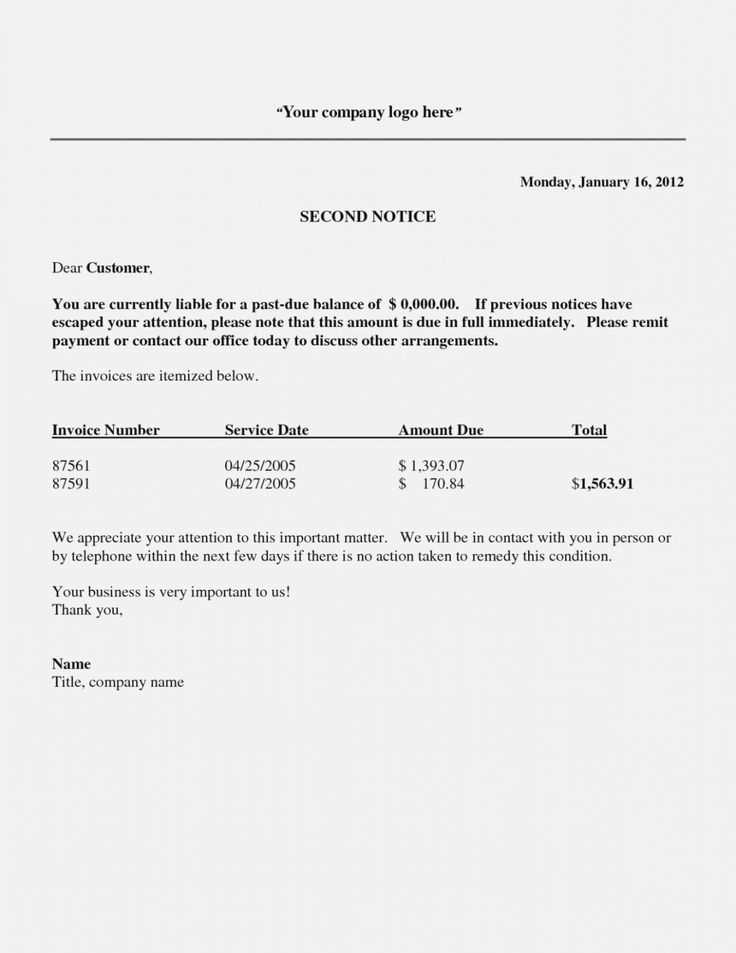

How to Construct an Effective Payment Reminder

When drafting a reminder, it’s important to follow a logical structure to ensure the message is clear and comprehensive. Begin by addressing the client politely and acknowledging the existing relationship. Include specifics such as the amount owed, any relevant previous agreements, and the new expected payment date. This clear structure helps avoid confusion and provides all necessary information for the recipient to take action.

As you structure the reminder, consider including any consequences of delayed payments, such as late fees or interest, in a professional manner. Ensure that the language used is firm yet respectful to maintain goodwill and ensure future business transactions remain intact.

Common Pitfalls in Drafting Payment Requests

Many businesses make the mistake of being either too vague or too aggressive in their communication. A vague message may not convey the urgency needed for the recipient to take action, while an overly harsh tone can harm the business relationship. Striking the right balance is key to ensuring that the reminder is effective without being confrontational.

Another common error is failing to provide clear instructions for payment. Without specific details on how to pay or where to send the funds, the client may feel confused or uncertain about how to resolve the issue. Always provide clear payment options and contact information to streamline the process.

Best Practices for Sending Payment Reminders

It is essential to choose the right delivery method when sending payment reminders. Emails are quick and effective, but for larger sums, consider using more formal methods, such as certified mail, to ensure the client receives the reminder. Timing is also critical–send reminders promptly after a missed payment and follow up periodically until the matter is resolved.

Always document all communication with clients regarding payments. This provides a record in case the situation escalates and allows you to track the progress of your collection efforts. Maintaining professionalism throughout is essential for preserving long-term business relationships.

Legal Aspects of Debt Collection Communication

When sending payment reminders, it’s vital to understand the legal implications surrounding debt collection. Certain language or threats of legal action may violate consumer protection laws. Be aware of the regulations in your region or industry regarding how and when you can collect overdue amounts, and avoid using coercive or misleading language in your communications.

If the situation escalates and requires legal intervention, it is essential to be familiar with the procedures for escalating the matter. Consult with legal professionals to ensure that your actions align with the law and that you are using the proper methods for pursuing overdue payments.

How to Personalize Your Payment Reminder

Each client may have different needs or circumstances that affect how they respond to payment reminders. Personalizing your communication based on the client’s history with your business or any past issues they may have encountered can improve the chances of a quick resolution. Whether it’s offering an extended payment plan or simply reminding them of the value they’ve received, tailoring the message can show understanding and maintain goodwill.

Consider implementing flexibility in your communication style based on the client’s behavior. Some may appreciate a formal reminder, while others may respond better to a more friendly tone. Understanding these preferences can help you create a more effective strategy for collecting payments while keeping clients satisfied.